A PROJECT WORK IN CORPORATE LAWS

SEBI TAKEOVER CODE

____________

INTRODUCTION

The concept of takeover emerged in late 19th century in some countries like US, UK etc. when the first wave of mergers and acquisitions started. However, in India it was only in 20th century that the concept of takeover took birth but even then the concept of hostile takeovers was not known to anybody. This concept emerged when Swaraj Paul started efforts to takeover Escorts Ltd. and DCM Ltd. He was the first hostile raider among the raiders of Indian stock market. Although Paul could not succeed in his efforts because the incumbents fend him off by using the technicalities of rules governing non-residents but this created a need for a takeover code.

This need was further accentuated in 1990s when the government initiated the policy of liberalization and globalization which resulted in growth of Indian economy at an increased pace, and it created a highly competitive business environment, which motivated many companies to restructure their corporate strategies by including the tools of mergers and takeovers.

In the meantime, SEBI was established in 1992 as a body corporate under the SEBI Act, 1992 with the main objectives to,

i) protect the interest of investors in securities market, and

ii) to provide for the orderly development of securities market.

Thus while the possibility of takeover of a company through share acquisition is desirable in new competitive business environment for achieving strategic corporate objectives, there has to be well defined regulation so that the interest of all concerned are not jeopardized by sudden takeover threats.

In the light of the then present circumstances, the need for some law to regulate takeover was strongly felt. Moreover to achieve its objectives as stated in SEBI Act, 1992, SEBI enacted SEBI (Substantial Acquisition of Shares and Takeover) Regulations, 1994 in exercise of powers conferred under section 30 of the Act which laid down a procedure to be followed by an acquirer for acquiring majority shares or controlling in another company, so that process of takeover is carried out in a fair and transparent manner.

Thereafter, these regulations have been amended a number of times to address the changing circumstances and needs of corporate sector. In 1997 SEBI Takeover Code has been rechristened by enacting SEBI (Substantial Acquisition of Shares and Takeover) Regulations, 1997 substituting SEBI (Substantial Acquisition of Shares and Takeover) Regulations, 1994.

In September 2009, the Takeover Regulations Advisory Committee (TRAC) under the chairmanship of Mr. C Achuthan was constituted by SEBI with the mandate to examine and review the SEBI (SAST) Regulations, 1997 and to suggest suitable amendments, as deemed fit. Thereafter in June 2010, the Committee came out with the TRAC Report proposing some sweeping changes on critical issues, including the open offer triggering event, offer size, indirect acquisitions, exemptions from open offer obligations, offer price calculations and competing offers which was then open for public comments. After considering the public comments and further to discussion, the report has been modified to the present form i.e. SEBI (SAST) Regulations, 2011 substituting the SEBI (SAST) Regulations, 1997.

RESEARCH METHODOLOGY

Area: Corporate Laws

Topic: SEBI Takeover Code

Objectives: The following are the underlying objectives of this study:

1. To study about the concept of Takeover.

2. To understand various elements and necessity of Takeover.

3. To analyse the new Takeover Code i.e. SEBI (SAST) Regulations, 2011.

4. To identify the international application of the Takeover mechanism.

5. To Study various Open Offers made under SEBI (SAST) Regulations, 2011

Data– The data was completely secondary in nature due to the analytical nature of the project and limitations of researcher of conducting a primary study.

Approach: The secondary data has been analysed deductively so as to meet the requirements of the study.

Research Tools: The research tools for the secondary data included soft as well as hard materials. The soft material includes various websites, online journals, online books etc., whereas the hard material refers to the study of various books, newspapers, journals etc. The important point to note is that the above mentioned materials have just been referred for a basic theoretical understanding developed over the time and the study has been made specifically first hand.

MEANING AND KINDS OF TAKEOVER

Meaning of Takeover:

Takeover implies acquisition of control of a company which is already registered through the purchase or exchange of shares. Takeover takes place usually by acquisition or purchase from the shareholders of a company their shares at a specified price to the extent of atleast controlling interest in order to gain control of the company.

Thus, when an “acquirer” takes over the control of the “Target Company”, it istermed as Takeover. When an acquirer acquires “substantial quantity ofshares or voting rights” of the Target Company, it results into substantial acquisition of shares.

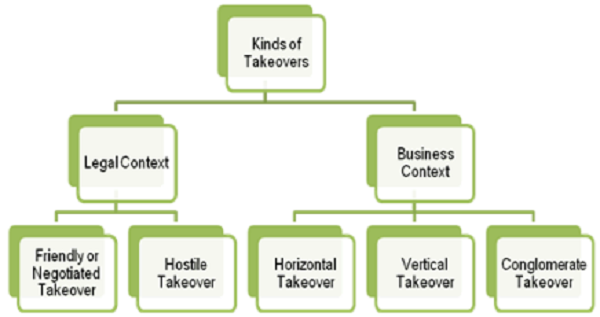

Kinds of Takeover:

I. Legal Context:- From legal perspective, takeover is of two types:

a. Friendly or Negotiated Takeover: Friendly takeover means takeover of one company by change in its management & control through negotiations between the existing promoters and prospective investor in a friendly manner. Thus it is also called Negotiated Takeover. This kind of takeover is resorted to further some common objectives of both the parties. Generally, friendly takeover takes place as per the provisions of Section 395 of the Companies Act, 1956.

b. Hostile Takeover: Hostile takeover is a takeover where one company unilaterally pursues the acquisition of shares of another company without being into the knowledge of that other company, or if the target company’s board rejects the offer, or the bidder makes the offer directly after having announced its firm intention to make an offer. The most dominant purpose which has forced most of the companies to resort to this kind of takeover is increase in market share.

II. Business Context:In the context of business, takeover is of three types:

a. Horizontal Takeover:Takeover of one company by another company in the same industry. The main purpose behind this kind of takeover is achieving the economies of scale or increasing the market share. E.g. takeover of Henkel by Jyothy Laboratories, Patni Computers by iGate.

b. Vertical takeover:Takeover by one company of its suppliers or customers. The former is known as backward integration and latter is known as Forward integration. E.g. takeover of Sona Steerings Ltd. by Maruti Udyog Ltd.

c. Conglomerate takeover:Takeover of one company by another company operating in totally different industries. The main purpose of this kind of takeover is diversification.

Necessity of Takeover Code

The twentieth century began with the process of transformation of entire business scenario. The economy of India which was hitherto controlled and regulated by the Government was set free to seize new opportunities available in the world. With the announcement of the policy of globalization, the doors of Indian economy were opened for the overseas investors. But to compete at the world platform, the scale of business was needed to be increased. In this changed scenario, mergers and acquisitions were the best option available for the corporates considering the time factor involved in capturing the opportunities made available by the globalization.

This new weapon in the armoury of corporates though proved to be beneficial but soon the predators with huge disposable wealth started exploiting this opportunity to the prejudice of retail investor. This created a need for some regulation to protect the interest of investors so that the process of takeover and mergers is used to develop the securities market and not to sabotage it. In the year 1992, with the enactment of SEBI Act, SEBI was established as regulatory body to promote the development of securities market and protect the interest of investors in securities market. Further it got the power to make regulations for the above objectives. Thus SEBI appointed a committee headed by P.N. Bhagwati to study the effect of takeovers and mergers on securities market and suggest the provisions to regulate takeovers and mergers.

In its report, the committee stated the necessity of a Takeover Code on the following grounds:

- The confidence of retail investors in the capital market is a crucial factor for its development. Therefore, their interest needs to be protected.

- An exit opportunity shall be given to the investors if they do not want to continue with the new management.

- Full and truthful disclosure shall be made of all material information relating to the open offer so as to take an informed decision.

- The acquirer shall ensure the sufficiency of financial resources for the payment of acquisition price to the investors.

- The process of acquisition and mergers shall be completed in a time bound manner.

- Disclosures shall be made of all material transactions at earliest opportunity.

Thereafter, these regulations have been amended a number of times to address the changing circumstances and needs of corporate sector. In 1994 SEBI came out with SEBI (Substantial Acquisition of Shares and Takeover) Regulations, 1994. Later SEBI Takeover Code has been rechristened by enacting SEBI (Substantial Acquisition of Shares and Takeover) Regulations, 1997 substituting SEBI (Substantial Acquisition of Shares and Takeover) Regulations, 1994.

Thereafter, in September 2009, the Takeover Regulations Advisory Committee (TRAC) under the chairmanship of Mr. C Achuthan was constituted by SEBI with the mandate to examine and review the SEBI Takeover Regulations of 1997 and to suggest suitable amendments, as deemed fit. Later in June 2010, the Committee came out with the TRAC Report proposing some sweeping changes on critical issues, including the open offer trigger, offer size, indirect acquisitions, exemptions from open offer obligations, offer price calculations and competing offers which was then open for public comments.

The fundamental objectives of the Proposed Takeover Regulations were:-

a. To provide a transparent legal framework for facilitating takeover activities;

b. To protect the interests of investors in securities and the securities market, taking into account that both the acquirer and the other shareholders or investors and need a fair, equitable and transparent framework to protect their interests;

c. To balance the conflicting objectives and interests of various stakeholders in the context of substantial acquisition of shares in, and takeovers of, listed companies.

d. To provide each shareholder an opportunity to exit his investment in the target company when a substantial acquisition of shares in or takeover of a target company takes place.

e. To provide acquirers with a transparent legal framework to acquire shares in or control of the target company and to make an open offer;

f. To ensure that the affairs of the target company are conducted in the ordinary course when a target company is subject matter of an open offer;

g. To ensure that fair and accurate disclosure of all material information is made by persons responsible for making them to various stakeholders to enable them to take informed decisions;

h. To regulate and provide for fair and effective competition among acquirers desirous of taking over the same target company; and

i. To ensure that only those acquirers who are capable of actually fulfilling their obligations under the Takeover Regulations make open offers.

After considering the public comments and further to discussion, the report has been modified to the present form i.e. SEBI (SAST) Regulations, 2011 substituting the SEBI (SAST) Regulations, 1997.

New Takeover Code –Comparision and ANALYSIS

Vide Notification dated September 23, 2011, Market watchdog SEBI has notified the much awaited New Takeover Regulations namely SEBI (Substantial Acquisition of Shares and Takeovers) Regulations, 2011 (hereinafter referred to as “SEBI (SAST) Regulations, 2011”) which will replace the existing Takeover (SAST) Regulations, 1997. The new Regulations shall come into force on the 30th day from the date of their publication in the Official Gazette i.e. w.e.f. October 22, 2011, any acquisition or sale of shares of Listed Company shall be governed by provisions of SEBI (SAST) Regulations, 2011.

Comparison of the New Takeover Codewith the Old Takeover Code

1) Increase in Initial Threshold Limit from 15% to 25%: The Initial Threshold limit provided for Open Offer obligations is increased from 15% to 25% of the voting rights of the Target Company. Since SEBI (SAST) Regulations, 2011 will be applicable from October 22, 2011, thus it’s a last opportunity for all the Promoters holding less than 25% but more than 20% to come within bracket of Creeping Acquisition. Otherwise even the existing Promoters of these Companies have to give offer to consolidate their holding.

2) Creeping Acquisition Limit raised from 15%-55% to 25%-75%:Now there will a single and clear creeping acquisition bracket. This will be available to all persons holding 25% or more but up to 75% i.e. maximum permissible non-public holding shall be eligible for creeping acquisition of 5% each financial year.

3) Open Offer Trigger Point based on Individual Holding:Now the Individual Acquirer Shareholding shall also be considered for determining the Open Offer Trigger Points apart from consolidated promoter shareholding. (Regulation 3(3) of SEBI (SAST) Regulations, 2011).

4) Increase in Offer Size from 20% to 26%: The Offer Size is increased only up to 26% instead of TRAC Recommendation of 100%. It’s a good move from the point of view of domestic acquirers on account of lack of proper bank funding options available in India.

5) New Provisions in case of increase in shareholding beyond the maximum permissible non-public shareholding due to Open Offer:

- Obligation on the acquirer to bring down the non-public shareholding to the level specified and within the time permitted under Securities Contract (Regulation) Rules, 1957;

- Ineligibility to make a voluntary delisting offer under SEBI (Delisting of Equity Shares) Regulations, 2009, unless a period of twelve months has elapsed from the date of the completion of the offer period.

6) Abolition of Non-compete fees: SEBI has accepted the TRAC Recommendation of scrapping the non-compete fee or control premium. Any amount paid to the Promoters/Sellers whether as consideration, non-compete fee or control premium or otherwise, shall be added in Offer Price and hence public shareholders shall be given offer at the highest of such prices.

7) Definition of “Control” modified:A new definition of Control has been introduced in the new Regulation which is similar to recommendation of TRAC Report with an exception that the word “Ability” has been removed. The definition is as under:

“Control” includes the right to appoint majority of the directors or to control the management or policy decisions exercisable by a person or persons acting individually or in concert, directly or indirectly, including by virtue of their shareholding or management rights or shareholders agreements or voting agreements or in any other manner:

Provided that a director or officer of a target company shall not be considered to be in control over such target company, merely by virtue of holding such position

8) Change in Control: Any change in control of the listed company shall be only after Open Offer. The exemption from Open Offer available in case of change in control without acquisition of substantial shares, through a special resolution by postal ballot process, has been withdrawn and now the only route available for change in management and control is through the Open Offer to the shareholders of the Target Company. This is in contrast with the Regulation 12 of the SEBI (SAST) Regulations, 1997 which provides for the change in control through the special resolution passed by way of postal ballot.

9) No Exemption in case of acquisition from other competing acquirer in the New Takeover Code.

10) Frequently Traded Shares: For determining the frequency of trading in shares, the trading turnover during the 12 months preceding the month in which the Public Announcement is made will be considered. Further, the volume of trading for frequently traded company increase from 5% to 10% to have a more realistic picture.

11) New Definitions Introduced:

- “Enterprise Value” means the value calculated as market capitalization of a company plus debt, minority interest and preferred shares, minus total cash and cash equivalents.

- “Volume weighted average market price” means the product of the number of equity shares traded on a stock exchange and the price of each equity share divided by the total number of equity shares traded on the stock exchange.

- “Volume weighted average price” means the product of the number of equity shares bought and price of each such equity share divided by the total number of equity shares bought.

- “Weighted average number of total shares”means the number of shares at the beginning of a period, adjusted for shares cancelled, bought back or issued during the aforesaid period, multiplied by a time-weighing factor.

12) New Formats Introduced for PA, LOO, and Disclosures, Exemptions, Recommendation on the Open Offer by the Board of Directors and so on.

13) Detailed provisions for Voluntary Open Offer: The concept of voluntary open offer has been separately dealt in the SEBI (SAST) Regulations, 2011.

In case of voluntary open offer, the offer size may be of 10% or more of the voting rights at the will of the Acquirer.

14) Detailed provisions relating to Indirect Acquisition: The New Regulations prescribes detailed provisions relating to Indirect Acquisitions which is a welcome move as there was quite confusion. The New Regulations define the situations which will be deemed as Indirect Acquisition.

15) Recommendation on the Open Offer by the Board of Target Company: Arecommendation on the offer by the Board of Target Company has been made mandatory and such recommendations shall be published at least two working days before the commencement of the tendering period in the same newspapers where the public announcement of the open offer was published, and simultaneously, a copy of the same shall be sent to SEBI, Stock Exchange and Manager to the Offer.

16) Revision in SEBI fees to be given while submitting the draft letter of offer.

17) Provisions relating to Exemption from Open Offer have been modified.

18) Other Consequential Amendments: Simultaneously with the amendment in SEBI (SAST) Regulations, 2011, the format of disclosure of shareholding as provided under Clause 35 of the Listing Agreement in respect of following has been replaced

- Statement showing holding of securities (including shares, warrants, convertible securities) of persons belonging to the category “Promoter and Promoter Group”, :

- Statement showing holding of securities (including shares, warrants, convertible securities) of persons belonging to the category “Public” and holding more than 1% of the total number of shares;

- Statement showing holding of securities (including shares, warrants, convertible securities) of persons (together with PAC) belonging to the category “Public” and holding more than 5% of the total number of shares of the company.

Analysis of SEBI (SAST) Regulations, 2011

Triggers for making an open offer

1. Any acquisition of shares or voting rights in the target company by the acquirer and PAC which entitle them to exercise in aggregate 25% or more voting rights.

2. Any acquisition of shares or voting rights exceeding permissible creeping limit (5%) in a financial year. This situation arises in cases where the acquirer and PAC have acquired and holds shares or voting rights in the target company which entitles them to exercise 25% or more but less than maximum permissible non-public shareholding and further acquires more than 5% shares or voting rights in a financial year.

3. Acquisition of shares by any person such that the individual shareholding of such person acquiring shares exceeds stipulated thresholds irrespective of whether there is a change in the aggregate shareholding with the PAC.

4. An indirect acquisition of shares or voting rights requiring an open offer would be considered as direct acquisition, for pricing, timing of open offer and other compliances/requirements of open offer, where the proportionate net assets or sales turnover or market capitalization of the target company as a percentage of the consolidated net asset or sales turnover or the enterprise value for the entity or business being acquired is in excess of 80% on the basis of the most recent audited annual financial statements (Deemed Direct Acquisition).

5. Any revision in voluntary offer size made by the acquirer within 15 working days from the PA of the competing offer.

Acquisition of control

Any direct or indirect acquisition of control of Target Company by an acquirer irrespective of acquisition or holding of shares or voting rights. Indirect acquisition of shares or control Acquisition of shares or voting rights in, or control over, any company or other entity, that would enable any person and PAC to exercise or direct the exercise of such percentage of voting rights in, or control over a target company, the acquisition of which would otherwise trigger open offer obligation, shall be considered as an indirect acquisition of shares or voting rights in, or control over the target company necessitating an open offer.

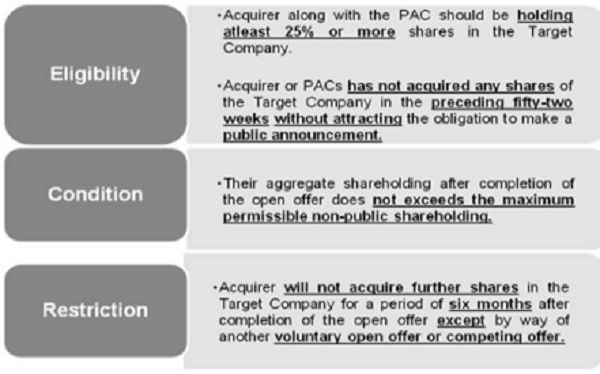

Voluntary offer

An acquirer, who together with PAC, holds shares or voting rights in a target company entitling them to exercise 25% or more but less than the maximum permissible non-public shareholding, shall be entitled to voluntarily make a PA of an open offer for acquiring shares. A voluntary offer is subject to certain conditions which includes the following:

a. Minimum offer size is 10% of the total shares of the target company;

b. The aggregate shareholding of the acquirer and PAC after completion of the open offer cannot exceed the maximum permissible non-public shareholding;

c. Voluntary offer cannot be made where an acquirer or PAC has acquired shares of the target company in the preceding 52 weeks without attracting the obligation to make an open offer;

d. During voluntary offer period such acquirer shall not be entitled to acquire any shares otherwise than under the open offer;

e. An acquirer and PAC who have made a voluntary offer shall not be entitled to acquire any shares of the target company for a period of 6 months after completion of the open offer except pursuant to another voluntary open offer or making a competing offer upon any other person making an open offer or bonus issue or stock splits.

Minimum open offer size

| Trigger for Open Offer | Minimum Open Offer Size | Other Conditions/Observations |

| • Direct acquisition of shares or voting rights or control over the target company

• Indirect acquisition

|

26% of the total shares of the target company as of 10th working day from the closure of the tendering period.

|

Where post open offer shareholding of acquirer and PAC is in excess of the maximum permissible non public shareholding:

• it must be reduced within 1 year; • it shall not be eligible to make a voluntary delisting offer under SEBI Delisting Regulations for 12 months from the date of the completion of the offer period. |

| Voluntary open offer | 10% of the total shares of the target company. The post acquisition holding in such cases shall not exceed the maximum permissible non-public shareholding. |

Any open offer shall be made to all shareholders of the target company, other than the acquirer, PAC and the parties to any underlying agreement including persons deemed to be PAC with such parties, for the sale of shares of the target company.

Minimum open offer price shall be the highest of the following:

| In cases of direct and deemed direct acquisition of shares or voting rights or control over the target company | In case of an indirect acquisition of shares, voting rights or control over the target company |

| Highest negotiated price per share of the target company under the agreement that attracted the open offer. | Highest negotiated price per share, if any of the target company, under the agreement attracting open offer. |

| Volume-weighted average price paid or payable for acquisitions by the acquirer or PAC during 52 weeks preceding the date of PA.

|

Volume-weighted average price paid or payable for any acquisition by the acquirer or PAC during preceding 52 weeks immediately preceding the earlier of:

• the date on which the primary acquisition is contracted, and • date on which intention or decision to make primary acquisition is announced in public domain. |

| Highest price paid or payable for any acquisition by the acquirer or PAC during 26 weeks preceding the date of PA

|

Highest price paid or payable by the acquirer or PAC for any acquisition during 26 weeks preceding the earlier of:

• date on which the primary acquisition is contracted, and • date on which intention or decision to make primary acquisition is announced in public domain. |

| Where shares are frequently traded – volume weighted average market price of the target company during 60trading days immediately preceding the date of PA

|

Where shares are frequently traded – volume

weighted average market price during 60 trading days immediately preceding the earlier of: • the date on which the primary acquisition is contracted, and • date on which intention or decision to make primary acquisition is announced in public domain. |

| Where shares are infrequently traded – the price determined by the acquirer and manager to open offer taking into account valuation parameters, including,book value, comparable trading multiples and such

other parameters as are customary for valuation of shares of such companies.

|

Where minimum offer price cannot be computed as per any of the parameters, it shall be fair price determined by acquirer and manager to the open offer taking into account valuation parameters including, book value, comparable trading multiples, and such other parameters as are customary for valuation of shares of such companies. |

| In case of Deemed Direct Acquisition where net assets value or sales turnover or market capitalization of the target company is more than 15% of consolidated net asset or sales turnover or the enterprise value of the entity or business being acquired as per latest audited annual financial statements, the per share value of the target company computed by the acquirer.

|

Where net assets value or sales turnover or market capitalization of the target company is more than15% of consolidated net asset or sales turnover or the enterprise value of the entity or business being acquired as per latest audited annual financial statements, the per share value of the target company computed by the acquirer.

|

| Highest price paid or payable for any acquisition by the acquirer or PAC during the earlier of:

• date on which the primary acquisition is contracted; • date on which intention or decision to make primaryacquisition is announced in public domain; • date of PA under SAST 2011. |

Other parameters for determining offer price:

1. Where acquirer or PAC has any outstanding convertible instruments convertible into shares of the target company at a specific price, the price at which such instruments are to be converted shall be considered.

2. Where acquirer or PAC has acquired any shares of the target company during the period of 26 weeks after the tendering period at a price higher than the offer price paid, the acquirer and PAC shall pay the difference between the highest acquisition price and offer price, to all the shareholders whose shares were accepted in the open offer, within 60 days from the date of such acquisition except where acquisitions are pursuant to SEBI Delisting Regulations or open market purchases made in the ordinary course on the stock exchanges which are not negotiated deals or bulk deals or block deals or in any other form.

3. Minimum price shall include any price paid or payable in any form or manner and includes:

a) control premium, if any;

b) non-compete fees or otherwise

4. Adjustment to minimum open offer price in following cases:

a) If during the offer period acquirer directly or through PAC agrees or acquires any shares or voting rights in the target company in any manner at a price higher than the minimum offer price, the minimum offer price shall stand revised to such higher price.

b) Where the open offer is subject to minimum level of acceptances and the open offer does not receive the minimum acceptance, the acquirer may indicate lower price for acquiring all the acceptances.

c) For corporate actions like rights issue / bonus issue/ stock splits / dividend / de-mergers / reduction of capital etc. where the record date for effecting the same falls 3 business days prior to the commencement of the tendering period.

5. In case of an indirect acquisition, the minimum offer price would stand increased by 10% p.a. for the period earlier of the date on which primary transaction is contracted, or date on which the intention / decision to make primary acquisition is announced in public domain, and the date of detailed public statement, provided such period is more than 5 working days.

General exemptions from making an Open Offer

Illustrative list of acquisition which are exempted from making an open offer requirement (subject to conditions) are as under:

1. Acquisition pursuant to inter-se transfer of shares among qualifying persons. Such transactions are to be intimated to the stock exchange 4 working days in advance. List of qualifying persons include:

a) Immediate relatives;

b) Persons named as promoters in the shareholding pattern filed by the target company for not less than 3 years;

c) Persons acting in concert for not less than 3 years and disclosed to stock exchange;

d) Specified ensemble of persons etc.

2. Acquisition in the ordinary course of business in specified cases like scheduled commercial bank acting as an escrow agent or invocation of pledge by scheduled commercial bank or public financial institution as a pledgee etc.

3. Acquisition at subsequent stages by an acquirer pursuant to an agreement of disinvestment.

4. Acquisition pursuant to a scheme –

a) Made under section 18 of SICA;

b) Of arrangement involving target company or reconstruction of the target company including amalgamation, merger, de-merger pursuant to an order of court or an authority whether Indian or foreign;

c) Of arrangement not directly involving target company or reconstruction not involving target company’s undertaking including amalgamation,merger, de-merger pursuant to an order of court or an authority whether Indian or foreign.

This exemption is subject to the following specific conditions viz:

i. Cash and cash equivalent paid is less than 25% of the consideration paid; and

ii. After the implementation of the scheme, the persons holding minimum 33% of the voting rights in the combined entity are the same persons who held the entire voting rights before the implementation of the scheme.

5. Acquisition pursuant to SARFAESI Act.

6. Acquisition pursuant to SEBI Delisting Regulations.

7. Acquisition by way of transmission, succession or inheritance.

8. Acquisition of voting rights or preference shares carrying voting rights arising out of operation of section 87 (2) of the Companies Act.

9. Acquisition of shares of a target company not involving a change in control pursuant to scheme of CDR notified by RBI subject to such scheme being authorized by the shareholders of the target company by postal ballot.

10. An increase in voting rights in a target company pursuant to buy-back of shares which necessitate making an open offer shall be exempt provided such shareholder reduces his shareholding so that the voting rights fall below the threshold within 90 days from the date on which the voting rights so increase.

11. Acquisition of rights shares or voting rights in the target company in excess of creeping limit (5%):

a) upto one’s entitlement;

b) beyond one’s entitlement if the following conditions are fulfilled viz;

i. the acquirer has not renounced any of his entitlements in such rights issue; and

ii. the price at which the rights issue is made is not higher than the ex-rights price of the shares of the target company computed in a specified manner

12. Increase in voting rights in a target company of any shareholder in excess of the creeping limit (5%) pursuant to buy-back of shares subject to conditions that:

a) such shareholders have not voted in favour of buy back resolution which is to be passed through postal ballot mechanism; or

b) such shareholder in capacity as a director or any other interested director has not voted in favour of buy back at the board meeting of the target company where buy back is through board approval route; and

c) the increase in voting rights does not result in an acquisition of control by such shareholder over the target company.

If the above conditions are not met and such shareholders reduce the increase in shareholding within 90 days to the creeping acquisition limit, open offer obligations will not be attracted.

13. Acquisition of shares in a target company from a venture capital fund or a foreign venture capital investor registered with SEBI, by promoters of the target company pursuant to an agreement between such venture capital fund or foreign venture capital investor and such promoters.

14. SEBI may grant an exemption from the obligation to make an open offer for acquiring shares subject to such conditions as it deems fit.

Open Offer Process

The open offer process is broadly divided into following sequential stages:

1. Public Announcement (PA) for an open offer for acquiring shares of the target company shall be made by the acquirer through the SEBI registered merchant banker to be appointed as the manager to the open offer in a specified manner. PA is to be sent to all stock exchanges where shares of the target company are listed for dissemination to the public.

2. The Public Announcement shall be sent to all the stock exchanges on which the shares of the target company are listed. Further, a copy of the same shall also be sent to the Board and to the target company at its registered office within one working day of the date of the public announcement. The time within which the Public Announcement is required to be made to the Stock Exchanges under different circumstances is tabulated below:

| Applicable Regulations | Particulars | Time of making PA |

| 13(1)

|

Agreement to Acquirer Shares or Voting Rights or Control Over The Target Company | On the same day of entering into agreement to acquire share, voting rights or control over the Target Company. |

| 13(2)(a)

|

Market Purchase of shares

|

Prior to the placement of purchase order with the stock broker. |

| 13(2)(b)

|

Acquisition pursuant to conversion of Convertible Securities without a fixed date of conversion or upon conversion of depository receipts for the underlying shares | On the same day when the option to convert such securities into shares is exercised.

|

| 13(2)(c)

|

Acquiring shares or voting rights or control pursuant to conversion of Convertible Securities with a fixed date of conversion | On the second working day preceding the scheduled date of conversion of such securities into shares.

|

| 13(2)(d)

|

In case of disinvestment

|

On the date of execution of agreement for acquisition of shares or voting rights or control over the Target Company. |

| 13(2)(e)

|

In case of Indirect Acquisition where the parameters mentioned in Regulation 5(2) are not met

|

Within four working days of the following dates, whichever is earlier:

a. When the primary acquisition is contracted; And b. Date on which the intention or decision to make the primary acquisition is announced in the public domain. |

| 13(2)(f)

|

In case of Indirect Acquisition where the parameters mentioned in Regulation 5(2) are met | On the same day of the following dates, whichever is earlier:

a. When the primary acquisition is contracted; And b. Date on which the intention or decision to make the primary acquisition is announced in the public domain. |

| 13(2)(g)

|

Acquisition of shares, voting rights or control over the Target Company pursuant to Preferential Issue | On the date when the Special Resolution is passed for allotment of shares under Section 81(1A) of Companies Act 1956. |

| 13(2)(h)

|

Increase in voting rights pursuant to a buy-back not qualifying for exemption under Regulation 10 | Not later than 90th day from the date of increase in voting rights.

|

| 13(2)(i)

|

Acquisition of shares, voting rights or control over the Target Company where the such acquisition is beyond the control of acquirer | Not later than two working days from the date of receipt of such intimation.

|

| 13(3)

|

Voluntary Offer

|

On the same day when the Acquirer decides to make Voluntary Offer |

3. Detailed Public Statement (DPS) is to be published by the acquirer in the newspaper within 5 working days from the PA.However in case of Indirect Acquisition where none of condition specified in Regulation 5(2) are satisfied, the Detailed Public Statement shall be published not later than five working days of the completion of the primary acquisition of shares or voting rights in or control over the company or entity holding shares or voting rights in, or control over the target company.

Regulation 14 of SEBI (SAST) Regulation, 2011 provides the requirements relating to publication of Public Announcement and Detailed Public Statement which are tabulated below:

| Regulation | Particulars | Time | To whom |

| 14(1)

|

Public Announcement

|

On the same day

|

All the stock exchanges on which the shares of the target company are listed.

The stock exchanges shall forthwith disseminate such information to the public. |

| 14(2)

|

Public Announcement

|

One working day of the date of the public announcement | Board and to the target company at its registered office

|

| 14(3)

|

Detailed Public Statement

|

5 working days from the date of Public Announcement.

|

Publication in the following newspaper:

(a) One Hindi national language daily with wide circulation (b) One English national language daily with wide circulation (c) One regional national language daily with wide circulation language at a place where registered office of the company is situated. (d) One regional language daily with wide circulation at the place of the stock exchange where the maximum volume of trading in the shares of the target company is recorded during the sixty trading days preceding the date of the public announcement. |

| 14(4)

|

Detailed Public Statement

|

A copy of ‘Detailed Public Statement shall be sent to followings:

(a) Board (b) All the stock exchanges in which the shares of the target company are listed (c) The target company at its registered office |

4. Upon completion of the process of PA and DPS, the acquirer is required to file a draft Letter of Offer (LO) with SEBI and once the same is approved by SEBI, it has to be given to the shareholders of the target company.

5. Escrow account is to be created not later than 2 working days prior to the date of DPS.

6. Competing offers can be made within 15 working days from the date of the DPS published by the acquirer who has made the first PA.

7. The acquirer shall not complete the acquisition of shares or voting rights in or control over the target company until the expiry of offer period except in following cases:

| Nos. | Event | Completion Time |

| 1. | An offer under preferential allotment | Within 15 days from the date of passing special resolution by shareholders |

| 2. | Acquirer depositing in the escrow account 100% of the consideration payable under the open offer assuming full acceptance of the open offer | The parties to such agreement may after the expiry of 21 working days from the date of DPS, act upon the agreement and the acquirer may complete the acquisition of shares or voting rights in, or control over the target company as contemplated. |

Upon receipt of the DPS, board of directors of the target company shall constitute a committee of independent directors to provide reasoned recommendations on open offer, and the same shall be published in the newspapers

International Application

Comparison between the International Applications of the Concept of Takeover in various countries

| Areas of comparison | INDIA | AUSTRALIA | U.K. | USA |

| Are takeovers regulated | Yes | Yes | Yes | Yes |

| Who Regulates | SEBI | SIC | FSA | Securities and Exchange Commission (SEC) |

| Threshold limit (Initial Acquisition) | 25% | 20% | 30% | Offers are only voluntary |

| Creeping Acquisition limit (subsequent acquisitions for consolidation of holdings) | 5% in each Financial Year for shareholders holding between 25% to 75%. | 3% in 6 months |

No | No |

| Concept of Control | No % specified for acquisition of control. | 20% | 30% | No |

| Public announcement | To be made. −Short PA −Detailed PA | To be made | To be made | To be made |

| Letter of offer | To be sent | Target response statement to be sent | To be sent | To be sent. |

| Offer size | Minimum 26 % of the voting capital of the company | All the securities of a class or a specified proportion | Conditional on holding more than 50% of voting rights | “As much as 5% called “Tender Offers Less than – ‘Mini tender offer’” |

| Offer price | Parameters specified under Regulation 8 | parameters specified | parameters specified | – |

| Escrow Account | 25% of consideration payable | No escrow. But disclosure of the basis of funding is required. | Confirmation from a third party that there are resources. | – |

| Form of consideration | Cash and / or securities | Cash and / securities | Cash as well as cash alternatives | Cash/ securities |

| Competitive bids allowed | Yes | Yes | Yes | – |

| Can offer be withdrawn | Yes, under certain conditions: – Refusal of statutory approvals. – Death of sole acquirer – Conditions specified in agreement not met – As and when SEBI deems fit |

Yes, only with permission of ASIC | Yes, If a competitive bid is made at a higher price. | |

| Can offer price be revised | Yes | Only upward revision allowed | Yes. | Yes |

| Can shares be acquired after PA is made | Yes | Yes | Yes | |

| Can shareholders withdraw the acceptances tendered? | No | Limited withdrawal rights | Yes. Under certain circumstances. | Yes, up to seven days of the copies of the offer are sent. |

| Continuous disclosures required | Event Based:On acquisition of 5% or more shares. For shareholders holding 5% or more shares on acquisition or sale of 2% or more shares/voting rights.

Continual Disclosure:By persons along with PAC holding 25% or more shares or voting rights. |

Disclosure if shareholder has interest in voting shares 5%+. And every change + or – 1% triggers further disclosure. | Disclosure at acquisition of 15% or more | When shareholding is 10% or more, then reporting has to be made to SEC |

| Timing of disclosures to be made | Event Based:Within 2 working days from the date acquisition or receipt of intimation of allotment or acquisition of shares, as the case may be. Continual Disclosure:Within 7 working days from the end of financial year. |

Within 2 working days. Otherwise, when the bid is open, then at 9:30 p.m. next working day. | ||

| Concept of Indirect acquisitions | Specified in Regulation 5 | Present | Yes, chain rule is existing subject to condition of significant shareholding | – |

| Defence Techniques | Competitive bids | Competitive bids | Competitive Bids | – |

| Concept of persons acting in concert | Yes, as defined in Regulation 2(1)(q) | Not defined | Yes | Yes |

| Any exemptions from Open offer | Automatic under Regulations | The legislation has a list of exceptions | Panel appears to have the discretion | Yes, as specified by the SEC |

| Penalties | Civil and Criminal Liabilities | Criminal & civil penalties. | Reprimand, public censure, etc. | Civil penalties |

Open Offers made under SEBI (SAST) Regulations, 2011

On September 23, 2011, the market watchdog SEBI has notified the New Takeover Regulations i.e. “Securities and Exchange Board of India (Substantial Acquisition of Shares and Takeovers) Regulations, 2011” (hereinafter called as SEBI (SAST) Regulations, 2011) applicable w.e.f. October 22, 2011. Some of the Open Offers made under New Takeover Regulations are given below:

1. Open Offer for Andhra Cements Limited

About Andhra Cements Limited (Target Company)

Andhra Cements Limited was incorporated on December 9, 1936 under the Indian Companies Act,1913 with the Registrar of Companies, Vizagapatam. The shares of the Target Company are presently listed on the Bombay Stock Exchange Limited (BSE) and the National Stock Exchange of India Limited (NSE).

About the Jaypee Development Corporation Limited

The Acquirer, Jaypee Development Corporation Limited was incorporated on December 5, 2007 and is engaged in the business of providing Industrial Security and Medical Services to various companies engaged in the infrastructure development. The Acquirer is a part of the Jaypee Group and is a wholly owned subsidiary of Jaypee Ventures Private Limited. The shares of the Acquirer are not listed on any Stock Exchange.

Background of the Offer

The Acquirer has entered into a Share Subscription and Share Purchase Agreement dated November 15, 2011 (“SSSPA”) with the promoter and promoter group of the Target Company and the Target Company, to acquire by way of transfer and subscription 195,619,550 equity shares representing 66.646% of the Expanded Paid up Share Capital of the Target Company post preferential allotment approved by the meeting of Board of Directors dated November 15, 2011 comprising of:

i. 48,119,550 Equity Shares being purchased from the Sellers; and

ii. to subscribe to 147,500,000 Equity Shares pursuant to a Preferential Allotment to be made by the Target Company at a price of Rs. 12/- per equity share.

Details of the offer

Pursuant to the above acquisition, the Acquirer has made a Public Announcement of an Open Offer to the shareholders of the Target Company to acquire upto 76,315,328 equity shares representing 26% of the expanded paid up Share Capital of the Target Company at a price of Rs. 12 per fully equity share payable in cash.

2. Open Offer for Swadeshi Industries and Leasing Limited

About Swadeshi Industries and Leasing Limited (Target Company)

Established in October 31, 1983, the Target Company was originally incorporated in the name of Swadeshi Leasing Company Limited. The name of the Target Company then changed to SwadeshiIndustries and Leasing Limited. The Equity Shares of the Target Company are listed on Bombay Stock Exchange Limited (“BSE”) and Delhi Stock Exchange Association Limited (“DSE”).

About Chin Info Tech Private Limited (Acquirer)

Located in Mumbai, the Acquirer was incorporated with the main object to carry on the business to manufacture, alter or deal in electrical and electronic appliances and in the business of computers. There are no other PACs with the Acquirer.

Background of the Offer

On November 09, 2011, the Acquirer has entered into a Share Purchase Agreement (SPA) with the Promoters of Target Company for acquisition of 6,31,300 fully paid up equity shares representing 16.15% of the total paid-up equity share capital of Target Company at a price of Rs.15 per fully paid up equity share payable in cash. Further, on the same day the Target Company has made preferential allotment of 15,00,000 Equity Shares to the Acquirer which amount to 27.74% of the total paid up equity shares (post allotment of shares) of the Target Company. Consequent upon acquiring the shares pursuant to the execution of SPA & proposed allotment of equity shares on preferential basis the post shareholding & voting rights of the Acquirer will increase to 39.41% of the total paid up equity shares of the Target Company post preferential allotment. The Acquirer also intends to acquire control over the Target Company and make changes in the Board of Directors of the Target Company subsequent to the completion of this Open Offer in accordance hereof. Thus this mandatory offer is being made by the acquirer in accordance with Regulations 3 and 4 of SEBI (SAST) Regulations, 2011.

Details of the Offer

The Acquirer has made an offer for acquisition of upto 14,06,067 equity shares representing 26% of the total paid up equity share capital of the Target Company at a price of Rs 15 per fully equity share payable in cash to the shareholders of the Target Company. If the Target Company doesn’t receive the approvals as required in order to allot 15,00,000 Equity Shares to the Acquirer on Preferential Basis for which it has passed Special Resolution under Section 81 (1A) of Companies Act, 1956 then the acquirer will withdraw the offer under regulation 23 of SEBI (SAST) Regulations, 2011.

3. Open Offer for Swaraj Automotives Limited

About the Swaraj Automotives Limited (Target Company)

Incorporated in the year 1974, Swaraj Automotives Limited (Target Company) is engaged in the business of manufacturing seats & seating systems for tractors, commercial vehicles, cars and passenger vehicles. The shares of the Target Company are listed at Delhi Stock Exchange Ltd. (DSE).

About the Mahindra & Mahindra Ltd. (Acquirer)

The Acquirer is a part of the Mahindra Group and is engaged in the business of manufacturing and marketing of tractors utility vehicles and light commercial vehicles. The Acquirer belongs to the promoter group of the Target Company and holds 10, 59,543 equity shares constituting 44.19% of the Voting Share Capital of the Target Company. The Acquirer is listed on the Bombay Stock Exchange Limited (“BSE”) and National Stock Exchange of India Limited (“NSE”). The Global Depositary Receipts (“GDRs”) of the Acquirer are listed on the Luxembourg Stock Exchange and are also admitted for trading on International Order Book (IOB) of the London Stock Exchange.

Details of the Offer

The Acquirer is already in control of Target Company and the proposed acquisition under the offer is for the purpose of consolidation of shareholding in the Target Company. Thus this voluntary offer is made by the Acquirer under Regulation 6 of SEBI (SAST) Regulations, 2011 to acquire upto 6,47,382 fully paid up equity shares representing 27% of the voting share capital of Target Company at a price of Rs.90 per share.

CASE STUDY

Analysis of Takeover Open Offer of Kamat Hotels (India) Limited

Kamat Hotels (India) Limited (“KHIL/Target Company”)was incorporated on 21st March, 1986, Kamat Hotels (India) Limited is engaged in the business of hospitality and allied businesses, and its activities may be broadly categorized into (i) operation of hotels owned by the Company, (ii) management of hotels owned by other parties under contract (iii) catering services and (iv) timeshare. The Company has established four brands viz. Gadh, Orchid, Vits and Lotus. The shares of the Target Company are listed on Bombay Stock Exchange Limited (BSE) and National Stock Exchange Limited of India Limited (NSE).

About Clearwater Capital Partners (Cyprus) Limited (“Acquirer”)

Clearwater Capital Partners (Cyprus) Limited was incorporated in 2004 as a ‘Limited Liability Company’ having its registered office in Cyprus for the purpose of investment in securities particularly in Asia. The Acquirer belongs to “Clearwater Capital Partners” group. The Acquirer holds 3,941,803 equity shares representing 23% of the total existing paid-up and voting capital of the Target Company.

About Clearwater Capital Partners Singapore Fund III Private Limited (“PAC”)

Incorporated on August 28, 2007 under the companies Act in the Republic of Singapore, Clearwater‐Singapore is a financial investor and belongs to “Clearwater Capital Partners” group. The shares of the company are not listed on any stock exchange in India or/and abroad. At present, the PAC holds 257,431 equity shares aggregating to 1.50% of the total existing paid-up and voting capital of the Target Company.

Triggered Event

The Acquirer had subscribed to the bonds offered by the Target Company in terms of the Offering circular dated March 13, 2007 of which US$ 5,966,000 Bonds are still held by the acquirer and are mandatorily due for conversion on January 30, 2012. The Acquirer has exercised its right to convert the remaining US$ 5,966,000 Bonds into equity shares of the Target Company and to effect the conversion, a written “Conversion Notice” is served to the Principal Paying and Conversion Agent after the Board of Directors of Clearwater‐Cyprus has passed a resolution to convert the remaining Bonds on January 11, 2012.

Shareholding of the Acquirer and PAC before and after the conversion:

| Acquirer | PAC | Total | |

Pre Transaction shareholding

|

3,941,803 23%

|

257,431 1.50% |

4,199,234 24.50%

|

| Proposed shareholding after the acquisition of equity shares which triggered the Open Offer | 5,895,999

30.88%^

|

257,431

1.35%

|

6,153,430

32.23%^ |

^Calculated on post‐conversion equity share capital of the Target Company.

Pursuant to conversion of remaining Bonds into equity shares, the Acquirer along with PAC has triggered Regulation 3(1) of SEBI (SAST) Regulations, 2011; accordingly a Public Announcement was made to BSE and NSE by the Acquirer and PAC on January 11, 2012.

Takeover Open Offer

Pursuant to above conversion of bonds into equity shares, the Acquirer along with PAC has made Open Offer to the shareholders of the Target Company for acquisition of 4,964,283 equity shares representing 26% of the post‐conversion paid‐up equity share and voting capital at Rs.135 per equity share payable in Cash.

If the ongoing ‘Composite Scheme of Arrangement and Amalgamation’ (“the Scheme”) of promoters’ group entities of the Target Company is completed within 10 working days from the closure of the Tendering Period, the Acquirer and the PAC will increase the Offer Size to the extent of 26% of the post-amalgamation equity share capital of the Target Company in accordance with Regulation 7(1) of the said Regulations.

Compliance with Regulation 22(1) of SEBI (SAST) Regulations, 2011

The Manager to the Offer has opened a “Demat Escrow Account” wherein the Conversion Equity Shares will be kept in compliance with Regulation 22(1) of the Regulations which restrict the completion of acquisition of shares or voting rights in, or control over, the target company, whether by way of subscription to shares or a purchase of shares attracting the obligation to make an open offer for acquiring shares, until the expiry of the offer period. Upon fulfilment of the Offer related formalities, the Conversion Equity Shares will be transferred to the Acquirer’s DP account.

The relevant text of regulation 22(1) of SEBI (SAST) Regulations, 2011 is reproduced herein below:

The acquirer shall not complete the acquisition of shares or voting rights in, or control over, the target company, whether by way of subscription to shares or a purchase of shares attracting the obligation to make an open offer for acquiring shares, until the expiry of the offer period:

Provided that in case of an offer made under sub-regulation (1) of regulation 20, pursuant to a preferential allotment, the offer shall be completed within the period as provided under sub-regulation (1) of regulation 74 of Securities and Exchange Board of India (Issue of Capital and Disclosure) Regulations, 2009.

CONCLUSION

The new regulation is indeed a path breaking legislation which is likely to change the landscape of corporate India in the near future. With the increased threshold limit, the level of activity in listed companies by PE’s/ strategic investors will increase to more material stakes (up to 24.99%). Also, “head room” for foreign technical collaborators / minority foreign partners to increase their shareholding without triggering cumbersome and costly takeover regulations will increase. Companies would be able to raise expansion capital in a more cost effective manner (i.e. without triggering open offer till 25% stake);

For the economy, more investment from PE/foreign partners should be expected in the coming months, which should give a fillip to FDI numbers which have been languishing in the recent past.

With a 24.99% threshold limit, the acquirers would be able to block special resolutions in target companies with relative ease. Let us assume a promoter who holds 45% stake in the target company. If a hostile acquirer were to reach 24.99%, such acquirer can effectively have ~ 35% voting right (24.99/(24.99+45)) and therefore can easily block special resolutions (assuming that the participation by minority public shareholders either in physical meeting or postal ballot is negligible (which is invariably the case)).

Further, with the possibility of acquiring 24.99% without triggering open offer, acquirerswould practically be able to get a Board position in target-company and therefore having a greater say in the company’s operations.The role of minority public shareholders holding significant stake (say 1-5%) would also increase. Strategic long-term acquirers can easily acquire up to 24.99% and then negotiate with these significant minority shareholders to consolidate their shareholding / trigger open offer for takeover of the target companies. Expect off-market transactions at higher than market valuations for such strategic buy-outs to rise.

Even if the promoter has more than 25% stake, they may seek to consolidate their holding by 5% through creeping acquisition route with a view to strengthening their position in the Company.Similarly, with the market indices/ stock prices pegged low due to the international market scenario and also local factors, strategic/ long term players may be inclined to ramp up shareholding in value stocks with an intention of having a material and influential stake in such companies in the future.

In light of the above, expect some serious action in stocks of such companies in the coming weeks.This one step of increasing the open offer threshold limit to 25% is a significant development and changes the landscape for promoters significantly. There is likelyto be a war for retaining/ takeover of good companies (especially with the market multiples currently being really attractive) and promoters with low shareholding and high public float should be worried.

The new regulation will facilitate consolidation of promoter shareholding to the maximum permissible level i.e. 75% which was a challenge in the earlier regulation.This would be welcome move for the Promoters who will have more flexibility to bump-up their shareholding. However, the reduction of “public float” due to this measure and consequential impact on trading volumes/ reflection of real “market” price of such scrips on bourses would need to be watched.

With the increase in the initial threshold to 25% and the increase in open offer size to 26%, there is a possibility of the acquirer getting simple majority (25% + 26%). This would be welcome for M&A transactions because there is significant comfort that acquirers get when they hold more than 50% stake directly and therefore do not need to depend on other shareholders for passing simple corporate law resolutions.

With a view to facilitate consolidation of holdings in excess of 5% (creeping acquisition) by substantial shareholders, the conceptof voluntary offer for 10% stake has been introduced. This will provide flexibility to substantial shareholders (holding 25% or more) to increase their shareholding (of course by following the process of open offer) without being an obligation to make the offer for additional 26% stake thereby reducing the overall outflow from such consolidation.

Of course, at a practical level, the experience in open offers has been that the public does not fully subscribe to such public offers. Therefore, practically, time will tell in how many cases the 26% limit (or 10% in case of voluntary offer) would be reached. However, the fact that the regulatory mechanism has been enabled is commendable.

In case the public offer results in public shareholding falling below 25%, then the acquirer is obligated to reduce his shareholding so that the minimum 25% public float is maintained.

Thus, the revised norms will change the dynamics of mergers and acquisitions in India. Although, the revisions are not as dynamic as proposed by Takeover Committee, which proposed an open offer size of 100 per cent after the trigger was hit. However, even under the current norms the cost of acquisitions goes up substantially. Because earlier after the 15 per cent trigger, the acquirer had to seek another 20 per cent and hold a cumulative 35 per cent in the target company. The cost would now be higher as the acquirer needs to hold 51 per cent subsequent to the open offer.

It would not be surprising to see promoters allotting convertible warrants to themselves, especially in companies where promoter holding is thin. There are 24 companies in the BSE500 index where promoter holding is below 26 per cent, and the number of companies where promoter holding is 51 per cent or below is 210.

For smaller investors, removal of non-compete fees which is in line with Takeover Committee recommendations, is good news. That largely serves the purpose of protecting the interests of minority shareholders. Going forward, we will not see the non-compete fees element in the mergers and acquisition deals.

LIST OF REFRENCES

Books:

1. S. Ramanujam, Mergersetal, 2007, Tata McGraw Hill, New Delhi

2. H. R. Machiraju, Mergers, Acquisitions and Takeovers, 2006, New Age International Publishers, New Delhi.

3. Ch. Rajeshwar, Mergers and Amalgamation: New Perspective, 2001, ICFAI Press, Hyderabad.

Articles:

1. Takeovers in India – An overview, by Vijay Sambamurthi & Siddharth Shah

2. Corporate Governance Structure, Mergers and Takeovers in India in the Post Liberalization Regime-Proposals and Policies, by Nandita Das Gupta

Websites:

1. www.sebi.gov.in

2. www.capitalmarket.com

3. www.takeovercode.com

4. www.corporateprofessional.com

5. www.indiainfoonline.com

6. www.deloitte.com

7. www.financialexpress.com

8. www.businesstoday.intoday.in

9. rediff.com/money

Newspapers:

- Economic Times

- Financial Express

- Business Line

Reports:

- Bhagwati Committee Report

- Takeover Regulations Advisory Committee (TRAC) Report

Journal:

- Takeover Panorama