Introduction: NPCI, the National Payments Corporation of India, has revolutionized digital payments with the introduction of ‘Hello! UPI.’ This innovative feature empowers users with voice-assisted interactions, covering transactions, onboarding, alerts, and more. In this article, we delve into the guidelines and updates, enhancing the UPI experience.

Detailed Analysis: ‘Hello! UPI’ amplifies accessibility and convenience for UPI users. Encompassing voice-powered transaction initiation, onboarding assistance, fraud alerts, and user prompts, this feature ensures a seamless experience. Users initiate interactions with “Hello <app name>,” enabling effortless communication. NPCI mandates compliance, including specific tags for transactions and language identifiers. Members must enable ‘Hello! UPI’ in their apps by March 31, 2024, using self-developed or NPCI AI models.

FAQs on ‘Hello! UPI’

What is Hello! UPI?

Hello! UPI introduces conversational UPI payments, enhancing the user experience by enabling voice-enabled UPI payments through UPI apps, telecom calls, and IoT devices in Hindi and English. It will soon be available in various regional Indian languages, expanding accessibility for users. Users can make transactions by giving voice commands and entering their UPI PIN.

Hello! UPI will support which type of phones?

Hello! UPI is compatible with both feature phones and smartphones, allowing users to perform conversational UPI payments on either type of device.

How does Hello! UPI on Smartphone work?

On smartphones, UPI apps will feature additional voice navigation capabilities, allowing users to navigate within the app using voice commands.

What type of transactions can users perform in smartphone UPI Apps using Hello! UPI?

Currently, users can make Pay-to-Contact and Scan-and-pay transactions via Hello! UPI, utilizing voice navigation within the UPI app.

Which languages are supported in Hello! UPI?

Hello! UPI supports UPI payments in both English and Hindi, with support for several other regional Indian languages coming soon.

How does Hello! UPI on feature phone work?

Users can make payments via Hello! UPI on feature phones by placing a call to the designated payment numbers and conducting conversational transactions over the call.

What type of transactions can users perform on a feature phone using Hello! UPI?

Presently, Hello! UPI on feature phones allows for Pay-to-mobile number transactions and Balance Checks.

Can smartphones also use Hello! UPI’s call feature?

The call functionality can be used by both smartphone and feature phone users for Hello! UPI transactions.

Who launched Hello! UPI?

Hello! UPI was officially launched by Hon’ble RBI Governor Mr. Shaktikanta Das on September 6, 2023, at the Global Fintech Fest (GFF) 2023.

How are Hello! UPI transactions authorized?

For on-call transactions, users must input their UPI PIN during the call by using their mobile keypad. In-app transactions require users to enter their UPI PIN on the UPI PIN page within the app.

What is the transaction limit of Hello! UPI on-call?

Currently, Hello! UPI transaction limits for pay-to-mobile numbers are capped at ₹1000 per transaction, with a maximum of 5 transactions allowed within a 24-hour period.

What is the transaction limit of Hello! UPI in-app?

Hello! UPI transaction limits align with the existing limits of UPI.

How do I register for Hello! UPI?

For in-app usage, users need to complete a one-time UPI on-boarding within the app. There’s no separate on-boarding process for Hello! UPI within the app. For on-call usage, users must call the designated payment number and complete a one-time on-boarding process by linking their bank account.

Is the internet required for Hello! UPI?

On-call Hello! UPI does not require internet connectivity, while in-app Hello! UPI transactions do require an internet connection.

Can UPI work without a bank account?

No, UPI requires a bank account linked to a mobile number for transactions. Users must have a bank account to register and use UPI services.

Will my UPI ID be created when I onboard on Hello! UPI?

Yes, your UPI ID will be created, and you will receive an SMS confirming the same.

Are there any transaction charges for making payments through Hello! UPI?

No, there are no transaction charges for using Hello! UPI.

What is payment through IVR number?

Using this solution, customers can access UPI services by calling a predefined number. They can select options via their keypad and utilize UPI services through the IVR system.

Conclusion: With ‘Hello! UPI,’ NPCI pioneers a user-centric approach to digital payments. Voice-enabled interactions redefine UPI usage, emphasizing accessibility, security, and user engagement. As participants adhere to guidelines, the future of digital payments in India promises unparalleled ease and efficiency, setting new benchmarks for global payment ecosystems. Embrace ‘Hello! UPI’ and embark on a journey toward seamless, voice-assisted transactions, transforming the way we experience digital finance.

*****

NPCI

NATIONAL PAYMENTS CORPORATION OF INDIA

NPCl/UPII0C-175/2023-24 Dated: October 27, 2023

To,

All UPI Members – Banks, PSPs and TPAPs

Subject: Guidelines for ‘Hello! UPI’

To improve access and experience on digital platforms which support payments, NPCI has introduced ‘Hello! UPI as feature to drive access and experience of UPI, assisted with voice. The UPI features such as user onboarding, balance enquiry, financial transaction, complaint resolution, etc. will be enabled using voice commands by the user. These interactions powered by voice/conversation shall be referred as `Hello! UPI.

Accessibility for Users

`Hello! UPI’ will be made available to users through the following channels.

1. In App: Assist navigation inside UPI App using voice commands.

2. On-Call: Voice based interaction through telecom call.

3. Device based: loT based devices which respond to voice commands.

Guidelines for ‘Hello/ UPI’

a. The scope of ‘Hello! UPI’ experience shall cover

i. UPI Transaction initiation by voice

ii. Assisting user for UPI Onboarding in UPI App

iii. Alert to user for suspicious and possible fraudulent transaction

iv. Smart prompts for improving user experience

v. User consent based action for the feature enablement by voice prompts

vi. User complaint redressal assistance with UPI Help

vii. Other use cases, if any, approved by NPCI from time to time

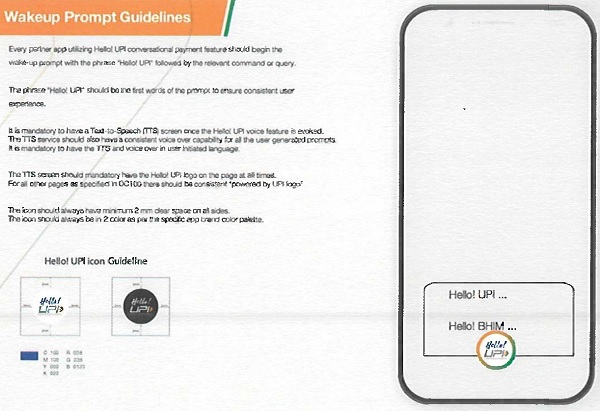

b. ‘Hello! UPI’ brand guidelines shall be adhered for enabling various experiences. Brand Guidelines’ details in Annexure 1.

c. For any information or action sought by the user using voice which pertains to UPI, the user interaction shall start with “Hello <app name>” as the wake-up word by the user. For eg: Hello! BHIM, make Rs. 10 payment to Arvind (saved contact).

d. UPI PIN shall be entered by user manually on the UPI common library screen when transaction initiated from UPI app and loT display devices. For On-call payments, UPI PIN to be entered manually by user on keypad of the mobile phone from which the call is initiated.

e. The device should take specific and relevant consent for enabling ‘Hello! UPI’. Similarly, there should be an option to disable voice assisted services for ‘Hello! UPI’.

f. On-Call channel through UPI 123Pay shall now empower customers to interact with voice using ‘Hello! UPI’. This enablement shall be enabled through Server-Side Common Library (SSCL) at NPCI. Device based enablement shall be through SSCUUPI Plug-in. All the guidelines and controls of SSCUUPI Plugin will be extended here. All current and future experiences for 123Pay on-call shall be using ‘Hello! UPI’.

g. The device and the PSP shall collectively identify and tag such transactions with separate `Initiating Channel’ name and Refcategory as per the language used by user (details in Annexure 2). No transactions to be sent without these tags. When a user completes the transaction with smart prompt assistance, transactions tags to be populated as per the type of transaction.

h. Voice Assistance Platforms in the mobile handsets and loT devices should support ‘Hello! UPI’ and allow users to select UPI Apps of their choice using voice commands. User should be able to start giving voice command by starting with ‘Hello <Platform defined Assistant Name>.

Compliance for ‘Hello! UP!’

1. Details about ‘Initiating Channel’ and ‘Refcategory’ which are to be populated by members going live on ‘Hello! UPI are provided in Annexure 2.

2. UPI Apps live on ‘Hello! UPI` and not sending correct required fields will be considered as non-compliant. Failure to comply will lead to action from NPCI.

Participants in the above channels shall enable ‘Hello! UPI’ using self-developed language Al models or NPCI models. Participants using NPCI Al models to ensure availability of newly added languages within 3 months of NPCI enablement. Presently NPCI models support English and Hindi. NPCI model usage specifications shall be shared with the participants. Participants should ensure accuracy and customer choice before processing the consumer action.

Roles and responsibilities of all parties involved in the UPI payment such as UPI switch, Issuer Bank, Beneficiary Bank, Payer PSP, Payee PSP, and TPAP will remain the same. Member Banks, PSPs, TPAPs and PPI apps are hereby requested to take note of the above and

enable ‘Hello! UPI’ feature in app by March 31, 2024.

Yours sincerely,

SD/-

Kunal Kalawatia

Chief of Products

Annexure 1:

`Hello! UPI’ Brand Guidelines

Annexure 2:

Initiating Channel:

| Sr. No. | ‘Hello! UPI’ Channel | Initiating Channel identifiers |

| 1 | App | MOBH |

| 2 | On-call | IVRH |

| 3 | loT Devices | 10TH |

The initiating channel identifier needs to be passed under the ‘Type’ in the ‘device’ tag of UPI request. This shall be required to pass in all the respective APIs where device details are captured.

Refcategory

| Sr. No. | Language | Refcategory |

| 1 | English | 01 |

| 2 | Hindi | 02 |

| 3 | Tamil | 03 |

| 4 | Oriya | 04 |

| 5 | Bengali | 05 |

| 6 | Kannada | 06 |

| 7 | Telugu | 07 |

| 8 | Malayalam | 08 |

| 9 | Marathi | 09 |

| 10 | Gujarati | 10 |

| 11 | Assamese | 11 |

| 12 | Punjabi | 12 |

| 13 | Konkani | 13 |

Language details to be passed in Refcategory tag for financial and mandate APIs. When any new language is added in ‘Hello! UPI’, new Refcategory code will be defined and communicated to eco-system.