To get something ‘one has to suffer the pain also’

In terms of Gazette Notification No 2652 dated November 08, 2016 issued by Government of India, Rs. 500 and Rs. 1,000 denominations of Bank Notes of the existing series issued by Reserve Bank of India (hereinafter referred to as Specified Bank Notes) shall cease to be legal tender with effect from November 9, 2016, to the extent specified in the Notification. It’s a huge step by Indian Government.

Denomination of currency is previously done by the America. Its denominate the Currency of $100 in 1969 in the president ship of Mr. Nixon Withdrew. “American Peoples found it very difficult to shift suddenly but to get something ‘one has to suffer the pain also’.

While Prime Minister Narendra Modi might have taken India by surprise, the move to demonetize high denomination notes in not unprecedented in Indian history. In January 1978, the Indian government had demonetized that Rs 1,000, Rs 5,000 and Rs 10,000 notes in a bid to counter black money in the economy.

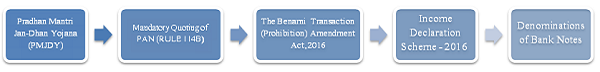

Its seems to be surprise move by PM Narendra Modi but if we look at the past policies of the PM Modi then it can be analyze that this is a strategic move and decision take after many earlier decisions Like:

A. PRADHAN MANTRI JAN-DHAN YOJANA (PMJDY)

Pradhan Mantri Jan-Dhan Yojana (PMJDY) was a National Mission for Financial Inclusion to ensure access to financial services, namely, Banking/ Savings & Deposit Accounts, Remittance, Credit, Insurance, Pension in an affordable manner. Account could be opened in any bank branch or Business Correspondent (Bank Mitr) outlet. PMJDY accounts are being opened with Zero balance.

By this Yojana they have started to encourage the peoples to open Bank Account. After policy nearly every Indian household has a bank account. Below given is Progress-Report Pradhan Mantri Jan – Dhan Yojana (Accounts Opened as on 02.11.2016)

(All Figures in Crores)

Bank Name |

RURAL |

URBAN |

TOTAL |

NO OF RUPAY CARDS |

AADHAAR SEEDED |

BALANCE IN ACCOUNTS |

% OF ZERO-BALANCE-ACCOUNTS |

Public Sector Bank |

11.39 |

8.90 | 20.28 | 15.69 | 11.25 | 36074.62 | 23.47 |

| Regional Rural Bank | 3.70 | 0.60 | 4.30 | 2.95 | 1.98 | 7621.64 | 20.31 |

| Private Banks | 0.53 | 0.34 | 0.86 | 0.80 | 0.37 | 1606.22 | 36.20 |

| Total | 15.62 | 9.83 | 25.45 | 19.44 | 13.60 | 45302.48 | 23.37 |

B. MANDATORY QUOTING OF PAN (RULE 114B) http://pib.nic.in/newsite/PrintRelease.aspx?relid=133304

The Modi Government amended Rules regarding quoting of PAN for specified transactions. The changes to the Rules taken info effect from 1st January, 2016.

The Income tax Rules require quoting of Permanent Account Number (PAN) where the transactions exceed a specified limit. Persons who do not hold PAN are required to fill a form and furnish any one of the specified documents to establish their identity.

The amendment in the PAN reportable transactions and AIR represent important measures adopted by the government to collect the information of specified type of transactions from third parties in a non-intrusive manner and to tackle the menance of black money transactions.

C. BENAMI TRANSACTION ACT, 2016:

The Benami Transactions (Prohibition) Amendment Act to curb black money came into force on November 1, 2016. The Benami Transactions (Prohibition) Amendment Act, 2016 is an amendment of the older Benami Transactions (Prohibition) Act 1988.

This Act defines benami transactions, prohibits them and further provides that violation of the Act is punishable with imprisonment and fine. “The Act prohibits recovery of the property held benami from benamidar by the real owner. Properties held benami are liable for confiscation by the Government without payment of compensation.”

The practice of adding the correct name to the property transacted, will bring transparency in the residential markets. With increased transparency, title risks will reduce, thereby, boosting buyers’ confidence. It will also increase professionalism and the tag of corruption and unaccounted wealth, which follows most developers, will hopefully, be limited to a few unethical players

D. INCOME DECLARATION SCHEME – 2016

The Modi Government came out with new scheme Income Declaration Scheme. This scheme was effective from 1st June, 2016 and declaration required to be filed upto 30th September 2016.

This scheme was relating to, Declaration can be made in respect of— any undisclosed income or investment in any asset representing undisclosed income relating to any financial year upto 2015-16. Amount payable by the declarant in this scheme was 45% of undisclosed income declared.

To encourage people to declare their undisclosed income, the government said that information contained in the declaration shall not be shared with any other law enforcement agency. ,Also, there was no need to explain the source of income. The scheme applied to undisclosed income pertaining to financial year 2015-16 or earlier.

The government has been deservedly complimented for a very successful implementation of the Income Declaration Scheme (IDS)

Finance Minister Arun Jaitley said 64,275 declarants disclosed over Rs 65,000 crore under the black money disclosure scheme.

E. DENOMINATIONS OF BANK NOTES effect from the expiry of the 8th November, 2016

From all the above 4 schemes it is clear that all the steps are pre planned to control the black money.

Narendra Modi’s currency ban may not have been the first the country has seen, but it is definitely the first that has caused such a stir. While the previous demonetisation acts affected only the privileged few, Modi’s currency ban, in contrast, has been barely felt by the privileged few with access to online payment methods. Black money hoarders on the other hand, are feeling the heat. But the role that this currency ban will play in the future of corruption control is yet to be seen.

Reason of Introduction of This Scheme: The incidence of fake Indian currency notes in higher denomination has increased. For ordinary persons, the fake notes look similar to genuine notes, even though no security feature has been copied. In order to contain the rising incidence of fake notes and black money, the scheme to withdraw has been introduced.

With a view to curbing financing of terrorism through the proceeds of Fake Indian Currency Notes (FICN) and use of such funds for subversive activities such as espionage, smuggling of arms, drugs and other contrabands into India, and for eliminating Black Money which casts a long shadow of parallel economy on our real economy, it has been decided to cancel the legal tender character of the High Denomination bank notes of Rs.500 and Rs.1000 denominations issued by RBI till now.

Conclusion:

While it is a very bold and positive step for the country as a whole, it may not auger well for some – for those whom it will be difficult to disclose or use this money any more. The declaration of Rs. 500 and Rs. 1000 currency notes to be no longer ‘a legal tender’ will address many problems of the country, viz.Counterfeit / fake currency notes, Money used in terrorist activities, Corruption in politics / administration / business, Imbalance between haves and have notes (to some extent),Malpractices in political system and Unaccounted / black money menace.

Disclaimer: The entire contents of this document have been prepared on the basis of relevant provisions and as per the information existing at the time of the preparation. Although care has been taken to ensure the accuracy, completeness and reliability of the information provided, I assume no responsibility therefore. Users of this information are expected to refer to the relevant existing provisions of applicable Laws. The user of the information agrees that the information is not a professional advice and is subject to change without notice. I assume no responsibility for the consequences of use of such information. IN NO EVENT SHALL I SHALL BE LIABLE FOR ANY DIRECT, INDIRECT, SPECIAL OR INCIDENTAL DAMAGE RESULTING FROM, ARISING OUT OF OR IN CONNECTION WITH THE USE OF THE INFORMATION. This is only a knowledge sharing initiative and author do not intend to solicit any business or profession.

(Author can be reached at csdiveshgoyal@gmail.com )