Step by step process of registration for online TDS/TCS return filing and upload

1. First of all, allow the pop-ups in your browser (following is the screenshot of chrome browser). Afterwards, don’t forget to block it again.

2. Now open http://tdscpc.gov.in/ and make login as usual. You will find a link with words “Register at e-filing site” on left side panel of Quick Links. Click on that.

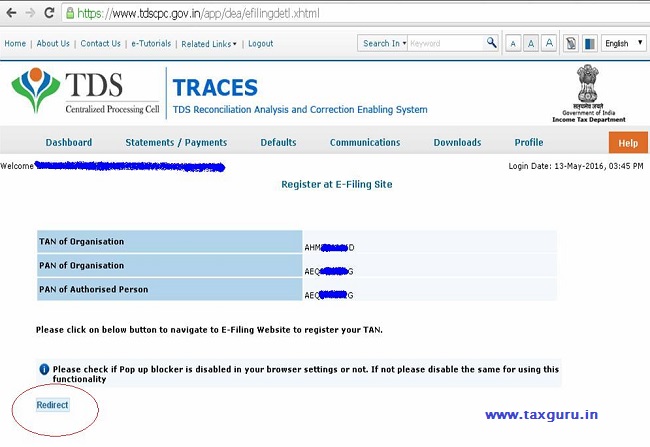

3. Now you will find the following screen. Click on “redirect”.

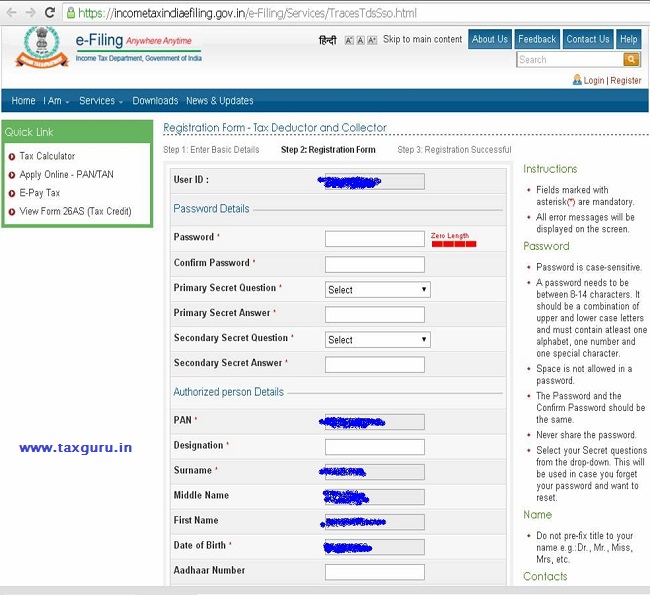

4. Now you will be redirected to incometaxefiling.gov.in. Refer to the following screenshot.

5. Fill up the details there and click on submit. Now you will get a message as under. Read it carefully.

5. Fill up the details there and click on submit. Now you will get a message as under. Read it carefully.

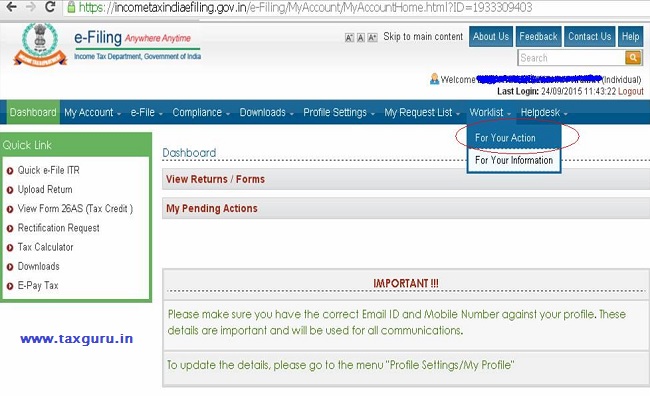

6. Now go to http://incometaxindiaefiling.gov.in/ and make usual login by PAN, D.O.B. and password and put curser on “worklist” and click on “For your action”. Screen will appear with all details like PAN, Name, Mobile number, Email ID etc. Go through it carefully and if there is any mistake at data entry level then “reject” the same, otherwise click on “approve”.

6. Now go to http://incometaxindiaefiling.gov.in/ and make usual login by PAN, D.O.B. and password and put curser on “worklist” and click on “For your action”. Screen will appear with all details like PAN, Name, Mobile number, Email ID etc. Go through it carefully and if there is any mistake at data entry level then “reject” the same, otherwise click on “approve”.

7. Then you will get the message as “Request has been approved successfully”.

8. Now open the email ID which you have given at the time of registration and you might have received an email there with link for verification. Click on that link and there will appear a box which asks for “Mobile PIN” which you would have received on mobile number entered at the time of registration. Enter the “Mobile PIN” and click on “Submit”. Or if you have not received either “email” or “mobile pin”, then you may request for resending the same. For that open http://incometaxindiaefiling.gov.in and click on “Login” and then click on “Resend Activation Link”. From the dropdown menu, select “TDS User”. Now fill up the required fields and again “Submit”. Now again open the email ID which you have given at the time of registration and you might have received an email there with link for verification. Click on that link and there will appear a box which asks for “Mobile PIN” which you would have received on mobile number entered at the time of registration. Enter the “Mobile PIN” and click on “Submit”. And then you will get a message “The user ID is successfully activated”.

9. Make “login” to the same website (http://incometaxindiaefiling.gov.in) with “TAN” as ID and give the password which you have set at the time of this registration. Now put a curser on “TDS” menu and select “Upload TDS” (Actually it should be “Upload TDS/TCS”).

10. Now select the appropriate options from the dropdown menus and click on “Validate”. On next screen follow the instructions given there and click on “Upload”.

That’s it…………….

I hope this might have helped you to understand this new procedure in appropriate manner.

CA. Tejas K. Andharia

CA. Tejas K. Andharia

B. COM, F.C.A., D.I.S.A.(ICAI), D.I.R.M.(ICAI)

Bhavnagar, Gujarat

Email: tejasinvites@gmail.com

Disclaimer: The contents of this article are for information purposes only and does not constitute advice or a legal opinion and are personal views of the author. It is based upon relevant law and/or facts available at that point of time and prepared with due accuracy & reliability. Readers are requested to check and refer to relevant provisions of statute, latest judicial pronouncements, circulars, clarifications etc before acting on the basis of the above write up. The possibility of other views on the subject matter cannot be ruled out. By the use of the said information, you agree that Author / TaxGuru is not responsible or liable in any manner for the authenticity, accuracy, completeness, errors or any kind of omissions in this piece of information for any action taken thereof. This is not any kind of advertisement or solicitation of work by a professional.

(Republished with Amendments by Team Taxguru)

Error:Your current request has been expired due to idle time limit exceed.Kindly proceed with fresh request.

Hello,

Please let me know how to do tds registration(traces) online

Hi Taxguru,

I appreciate your knowledge and experience in Tax and accounting. My Question is regarding GST I’m an Amazon seller I don’t file any return from 8 months so what should I do.

PLEASE SEND MI STEPS ON REGISTRATION TDS RETURN FILING ONLINE?

AND WHEN SHOWING IN UPLOAD TDS & VIEW FILED TDS OPTION ON PORTAL .

THANKS

At the Time of Registration wrong PAN is insert what is the next process

Sir,

From TDS return utility return is generated in FVU file.

In the priscribed procedure as above TDS return must be in XML file. Can

u please tell how to generate TDS return in XML file ??

Thanks

IT only accepts Regular Returns and not Corrected Returns.