Brief about new Personal Income Tax Regime & Key Highlights

New section 115BAC is inserted in Income Tax Act by the Finance Act 2020 and it is applicable w.e.f 1st April 2020 and will be applicable on Individuals and HUFs for assessment year 2021-22 and subsequent assessment years.

Under this section taxpayers i.e Individuals and HUFs has an option to pay the tax on the basis of concessional slab rates subject to some conditions.

The new income tax slab rates as per section 115BAC are as follows:

| Total Income (Rs) | New Regime Tax Rate (%) |

| Up to 2,50,000 | Nil |

| From 2,50,001 to 5,00,000 | 5 |

| From 5,00,001 to 7,50,000 | 10 |

| From 7,50,001 to 10,00,000 | 15 |

| From 10,00,001 to 12,50,000 | 20 |

| From 12,50,001 to 15,00,000 | 25 |

| Above 15,00,000 | 30 |

Conditions to opt new tax scheme

In order to avail the benefit of section 115BAC, an individual/HUF assessee has to forgo the ‘specified Exemptions and Deductions’ under various chapters and sections of the Income Tax Act which are as follows:

√ Leave travel concession as contained in clause (5) of section 10;

√ House rent allowance as contained in clause (13A) of section 10;

√ Some of the allowance as contained in clause (14) of section 10;

√ Allowances to MPs/MLAs as contained in clause (17) of section 10;

√ Allowance for income of minor as contained in clause (32) of section 10;

√ Exemption for SEZ unit contained in section 10AA;

√ Standard deduction, deduction for entertainment allowance and employment/professional tax as contained in section 16;

√ Interest under section 24 in respect of self-occupied or vacant property referred to in sub-section (2) of section 23. (Loss under the head income from house property for rented house shall not be allowed to be set off under any other head and would be allowed to be carried forward as per extant law);

√ Additional deprecation under clause (iia) of sub-section (1) of section 32;

√ Deductions under section 32AD, 33AB, 33ABA;

√ Various deduction for donation for or expenditure on scientific research contained in sub-clause (ii) or sub-clause (iia) or sub-clause (iii) of sub-section (1) or sub-section (2AA) of section 35;

√ Deduction under section 35AD or section 35CCC;

√ Deduction from family pension under clause (iia) of section 57;

√ Any deduction under chapter VIA (like section 80C, 80CCC, 80CCD, 80D, 80DD, 80DDB, 80E, 80EE, 80EEA, 80EEB, 80G, 80GG, 80GGA, 80GGC, 80IA, 80-IAB, 80-IAC, 80-IB, 80-IBA, etc).

However, deduction under sub-section (2) of section 80CCD (employer contribution on account of employee in notified pension scheme) and section 80JJAA (for new employment) can be claimed.

Comparative analysis of Old Vs New Tax regime:

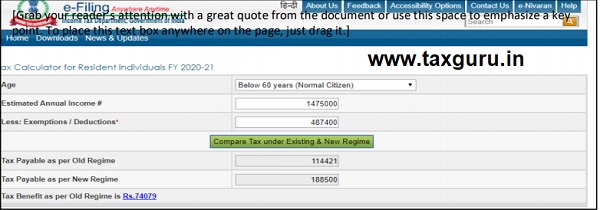

We have an example of Mr. A with his Taxable Income with two different scenarios under new and old Tax Regime:

Scenario-1

| Taxable Income of Mr. A (Scenario-1) | Taxable Income as per old tax regime | Taxable Income as per new tax regime | ||

| Particulars | Amount in (INR) | Amount in (INR) | Amount in (INR) | Amount in (INR) |

| Salary (Including all allowances) (A) | 1525000 |

INR 9,87,600/- (Considering All the Exemptions & deductions) |

INR 14,75,000/- (Without considering all exemptions and deductions Except 80CCD (2)) |

|

| Less Exemptions: | ||||

| (i) House Rent Allowance | 85000 | |||

| (ii) Children education Allowance | 2400 | |||

| Total Exemptions (B) | 87400 | |||

| Taxable Salary (A)-(B) = (C) | 1437600 | |||

| Less: Deductions | ||||

| (i) Standard Deduction | 50000 | |||

| (ii) Deduction i.r.o Housing loan Interest U/S 24(b) | 200000 | |||

| (iii) Deduction U/S 80 (C) | 150000 | |||

| (iv) Deduction U/S 80 CCD (2) | 50000 | |||

| Total Deductions (D) | 450000 | |||

| Net Taxable Income | 987600 | |||

Tax calculation of Mr. A (Scenario-1)

| As per old tax regime | As per new tax regime | ||||

| Income range From | Income range To | Tax Rate | Tax Amount | Tax rate | Amount |

| 250000 | Nil | 0 | Nil | ||

| 250001 | 500000 | 5% | 12500 | 5% | 12500 |

| 500001 | 750000 | 20% | 50000 | 10% | 25000 |

| 750001 | 1000000 | 20% | 47520 | 15% | 37500 |

| 1000001 | 1250000 | 30% | 0 | 20% | 50000 |

| 1250001 | 1500000 | 30% | 0 | 25% | 56250 |

| Above 1500000 | 30% | 30% | |||

| Total Tax | 110020 | 181250 | |||

| Add: Education Cess @4% | 4401 | 7250 | |||

| Total Tax Liability | 114421 | ||||

As per scenario-1 Mr. A Should Opt his taxation as per Old tax Regime.

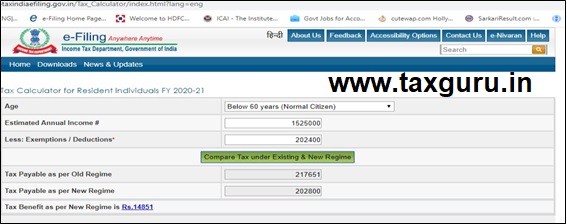

Scenario-2

|

Taxable Income of Mr. A (Scenario-2) |

Taxable Income as per old tax regime | Taxable Income as per new tax regime | ||

| Particulars | Amount in (INR) | Amount in (INR) | Amount in (INR) | Amount in (INR) |

|

Salary (Including all allowances) (A) |

1525000 |

INR 13,22,600/- (Considering All the Exemptions & deductions) |

INR 15,25,000/- (Without considering all exemptions and deductions) |

|

| Less Exemptions: | ||||

| (i) House Rent Allowance | ||||

| (ii) Children education Allowance | 2400 | |||

| Total Exemptions (B) | 2400 | |||

| Taxable Salary (A)-(B) = (C) | 1522600 | |||

| Less: Deductions | ||||

| (i) Standard Deduction | 50000 | |||

| (ii) Deduction i.r.o Housing loan Interest U/S 24(b) | ||||

| (iii) Deduction U/S 80 (C) | 150000 | |||

| (iv) Deduction U/S 80 CCD (2) | ||||

| Total Deductions (D) | 200000 | |||

| Net Taxable Income | ||||

Tax calculation of Mr. A

| As per old tax regime | As per new tax regime | ||||

| Income range From | Income range To | Tax Rate | Tax Amount | Tax rate | Amount |

| 250000 | Nil | 0 | Nil | ||

| 250001 | 500000 | 5% | 12500 | 5% | 12500 |

| 500001 | 750000 | 20% | 50000 | 10% | 25000 |

| 750001 | 1000000 | 20% | 50000 | 15% | 37500 |

| 1000001 | 1250000 | 30% | 75000 | 20% | 50000 |

| 1250001 | 1500000 | 30% | 21780 | 25% | 62500 |

| Above 1500000 | 30% | 30% | 7500 | ||

| Total Tax | 209280 | 195000 | |||

| Add: Education Cess @4% | 8371 | 7800 | |||

| Total Tax Liability | 217651 | 202800 | |||

As per scenario-2 Mr. A Should Opt his taxation as per New tax Regime.

Selection of New or Old Tax Regime depends upon some factors which are explained as follows:

1. Nature of Income:- Whether assesse’s of Income is only from the “Salary” or it will include income from other heads later in the current financial year i.e between 01.04.2020 to 31.03.2021. If assessee is expecting his income from other heads for which amount can’t be determined in the beginning of financial year or any time before the end of relevant financial year then assessee should not make hurry to opting the tax regime old or

For example generally a salaried employee receive some incomes from his employer in the mid or by the end of financial year like Bonus, Performance related pay etc. for which employee don’t know the exact amount which is expected to be received in the mid or by the end of relevant financial year.

So income is a variable factor while opting old or new Tax Regime and must be considered & properly analyzed by the assessee.

2. Exemptions/Deductions to be availed:- Before opting the old or new Tax Regime assessee must review all the exemptions/deductions which are to be availed by him like number of exemptions/deductions, quantum/amount of exemptions/deductions and their impact on taxable income i.e whether is there any change in slab of his income such due to exemptions/deductions.

For example sometimes assessee has less number of exemptions/deductions with very low impact on taxable income like an assessee may or may not have interest on housing loan which is available for deduction U/S 24(b) of Income Tax Act 1961 or if assessee has the same but amount is not as much as it will change the slab of Income after considering the same.

Hence it is personal advice of author of this article to all the taxpayers covers u/s 115BAC that make proper analysis of your Tax liability before opting old or new Tax Regime, even this section also provided that assessee can opt old or new Tax Regime before filing his return of income.

So it is advised to all taxpayers that they should opt the old or new Tax Regime only while file your income tax return.

Note:

-

- To calculate/access your tax liability under both old and new Tax Regime you may refer income tax calculator F.Y 2020-21 which is available at incometaxindiaefiling.gov.in

- If you want MS Excel based utility/Income tax Calculator for F.Y 2020-21 under both old and new Tax Regime you can mail at cmajeevan2014@gmail.com or WhatsaApp on 9897685997 I will share the same.

CBDT has issued a circular C1 of 2020 dated 13th April on clarification of TDS under section 115BAC .

Main points which are clarified by CBDT through this circular are as follows:

1. If an employee having Income from other than Income under the head “ Profits & Gains of Business or Profession” and willing to opt new Tax Regime U/S 115BAC may intimate the duductor being his employer of such intention on each financial year and upon such intimation the deductor shall compute his total income and deduct TDS accordingly.

If such intimation is not made by employee the employer shall make TDS without considering the provisions of section 115BAC.

2. It is also clarified that if intimation made by employee to opt new Tax Regime U/S 115 BAC and willing to deduct TDS accordingly during the financial year in such case the employee can’t modify his option during financial year to opt old Tax Regime.

However at the time of filing of return of income the option could be different from the intimation that made by such employee to the employer for that financial year.

References to this article:

- Finance Act 2020, Income Tax Act 1961

- CBDT Circular C1 of 2020 dated 13th April 2020

- Different websites like Taxmann.com, Taxguru.in and incometaxindiaefiling.gov.in