Insight Instruction No. 77, issued by the Directorate of Income Tax (Systems), introduces a functionality for the verification of high-risk refund cases by jurisdictional assessing officers (JAO) through the Insight Portal. This directive aims to streamline the verification process and ensure the accuracy of refund claims. Let’s explore the details of this instruction and its implications. Insight Instruction No. 77 introduces a systematic approach for jurisdictional assessing officers to verify high-risk refund cases, ensuring compliance with tax regulations and preventing fraudulent refund claims. By adhering to the SOP and guidelines outlined in this directive, JAOs can effectively identify potential discrepancies, conduct thorough investigations, and provide timely feedback, thereby contributing to the integrity and efficiency of the tax assessment process.

Insight Instruction No. 77

DIRECTORATE OF INCOME TAX (SYSTEMS)

ARA Centre, Ground Floor, E-2, Jhandewalan Extension,

New Delhi-110055

F.No. DGIT(S)/ADG(S)-2/HRR/2023-24/

Dated: 02.04.2024

To,

All Pr. CCsIT

Sir / Madam,

Sub.: -Functionality for Verification of High-Risk Refund Cases for Jurisdictional Assessing Officer at Insight- reg.

Kindly refer to the above.

2. Cases related to High-Risk refund ITRs identified based upon certain rules have been disseminated to the Jurisdictional Assessing Officer (JAO) for the purpose of verification of refund claim for timely processing of ITRs.

3. JAOs need to verify the cases and provide one of the following feedbacks on Insight Portal in a time-bound manner:

a) “ITR can be processed” or

b) “Further risk assessment required”

4. In this regard, SOP for JAO for verification of High Risk Refund cases is attached as Annexure- A. All the aspects mentioned in the SOP have to be examined in detail before providing feedback as mentioned above. Further, kindly refer to Annexure-B for Step-by-Step guidance on case view, verification, and feedback on Insight portal.

5. In case of any technical difficulty being observed, users may contact Insight help desk. (Helpdesk number- 1800-103-4216, Email id: helpdesk@insight.gov.in).

Yours faithfully,

(Abhishek Kumar)

ADG(Systems)-2, New Delhi.

Copy to:

1. PPS to the Chairman, Member (S&FS), Member (TPS), Member(L),Member (A&J), Member (Adm.) & Member (IT & Rev.), CBDT and DGIT(Systems), New Delhi for information.

Nod2. al officer of ITBA, Insight i-Library, https://www.irsofficersonline.gov.in

ADG(Systems)-2, New Delhi.

Annexure A

F. No. Dir (Hqrs.)/Ch(DT)/07/Misc./2023

Government of India

Ministry of Finance

Department of Revenue

[Central Board of Direct Taxes]

Room No. 226, North Block

New Delhi, 13 .03.2024

OFFICE MEMORANDUM

Sub: Standard Operating Procedure (SOP) for Jurisdictional Assessing Officer (JAO) for verification of High-Risk Refund (HRR) cases– reg.

It has been noticed that many return filers are claiming excess refunds through various means such as wrong claim of TDS credit, under reporting of income, over stating of deductions, claim of bogus expenses etc. Accordingly, some cases have been identified based upon approved risk rules for high-risk refund. These cases are now being sent to JAO through Insight Portal. Such cases should be dealt with as per the procedure prescribed below: –

Guidelines for handling high risk refund cases disseminated by Pr. DGIT / DGIT (Systems) to JAO for verification:

1) Details of ITRs claiming High Risk refund which are disseminated to the JAO for the purpose of verification for timely processing of ITR will be visible in Insight portal in Verification Module with a new case type- “High Risk Refund Cases-JAO”.

2) JAO needs to refer to the relevant Insight Instruction for accessing the case type and related details in Insight Portal. In case of uneven distribution of cases (more than average) i.e., a few JAOs get more cases than average, PCIT/CIT can reassign/redistribute cases within the PCIT/CIT charge for rationalization of workload or where a PCIT/CIT charge has more than the average cases, CCIT can reassign/redistribute cases within the CCIT charge for rationalization of workload. As most of the High-Risk Refund cases will be identified during the time of peak return filing, it is suggested that MIS be regularly monitored in the months of August to October as there may be requirement of redistribution during this period for workload management.

3) JAO must give one of the two feedbacks, that is, “ITR can be processed” or “Further risk assessment required” after verification. The feedback must be given within 30 days from the date of receipt of the case in Insight Portal.

4) JAO shall provide the feedback “Further risk assessment required” only if any of the following-mentioned criteria is fulfilled. If not, JAO shall provide feedback “ITR can be processed”. The criteria are as follows:

i. To examine if any major claim of deductions, etc. has been disallowed in any of the latest 3 assessment orders (orders including assessment orders passed u/s 143(3)/144/147/153A/153C/263 of the Income Tax Act-1961) out of last 8 years assessment order data as available in ITBA Portal. After examining the disallowance, JAO shall check the status of appellate proceedings. Only in cases where no appeal has been filed or the disallowance stands confirmed as on date, the feedback “Further risk assessment required” is required to be given.

ii. To examine if any penalty order has been passed for any incorrect submission of facts in any of the latest 3 Penalty Orders out of last 8 years as available in ITBA Portal. If yes, the feedback “Further risk assessment required” must be given.

iii. To examine if taxpayer has revised return and increased claim of refunds in 3 or more years out of the last 8 years as available in AO Portal of e-filing. If yes, the feedback “Further risk assessment required” must be given.

iv. To examine if a PAN has been flagged in High-Risk Refund rules in 3 or more years out of last 8 / available years as available in Insight. If yes, the feedback “Further risk assessment required” must be given.

v. To examine if any information with respect to CRIU/VRU uploads of the latest 3 years is available (and where order taking into account the said uploads has not been passed) for taxpayer in profile views of Insight Portal, which states that the taxpayer has under reported receipt or / claimed deduction not allowable as per the Income-Tax Act, or any other information which suggests any form of tax evasion/ non-compliance on part of the assesses. If yes, the feedback “Further risk assessment required” must be given.

5) If during the verification, taxpayer revises the Income Tax return, the details of Income, exempted allowances, deductions claimed, refund claimed, etc. furnished, such revised return may be considered by JAO and accordingly feedback may be provided.

6) This issues with the approval of Competent Authority.

(Vikas Jakhar)

DCIT (OSD) HQ cum Dy CISO, CBDT

Mob- 9958528169

To,

All Pr. CCsIT

All CCsIT (Central)

All DGsIT (Inv.)

Annexure B- Step by Step Quick Reference Guide

Navigation Taxpayer Verification

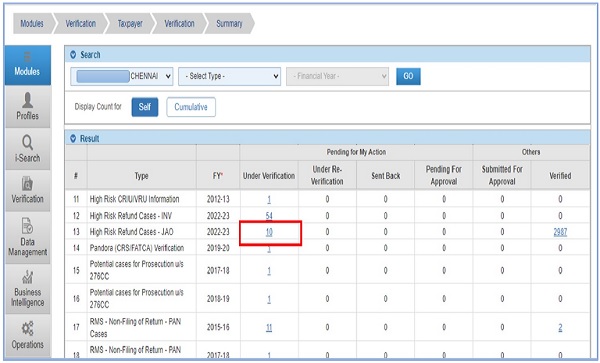

1. After successful login to Insight, user needs to navigate to Taxpayer Verification and Select “Verification” to select High Risk Refund- JAO Cases.

Navigate to HRR JAO Cases

2. User will be navigated to Case summary view to select High Risk Refund Cases- JAO and click on count as displayed below to navigate to Case List View.

Navigate to Case List View

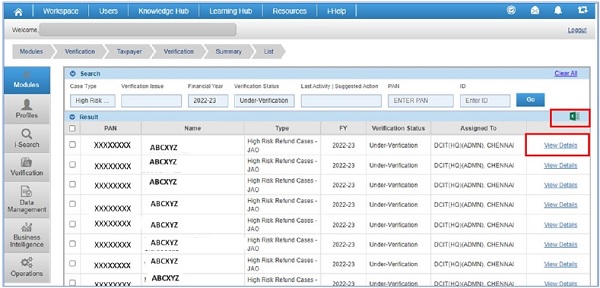

3. In Case List view, user will be able to view List of Cases created on PANs along with certain other attributes like FY, Assigned to. User will be able to download the List of Cases in Excel available at top right corner of the screen.

4. By clicking “View Detail” hyperlink user will be navigated to Case Detail View.

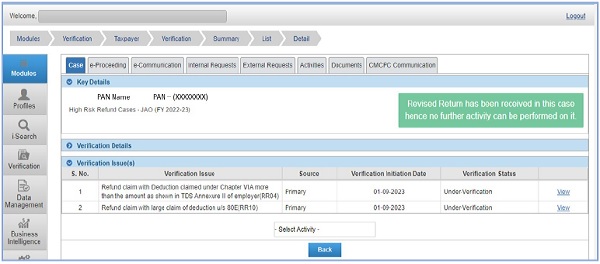

Case Detail View and Case level activities

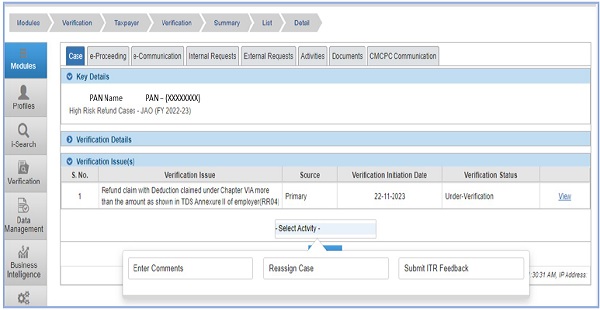

5. At Case Detail View, user will be able to view Verification Issue of the case and perform Case Level activities.

a. User will be able to click on view hyperlink displayed against Verification Issue to navigate to Information detail underlying the Verification Issue.

6. Following Case level activities will be available to the user at Case Detail Page

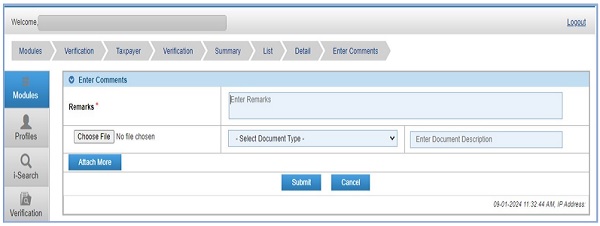

a. Enter Comments

b. Reassign Case

c. Submit ITR Feedback

Enter Comments

7. The following screen will be visible to user on clicking activity “Enter Comments”. User will be able to update comments in the case which will be visible to the user and all supervisor in hierarchy (In cumulative View).

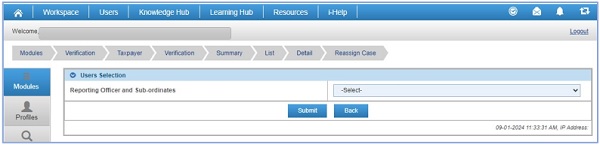

Reassign Case

8. User will be able to Reassign case to the Reporting Officer and Subordinates in hierarchy.

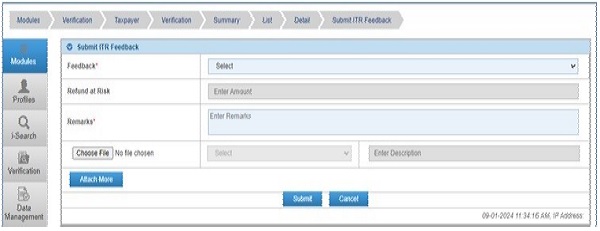

Submit ITR Feedback

9. This activity will be performed by ITD User to submit the Feedback on the Case.

a. Options available for Feedback will be – “ITR can be processed” or “Further Risk Assessment Required”.

b. In case user selects Further Risk Assessment Required, User will be prompted to enter the Amount.

i. Amount to be entered will be of Refund at Risk.

10. Remarks will be mandatory and adding of documents will be optional.

11. On clicking submit button, ITR Feedback will be submitted and status of the case will be updated from “Under Verification” to “Verified”.

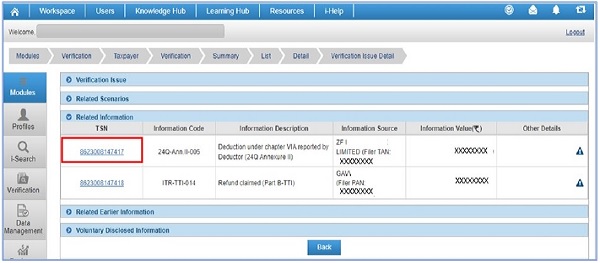

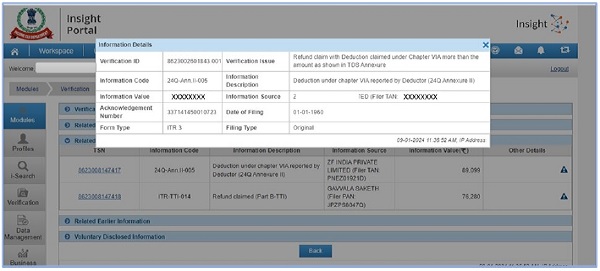

Information Detail View

12. Information Detail view will provide detail of Information underlying the Verification Issue. TSN will be hyperlink which will provide detail of Information like Acknowledgement Number, Date of Filing, Form Type and Filing Type.

TSN Pop up view

Cases where Revised Return is filed by Taxpayer- No further activity can be performed

13. The flag to indicate the fact that revised return has been filed by the Taxpayer for the relevant AY, will be displayed in existing case at Case Detail page to the User. User will not be able to perform any further activities in the case.

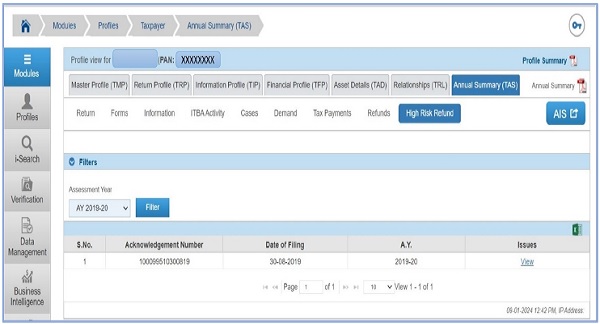

View Previous Years HRR Issue in Taxpayer Profile views

14. The user will be able to view the Details of the High-Risk Refund issues flagged on PAN of the Taxpayer in Previous years, if any, in Taxpayer Profile Views under Taxpayer Annual Summary (TAS).

15. User needs to select the relevant Assessment Year filter.

16. User will be able to click on view hyperlink and view the Verification issues of previous year acknowledgement Number wise.