The Income Tax department has introduced a groundbreaking feature for taxpayers – the ‘Challan Correction’ functionality on its e-filing portal. This transformative addition offers taxpayers a convenient and efficient way to correct errors in their challans related to Advance Tax, Self-Assessment Tax, and Regular Assessment Tax.

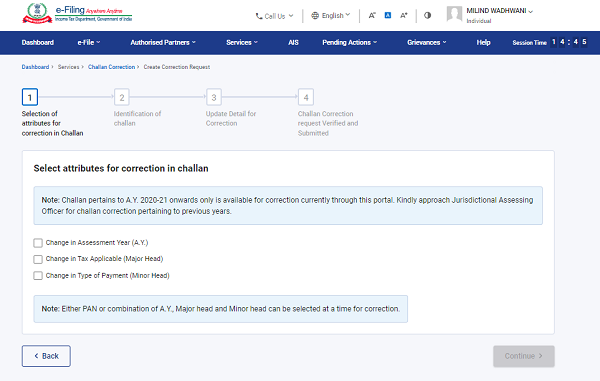

Path: Dashboard > Services > Challan Correction

Income Tax department has introduced a new functionality for “Challan Correction” on its e-filing portal.

This new feature, accessible through the path Dashboard > Services > Challan Correction, allows taxpayers to make certain corrections to their challans related to Advance Tax, Self-Assessment Tax, and Demand Payment as Regular Assessment Tax, specifically for the Assessment Year (A.Y.) 2020-21 onwards.

The introduction of this functionality marks a significant step towards reducing the burden on taxpayers when it comes to correcting errors or making amendments to their challans. Traditionally, rectifying errors in tax-related transactions could be a cumbersome and time-consuming process, often involving the submission of numerous documents, including Indemnity Bonds, which aimed to protect the authorities from potential misuse.

This new “Challan Correction” functionality is poised to transform this experience. By providing taxpayers with the flexibility to modify crucial details such as Assessment Year, Major Head, and Minor Head for Advance Tax, Self-Assessment Tax, and Demand Payment as Regular Assessment Tax, the Income Tax India portal empowers taxpayers to correct inadvertent errors in a more convenient and efficient manner.

The scope of this feature covers challans pertinent to A.Y. 2020-21 onwards, ensuring that recent tax transactions are subject to easier correction processes. This development comes as a welcome initiative, reflecting the tax authority’s commitment to embracing digital innovation for the benefit of taxpayers and stakeholders alike.

Rs. 10000/- was wrongly paid toward the payment of Tax on Regular Assessment under Minor Head {400) for the A.Y: 2022-23 vide Chalan No:- 02064 on dated 09-11-2022 having BSR Code :- 0014431 instead of the Outstanding Demand pertaining to the A.Y: 2008-09. By the way again Rs. 9500/- was also paid on Minor Head: Tax on Regular Assessment Year (400) vide Challan No:- 25525 on dated 09-11-2022 having BSR Code:- 0004329.. Now no any outstanding demand is pending and no payments was accounted for. Now how shall I claim rs. 10,000/- which was wrongly paid or that Challan may be corrected for forthcoming Assessment Year? Please suggest me. Thank You. Suresh Prasad.

Adv. Tax Chalan for AY 22-23, Paid by employee putting his own PAN, under TDS head.

Whether it can be corrected on line? How?

Challan correction for AY 2022-23 not reflecting there. How to rectify them ?