Vide its representation requested CBDT that the due date of filing return of income be extended by at least a month from the prescribed date of 31st July, 2018 for AY 2018-19.

THE INSTITUTE OF CHARTERED ACCOUNTANTS OF INDIA

(Set up by an Act of Parliament)

ICAl/DTC/2018-19/Rep-23

23rd July, 2018

Shri Sushil Chandra ji,

Chairman,

Central Board of Direct Taxes,

Ministry of Finance,

Government of India,

North Block,

New Delhi-110 001.

Dear Sir,

Re: Request to extend due date of filing Income-tax returns for the AY 2018-19

As you are kindly aware that ICAI, being a partner in nation building, plays a pivotal role in strengthening the relationship between the taxpayers and the Department, by bringing to the notice of the Department, genuine hardships being faced by its members and the assessees under the Income-tax law and to ensure timely redressal of the same. Continuing in this direction, we bring before your kind notice the issues and difficulties faced by tax payers in filing their return of income for Assessment Year 018-19 within the time prescribed u/s 139 of the Income-tax Act, 1961.

As you are kindly aware that the due date for assessees mentioned under clause (c) of Explanation 2 to section 139(1) is 31 July, 2018 for AY 2018-19 which is fast approaching. We wish to inform that ICAI is increasingly getting information from our members about various legal, technical and practical difficulties being faced by tax payers w.r.t.’ coping up with the new forms of returns of income for AY 2018-19, which is ultimately leading to delays in filing the returns of income by the prescribed time limits.

Suggestion by Taxguru Team: Link ITR Filing Due date with ITR E-filing Utility Release Date

The assessees are facing difficulty in filing the ITR Forms by 31st July, 2018 due to the reasons enumerated below:

Page Contents

- 1. Delay in release of ITR form utilities and continuous and regular updation in the Schemas

- 2. Delay in updation of TDS credit in Form No. 26AS of the taxpayer and approaching due date of TDS statement filing for first quarter

- 4. Applicability of penal provisions of section 234F of the Income-tax Act, 1961 for the first time from AY 2018-19

- 5. Natural calamities disrupting normal life

- 6. Issues arising due to first time implementation of GST Law

- Download ICAI Representation to CBDT on ITR Due Date Extension in PDF Format

1. Delay in release of ITR form utilities and continuous and regular updation in the Schemas

As per Rule 12 of the Income-tax Rules, 1962, ITR Forms are to be filed electronically barring a few exceptions,which is possible only if the ITR Form utilities are made available on a timely basis.

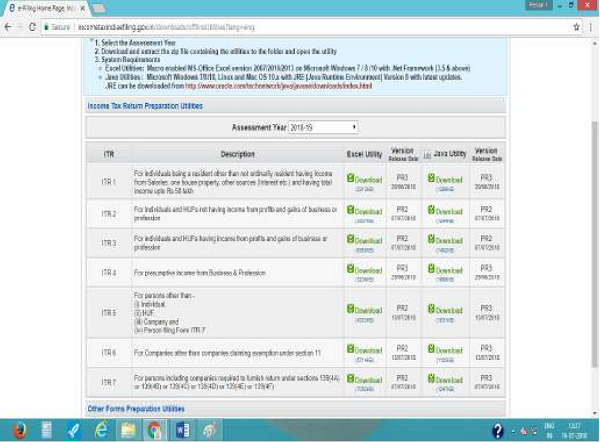

Although the ITR forms for AY 2018-19 were notified on 3rd April, 2018 vide Notification No. 16/2018, the ITR Form utilities in Java and Excel were released much later in the month of May, 2018 (except ITR 1 utility which was released on 14.4.18). Almost one and the half months after the start of the financial year, the ITR utilities were made available for e-filing by the Income-tax department.

As is clear from above, out of the 4 months (for 31st July cases) available to taxpayers for filing ROI, almost half the time (approx. 2 months of April and May) is lost due to non-availability of ITR Form utilities. The delay in issuing the relevant ITR Forms and other utilities necessary for filing the returns results in delay in filing ITR forms as the taxpayers are deprived of the time contemplated by the statute for preparing the return.

Referring to the screenshot above, it could be seen that the schema for ITR Forms 2, 3 and 7 were last updated on 7th July, 2018, and Schema for ITR 5 was last updated on 13th July, 2018.

Such updations in schema implies that the changes need to be made in the bulk filing ITR softwares by the vendors supplying such software. These ITR filing softwares are being used by the taxpayers for filing the ITR forms. It, in effect, delays the filing process further as software vendors requires atleast a week’s time to update its software as per changed schema of ITR forms.

Posts related to Delay in ITR Release

2. Delay in updation of TDS credit in Form No. 26AS of the taxpayer and approaching due date of TDS statement filing for first quarter

As you may be kindly aware that the due date to file TDS statements for last quarter of the financial year is 31st May of the financial year immediately following the financial year in which the deduction is made (Rule 31A of the Income-tax Rules, 1962). Also, the due date to file TDS statements for first quarter ending on 30th June, 2018 of the current financial year is 31st July, 2018.

Further, as per Rule 31 of the Income-tax Rules, 1962, the certificate of TDS in Form 16 (annually) and 16A (quarterly) are to be issued by the deductor to the deductee by 15th June of the financial year immediately following the financial year in which the income was paid and tax deducted and within fifteen days from the due date for furnishing the statement of tax deducted at source under Rule 31A respectively.

Despite the fact that there are penal provisions for late submission of TDS returns, some deductors fail to submit the same within the prescribed time sometimes due to genuine reasons as well. This leads to non-reflection of TDS credit in the Form 26AS of the taxpayer.

Generally, most tax payers get their TDS certificates on or after 15th June and the TDS credit in Form No. 26AS get reflected by 15th June or thereafter. It may further be informed that most deductees do not get their Form 16 and 16A on time due to late issue of the same by the deductor (may be due to technical glitches or delayed filings of e-TDS returns) which may lead to delay in ITR form filing.

We would like to further inform you that even Reserve Bank of India issues Form No. 16 to their retired employees for Pension in third week of June every year.

Even TDS CPC portal is reportedly running slow resulting in extra time to download the Form No 26AS and with hardly a week’s time left to file ITRs , downloading the same is becoming an issue.

Normally, correct amount of TDS is not reflected, even till the end of June month and hence, the assessees are effectively left with 1 month to file their ITR forms.

It is pertinent to note that many assessees have multiple businesses and streams of revenue and in genuine situations, may have to await the proper reflection of tax credits. Also, GST compilation and reporting requires time and effort and has to conform with Form 26AS and follow up with the respective deductors for any inadvertent errors and such correspondences happen only after TDS is reflected and is complete in all respects.

The concern here is :

1. Unless the credits of TDS appear in Form No. 26AS, the returns are generally not filed/cannot be filed due to less credits which will result in tax demand/lower refund;

2. The assessee cannot claim the credits of the amounts not appearing in Form No. 26AS as he does not have TAN of the deductor which is mandatory field for generating valid XML.

3. Issues raised by ICAI vide representation ICAI/DTC/2018-19/Rep-20 dated 4th July, 2018 still needs to be resolved

We refer to our earlier representation ICAI/DTC/2018-19/Rep-20 dated 4th July, 2018 (copy enclosed herewith) submitted to your good office wherein certain issues were reported by ICAI which were being faced by tax payers while filing ITR Forms for AY 2018-19. Some of those concerns like clarification regarding GST data to be filed in the ITR forms and acceptance/uploading of ITR forms containing bank account details of certain co-operative banks still needs a solution. Assessees affected by those concerns are finding it difficult to file their ITR forms.

4. Applicability of penal provisions of section 234F of the Income-tax Act, 1961 for the first time from AY 2018-19

Section 234F was inserted vide the Finance Act, 2017 to levy mandatory fees amounting to Rs 1,000/5,000/10,000 depending on the time of filing and quantum of income reported for ITRs filed after the due date prescribed u/s 139. This is first year of applicability of the provisions of section 234F. Your goodself may appreciate that even for a delay of one day in filing ITR, the assessee has to incur an additional cost of Rs 1,000/Rs 5,000. This would be very harsh for assessees whose filing of ROI is delayed due to genuine reasons or for assessees having refund or having nil tax liability at the time of filing ITR. An assessee may not even be aware of this mandatory fees u/s section 234F and further, it may deter the assessees from filing ITR after the prescribed date due to incurrence of additional cost of filing ITR form which will be in addition to interest payable u/s 234A for delayed filing of ITR.

5. Natural calamities disrupting normal life

As you may be kindly aware, monsoon in India is in full fury currently. Heavy floods are reported in the States of Maharashtra, Uttrakhand, Gujarat and Jammu and Kashmir. Normal life in such States is crippled. Heavy rains throughout the country has damaged the infrastructure and telecommunication lines and also led to internet connectivity issue which is a prerequisite to upload/electronically file the ITRs. In view of the same, assessees have voiced their apprehensions and hardships in meeting the statutory obligations in a timely manner.

6. Issues arising due to first time implementation of GST Law

Credits of Input Tax Credit balance of earlier laws i.e. erstwhile Excise, VAT & Service Tax laws may not being availed in GST law due to system failure at the time of claiming the credits will have a significant impact on the financial statements based on the judgements passed by various High Courts of the Country to increase the deadlines of filing the claims in Form TRANS-1. If the credit is not granted/granted, will surely effect the income/expenses of the assessee.

GST reconciliation with books of accounts and Form 26AS would take significant time & efforts since this being 1st year of implementation of GST law.

We wish to inform you that the due date of filing Quarterly GSTR-1 is 31st July. The assessees and professionals get busy normally during 5th to 10th of very month with GST returns ( monthly GSTR-1) and during 15th to 20th of every month for filling GSTR3-B which results in delaying the working of Direct Taxes.

GST Department is in process of coming up with modifications of returns which have been filed for rectifications. The dates have not been declared yet, which will also have an impact on the profit and loss account filed and thereby affecting the incomes/profits being reported in the ITR Forms.

Suggestion

In view of the above and in the interest of the nation as a whole, we suggest and request that the due date of filing return of income for assessees mentioned under clause (c) of Explanation 2 to section 139(1) be extended by at least a month from the prescribed date of 31st July, 2018 for AY 2018-19.

We are hopeful for a positive consideration of our suggestion.

With Best Regards

CA. Tarun Jamnadas Ghia

Chairman, Direct Taxes Committee

The Institute of Chartered Accountants of India

Download ICAI Representation to CBDT on ITR Due Date Extension in PDF Format

Other Representations

| 1 | Central Gujarat Chamber of Tax Consultants | Extend due date of ITR to 30.09.2018 & 30.11.2018 respectively |

| 2 | Karnataka State Chartered Accountants Association | Extend Income Tax Return due date & Relax application of Section 234F |

| 3 | The Tax Practitioners’ Association, Aurangabad | Extend Due Date of ITR for AY 2018-19 |

Sir it is very good you have done excellent efforts and I request to your please again demand the date of extend of Audit return upto 30-11-2018 Thanks

PLEASE EXTEND DUE DATE OF ITR FILING 31.08.2018 TO 30.09.2018 AND TAX AUDIT 30.09.2018 TO 30.11.2018.

GOOD EFFORTS BY RESPECTED ICAI

inki site crash ho rehi thi isliye date extend ki hai ………………baki to inke pitaji bhi hamse kam kerwa le dead line tak …………….

Sir,

Excellent efforts have been taken by you.Please keep it up

almost all ae having their income and deduction details from their pay slips ,

bank passbook entries / statements ,

and their own personal work outs ;

trying to break their heads at the last

minute , is not correct ; extension means

delay in filing itr , and they will try to file

their I T R in the last day/s ; perhaps we

are all in the habit of finding one

excuse or the other ; HAS THE GOVT. / IT

Dept. taken severe action on the

offices for delay in supplying the

form 16 , 16-A , and updating the

26 – AS Statement ? when there is no

severe punishment / penalties , who will comply with the rules ????? why form 26 – AS cannot be filled every month ; all the income shou ld b e reflected in form 26 – AS Statement irrespective of the fact whethe rthere is any TDS or not ; this will

help IT Dept. / Govt / assessee / non-aassee

concerned to know the details ; this

will avoid assessees concealing / not showin g their exact income ??????

PLEASE EXTENSION MINIUMUM 2 MONTHS

I have been pleading for the poor soldiers fighting the terrorists and also posted at inhospitable terran such as Siachen and for those in submarines and also for those who are oosted at such establishments where their communication even with their families are prohibited. None including Defence Chiefs seem to bother

We request to extend due date of filling.

the levy of penalty is nothing but hardship and unjustified burden on assessee for late filing of itr. the procedure forms are very lengthy filing of gstr 1

is 10/7/18 gstr 3b is 20/7/18 tds return is 31/7/18 a

more over the correct 26as is not avilable on portal

under these circumtances how could be income tax

filed

We request to extend due date of filling.

We request to extend due date of filling. Accountantt

We hope that Gov will consider this appeal for extending due date of ITR from jul to aug 18,

We request to extend due date of filling.

Due date should be extended

DUE DATE MUST BE EXTEND DUE TO HEAVY BURDEN OF SHORT PERIOD SO IT MAY BE EXTEND TILL 30TH SEP.2018

CLIENTS ARE NOT AWARE FOR FIRST TIME IN SUCH YEAR.

due to various laws and prescribed dates all ca Accoubtant and consultants oveburdened.some of them sufferring high bp and sugar.they have also to face all others hazzards.so due date extension request is genuine

IMPLEMENTION OF U/S 234F HARASSMENT TO THE TAXPAYER

One more reason to extend date for filing ROI that if there is incorrect Q4 Form 16A issued by Deductor due to error of omission of missing transaction which is not corrected despite repeated follow up reflecting lower credit in form 26AS. However, as a last resort assesses filed ROI assuming correct credit will be available in Form 26AS before assessment of income to avoid levy mandatory fees.

Date extension is must. In the above issue explained the minimum/appropriate time to file return for such huge number of IT-return filers, has to be given. Providing insufficent time, & collecting in name of penalty from so many citizen is unjust.

Postponing things is in our DNA and a perennial habit.ICAI should not be giving these flimsy reasons. there is no need to postpone the date for filing.

Today we facing following Hardship:

31st July is the last date for TDS filling,

Compliation with GST returns, need special care,

Floods in most part of India,

Many other changes in Income Tax Law, needs special care.

it will be interest of the renue that date for filling of return may be extented till 30/09/2018, For Tax audit it will extend upto 30/11/2018. this will avoid any further litigations.

We hope that Gov will consider this appeal for extending due date of ITR from 31st jul to 31st Augt. 18, in the interest of indian public and growth of return filler and also request that remove Penalty of Rs. 1000/-, for Aam public interest at least F. Y. 2017-18. than after only Rs. 500/2500.

In ITR 2, PROVISION FOR INFORMATION ABOUT PARTNERSHIP FIRMS, WHERE THE ASSESSEE IS A PARTNER IS MISSING.

ONLY IN ITR 3 IT IS AVAILABLE.

Due date should be extended and imposition of late fine u/s.234F is not justified. CBDT should make compulsory for providing assets and liabilities list for all the ITRs, even for ITR 1 so that the declared assets of salary earners can be scanned.

Authenticity of letter?

ITR Filling due date need to extend bcoz regular arise GST monthly filling issues, Tax Audit date 30 Sept. also nearest and many taxpayers who direct or indirectly depend on some Tax Audit Decision. so once extension decision help to every one to resolve & understand the all issues.

clear clarifications are required about the

eligibility of standard deduction of Rs.40,000/-

and also about the Rs.50,000/- exemption

on interest income – Where LIC’s different

pension schemes like Annuity Pension ,

and 2018 Budget P M V V Y Pension .

the standard cdeduction is allowed in liewu of transport expense , medical expense etc.

all are incurring these expenses whether

they are employes or not , whether they are getting pension or not; immediate clear clarifications are required as already about 4 months of the financial 2018-19 are going to be over ; the clarifications will

help the helpless senior citizens to plan

about their investments. not only interest

from banks but the interest income from

all other types should also be covered

for standard deduction and also interest

exemption.

We request to extend due date of filling.

We hope that Gov will consider this appeal for extending due date of ITR from jul to aug 18, in the interest of indian citizens…..

instead of demanding like this, demand the dept. / Govt to fix the date as 3 months from the release of the ITRs.

Sushikumar follows Adhia’s maths. Extn will come on the last date. Will be 2 2 2 late. FM knows Half of India is under flood. His message is very clear. Don’t care about your health & wealth. Don’t help near & dear. All bullshit. Won’t help you. Help yourself filing before 31st. Help yourself saving the penalty.

Due date should not be extended. In India we have a fashion that we will complete our work at last moment. ICAI has enumerated many issues but this will remain even after extension. Penalty of 5000/10000 once levied, tax returns from next year would be timely filed. The habit of date extension is to be split out from Indian functional system.