E-Tutorial explains Important Information on How to Verify TDS Certificate, Brief Steps for Verifying TDS Certificate and Pictorial Guide on how to Verify TDS Certificate for Deductee.

1. Important Information on “Verify TDS Certificate”.

- Deductee can verify TDS Certificate (16/16A) with the help of “Verify TDS Certificate” option available at TRACES.

- Verification of TDS certificate enables Taxpayer to verify whether the deducted tax has actually been received by the Government or not.

- TDS Certificates (16/16A) can be verified from Assessment Year 2009-10 onwards at TRACES for Salary & Non Salary.

- Choose compatible browser while accessing TRACES web portal. Recommended Browser versions are listed below :

√ Internet Explorer Version – 8, 9, 10 and 11.

√ Chrome Version – 52,53

√ Mozilla Firefox Version – 42,43.0.1

2. Brief Steps for “Verify TDS Certificate”.

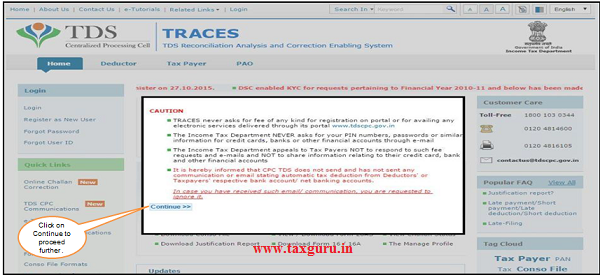

Taxpayer has to visit the website www.tdscpc.gov.in. TRACES homepage will appear, Click on “Continue” to proceed further.

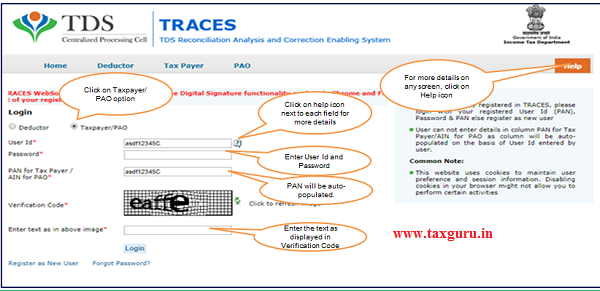

- Step 1 : Login to TRACES website and select Taxpayer/PAO option then enter “User ID”, “Password”, and “Verification Code” to proceed further. Landing page will be displayed on screen.

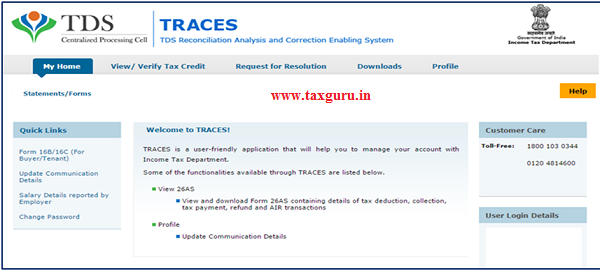

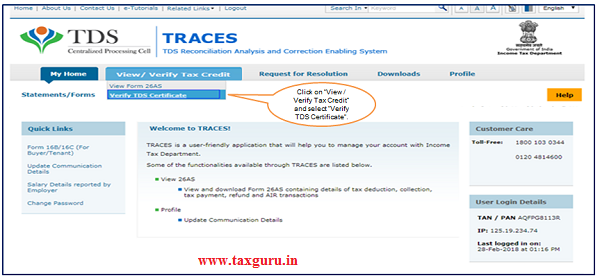

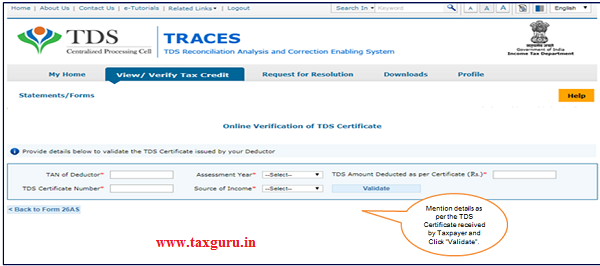

- Step 2: Click on “View / Verify Tax Credit” tab. Then click on “Verify TDS Certificate”.

- Step 3 : Mention “TAN of Deductor”, “TDS Certificate Number”, “Total amount deducted as per Certificate” select “Assessment Year” and “Source of Income” and click on “Validate”. Please DO NOT copy /paste the data taxguru.in.

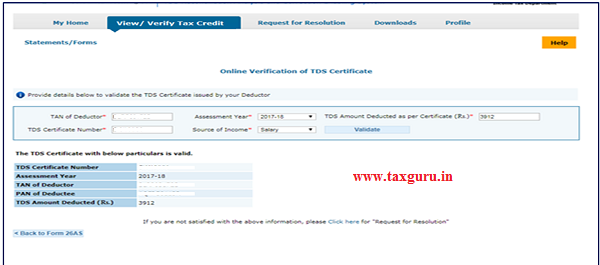

- Step 4 : Upon clicking on “Validate”, Details reflecting on TDS Certificate will appear on screen.

3. Pictorial Guide for “Verify TDS Certificate”.

Taxpayer has to visit the website www.tdscpc.gov.in. TRACES homepage will appear , click on “Continue” to proceed further.

Step 1 : Login to TRACES website and select Taxpayer/PAO option then enter “User ID”, “Password”, and “Verification code” to proceed further.

Step 1 (Conti.) : Landing page will be displayed on screen.

Step 2: Click on “View / Verify Tax Credit” tab. Then click on “Verify TDS Certificate”.

Step 3 : Mention “TAN of Deductor”, “TDS Certificate Number”, “Total amount deducted as per Certificate” select “Assessment Year” and “Source of Income” and click on “Validate”.

Step 4 : Clicking on “Validate”, Details reflecting on TDS Certificate will appear on screen.

Source- https://contents.tdscpc.gov.in

This process is unnecessary. All these, in any caqse, get reflected in 26AS. Employers harass by not giving 16/16A. Provision should be made available for tax payers to download true copies.