Introduction:

Form 26QB plays a significant role in the realm of property transactions in India. It’s the mechanism for paying Tax Deducted at Source (TDS) to the government under Section 194IA of the Income Tax Act, 1961. However, what happens when you need to make corrections to this form? We’ve got you covered with a detailed guide on how to correct Form 26QB for TDS on property sales.

How to correct from 26QB

Form 26QB-TDS on Sale on Property :

Form 26 QB is a return cum challan form for the payment of TDS to the Government for deductions made U/S 194IA of the Income Tax Act, 1961. Form 26QB needs to be submitted within 30 days from the end of the month in which TDS was deducted.

Online correction in Form 26QB :

I. Who can apply for correction?

Only buyers registered on TRACES can submit request

for “26QB” correction under “Statements /Forms” tab.

II. In which field correction can be made?

a. PAN of buyers;

b. PAN of seller;

c. Financial Year;

d. Amount paid/credited;

e. Date of payment/credit;

f. Date of deduction;

g- Property details;

h. Total value of consideration.

III. What are the steps for 26QB correction?

26QB Correction Procedure: Taxpayers can rectify mistakes made in Form 26QB using the 26QB Correction Facility. Following are the steps in brief:

Step 1: Login on TRACES as a Taxpayer with registered User ID and Password.

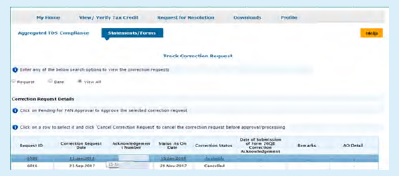

Step 2: Select option “Request for Correction” under “Statements/ Forms” tab to initiate correction request.

Step 3: Enter relevant “Assessment Year”, “Acknowledgment Number” and “PAN of Seller” according to filed Form 26QB, then Click on “File Correction” to submit request for correction. Request number will be generated after submission of Correction Request.

Step 4: Go to “Track Correction Request” option under “Statements/ Forms” tab and initiate correction once the status is “Available”. Click on “Available” status to continue.

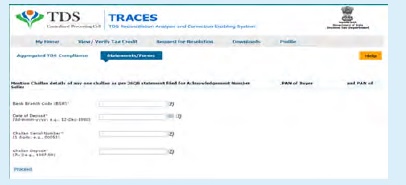

Step 5: Mention CIN details as per 26QB statement filed then click on “Proceed”.

Step 6: User can select the required field to edit details in 26QB. After clicking on “Edit” tab message will pop up on the screen. Click on “Save” to save updated details then click on “Submit Correction Statement”.

Screen will display “Confirm details” after submission of Correction Statement (Updated details will be highlighted in Yellow Colour).

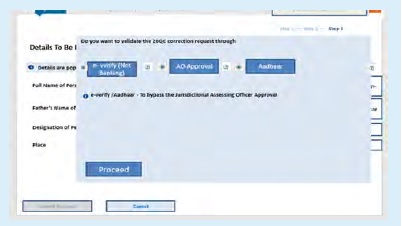

Profile details will be populated as updated on TRACES. Click on “Submit Request” to submit correction request.

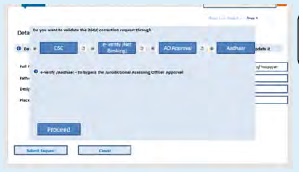

Step 7: After submission, user is required to validate the Correction request. If DSC is registered, user can validate the request using the DSC. If the DSC of the user is not registered, they can validate the correction request using the options e-Verify (Net Banking), AO Approval and Aadhaar OTP.

- After successful submission of correction, a Correction ID will be generated through which status of correction can be tracked.

- If DSC is not registered, furnish a hard copy of the acknowledgment of Form 26QB correction, Identity proof, PAN Card, the documents related to transfer of property and the proofs of payment to the Jurisdictional AO (whose details appear against your correction request) for verification.

- User can submit 26QB Correction statements without approval from Assessing Officer using e-Verify (Net-banking)/AADHAAR/DSC validation.

Conclusion:

Correcting Form 26QB is a crucial step to ensure the accuracy of TDS payments related to property sales in India. The online correction process offers a convenient and hassle-free way to rectify any errors. By following the steps outlined in this guide, you can easily navigate the correction process and maintain compliance with tax regulations. Whether it’s a simple typo or more significant corrections, the online correction facility simplifies the entire process.