How to Apply for Redressal of Grievances on traces website for deductee’s

Grievances in the field of taxation are a common occurrence, and the TRACES website offers a comprehensive platform for deductors to address and rectify these issues. In this article, we will guide you through the process of applying for the redressal of grievances on the TRACES website.

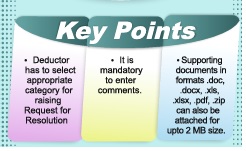

1. Request for the Resolution:

Deductor can raise grievances through online method at login at TRACES websites using “Request for Resolution “functionality. Grievances can be raised from Financial Year 2007-08 onwards

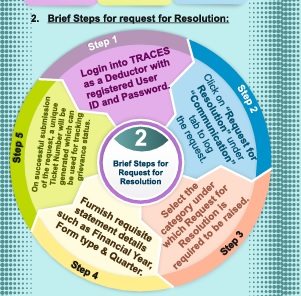

2. Brief Steps for request for Resolution

3. Resolution Tracking:

Deductor can track status of grievance raised through “Request for Resolution” by “Resolution Tracking” option available under “Communication” tab at TRACES.

Description of grievance status:

- Open- It means ticket is with CPC-TDS and will be responded within the prescribed SLA.

- Re-open- It means ticket can be reopened only when tickets status is ‘Closed’ and it has to be done within 14 working days of closure of ticket.

- In-Progress- It means ticket has been picked up by CPC-TDS and is under resolution.

- Clarification Requested – It means clarification has been sought by CPC-TDS for resolution of the issue. Same has to be provided by the deductor within 7 calendar days of ticket status being shown by CPC-TDS as ‘Clarification Requested’ or else request will be closed.

- Closed- It means ticket has been resolved by TDS CPC.

4. Rectification of Mistakes/Defaults in a TD tement:

4.1 Online Correction:

This functionality is available at TRACES website. Using above facility, deductor can file correction in a TDS statement without downloading a conso file*.

4.2 Types of Online Correction available at TRACES website:

- Add Challan to the Statement.

- Challan Correction.

- Pay 220, Interest, Late filling Levy.

- PAN Correction.

- Add/Modify Deductee Details.

- Personal information Correction.

- Add/Delete Salary Details-Annexure-II.

- Add/Delete Salary Details-Annexure-III(194P)

4.3 Guidelines for online Corrections:

| Type :of Error/Defaults/ Action to be performed | Type of online Correction to be performed |

F.Y. (Since when Correction Facility is available at TRACES website | Whether DSC Required to perform requisite Online Correction (Yes/No) |

| Challan is unmatched/ | Overbooked Challan |

FY 2007-08 No Onwards |

No

|

| To add new Challan |

Add Challan to the Statement | FY 2007-08 onwards | No |

| To clear interest and late fee demand payment | Pay 220, Interest, Levy, Late filing | FY 2007-08 onwards | No |

| To move Deductee Row | Challan Correction Resolution for overbooked Challan | FY 2007-08 onwards | No |

| To update PAN | PAN Correction | FY 2007-08 onwards | Yes |

| To Add/Modify Deductee row | Add/mod Deducteeify

details |

FY 2013-14 onwards | Yes |

| To update Personal details | Personal Information | FY 2007-08 onwards | Yes |

| To modify salary details | Add or delete salary details | FY 2013-14 onwards | Yes |

| To edit Deductee Row | Correction – Resolution for Unmatched | Challan Challan FY 2013-14 onwards | Yes |

- online correction functionally is available from financial Year 2007-08 onwards depending upon the type of correction: however, some of the correction are available from Financial year 2012-14 onwards with DSC (Refer for details at para 4.3)

- Online correction facilities can be used for TDS as well as TCS.

- Token number of an online correction statement also be traced using “Track Correction Request” functionally. Clicking on hyperlink under the heading “New Token Number” opens a pop-up window which contains the Token Number of the online correction statement.

Note: Online correction functionally on TRACES will not be available in case of paper return.

4.4 Brief Steps online online Correction Statement:

Step 1 : Login to TRACE website.

Step 2 : Go to “Request for correction” under “Default” Tab.

Step 3 : Furnish relevant financial Year, Quarter Form Type, correction category as “online” and Latest Token Number of the TDS statement. Thereafter submit request for correction. Note down correction request number.

Step 4 : Request will be available for correction under “Track correction Request” when the request status becomes ” Available/In Progress” which is also hyperlinked.

Step 5 : Click on hyperlink on provide information to validate KYC.

(User will get DSC Supported KYC and Normal KYC option, if DSC is registered on the TRACES).

Step 6 : Select the appropriate type of correction category from the drop-down list of categories

Step 7 : Make the required correction in the selected file.

Step 8 : Click on “Submit for processing” to submit correction (Only Available to Admin User).

Step 9 : On successful submission of the request 15 digit token number will be generated. Same is also mailed to Registered e-mail of the deductor

Step 10 : Deducted can track status of correction in “Track correction Request” available under “Defaults” Menu.

I have forgotten my login details, hence kindly advise me about how to proceed, is there any time limit for submission of form 16B? unable to login into traces for downloading form 16B.

I am an individual assessee and not received Refund for AY 2020-21 stating that account stands closed I visited My Profile in Efiling site & again E validated my SB account but failed to match by authorities. I uploaded my Ist page of my passbook, entries from 2020 to 2021 KYC letter from Branch, & cancelled cheque but Authorities declined. I requested to issue a physical cheque but no issued. I am a senior Citizen & unable to walk properly I NEED HELP for resolution of grievance.

@Mr Deepak Dang: Firstly, avoid posting on internet regarding any money you are going to receive. Someone may misguide you and take away the money. Get a professional help from a CA/qualified person locally.

Much required information. Hope this procedure will solve TDS mismatch. Hope it does not create further complications