Directorate of Income Tax (Systems)

Annual Information Statement (AIS)

Handbook

Version 2.0 (March 2022)

Document Version Control

| Version | Month | Remarks |

| 1.0 | October 2021 | First version |

| 2.0 | March 2022 | Second version – included details of GST Turnover, GST purchases , TDS-194Q (under Business receipts) and Income of specified senior citizens. |

1. About this Document

The objective of this document is to develop common and shared understanding related to Annual Information Statement (AIS) and various information sources.

2. Background

In order to promote transparency and simplifying the tax return filing process, CBDT vide Notification dated May 28, 2020 has amended Form 26AS vide Sec 285BB of Income Tax Act, 1961 r.w.r.114-I of Income Tax Rules, 1962 w.e.f. 01.06.2020. The new Form 26AS is an Annual Information Statement or AIS which will provide a complete profile of the taxpayer for a particular year.

The Board may also authorise the Principal Director General of Income-tax (Systems) or the Director General of Income-tax (Systems) or any person authorised by him to upload the information received from any officer, authority or body performing any function under any law or the information received under an agreement referred to in section 90 or section 90A of the Income-tax Act,1961 or the information received from any other person to the extent as it may deem fit in the interest of the revenue in the annual information statement . The format of Annual Information Statement is as under:

Part A

Permanent Account Number, Aadhaar Number, Name, Date of Birth/ Incorporation/ Formation, Mobile No., Email Address, Address.

Part B

1. Information relating to tax deducted or collected at source.

2. Information relating to specified financial transaction (SFT)

3. Information relating to payment of taxes

4. Information relating to demand and refund

5. Information relating to pending proceedings

6. Information relating to completed proceedings

7. Any other information in relation to sub-rule (2) of rule 114-I

3. Annual Information Statement Overview

Annual Information Statement or AIS is comprehensive view of information for a taxpayer displayed in Form 26AS. During preparation of AIS, information processing is required to display complete and accurate information to the taxpayer.

3.1 Objectives

The key objectives of AIS are:

- Display complete information to the taxpayer

- Promote voluntary compliance and enable seamless prefiling of return

- Deter non-compliance

3.2 AIS Features

Salient Features of new AIS are as under:

- Inclusion of new information (interest, dividend, securities transactions, mutual fund transactions, foreign remittance information etc.)

- Use of Data Analytics to populate PAN in non-PAN data for inclusion in AIS.

- Deduplication of information and generation of a simplified Taxpayer Information Summary (TIS) for ease of filing return (pre-filling will be enabled in a phased manner).

- Taxpayer will be able to submit online feedback on the information displayed in AIS and also download information in PDF, JSON, CSV formats.

- AIS Utility will enable taxpayer to view AIS and upload feedback in offline manner.

- AIS Mobile Application will enable taxpayer to view AIS and upload feedback on mobile.

Disclaimer: Annual Information Statement (AIS) includes information presently available with Income Tax Department. There may be other transactions relating to the taxpayer which are not presently displayed in Annual Information Statement (AIS). Taxpayer is expected to check all related information and report complete and accurate information in the Income Tax Return.

The schematic flow of information is as under:

3.3 AIS Preparation

Some key information processing steps are:

- PAN Population: In case no valid PAN is available in the submitted information, the PAN will be populated on matching Aadhaar and other key attributes.

- Information Display: Generally, the reported information is displayed against the reported PAN holder. The information display logic for specific information such as property, bank account, demat account etc. aims to show information to relevant PAN holders to enable review and submission of feedback

- Information Deduplication: In case where similar information is reported under different information types (e.g. reporting of interest/dividend in SFT and TDS) the information with lower value will be marked as “Information is duplicate / included in other information” using automated rules.

- Taxpayer Information Summary (TIS) preparation: The information category wise aggregated information summary for a taxpayer is prepared after deduplication of information based on pre-defined rules. It shows processed value (i.e. value generated after deduplication of information based on pre-defined rules) and derived value (i.e. value derived after considering the taxpayer feedback and processed value) under each information category (e.g. Salaries, Interest, Dividend etc.). The derived information will be used for prefilling of Return.

3.4 AIS Feedback

The taxpayer will be able to view AIS information and submit following types of response on the information:

- Information is correct

- Information is not fully correct

- Information relates to other PAN/Year

- Information is duplicate / included in other information

- Information is denied

- Customized Feedback

3.5 AIS Feedback Processing

The AIS Feedback processing approach is as under:

- The feedback provided by assessee will be captured in the Annual Information Statement (AIS) and reported value and modified value (i.e. value after feedback) will be shown separately.

- The feedback provided by assessee will be considered to update the derived value (value derived after considering the taxpayer feedback) in Taxpayer Information Summary (TIS)

- Information assigned to other PAN/Year in AIS will be processed and information will be shown in the AIS of the taxpayer using automated rules.

- In case the assigned information is modified/denied, the feedback will be processed in accordance with risk management rules and high risk feedback will be flagged for seeking confirmation from the information source.

3.6 Key Terms

| Annual Information Statement (AIS) | AIS is comprehensive view of information for a taxpayer displayed in Form 26AS. It shows both reported value and modified value (i.e. value after considering taxpayer feedback) under each section (i.e. TDS, SFT, Other information) |

| Reported Value | Reported Value refers to information value as reported by the information source against a PAN. |

| Modified Value | Modified Value refers to value which has been modified by the taxpayer by submitting feedback. The reported value and value after feedback will be shown separately in the Annual Information Statement (AIS) |

| Taxpayer Information Summary (TIS) |

TIS is an information category wise aggregated information summary for a taxpayer. It shows processed value (i.e. value generated after deduplication of information based on pre-defined rules) and derived value (i.e. value derived after considering the taxpayer feedback and processed value) under each information category (e.g. Salaries, Interest, Dividend etc.). The derived information in TIS will be used for prefilling of Return. |

| Processed Value | Processed Value refers to value generated after deduplication of information based on pre-defined rules. The Processed Value is displayed only in Taxpayer Information Summary (TIS) |

| Derived value | Derived value refers to value displayed in Taxpayer Information Summary (TIS) which is derived after considering the taxpayer feedback (if any) and processed value. The derived information will be used for prefilling of Return. |

| Information Category |

Information category is broad information category (refer Annexure A) which combines similar information sources to present a simplified summary to enable pre-filling of ITR. |

| L1 Level Information | L1 Level Information is the lowest level of information displayed in Annual Information Statement (AIS). Each information is displayed by unique Transaction sequence number (TSN). The taxpayer feedback is always captured at the L1 level. In case when taxpayer provides bulk feedback, the feedback is captured at TSN level. L1 Level display shows both reported value and modified value (i.e. value modified after considering the taxpayer feedback). |

| L2 Level Information | L2 Level Information is the source wise aggregated value displayed in Annual Information Statement (AIS) as well as Taxpayer Information Summary (TIS). During processing, duplicate information is marked at L2 level. L2 Level display shows reported value, processed value (i.e. value generated after deduplication of information based on pre-defined rules) and derived value (i.e. value derived after considering the taxpayer feedback). |

| L3 Level Information | L3 Level Information is the information category wise aggregated value displayed in Taxpayer Information Summary (TIS). During processing, duplicate information is marked at L2 level only. L2 Level display shows reported value, processed value (i.e. value generated after deduplication of information based on pre-defined rules) and derived value (i.e. value derived after considering the taxpayer feedback) |

3.7 Illustrations

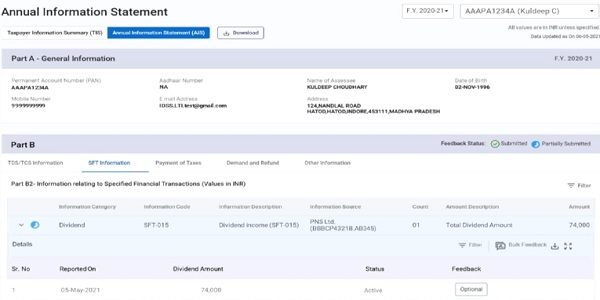

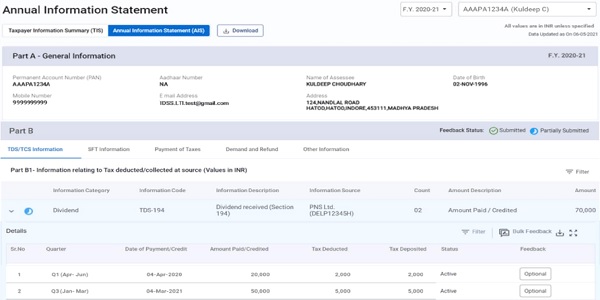

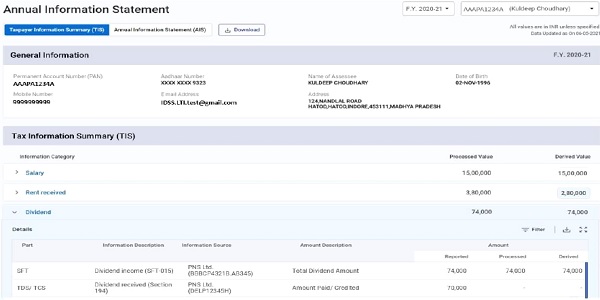

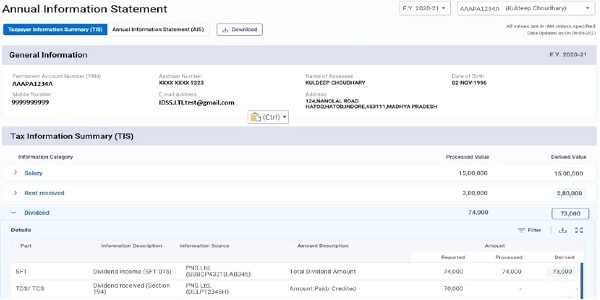

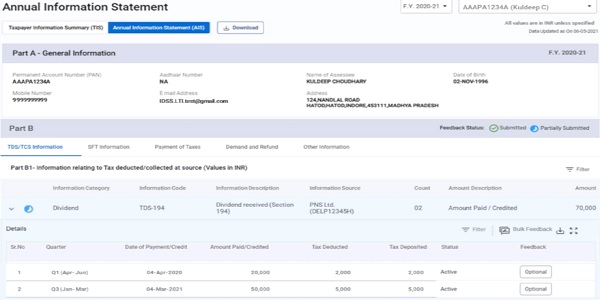

Illustration 1: Display of information reported under both TDS and SFT Payment of dividend above Rs 5,000 is required to be reported under TDS Statement. Under SFT all dividend payment is required to be reported. In this case, Dividend payment of Rs 70,000 was reported by the Deductor (TAN based) under TDS and 74,000 was reported under SFT by the reporting entity.

Annual Information Statement (AIS)

TDS – Information source (L2 level)

SFT – Information source (L2 level)

Note: In AIS, TDS information and SFT information is reported under sections B1 and B2

Taxpayer Information Summary (TIS)

Note: Information reported under TDS is marked as Duplicate during Processing

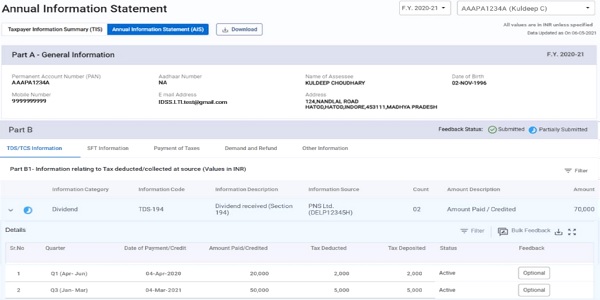

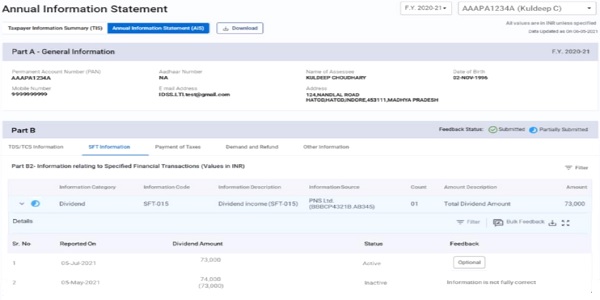

Illustration 2: Display of taxpayer feedback

Taxpayer has been provided a facility to provide feedback. If the taxpayer reduces the dividend amount to 73,000 under SFT, the derived value i.e. value derived after considering the taxpayer feedback will be shown both in Annual Information Statement (AIS) and Taxpayer Information Summary (TIS).

Annual Information Statement (AIS)

TDS – Information source (L2 level)

SFT – Information source (L2 level)

Taxpayer Information Summary (TIS)

Note: The derived information in TIS is reduced after considering taxpayer feedback. This information will be used for prefilling.

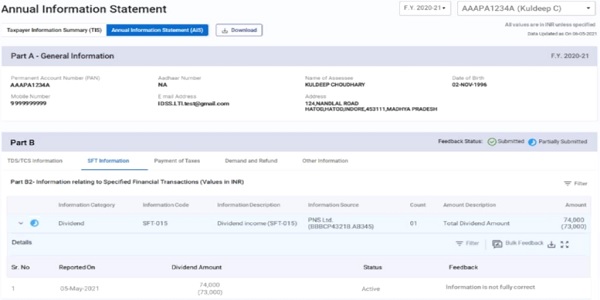

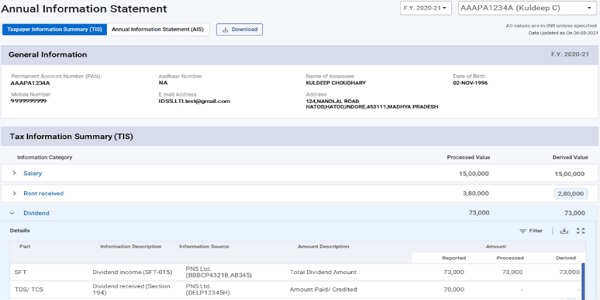

Illustration 3: Display of updation in information

If information is updated by submission of correction statement, the original transaction is marked as inactive and a new transaction vale is added in the view. If the reporting entity submits a correction statement (SFT-17) showing dividend income as 73,000, the same is added as a new transaction.

Annual Information Statement (AIS)

TDS – Information source (L2 level)

SFT – Information source (L2 level)

Note: The processed and derived information in TIS is updated to reflect correction statement

Taxpayer Information Summary (TIS)

Note: The processed and derived information in TIS is updated to reflect correction statement

4. AIS Information Category

The broad categories of Information in Taxpayer Information Summary (TIS) are as under:

The key information sources, approach for Annual Information Statement (AIS) processing and Taxpayer Information Summary (TIS) preparation is explained in following paragraphs.

1. Salary

2. Rent received

3. Dividend

4. Interest from savings bank

5. Interest from deposit

6. Interest from others

7. Interest from income tax refund

8. Rent on plant & machinery

9. Winnings from lottery or crossword puzzle u/s 115BB

10. Winnings from horse race u/s 115BB

11. Receipt of accumulated balance of PF from employer u/s 111

12. Interest from infrastructure debt fund u/s 115A(1)(a)(iia)

13. Interest from specified company by a non-resident u/s 115A(1)(a)(iiaa)

14. Interest on bonds and government securities

15. Income in respect of units of non-resident u/s 115A(1)(a)(iiab)

16. Income and long-term capital gain from units by an offshore fund u/s 115AB(1)(b)

17. Income and long-term capital gain from foreign currency bonds or shares of Indian companies’ u/s 115AC

18. Income of foreign institutional investors from securities u/s 115AD(1)(i)

19. Insurance commission

20. Receipts from life insurance policy

21. Withdrawal of deposits under national savings scheme

22. Receipt of commission etc. on sale of lottery tickets

23. Income from investment in securitization trust

24. Income on account of repurchase of units by MF/UTI

25. Interest or dividend or other sums payable to government

26. Sale of land or building

27. Receipts for transfer of immovable property

28. Sale of vehicle

29. Sale of securities and units of mutual fund

30. Off market debit transactions

31. Off market credit transactions

32. Business receipts

33. Business expenses

34. Rent payment

35. Miscellaneous payment

36. Cash deposits

37. Cash withdrawals

38. Cash payments

39. Outward foreign remittance/purchase of foreign currency

40. Receipt of foreign remittance

41. Payment to non-resident sportsmen or sports association u/s 115BBA

42. Foreign travel

43. Purchase of immovable property

44. Purchase of vehicle

45. Purchase of time deposits

46. Purchase of securities and units of mutual funds

47. Credit/Debit card

48. Balance in account

49. Income distributed by business trust

50. Income distributed by investment fund

51. GST turnover

52. GST purchases

53. Income of specified senior citizen

4.1 Salary

The key information sources under this information category are as under:

| # | Information | Description |

| 1. | Salary (TDS Annexure II) | Employer submits detailed breakup of salary, perquisites, profits in lieu of salary etc paid to the employee in Annexure II of the TDS statement (24Q) of the last quarter. This information is also provided by the employer to the employee (taxpayer) in Part B (Annexure) of Form 16. |

| 2. | Salary Received (Section 192) | Employer submits TDS quarterly statement (Form 24Q) with details of amount paid to employee and amount of tax deducted from the employee. All salary reported in TDS quarterly statement is provided by the employer to the employee (taxpayer) in Form 16. |

The approach for AIS processing and information handling is as under:

i. For an employer (TAN) and employee (PAN), if salary reported in TDS Annexure II is equal or more than the sum of salary payment in Quarterly TDS Statements (Section 192), all salary payment amount in Quarterly TDS Statements (Section 192) will be marked as “Information is duplicate / included in other information”.

ii. For an employer (TAN) and employee (PAN), if sum of salary payment in Quarterly TDS Statements (Section 192) is more than the salary reported in TDS Annexure II, salary reported in TDS Annexure II will be marked as “Information is duplicate / included in other information”.

iii. The AIS information level feedback can be used for providing following inputs:

a. Information is correct

b. Income is not taxable

c. Information is not fully correct – This functionality can be used to modify salary details.

d. Information relates to other PAN/Year

e. Information is duplicate / included in other information

f. Information is denied

iv. The feedback provided by taxpayer will be shown separately in AIS and will update the value in Taxpayer Information Summary (TIS).

v. The sum of salary received from all employers will be reflected at Taxpayer Information Summary.

vi. All exempt allowances should be included in Gross Salary. Allowances to the extent exempt u/s 10 and deduction u/s 16 needs to be claimed in the return.

4.2 Rent received

The key information sources under this information category are as under:

| # | Information | Description |

| 1. | Rent Received (Section 194I(b)) | Tenant responsible for paying of rent is liable to deduct tax at source on payment of rent. Deductor reports details of amount paid/credited, date of payment, details of Tax deduction made etc. in Form 26Q. This information is provided by the deductor to the deductee (taxpayer) in Form 16A. |

| 2. | Rent Received (Section 194IB) | Tenant (Individual/HUF) paying a rent of more than 50,000 is liable to deduct tax while making payment to the landlord. Tenant reports details of rent paid amount paid/credited, property details, date of payment and tax deduction details etc. pertaining to rent paid in Form26QC. |

| 3. | Rent/HRA claim of the tenant reported by employer (TDS Annexure II) | PAN of landlord is reported by employee to the employer if exemption is claimed under section 10(13A). Employer reports PAN of landlord to whom rent is paid by an employee in Annexure II of the TDS statement (24Q). |

The approach for AIS processing and information handling is as under:

i. Information reported under section 194I(b), 194IB and co-owner will be summed up at deductor PAN level.

ii. For each tenant (PAN), higher of rent reported through TDS statement (194I(b)+194IB) and rent reported by co-owner of property or reported in Annexure II will be retained for a ‘Landlord -Tenant’ combination and information source with lower value will be marked as “Information is duplicate / included in other information”.

iii. Employer reports PAN of landlord to whom rent is paid by an employee in Annexure II of the TDS statement (24Q). This information will only be shown only when the rent received from the tenant is not reported under other sources. The landlord can use the feedback option ‘’Information is not fully correct” to modify rent details.

iv. The AIS information level feedback can be used for providing following inputs:

a. Information is correct

b. Income is not taxable

c. Information is not fully correct: This functionality can be used to modify rent details

d. Information relates to other PAN/Year

e. Information is duplicate / included in other information

f. Information is denied

v. The feedback provided by taxpayer will be shown separately in AIS and will update the value

in Taxpayer Information Summary (TIS).

vi. The sum of rent received from all tenants will be reflected at Taxpayer Information Summary (TIS).

vii. All deductions from house property income like interest on borrowed capital, standard deduction to be claimed in the return.

4.3 Dividend

The key information sources under this information category are as under:

| # | Information | Description |

| 1. | Dividend income (SFT-015) | Dividend paid/declared by all companies (reporting entity) is reported under Statement of Financial Transactions (SFT). |

| 2. | Dividend received (Section 194) | Company paying/distributing dividend is liable to deduct TDS from the amount paid subject to the threshold applicable in the act and report through form 26Q (quarterly statement). This information is provided by the deductor to the deductee (taxpayer) in Form 16A. |

| 3. | Dividend on Units of Mutual Fund (SFT-018) | The Registrar and Share Transfer Agent reporst dividend payable on units of mutual funds in Statement of Financial Transaction. |

| 4. | Income received in respect of units of Mutual Funds (Section 194K) | Fund/Unit distributing Income in respect of units of Mutual Funds is liable to deduct TDS from the amount paid subject to the threshold applicable in the act and report through form 26Q (quarterly statement). This information is provided by the deductor to the deductee (taxpayer) in Form 16A |

The approach for AIS processing and information handling is as under:

i. Dividend Income will be listed on the basis of PAN of reportee person, Information Source and value. For dividend reported under SFT-018, the same shall be listed on the basis of PAN of AMC, PAN of reportee person and value .

ii. For each reporting entity, higher of dividend income reported under SFT-015 and amount reported by deductor u/s 194 will be retained and information source with lower value will be marked as “Information is duplicate / included in other information”. Similarly, in case of dividend reported under SFT-018 and u/s 194K, higher value shall be retained with lower value will be marked as “Information is duplicate / included in other information”.

iii. The AIS information level feedback can be used for providing following inputs:

a. Information is correct

b. Income is not taxable

c. Information is not fully correct: This functionality can be used to modify key attributes Information value etc.

d. Information relates to other PAN/Year

e. Information is duplicate / included in other information

f. Information is denied

iv. The feedback provided by taxpayer will be shown separately in AIS and will update the value in Taxpayer Information Summary (TIS).

v. The aggregate value of dividend after deduplication shall be populated in dividend field in Schedule OS of ITR.

vi. All deductions and depreciation u/s 57 from other source income to be claimed in the return.

4.4 Interest from savings bank

The key information sources under this information category are as under:

| # | Information Source | Information Description |

| 1. | Interest income (SFT-016) – Savings | Interest paid/credited/accrued on saving account is reported under Statement of Financial Transactions (SFT). |

The approach for AIS processing and information handling is as under:

i. Reporting Entity reports the Interest paid/credited/accrued on saving account held by an account holder under SFT code 016. Interest earned on savings account is taxable in the hands of account holder.

ii. The AIS information level feedback can be used for providing following inputs:

a. Information is correct

b. Income is not taxable

c. Information is not fully correct: This functionality can be used to modify key attributes (e.g. Account Number, Account Type in case of interest), Information value etc.

d. Information relates to other PAN/Year

e. Information is duplicate / included in other information

f. Information is denied

iii. The feedback provided by taxpayer will be shown separately in AIS and will update the value in Taxpayer Information Summary (TIS).

iv. Interest from Savings Bank will be reflected in Taxpayer Information Summary (TIS) and shall be shown under the corresponding field in Schedule OS.

v. All deductions and depreciation u/s 57 from other source income to be claimed in the return.

4.5 Interest from deposit

| # | Information Source | Information Description |

| 1. | Interest income (SFT-016) – Term Deposit | Interest paid/credited/accrued on Term Deposit is reported under Statement of Financial Transactions (SFT). |

| 2. | Interest income (SFT-016) – Recurring Deposit | Interest paid/credited/accrued on Recurring Deposit is reported under Statement of Financial Transactions (SFT). |

| 3. | Interest other than “Interest on Securities” received (Section 194A) | Bank/deductor at the time paying/crediting interest on deposits is liable to deduct tax from deposit holder paid subject to the threshold applicable in the act. This information is reported by the Bank/deductor in form 26Q (quarterly statement). This information is provided by the deductor to the deductee (taxpayer) in Form 16A. |

The key information sources under this information category are as under:

i. Reporting Entity reports the Interest paid/credited/accrued on Term Deposit and recurring deposit held by a deposit account holder under SFT code 016 as well as through TDS from 26Q. Interest earned on term/recurring deposit is taxable in the hands of deposit holder.

ii. Interest on Deposit will be listed on the basis of PAN of reporting person, Source (Reporting Entity) and value of interest paid/credited/accrued.

iii. For each reporting entity, higher of interest on deposit (both term and recurring ) reported under SFT-016 and amount reported by deductor u/s 194A will be retained and information source with lower value will be marked as duplicate.

iv. The AIS information level feedback can be used for providing following inputs:

a. Information is correct

b. Income is not taxable

c. Information is not fully correct: This functionality can be used to modify key attributes (e.g. Account Number, Account Type in case of interest), Information value etc.

d. Information relates to other PAN/Year

e. Information is duplicate / included in other information

f. Information is denied

v. The feedback provided by taxpayer will be shown separately in AIS and will update the value in Taxpayer Information Summary (TIS).

vi. Interest from all sources after deduplication will be reflected in Taxpayer Information Summary (TIS) and shall be shown under the corresponding field in Schedule OS.

vii. All deductions and depreciation u/s 57 from other source income to be claimed in the return.

4.6 Interest from others

The key information sources under this information category are as under:

| # | Information Source | Information Description |

| 1. | Interest income (SFT-016) – Others | Interest paid/credited/accrued on others (other than savings account, term deposit, recurring deposit) is reported under Statement of Financial Transactions (SFT). |

| 2. | Interest received on Securities (Section 193) | Bank/deductor at the time paying/ crediting other interest (interest on securities) is liable to deduct tax from deposit holder paid subject to the threshold applicable in the act. This information is reported by the Bank/deductor in form 26Q (quarterly statement). This information is provided by the deductor to the deductee (taxpayer) in Form 16A |

The approach for AIS processing and information handling is as under:

i. Reporting Entity reports the Interest paid/credited/accrued on other accounts (other than savings bank, term deposit or recurring deposit) held by an account holder under SFT code 016 as well as through TDS from 26Q. Interest earned on such other accounts is taxable in the hands of account holder.

ii. Interest on others will be listed on the basis of PAN of reporting person, Source (Reporting Entity) and value of interest paid/credited/accrued.

iii. For each reporting entity, higher of interest on others reported under SFT-016 and amount reported by deductor u/s 193 will be retained and information source with lower value will be marked as duplicate.

iv. The AIS information level feedback can be used for providing following inputs:

a. Information is correct

b. Income is not taxable

c. Information is not fully correct: This functionality can be used to modify key attributes (e.g. Account Number, Account Type in case of interest), Information value etc.

d. Information relates to other PAN/Year

e. Information is duplicate / included in other information

f. Information is denied

v. The feedback provided by taxpayer will be shown separately in AIS and will update the value in Taxpayer Information Summary (TIS).

vi. Interest from all sources after deduplication will be reflected in Taxpayer Information Summary (TIS) and shall be shown under the corresponding field in Schedule OS.

vii. All deductions and depreciation u/s 57 from other source income to be claimed in the return.

4.7 Interest from income tax refund

The key information sources under this information category are as under:

| # | Information Source | Information Description |

| 1. | Interest on Income Tax Refund | Interest received on Income Tax Refund in the financial year is liable to be taxed as Income from other sources. |

The approach for AIS processing and information handling is as under:

i. Income Tax department issues refund along with applicable interest amount. Interest earned on such refund is taxable as income from other source.

ii. The AIS information level feedback can be used for providing following inputs:

a. Information is correct

b. Income is not taxable

c. Information is not fully correct: This functionality can be used to modify key attributes (e.g. Account Number, Account Type in case of interest), Information value etc.

d. Information relates to other PAN/Year

e. Information is duplicate / included in other information

f. Information is denied

iii. In case where interest on refund is displayed as 0 in AIS/TIS, but the interest was paid along with refund, taxpayer can update the interest value through AIS feedback based on actual interest received.

iv. The feedback provided by taxpayer will be shown separately in AIS and will update the value

in Taxpayer Information Summary (TIS).

v. Interest from income tax refund will be reflected in Taxpayer Information Summary (TIS) and shall be shown under the corresponding field in Schedule OS.

vi. All deductions and depreciation u/s 57 from other source income to be claimed in the return.

4.8 Rent on plant & machinery

The key information sources under this information category are as under:

| # | Information Source | Information Description |

| 1. | Winnings from Lottery or Crossword Puzzle (Section 194B) | Payer is liable to deduct tax at applicable rate as per act from winnings from lottery or crossword puzzle etc. Information about winnings is reported by payer in TDS form 26Q. Information is reported on quarterly basis. Income is taxable at special rate. This information is provided by the deductor to the deductee (taxpayer) in Form 16A. |

The approach for AIS processing and information handling is as under:

i. Tenant/Deductor, while making payment of rent to the owner of Plant & Machinery, deducts TDS and reports the same in TDS form 26Q. Rent received from Plant & Machinery is taxable in the hands of owner under the head income from other sources.

ii. The AIS information level feedback can be used for providing following inputs:

a. Information is correct

b. Income is not taxable

c. Information is not fully correct: This functionality can be used to modify key attributes (e.g. Account Number, Account Type in case of interest), Information value etc.

d. Information relates to other PAN/Year

e. Information is duplicate / included in other information

f. Information is denied

iii. The feedback provided by taxpayer will be shown separately in AIS and will update the value in Taxpayer Information Summary (TIS).

iv. Rent on plant & machinery will be reflected in Taxpayer Information Summary (TIS) and shall be shown in respective field in Schedule OS.

v. All deductions and depreciation u/s 57 from other source income to be claimed in the return.

4.9 Winnings from lottery or crossword puzzle u/s 115BB

The key information sources under this information category are as under:

| # | Information Source | Information Description |

| 1. | Winnings from Horse Race (Section 194BB) | Payer is liable to deduct tax at applicable rate as per act from winnings from Horse race. Information about winnings is reported by payer in TDS form 26Q. Information is reported on quarterly basis and is chargeable to tax at special rate. This information is provided by the deductor to the deductee (taxpayer) in Form 16A. |

The approach for AIS processing and information handling is as under:

i. Payer/Deductor, while making payment relating to the winning from lottery or crossword puzzle to the winner, deducts TDS and reports the same in TDS form 26Q. Winning from lottery or crossword puzzle is taxable in the hands of recipient under the head income from other sources.

ii. The AIS information level feedback can be used for providing following inputs:

a. Information is correct

b. Income is not taxable

c. Information is not fully correct: This functionality can be used to modify key attributes (e.g. Account Number, Account Type in case of interest), Information value etc.

d. Information relates to other PAN/Year

e. Information is duplicate / included in other information

f. Information is denied

iii. The feedback provided by taxpayer will be shown separately in AIS and will update the value in Taxpayer Information Summary (TIS).

iv. Winnings from Lottery or Crossword Puzzle will be reflected in Taxpayer Information Summary (TIS) and shall be shown in respective field in Schedule OS.

v. All deductions and depreciation u/s 57 from other source income to be claimed in the return.

4.10 Winnings from horse race u/s 115BB

The key information sources under this information category are as under:

| # | Information Source | Information Description |

| 1. | Receipt of accumulated balance due to an employee (Section 192A) | Employer/recognised provided fund reports information about accumulated balance due to an employee in form 26Q. Information is reported on quarterly basis and is chargeable to tax at special rate. This information is provided by the deductor to the deductee (taxpayer) in Form 16A. |

The approach for AIS processing and information handling is as under:

i. Payer/Deductor while making payment, relating to the winning from horse races to the winner, deducts TDS and reports the same in TDS form 26Q. Winning from horse races is taxable in the hands of recipient under the head income from other sources.

ii. The AIS information level feedback can be used for providing following inputs:

a. Information is correct

b. Income is not taxable

c. Information is not fully correct: This functionality can be used to modify key attributes (e.g. Account Number, Account Type in case of interest), Information value etc.

d. Information relates to other PAN/Year

e. Information is duplicate / included in other information

f. Information is denied

iii. The feedback provided by taxpayer will be shown separately in AIS and will update the value

in Taxpayer Information Summary (TIS).

iv. Winnings from Horse Races will be reflected in Taxpayer Information Summary (TIS) and shall be shown in respective field in Schedule OS.

v. All deductions and depreciation u/s 57 from other source income to be claimed in the return.

4.11 Receipt of accumulated balance of PF from employer u/s 111

The key information sources under this information category are as under:

| # | Information Source | Information Description |

| 1. | Receipt of accumulated balance due to an employee (Section 192A) | Employer/recognised provided fund reports information about accumulated balance due to an employee in form 26Q. Information is reported on quarterly basis and is chargeable to tax at special rate. This information is provided by the deductor to the deductee (taxpayer) in Form 16A. |

The approach for AIS processing and information handling is as under:

i. Employer/ recognised provident fund while making payment of accumulated lance to an employee deducts TDS and reports the same in TDS form 26Q. Receipts of such accumulated balance is taxable in the hands of employee under the head income from other sources.

ii. The AIS information level feedback can be used for providing following inputs:

a. Information is correct

b. Income is not taxable

c. Information is not fully correct: This functionality can be used to modify key attributes (e.g. Account Number, Account Type in case of interest), Information value etc.

d. Information relates to other PAN/Year

e. Information is duplicate / included in other information

f. Information is denied

iii. The feedback provided by taxpayer will be shown separately in AIS and will update the value in Taxpayer Information Summary (TIS).

iv. Receipt of accumulated balance of PF from employer will be reflected in Taxpayer Information Summary (TIS) and shall be shown in respective field in Schedule OS.

v. All deductions and depreciation u/s 57 from other source income to be claimed in the return.

4.12 Interest from infrastructure debt fund u/s 115A(1)(a)(iia) The key information sources under this information category are as under:

| # | Information Source | Information Description |

| 1. | Income by way of interest from infrastructure debt fund (Section 194LB) | Information relating to interest paid is reported by payer in form 27Q. Information is reported on quarterly basis and is chargeable to tax at special rate. This information is provided by the deductor to the deductee (taxpayer) in Form 16A. |

The approach for AIS processing and information handling is as under:

i. Payer/Deductor, while making payment of interest to infrastructure debt fund holders, deducts TDS and reports the same in TDS form 27Q. Interest earned on infrastructure debt fund is taxable in the hands of (debt fund) holder under the head income from other sources.

ii. The AIS information level feedback can be used for providing following inputs:

a. Information is correct

b. Income is not taxable

c. Information is not fully correct: This functionality can be used to modify key attributes (e.g. Account Number, Account Type in case of interest), Information value etc.

d. Information relates to other PAN/Year

e. Information is duplicate / included in other information

f. Information is denied

iii. The feedback provided by taxpayer will be shown separately in AIS and will update the value in Taxpayer Information Summary (TIS).

iv. Interest from infrastructure debt fund will be reflected in Taxpayer Information Summary (TIS) and shall be shown in respective field in Schedule OS.

v. All deductions and depreciation u/s 57 from other source income to be claimed in the return.

4.13 Interest from specified company by a non-resident u/s 115A(1)(a)(iiaa)

The key information sources under this information category are as under:

| # | Information Source | Information Description |

| 1. | Income by way of interest from specified company payable to a non-resident (Section 194LC) | Information relating to interest paid is reported by payer in form 27Q. Information is reported on quarterly basis and is chargeable to tax at special rate. This information is provided by the deductor to the deductee (taxpayer) in Form 16A. |

The approach for AIS processing and information handling is as under:

i. Payer/Deductor while making payment of interest deducts TDS and reports the same in TDS form 27Q. Interest earned from specified company is taxable in the hands of recipient under the head income from other sources.

ii. The AIS information level feedback can be used for providing following inputs:

a. Information is correct

b. Income is not taxable

c. Information is not fully correct: This functionality can be used to modify key attributes (e.g. Account Number, Account Type in case of interest), Information value etc.

d. Information relates to other PAN/Year

e. Information is duplicate / included in other information

f. Information is denied

iii. The feedback provided by taxpayer will be shown separately in AIS and will update the value

in Taxpayer Information Summary (TIS).

iv. Interest received by a non-resident from specified company will be reflected in Taxpayer Information Summary (TIS) and shall be shown in respective field in Schedule OS.

v. All deductions and depreciation u/s 57 from other source income to be claimed in the return.

4.14 Interest on bonds and government securities

The key information sources under this information category are as under:

| # | Information Source | Information Description |

| 1. | Income from interest on bonds and government securities (Section 194LD) | Information relating to interest paid is reported by payer in form 27Q. Information is reported on quarterly basis and is chargeable to tax at special rate. This information is provided by the deductor to the deductee (taxpayer) in Form 16A. |

The approach for AIS processing and information handling is as under:

i. Payer/Deductor while making payment of interest on bonds and securities deducts TDS and reports the same in TDS form 27Q. Interest earned from bonds and government securities is taxable in the hands of recipient under the head income from other sources.

ii. The AIS information level feedback can be used for providing following inputs:

a. Information is correct

b. Income is not taxable

c. Information is not fully correct: This functionality can be used to modify key attributes (e.g. Account Number, Account Type in case of interest), Information value etc.

d. Information relates to other PAN/Year

e. Information is duplicate / included in other information

f. Information is denied

iii. The feedback provided by taxpayer will be shown separately in AIS and will update the value in Taxpayer Information Summary (TIS).

iv. Interest on bonds and government securities will be reflected in Taxpayer Information Summary (TIS) and shall be shown in respective field in Schedule OS.

v. All deductions and depreciation u/s 57 from other source income to be claimed in the return.

4.15 Income in respect of units of non-resident u/s 115A(1)(a)(iiab)

The key information sources under this information category are as under:

| # | Information Source | Information Description |

| 1. | Income in respect of units of Non Resident (Section 196A) (Other than those reported by RE through SFT) | Information about income in respect of units of Non Resident is reported by payer in form 27Q. Information is reported on quarterly basis and is chargeable to tax at special rate. This information is provided by the deductor to the deductee (taxpayer) in Form 16A. |

The approach for AIS processing and information handling is as under:

i. Payer/Deductor while making payment of income in respect of units deducts TDS and reports the same in TDS form 27Q. Income earned from units is taxable in the hands of recipient under the head income from other sources.

ii. The AIS information level feedback can be used for providing following inputs:

a. Information is correct

b. Income is not taxable

c. Information is not fully correct: This functionality can be used to modify key attributes (e.g. Account Number, Account Type in case of interest), Information value etc.

d. Information relates to other PAN/Year

e. Information is duplicate / included in other information

f. Information is denied

iii. The feedback provided by taxpayer will be shown separately in AIS and will update the value in Taxpayer Information Summary (TIS).

iv. Income in respect of units of Non Resident will be reflected in Taxpayer Information Summary (TIS) and shall be shown in respective field in Schedule OS.

v. All deductions and depreciation u/s 57 from other source income to be claimed in the return.

4.16 Income and long-term capital gain from units by an offshore fund u/s 115AB(1)(b)

The key information sources under this information category are as under:

| # | Information Source | Information Description |

| 1. | Income and long-term capital gain from units payable to an off shore fund (Section 196B) | Information about income and long-term capital gain from units payable to an off shore fund is reported by payer in form 27Q. Information is reported on quarterly basis and is chargeable to tax at special rate. This information is provided by the deductor to the deductee (taxpayer) in Form 16A. |

The approach for AIS processing and information handling is as under:

i. Payer/Deductor while making payment of income from units to offshore fund deducts TDS and reports the same in TDS form 27Q. Income and long-term capital gain earned by such off-shore fund is taxable in the hands of recipient under the head income from other sources.

ii. The AIS information level feedback can be used for providing following inputs:

a. Information is correct

b. Income is not taxable

c. Information is not fully correct: This functionality can be used to modify key attributes (e.g. Account Number, Account Type in case of interest), Information value etc.

d. Information relates to other PAN/Year

e. Information is duplicate / included in other information

f. Information is denied

iii. The feedback provided by taxpayer will be shown separately in AIS and will update the value in Taxpayer Information Summary (TIS).

iv. Income and long-term capital gain from units by an off shore fund will be reflected in Taxpayer Information Summary (TIS) and shall be shown in respective field in Schedule OS.

v. All deductions and depreciation u/s 57 from other source income to be claimed in the return.

4.17 Income and long-term capital gain from foreign currency bonds or shares of Indian companies u/s 115AC

The key information sources under this information category are as under:

| # | Information Source | Information Description |

| 1. | Income and long-term capital gain from foreign currency bonds or shares of Indian companies (Section 196C) | Information about income and long-term capital gain from foreign currency bonds or shares of Indian companies is reported by payer in form 27Q. Information is reported on quarterly basis and is chargeable to tax at special rate. This information is provided by the deductor to the deductee (taxpayer) in Form 16A. |

The approach for AIS processing and information handling is as under:

i. Payer/Deductor while making payment of income and long-term capital on foreign currency bonds or shares deducts TDS and reports the same in TDS form 27Q. Income earned from such bonds or shares is taxable in the hands of recipient under the head income from other sources.

ii. The AIS information level feedback can be used for providing following inputs:

a. Information is correct

b. Income is not taxable

c. Information is not fully correct: This functionality can be used to modify key attributes (e.g. Account Number, Account Type in case of interest), Information value etc.

d. Information relates to other PAN/Year

e. Information is duplicate / included in other information

f. Information is denied

iii. The feedback provided by taxpayer will be shown separately in AIS and will update the value in Taxpayer Information Summary (TIS).

iv. Income and long-term capital gain from foreign currency bonds or shares of Indian companies u/s 115AC will be reflected in Taxpayer Information Summary (TIS) and shall be shown in respective field in Schedule OS.

v. All deductions and depreciation u/s 57 from other source income to be claimed in the return.

4.18 Income of foreign institutional investors from securities u/s 115AD(1)(i) The key information sources under this information category are as under:

| # | Information Source | Information Description |

| 1. | Income of foreign institutional investors from securities (Section 196D) | Information about income of foreign institutional investors from securities is reported by payer in form 27Q. Information is reported on quarterly basis and is chargeable to tax at special rate. This information is provided by the deductor to the deductee (taxpayer) in Form 16A. |

The approach for AIS processing and information handling is as under:

i. Payer/Deductor while making payment of income to FIIs on securities deducts TDS and reports the same in TDS form 27Q. Interest earned from bonds and government securities is taxable in the hands of recipient under the head income from other sources.

ii. The AIS information level feedback can be used for providing following inputs:

a. Information is correct

b. Income is not taxable

c. Information is not fully correct: This functionality can be used to modify key attributes (e.g. Account Number, Account Type in case of interest), Information value etc.

d. Information relates to other PAN/Year

e. Information is duplicate / included in other information

f. Information is denied

iii. The feedback provided by taxpayer will be shown separately in AIS and will update the value in Taxpayer Information Summary (TIS).

iv. Income of foreign institutional investors from securities will be reflected in Taxpayer Information Summary (TIS) and shall be shown in respective field in Schedule OS.

v. All deductions and depreciation u/s 57 from other source income to be claimed in the return.

4.19 Insurance commission

The key information sources under this information category are as under:

| # | Information Source | Information Description |

| 1. | Insurance commission received (Section 194D) | Information about insurance commission received is reported by the payer in Form 26Q on a quarterly basis. This information is provided by the deductor to the deductee (taxpayer) in Form 16A. |

The approach for AIS processing and information handling is as under:

i. Insurance Company /Deductor while making payment of commission deducts TDS and reports the same in TDS form 26Q. Insurance commission income earned is taxable in the hands of recipient under the head income from other sources.

ii. The AIS information level feedback can be used for providing following inputs:

a. Information is correct

b. Income is not taxable

c. Information is not fully correct: This functionality can be used to modify key attributes (e.g. Account Number, Account Type in case of interest), Information value etc.

d. Information relates to other PAN/Year

e. Information is duplicate / included in other information

f. Information is denied

iii. The feedback provided by taxpayer will be shown separately in AIS and will update the value in Taxpayer Information Summary (TIS).

iv. Insurance commission will be reflected in Taxpayer Information Summary (TIS) and shall be shown in respective field in Schedule OS.

v. All deductions and depreciation u/s 57 from other source income to be claimed in the return.

4.20 Receipts from life insurance policy

The key information sources under this information category are as under:

| # | Information Source | Information Description |

| 1. | Receipts from life insurance policy (Section 194DA) | Receipts from life insurance policy are exempt under section 10(10D) subject to conditions specified therein. If such conditions are not met, the receipts become taxable and tax is also deducted u/s 194DA. The information is reported by the payer in Form 26Q on a quarterly basis. This information is provided by the deductor to the deductee (taxpayer) in Form 16A. |

The approach for AIS processing and information handling is as under:

i. Insurance company/Deductor while making payment in respect of life insurance policy deducts TDS and reports the same in TDS form 26Q. Amount received from life insurance policy is taxable in the hands of recipient under the head income from other sources.

ii. The AIS information level feedback can be used for providing following inputs:

a. Information is correct

b. Income is not taxable

c. Information is not fully correct: This functionality can be used to modify key attributes (e.g. Account Number, Account Type in case of interest), Information value etc.

d. Information relates to other PAN/Year

e. Information is duplicate / included in other information

f. Information is denied

iii. The feedback provided by taxpayer will be shown separately in AIS and will update the value in Taxpayer Information Summary (TIS).

iv. Receipts from life insurance policy will be reflected in Taxpayer Information Summary (TIS) and shall be shown in respective field in Schedule OS.

v. All deductions and depreciation u/s 57 from other source income to be claimed in the return.

4.21 Withdrawal of deposits under national savings scheme

The key information sources under this information category are as under:

| # | Information Source | Information Description |

| 1. | Withdrawal of deposits under National Savings Scheme (Section 194EE) | Withdrawals from NSS are taxable. Tax is also deducted on such withdrawals and reported in Form 26Q by the payer on a quarterly basis. This information is provided by the deductor to the deductee (taxpayer) in Form 16A. |

The approach for AIS processing and information handling is as under:

i. Deductor while making payment to NSS certificate holder, on withdrawals made by such certificate holder, deducts TDS and reports the same in TDS form 26Q. Amount received on such withdrawals is taxable in the hands of recipient under the head income from other sources.

ii. The AIS information level feedback can be used for providing following inputs:

a. Information is correct

b. Income is not taxable

c. Information is not fully correct: This functionality can be used to modify key attributes (e.g. Account Number, Account Type in case of interest), Information value etc.

d. Information relates to other PAN/Year

e. Information is duplicate / included in other information

f. Information is denied

iii. The feedback provided by taxpayer will be shown separately in AIS and will update the value in Taxpayer Information Summary (TIS).

iv. Withdrawal of deposits under National Savings Scheme will be reflected in Taxpayer Information Summary (TIS) and shall be shown in respective field in Schedule OS.

v. All deductions and depreciation u/s 57 from other source income to be claimed in the return.

4.22 Receipt of commission etc. on sale of lottery tickets

The key information sources under this information category are as under:

| # | Information Source | Information Description |

| 1. | Receipt of Commission etc. on sale of lottery tickets (Section 194G) | Commission on lottery business is subject to tax deduction under section 194G. The payer reports such information in Form 26Q on a quarterly basis. This information is provided by the deductor to the deductee (taxpayer) in Form 16A. |

The approach for AIS processing and information handling is as under:

i. Deductor while making payment of commission on sale of lottery tickets deducts TDS and reports the same in TDS form 26Q. Commission income earned is taxable in the hands of recipient under the head income from other sources.

ii. The AIS information level feedback can be used for providing following inputs:

a. Information is correct

b. Income is not taxable

c. Information is not fully correct: This functionality can be used to modify key attributes (e.g. Account Number, Account Type in case of interest), Information value etc.

d. Information relates to other PAN/Year

e. Information is duplicate / included in other information

f. Information is denied

iii. The feedback provided by taxpayer will be shown separately in AIS and will update the value in Taxpayer Information Summary (TIS).

iv. Receipt of Commission etc. on sale of lottery tickets will be reflected in Taxpayer Information Summary (TIS) and shall be shown in respective field in Schedule OS.

v. All deductions and depreciation u/s 57 from other source income to be claimed in the return.

4.23 Income from investment in securitization trust

The key information sources under this information category are as under:

| # | Information Source | Information Description |

| 1. | Income from investment made in securitization trust (Section 194LBC) | Income from investment made in securitization trust is subject to tax deduction. The payer reports such information in Form 27Q on a quarterly basis. This information is provided by the deductor to the deductee (taxpayer) in Form 16A. |

The approach for AIS processing and information handling is as under:

i. Payer /Deductor while making payment of income from investments deducts TDS and reports the same in TDS form 27Q. Income earned from investments made in securitisation trust is taxable in the hands of recipient under the head income from other sources.

ii. The AIS information level feedback can be used for providing following inputs:

a. Information is correct

b. Income is not taxable

c. Information is not fully correct: This functionality can be used to modify key attributes (e.g. Account Number, Account Type in case of interest), Information value etc.

d. Information relates to other PAN/Year

e. Information is duplicate / included in other information

f. Information is denied

iii. The feedback provided by taxpayer will be shown separately in AIS and will update the value in Taxpayer Information Summary (TIS).

iv. Income from investment in securitization trust will be reflected in Taxpayer Information Summary (TIS) and shall be shown in respective field in Schedule OS.

v. All deductions and depreciation u/s 57 from other source income to be claimed in the return.

4.24 Income on account of repurchase of units by MF/UTI

The key information sources under this information category are as under:

| # | Information Source | Information Description |

| 1. | Income on account of Repurchase of units by MF/UTI (Section 194F) | Receipt of income on account of repurchase of units by MF/UTI is subject to tax deduction under section 194F. The payer reports such information in Form 26Q on a quarterly basis. This information is provided by the deductor to the deductee (taxpayer) in Form 16A. |

The approach for AIS processing and information handling is as under:

i. Payer/Deductor while making payment of income on account of repurchase of units deducts TDS and reports the same in TDS form 26Q. Income earned on account of repurchase of units by MF/UTI is taxable in the hands of recipient under the head income from other sources.

ii. The AIS information level feedback can be used for providing following inputs:

a. Information is correct

b. Income is not taxable

c. Information is not fully correct: This functionality can be used to modify key attributes (e.g. Account Number, Account Type in case of interest), Information value etc.

d. Information relates to other PAN/Year

e. Information is duplicate / included in other information

f. Information is denied

iii. The feedback provided by taxpayer will be shown separately in AIS and will update the value in Taxpayer Information Summary (TIS).

iv. Income on account of Repurchase of units by MF/UTI will be reflected in Taxpayer Information Summary (TIS) and shall be shown in respective field in Schedule OS.

v. All deductions and depreciation u/s 57 from other source income to be claimed in the return.

4.25 Interest or dividend or other sums payable to government

The key information sources under this information category are as under:

| # | Information Source | Information Description |

| 1. | Interest or dividend or other sums payable to Government (Section 196) | Income from interest or dividend or other sums payable is not subject to tax deduction. The payer reports such information in Form 26Q on a quarterly basis. This information is provided by the deductor to the deductee (taxpayer) in Form 16A. |

The approach for AIS processing and information handling is as under:

i. Payer! Deductor while making payment of interest or dividend or other sums to government is not required to deduct TDS however the same may be reported in TDS form 26Q. Income earned is taxable in the hands of recipient under the head income from other sources.

ii. The AIS information level feedback can be used for providing following inputs:

a. Information is correct

b. Income is not taxable

c. Information is not fully correct: This functionality can be used to modify key attributes (e.g. Account Number, Account Type in case of interest), Information value etc.

d. Information relates to other PAN!Year

e. Information is duplicate ! included in other information

f. Information is denied

iii. The feedback provided by taxpayer will be shown separately in AIS and will update the value in Taxpayer Information Summary (TIS).

iv. Interest or dividend or other sums payable to Government will be reflected in Taxpayer Information Summary (TIS) and shall be shown in respective field in Schedule OS.

v. All deductions and depreciation u!s 57 from other source income to be claimed in the return.

4.26 Payment to non-resident sportsmen or sports association u/s 115BBA

The key information sources under this information category are as under:

| # | Information Source | Information Description |

| 1. | Payment received by non-resident sportsmen or sports association (Section 194E) | Information pertaining to amount paid to non-resident sportsmen or sports association is reported by deductor in form 27Q. This information is provided by the deductor to the deductee (taxpayer) in Form 16A. |

The approach for AIS processing and information handling is as under:

i. Deductor (remitter) while making payment to non-resident sportsmen or sports associations deducts tax and submit the information in TDS form 27Q. Amount received by such sportsmen or sports associations is taxable under the head income from other sources.

ii. The AIS information level feedback can be used for providing following inputs:

a. Information is correct

b. Receipts in the nature of reimbursement of expenses

c. Receipts in the nature of refundable security

d. Receipts treated as capital receipt

e. Income is not taxable

f. Information is not fully correct

g. Information relates to other PAN/Year

h. Information is duplicate / included in other information

i. Information is denied

iii. The feedback provided by taxpayer will be shown separately in AIS and will update the value in Taxpayer Information Summary (TIS).

iv. Amount received by sportsmen and sports association will be reflected in Taxpayer Information Summary (TIS) and shall be shown in respective field in Schedule OS.

v. All deductions and depreciation u/s 57 from other source income to be claimed in the return.

4.27 Sale of land or building

The key information sources under this information category are as under:

| # | Information | Information Description |

| 1. | Sale of immovable property (SFT-012) | Sales consideration of immovable property transferred is reported under Statement of Financial Transactions (SFT). The information will be shown in AIS of all sellers to enable submission of feedback. |

| 2. | Sale of immovable property (Form 60/61) | Sale of immovable property is also reported in Form 61 where PAN is not furnished by the transacting party. PAN is populated based on aadhaar and other attributes of the person. |

| 3. | Transfer of immovable property (Section 194IA) | Total Value of Consideration is reported by buyer of property in Form 26QB. This value will be derived from the deduplication of information reported in Form 26QB. Only transactions which do not match with information reported in SFT will be reflected here. This information is provided by the deductor to the deductee (taxpayer) in Form 16B. |

| 4. | Compensation received on acquisition of immovable property (Section 194LA) | Information related to compensation paid to seller on acquisition of any immovable property is reported by deductor in form 26Q. This information is provided by the deductor to the deductee (taxpayer) in Form 16A. |

| 5. | Receipts under specified agreement (Section 194IC) | Information related to receipts under specified agreement is reported by person making payment for specified agreement entered into. This information is provided by the deductor to the deductee (taxpayer) in Form 16A. |

The approach for AIS processing and information handling is as under:

i. In case of SFT information reported in property based reporting format, the transaction amount will assigned to each seller as the sub-registrar are not able to determine the share of each seller from the agreement. The value of property for stamp duty purposes is also displayed as per processing rules. The taxpayer can update the transaction amount, value of property for stamp duty purposes and Transaction amount assigned to the taxpayer.

ii. In case of information reported Transfer of immovable property (Section 194IA), value of consideration will be derived from the deduplication of information reported in Form 26QB. Only transactions which do not match with information reported in SFT will be reflected here.

iii. Information reported from all sources will be summed up at buyer/deductor PAN and address level.

iv. In case multiple values are found for a single property in SFT-012 and from rest of the sources, records with higher value of consideration will be retained and information source with lower value will be marked as “Information is duplicate / included in other information”.

v. The AIS information level feedback can be used for providing following inputs:

a. Information is correct

b. Sale of rural agricultural land

c. Transfer not in the nature of sale

d. Receipt is not taxable

e. Information is not fully correct: This functionality can be used to modify address of property, value of consideration/transaction amount, value of property for stamp duty purposes and Transaction amount assigned to the taxpayer.

f. Information relates to other PAN/Year: Transaction pertaining to other financial years, other PAN

g. Information is duplicate / included in other information

h. Information is denied

vi. The feedback provided by taxpayer will be shown separately in AIS and will update the value in Taxpayer Information Summary (TIS).

vii. The sum of value of consideration from all buyers will be reflected in Taxpayer Information Summary (TIS).

viii. Deductions relating to cost of acquisition, improvement, expenditure in connection to sale/transfer and deduction u/s 54 needs to be claimed in the return.

4.28 Receipts from transfer of immovable property

The key information sources under this information category are as under:

| # | Information | Information Description |

| 1. | Receipts from transfer of immovable property (Section 194IA) | Information related to receipts from transfer of immovable property is reported by buyer of property in Form 26QB. This information is provided by the deductor to the deductee (taxpayer) in Form 16B. |

The approach for AIS processing and information handling is as under:

i. Buyer /Deductor while making payment in respect of property purchased is required to deduct tax and report the same in TDS form 26QB if the overall payment in respect of such property exceeds 50 lakhs rupees.

ii. The AIS information level feedback can be used for providing following inputs:

a. Information is correct

b. Information is not fully correct

c. Information relates to other PAN/Year

d. Information is duplicate / included in other information

e. Information is denied

iii. The feedback provided by taxpayer will be shown separately in AIS and will update the value in Taxpayer Information Summary (TIS).

4.29 Sale of vehicle

The key information sources under this information category are as under:

| # | Information | Information Description |

| 1. | Sale of a motor vehicle (Form 60/61) | Sale of motor vehicle is reported in Form 61 where PAN is not furnished by the transacting party. PAN is populated based on aadhaar and other attributes of the person. |

The approach for AIS processing and information handling is as under:

i. Reporting entity reports transactions relating to sale of motor vehicle through form 61. RE reports non-PAN transactions through form 61.

ii. The AIS information level feedback can be used for providing following inputs:

a. Information is correct

b. Transfer not in the nature of sale

c. Receipt is not taxable

d. Information is not fully correct: This functionality can be used to modify value of consideration/transaction amount.

e. Information relates to other PAN/Year: Transaction pertaining to other financial years, other PAN

f. Information is duplicate / included in other information

g. Information is denied

iii. The feedback provided by taxpayer will be shown separately in AIS and will update the value in Taxpayer Information Summary (TIS).

iv. The sum of value of consideration from all buyers will be reflected in Taxpayer Information Summary (TIS).

v. Deductions relating to cost of acquisition, improvement, expenditure in connection to sale/transfer and deduction u/s 54 needs to be claimed in the return.

4.30 Sale of securities and units of mutual fund

The approach for preparation of information by Depository and RTAs is as under:

i. Only user-initiated debit transactions are reported. In case of a minor, details of legal or natural guardian (PAN, Name etc.) is provided.

ii. The Estimated Sale Consideration for the debit transaction is determined on the best possible available price of the asset with the reporting entity (e.g. end of day price). The taxpayer will be able to modify the sales consideration before filing the return.

iii. The securities are classified into specified security class for determining the type of asset (short term/long term) and applicable rate.

iv. The period of holding (difference between date of sale and date of acquisition of any share/security) is used to classify the asset as short term or long-term asset. First in First out (FIFO) method is used for identification of corresponding credit and computation of period of holding. Any capital asset held by the taxpayer for a period of more than minimum period of holding will be treated as long-term capital asset and remaining assets will be classified as short-term asset. The specified minimum period of holding for different asset class is as under:

| Security Class Code | Security Class Description | Minimum Period of Holding |

| LES | Listed Equity Share | 12 months |

| LPS | Listed Preference Share | 12 months |

| LDB | Listed Debenture | 12 months |

| ZCB | Zero Coupon Bond | 12 months |

| CIB | Listed Capital Indexed Bond | 12 months |

| EMF | Unit of Equity Oriented Mutual Fund | 12 months |

| UTI | Unit of UTI | 12 months |

| UBT | Unit of Business Trust | 36 months |

| OTU | Other Units | 36 months |

| OTH | Other Listed Securities (Other than a unit) | 12 months |

v. For every debit transaction, the corresponding credit transaction is identified using First in First Out (FIFO) method. The estimated cost of acquisition for the credit is determined on the best possible available price with the reporting entity. The estimated cost of acquisition is to be taken as NIL for OFF Market credits. The taxpayer will be able to modify the cost of acquisition before filing the return.

vi. In relation to a long-term capital asset, being an equity share in a company or a unit of an equity-oriented fund acquired before the 1st day of February, 2018, adjusted cost of acquisition is taken as higher of (i) the cost of acquisition of such asset; and (ii) lower of (A) the fair market value of such asset as on 31st January, 2018; and (B) the full value of consideration received or accruing as a result of the transfer of the capital asset. The Cost Inflation Index is used to determine estimated indexed cost of acquisition wherever applicable.

The key information sources under this information category are as under:

| # | Information | Information Description |

| 1. | Sale of Listed Equity Share (Depository) | In the SFT reporting of depository transactions, the

estimated sale consideration for the debit transaction is determined on the best possible available price of the asset with the depository (e.g. end of day price). The taxpayer will be able to modify the sales consideration and other related information before filing the return. |

| 2. | Buy back of shares | In the SFT reporting of depository transactions, the estimated sale consideration for the debit transaction is determined on the best possible available price of the asset with the depository (e.g. end of day price). The taxpayer will be able to modify the sales consideration and other related information before filing the return. |

| 3. | Sale of Listed Preference Share (Depository) | In the SFT reporting of depository transactions, the estimated sale consideration for the debit transaction is determined on the best possible available price of the asset with the depository (e.g. end of day price). The taxpayer will be able to modify the sales consideration and other related information before filing the return. |

| 4. | Sale of Listed Debenture (Depository) | In the SFT reporting of depository transactions, the estimated sale consideration for the debit transaction is determined on the best possible available price of the asset with the depository (e.g. end of day price). The taxpayer will be able to modify the sales consideration and other related information before filing the return. |

| 5. | Sale of Zero Coupon Bond (Depository) | In the SFT reporting of depository transactions, the estimated sale consideration for the debit transaction is determined on the best possible available price of the asset with the depository (e.g. end of day price). The taxpayer will be able to modify the sales consideration and other related information before filing the return. |

| 6. | Sale of Listed Capital Indexed Bond (Depository) | In the SFT reporting of depository transactions, the estimated sale consideration for the debit transaction is determined on the best possible available price of the asset with the depository (e.g. end of day price). The taxpayer will be able to modify the sales consideration and other related information before filing the return. |

| 7. | Sale of Unit of Equity Oriented Mutual Fund (Depository) | In the SFT reporting of depository transactions, the estimated sale consideration for the debit transaction is determined on the best possible available price of the asset with the depository (e.g. end of day price). The taxpayer will be able to modify the sales consideration and other related information before filing the return. |

| 8. | Sale of Unit of Equity Oriented Mutual Fund (RTA) | In the SFT reporting of mutual fund transactions, the sale consideration for the debit transaction is determined on the best possible available price of the asset with the Registrar and Transfer Agent (RTA). The taxpayer will be able to modify the sales consideration and other related information before filing the return. |

| 9. | Sale of Unit of UTI (Depository) | In the SFT reporting of depository transactions, the estimated sale consideration for the debit transaction is determined on the best possible available price of the asset with the depository (e.g. end of day price). The taxpayer will be able to modify the sales consideration and other related information before filing the return. |

| 10. | Sale of Unit of UTI (RTA) | In the SFT reporting of mutual fund transactions, the sale consideration for the debit transaction is determined on the best possible available price of the asset with the Registrar and Transfer Agent (RTA). The taxpayer will be able to modify the sales consideration and other related information before filing the return. |

| 11. | Sale of Unit of Business Trust (Depository) | In the SFT reporting of depository transactions, the estimated sale consideration for the debit transaction is determined on the best possible available price of the asset with the depository (e.g. end of day price). The taxpayer will be able to modify the sales consideration and other related information before filing the return. |

| 12. | Sale of Other Unit (Depository) | In the SFT reporting of depository transactions, the estimated sale consideration for the debit transaction is determined on the best possible available price of the asset with the depository (e.g. end of day price). The taxpayer will be able to modify the sales consideration and other related information before filing the return. |

| 13. | Sale of Other Unit (RTA) | In the SFT reporting of mutual fund transactions, the sale consideration for the debit transaction is determined on the best possible available price of the asset with the Registrar and Transfer Agent (RTA). The taxpayer will be able to modify the sales consideration and other related information before filing the return. |

| 14. | Sale of Other Listed Securities (Depository) | In the SFT reporting of depository transactions, the estimated sale consideration for the debit transaction is determined on the best possible available price of the asset with the depository (e.g. end of day price). The taxpayer will be able to modify the sales consideration and other related information before filing the return. |

The approach for AIS processing and information handling is as under:

i. Information reported by Depository and RTA in respect of mutual fund transactions will be deduplicated.

ii. Information reported by Depository and Company in respect of share buy back will be deduplicated.

iii. The AIS information level feedback can be used for providing following inputs:

a. Information is correct

b. Transfer not in the nature of sale