♦ Basic & Accounting Treatment of ESOP :

- What is ESOP: ESOPs, ‘Employees Stock Ownership Plans’ or “Employees Stock Options Plans” is the generic term for a basket of instruments and incentive schemes provided to the employees of the company.

- A Stock Option is a right but not an obligation granted to an employee in pursuance of the Employee stock option scheme to apply for shares of the company at the pre- determined price.

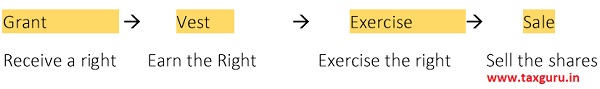

- ESOP’s Cycle

- An option is first granted to an employee and after a specific period (when it exercised) vests with the employee. This period is referred to as the vesting period.

- Vesting Period = Period between Vesting Period & Grant Period

- HOW MUCH COST TO BE RECOGNISED IN PROFIT & LOSS Account?

Cost of services received in a share based payment is required to be recognised over a vesting period with a corresponding credit to an appropriate equity account namely ‘’Stock option outstanding account’’.

- How cost of service is determined?

Fair value of shares determined on Grant Date should be used as a cost of service received.

- Accounting Treatment at various stage of Cycle?

At the time of Grant & at subsequent period:

The Company needs to recognise an amount for the service received during the vesting period based upon the best available estimate of number of shares expected to vest and should reverse estimate if necessary.

Example:

1. Vesting period: 3 years

2. Expected Period: 4 Years

3. Expected Life: 6 Years

4. Exercise Price: Rs.15/-

5. Market Price on exercise Date: Rs.25/-

6. E. g. – Fair Value of Option: Rs.8/- (Option Pricing Model)

(Option Pricing Model: It is to be calculated based on above factors and discounted value of Price recovered from employee, Interest free Rate based on guidance note prescribed by ICAI and as per Ind AS)

7. No of Employees – 300

8. Option per employee – 1000 Expected exercise Ratio – 90%

Fair value of Option expected to Vest = 1000*300*90%*Rs.8 = Rs.21,60,000/- Accounting Entry:

Year-1

| Employee Compensation expense A/c | Dr | 7,20,000 |

| To Stock Options Outstanding A/c | Cr | 7,20,000 |

Year-2

| Employee Compensation expense A/c | Dr | 7,20,000 |

| To Stock Options Outstanding A/c | Cr | 7,20,000 |

Year-3

| Employee Compensation expense A/c | Dr | 7,20,000 |

| To Stock Options Outstanding A/c | Cr | 7,20,000 |

Equated value over a vesting Period for 3 Years based on estimates & revised estimates every year is to be charged to P & L Account.

On Exercise of Option:

| Bank A/c (Rs.15*shares 2,70 Lacs) | Dr | 40,50,000 |

| Stock Options Outstanding A/c (Rs.8*2.70 Lacs) | Dr | 21,60,000 |

| Equity Shares Capital A/c (Rs.10*2.70 Lacs) | Cr | 27,00,000 |

| Security Premium A/c (Rs.13*2.70 Lacs) | Cr | 35,10,000 |

♦ Tax Treatment of ESOP:

ESOP valuation plays vital role in the success of ESOP Scheme. ESOP Valuation effects EPS of the company and higher valuation may result in to higher tax pay-out by employees as a perquisite and may turn ESOP scheme unattractive thus appropriate plan & scheme is required for success ESOP.

Calculating Taxes:

A. ESOP Expenditure allow ability under Income tax Act.

– There is no specific section which specify about whether it will be allowed as deduction or not. It is allowed as business expenditure u/s 37 as other business However, the matter of ESOP expenses is majorly litigative in nature and disallowed in major of the Judgements.

The grounds of litigation are:

– If ESOP expenditure is considered as capital expenditure then it will not be allowed as deduction from profit from Profit from Business. Further, it’s a notional expenses based on FMV calculation and not actual expense incurred.

– If it’s a revenue expenditure then it will be allowed.

– In Major of the judgements it’s considered as negative value of Security premium in nature and disallowed. However, matters are still pending before Delhi High Court under litigation in case of Ranbaxy (Supra).

B. ESOPs are taxed at 2 instances in the hands of employee –

(i) At the time of exercise – as a perquisite.

– When the employee has exercised the option — the difference between the FMV on exercise date and exercise price is taxed as perquisite.

– The employer deducts TDS on this perquisite.

– This amount is shown in the employee’s Form 16 and included as part of total income from salary in the tax return.

(ii) At the time of sale by employee – as a capital gain.

– When employee sale the shares

– The difference between sale price and FMV on the exercise date is taxed as capital gains.

Exercise price —<Perquisite>— FMV on exercise date —<capital gains>—sale price

Capital Gain Taxation:

* Capital gain taxation of Listed securities is considered in below notes:

At what rates your capital gains shall be taxed depends upon your period of holding. Period of holding is calculated from exercise date up to the date of sale.

- If these are sold within 1 year, these are considered short term capital gain and gain will be taxable @15%.

- If these are sold after 1 year, it will be long term capital gain. LTCG are tax free up to Rs. 1 Lac and above one lac it will be taxable @ 10%.

I would modify the description of the vesting period for better clarity, thus: Vesting Period = Period between Grant date and Date of Vesting (Vesting Date).

very well explained, remarkably good

Nice article and good explanation