In these article we will see the resolution for the error of ‘Invalid Summary Payload’ in GSTR-10. The steps to resolved the error are:

1. What is Form GSTR-10?

Ans. A taxable person whose GST registration is cancelled or surrendered has to file a return in Form GSTR-10 called as Final Return. This is statement of stocks held by such taxpayer on day immediately preceding the date from which cancellation is made effective. This return should be filed within three months of the date of cancellation or date of order of cancellation, whichever is later.

2. Who needs to file Form GSTR-10?

Ans. Form GSTR-10 is required to be filed by every taxpayer except:

(i) Input Service Distributor

(ii) Non-resident taxable persons

(iii) Persons required to deduct tax at source (TDS) under section 51

(iv) Persons paying tax under section 10 (Composition Taxpayer)

(v) Persons required to collect tax at source (TCS) under section 52

3. What is the difference between Final Return and Annual Return?

Ans. Annual return has to be filed by every registered person under GST. Annual return is to be filed once a year in Form GSTR-9.

Final return is required to be filed by the persons whose registration has been cancelled or surrendered in Form GSTR-10.

Procedure:

Login > Services > Returns > Final Return.

2. After clicking on Final Return, the below mentioned window will be appearing:

3. After clicking on Final Return > Prepare Online, the following window will be appeared:

4. Click on “Address for future correspondence”, then the address will auto-populated. The address would be an editable format, the same would be edited. If the address details are not auto-populated, kindly provide the details as required. Click on ‘Save’ after adding the required details.

5. Click on “PROCEED TO FILE” button and refresh the page.

6. The following message is displayed on the top page of the screen that Proceed to file request has been received. Please check the status in sometime. Click on Refresh button.

7. Once the status of Form GSTR-10 is Ready to File, 9 & 10 – Amount of tax payable and paid tile gets enabled. Click on 9 & 10 – Amount of tax payable and paid tile.

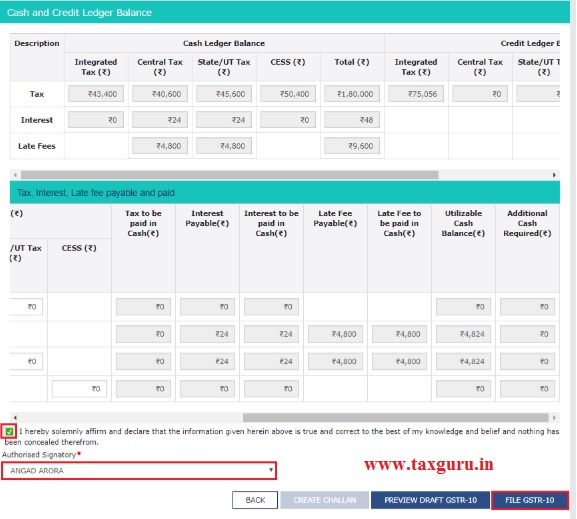

8. Click on declaration box, select the authorised signatory then “File Form GSTR-10 with DSC/ EVC” will enable.

9. The Submit Application page is displayed. Click the FILE WITH DSC or FILE WITH EVC

10. The success message is displayed and ARN is displayed after filing the return.

I hope you all like my article. For any clarification mail me @shashank.kothiyal9@gmail.com . Please share your valuable comments and feedback.

Thank you so much, it worked.

My GST number is cancelled by authorities due to

GST R 10 filed by my auditor without a purchase bill which I have purchased on 2019. They shows that’s a reason for cancellation. Even I have pay my 10000 RS fine amount for that mistake. But now I can’t able to reopen my GST number even I can’t able to use my pan for new GST number. It shows that error simultaneously .. kindly suggest me a solution..

I AM GETTING INVALID SUMMARY PLAYLOAD ERROR

You needs to update Address in Future Correspondence in GSTR 10 ( Even if the Address is coming there, you have to again enter and save details ) BUT make sure that you do not use any special character such as . , / ‘ ” () or any other

That saved me too.

Thanks a lot to Rohit Rajendra Thaker.

Thank you so much, saving address again works out to this problem

THIS SOLUTION WAS SO VERY HELPFUL SIR!!

Thank you very much for the solution

THANKS A LOT… IT WORKED ..

Thank u for reply I am also same error but now resolved and able to file it.

How to resolved from invalid play load error

At the time of proceeding last step of filing GSTR 9C (EVC) Process otp also put and then submit,then shown as INVALID SUMMARY PAYLOAD ERROR can you tell me how to resolve this issue