It has been noticed by the Institute of Chartered Accountants of India that Financial Documents / Reports / Certificates are being signed by Non-CAs misrepresenting themselves as CA Members thereby misleading the Regulators, Authorities and Stakeholders.

To curb this menace and malpractices, ICAI has conceptualised and implemented an innovative concept called Unique Document Identification Number (UDIN). ICAI at its 379th Council Meeting held on 17th – 18th December, 2018 made generation of UDIN mandatory for every signature of Full time Practising Chartered Accountants in phased manner for the following services:

- All Certificates with effect from 1st February, 2019

- GST and Income Tax Audit with effect from 1st April, 2019

- All Audit and Assurance Functions with effect from 1st July, 2019

Therefore, UDIN is being made mandatory for all Audit and Assurance Functions like Documents and Reports certified / issued by full time Practising Chartered Accountants from 1st July, 2019

Members are being advised to plan the Audits and Assurance functions accordingly as UDIN has to be generated on the date of signature dates of Certificates / Report / Audit Reports although a 15 days window is there for exceptional circumstances.

Further, non-compliance of UDIN directive may attract Disciplinary Proceedings as per Clause 1 of Part II of Second Schedule of The Chartered Accountants Act, 1949.

PROCESS OF GENERATING UDIN

STEP-1

- Go to the website: https://udin.icai.org

- Login through “Member Login” option given on the portal by providing 6 digits membership no. in username and relevant password in password option.

STEP-2

- After Logging in the Member has to click on Generate UDIN.

STEP-3

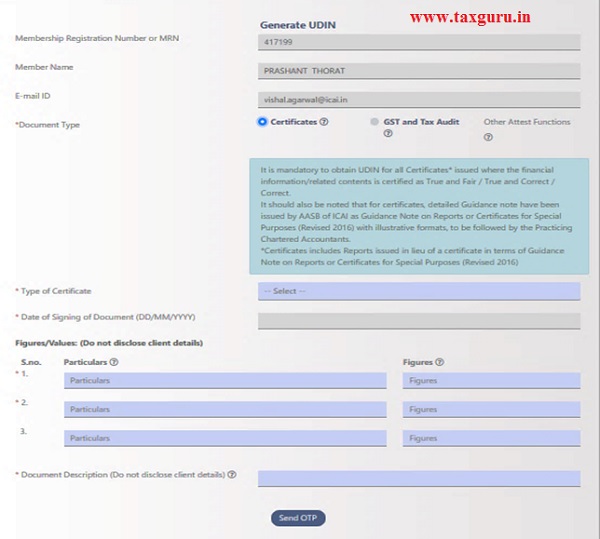

- After clicking on Generate UDIN, following details will be auto-populated;

a. Membership registration number

b. Member name

c. E-mail ID

- After that select the “Document Type” for generation of UDIN w.r.t.

a. Certificates – Applicable from 1st February, 2019

b. GST and tax Audit – Applicable from 1st April, 2019

c. Audit and Assurance Functions – Applicable from 1st July, 2019

STEP-4

- IN CASE WHERE “CERTIFICATES” OPTION SELECTED IN DOCUMENT TYPE

a. Select the relevant “Type of Certificate” from the drop down list available with the below options:

1. Additional Certification by Concurrent Auditors not forming part of concurrent audit assignment

2. Capital Contribution Certificate/net worth certificate

3. Certificate issued by Statutory Auditors of Banks

4. Certificate issued by Statutory Auditors of Insurance Companies

5. Certificate issued for KYC purpose to banks confirming sole proprietorship

6. Certificate issued under RERA

7. Certificate of Liquid Asset U/S 45-IB of RBI Act, 1945

8. Certificate of physical verification of securities issued by Concurrent Auditors of Treasury Department of Banks

9. Certificate of Short Sale of securities issued by Concurrent Auditors of Treasury Department of Banks

10. Certificate Regarding Sources of Income

11. Certificates for Claiming Deductions and Exemptions under various Rules and Regulations

12. Certificates for Funds/ Grants utilisation Charitable Trust/Institution

13. Certificates for Funds/ Grants utilisation for NGO’s

Certificates for Funds/ Grants utilisation for Statutory Authority

14. Certificates for Funds/ Grants utilisation under FERA/FEMA/Other Laws

15. Certificates in form 15CB

16. Certificates in relation to initial Public Issue/compliances under ICDR and LODR.

17. Certificates issued on basis of Statutory Records under Companies Act, 2013 & applicable provisions

18. Certificates issued under LLP Act

19. Certification for claim of refund other Indirect Taxes

20. Certification for claim of refund under GST

21. Certification of arms length price u/s 92 of the Income Tax Act, 1961.

22. Certification of Fair Values of Shares of Company for Buy Back

23. Certification of Fair Values of Shares of Company for the scope of merger / de-merger

24. Certification of Fair Values of Shares of Company for transfer of shares from resident to non-resident

25. Certification of Fair Values of Shares of Company for Allotment of further shares

26. Certification under Exchange Control legislation

27. Certification under the Income-Tax Laws for various Deductions etc

28. Net worth Certificates for Bank finances

29. Net worth Certificates for Bank Guarantee

30. Net worth Certificates for Student Study Loan

31. Net worth Certificates for Visa by Foreign Embassy

32. RBI Statutory Auditor Certificate for NBFCs

33. Turnover Certificate

34. Working Capital Certificate/Net Working Capital Certificate

35. Others

b. Select the relevant date for signing the document from “Date of Signing of Document” option.

c. Enter the relevant “Figures/Values” in the format described below:

| 1* | Particulars | Figures |

| 2* | Particulars | Figures |

Note: Two Financial Figures are mandatory out of 3 (three) given fields. In case, there is no Financial Figure in the Certificate, Zero (0) is to be mentioned in Financial Figure and in its Particulars mention “There is no Financial Figure in Certificate”.

d. After that provide the description of nature of certificate in “Documents Description”

e. Click on “Send OTP” button, which enables the system to send OTP on the registered mobile no. and email of the member.

f. After that provide the OTP received on the registered mobile no. and then Click the submit button.

g. After clicking the submit button, System will generate the 18 digits UDIN.

- IN CASE WHERE “GST and Tax Audit” OPTION SELECTED IN DOCUMENT TYPE

a. Select the relevant section in “Particulars of Section/Form under which report issued” option from the drop down list available and provide relevant financial figures in “Figures/Values” option corresponding to the relevant section selected.

Below are the key fields required under “Figures / Values” option corresponding to different reports required under GST and Tax Audit.

1. Under Section 44AB of IT Act, 1961

a. Total Turnover as per Form 3CD

b. Net Profit/ Turnover as per Form 3CD

c. WDV of Fixed Assets as per Form 3CD

d. Assessment Year

e. Firm Registration Number (FRN)

2. For Other Tax Audit Reports other than Section 44AB of IT Act, 1961

a. Assessment Year

b. Firm Registration Number (FRN)

c. Any Figure/Value from the Report

3. For Section 35(5) of CGST Act, 2017 – Form GST 9C

a. Turnover (incld. exports) as per Audited Financial Statements under Clause 5 (A) of Form 9C

b. Turnover as declared in Annual Return GSTR 9 under Clause 5 (Q) of Form 9C

c. Assessment Year

d. Firm Registration Number (FRN)

4. For Section 66(1) of CGST Act, 2017 -Form ADT-04

a. Short payment of Tax as per Form ADT-04

b. Any other amount as per Form ADT-04

c. Assessment Year

d. Firm Registration Number (FRN)

b. Select the relevant date for signing the report from “Date of Signing of Report” option.

c. After that provide the relevant description in “Documents Description”

d. Click on “Send OTP” button, which enables the system to send OTP on the registered mobile no. and email of the member.

e. After that provide the OTP received on the registered mobile no. and then Click the submit button.

f. After clicking the submit button, System will generate the 18 digits UDIN.

- IN CASE WHERE “AUDIT AND ASSURANCE FUNCTIONS” OPTION SELECTED IN DOCUMENT TYPE

a. Select the relevant “Type of Audit” from the drop down list available with the below options:

1. Statutory Audit – Corporate

2. Statutory Audit – Non-Corporate

3. Statutory Audit – Branch

4. Independent Financial Audit

5. Forensic Audit

6. Concurrent Audit

7. Internal Audit

8. Energy Audit

9. Income/receipt and payment/Expenditure Audit

10. Propriety Audit

11. Environment Audit

12. Information system audit, etc.

b. Select the relevant option in “Under Act/Law/Statue/Regulation” corresponding to the option selected in “Type of Audit” from the drop down list available with the below options:

1. Companies Act, 2013

2. Companies Act, 1956

3. Banking Regulation Act, 1949

4. Limited Liability Partnership Act, 2008

5. Insurance Act, 1938

6. SEBI Act, 1992

7. Societies regulations act, 1860 etc.

c. Select the relevant date for signing the document from “Date of Signing of Report” option.

d. Provide key fields required under “Figures / Values” option available on the basis of type of audit selected. For Example:

-

- In case ‘Statutory Audit’ selected in “Type of Audit”

| 1* | Financial Year | Figures |

| 2* | PAN of the Assessee | Figures |

| 3* | Gross turnover/Gross Receipt | Figures |

| 4* | Shareholder Fund/Owners Fund | Figures |

| 5* | Net Block of property, plant & equipment | Figures |

| 6* | FRN (Firm Reg. No.) | Figures |

e. After that provide the relevant description in “Documents Description” For Ex: Audited balance sheet in case of statutory audit.

f. Click on “Send OTP” button, which enables the system to send OTP on the registered mobile no. and email of the member.

g. After that provide the OTP received on the registered mobile no. and then Click the submit button.

h. After clicking the submit button, System will generate the 18 digits UDIN.

Don’t forget to check icai student login.

IS IT NECESSARY TO GIVE UDIN FOR NON CORPORATE ASSESSEE WHO IS NOT REQUIRED TO CONDUCT AUDIT

Is to quote DIN/ PAN for director mandatory for sign the FS.