Introduction

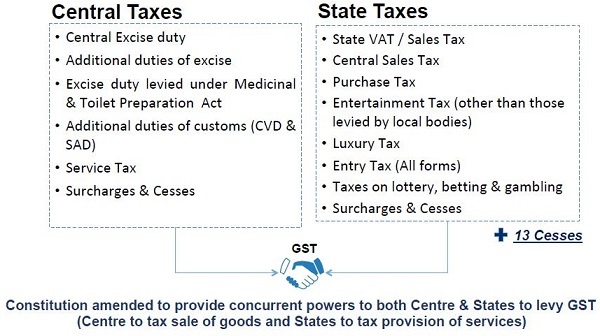

Whether it was uniformity of taxation and consequent free interior trade or possession of ‘the jewel in the crown’ at the root of prosperity of Britain is debatable, nonetheless the words of father of modern economics on the benefits of uniformity of system of taxation cannot be taken too lightly. Before implementation of Goods and Service Tax (GST), Indian taxation system was a farrago of central, state and local area levies. By subsuming more than a score of taxes under GST, road to a harmonized system of indirect tax has been paved making India an economic union.

Genesis:

Several countries have already established the Goods and Services Tax. In Australia, the system was introduced in 2000 to replace the Federal Wholesale Tax. GST was implemented in New Zealand in 1986. A hidden Manufacturer’s Sales Tax was replaced by GST in Canada, in the year 1991. In Singapore, GST was implemented in 1994. GST is a value-added tax in Malaysia that came into effect in 2015.

| Month, Year | Journey of GST |

| 2000 | In India, the idea of adopting GST was first suggested by the Atal Bihari Vajpayee Government in 2000. The state finance ministers formed an Empowered Committee (EC) to create a structure for GST, based on their experience in designing State VAT. Representatives from the Centre and states were requested to examine various aspects of the GST proposal and create reports on the thresholds, exemptions, taxation of inter-state supplies, and taxation of services. The committee was headed by Asim Dasgupta, the finance minister of West Bengal. Dasgupta chaired the committee till 2011. |

| 2004 | A task force that was headed by Vijay L. Kelkar the advisor to the finance ministry, indicated that the existing tax structure had many issues that would be mitigated by the GST system. |

| February 2005 | The finance minister, P. Chidambaram, said that the medium-to-long term goal of the government was to implement a uniform GST structure across the country, covering the whole production-distribution chain. This was discussed in the budget session for the financial year 2005-06. |

| February 2006 | The finance minister set 1 April 2010 as the GST introduction date. |

| November 2006 | Parthasarthy Shome, the advisor to P. Chidambaram, mentioned that states will have to prepare and make reforms for the upcoming GST regime. |

| February 2007 | The 1 April 2010 deadline for GST implementation was retained in the union budget for 2007-08. |

| February 2008 | At the union budget session for 2008-09, the finance minister confirmed that considerable progress was being made in the preparation of the roadmap for GST. The targeted timeline for the implementation was confirmed to be 1 April 2010. |

| July 2009 | Pranab Mukherjee, the new finance minister of India, announced the basic skeleton of the GST system. The 1 April 2010 deadline was being followed then as well. |

| November 2009 | The EC that was headed by Asim Dasgupta put forth the First Discussion Paper (FDP) , describing the proposed GST regime. The paper was expected to start a debate that would generate further inputs from stakeholders. |

| February 2010 | The government introduced the mission-mode project that laid the foundation for GST. This project, with a budgetary outlay of Rs.1,133 crore, computerised commercial taxes in states. Following this, the implementation of GST was pushed by one year. |

| March 2011 | The government led by the Congress party puts forth the Constitution (115th Amendment) Bill for the introduction of GST. Following protest by the opposition party, the Bill was sent to a standing committee for a detailed examination. |

| June 2012 | The standing committee starts discussion on the Bill. Opposition parties raise concerns over the 279B clause that offers additional powers to the Centre over the GST dispute authority. |

| November 2012 | P. Chidambaram and the finance ministers of states hold meetings and set the deadline for resolution of issues as 31 December 2012. |

| February 2013 | The finance minister, during the budget session, announces that the government will provide Rs.9,000 crore as compensation to states. He also appeals to the state finance ministers to work in association with the government for the implementation of the indirect tax reform. |

| August 2013 | The report created by the standing committee is submitted to the parliament. The panel approves the regulation with few amendments to the provisions for the tax structure and the mechanism of resolution. |

| October 2013 | The state of Gujarat opposes the Bill, as it would have to bear a loss of Rs.14,000 crore per annum, owing to the destination-based taxation rule. |

| May 2014 | The Constitution Amendment Bill lapses. This is the same year that Mr. Narendra Modi was voted into power at the Centre. |

| December 2014 | India’s new finance minister, Arun Jaitley, submits the Constitution (122nd Amendment) Bill, 2014 in the parliament. The opposition demanded that the Bill be sent for discussion to the standing committee. |

| February 2015 | Mr. Jaitley, in his budget speech, indicated that the government is looking to implement the GST system by 1 April 2016. |

| May 2015 | The Lok Sabha passes the Constitution Amendment Bill. Jaitley also announced that petroleum would be kept out of the ambit of GST for the time being. |

| August 2015 | The Bill is not passed in the Rajya Sabha. Jaitley mentions that the disruption had no specific cause. |

| March 2016 | Mr. Jaitley says that he is in agreement with the Congress’s demand for the GST rate not to be set above 18%. But he is not inclined to fix the rate at 18%. In the future if the Government, in an unforeseen emergency, is required to raise the tax rate, it would have to take the permission of the parliament. So, a fixed rate of tax is ruled out. |

| June 2016 | The Ministry of Finance releases the draft model law on GST to the public, expecting suggestions and views. |

| August 2016 | The Congress-led opposition finally agrees to the Government’s proposal on the four broad amendments to the Bill. The Bill was passed in the Rajya Sabha. |

| September 2016 | The Honourable President of India gives his consent for the Constitution Amendment Bill to become an Act. |

| The GST Council also finalised on the GST rates and GST rules. The Government declares that the GST Bill will be applicable from 1 July 2017. | |

Pre-GST Indirect Tax Structure in India

GST Law from a Constitutional Perspective

A. Definition of GST

“Goods and services tax” means any tax on supply of goods, or services or both except taxes on the supply of the alcoholic liquor for human consumption.

| S.No | Definition | Article | Definition |

| 1 | Goods | 366(12) | Includes all materials, commodities, and articles. |

| 2 | Service | 366(26A) | Anything other than goods [Introduced vide 101st Constitutional Amendment Act] |

| 3 | State | 366(2B) | With reference to articles 246A, 268, 269,269A and Article 279A includes a

Union territory with Legislature. [Introduced vide 101st Constitutional Amendment Act] |

*“Goods and Services tax” law while having unique principles, has significant elements of prior Central and State laws; and is also inspired by VAT/GST legislation of EU, Australia, Malaysia etc. along with International VAT/GST guidelines of OECD.

B. Constitutional Amendment

- Bill passed by Rajya Sabha on 03.08.2016 & Lok Sabha on 08.08.2016.

- Notified as Constitution (101st Amendment ) Act, 2016 on 08.09.2016.

- Key Features:

- Concurrent jurisdiction for levy & collection of GST by the Centre & the States – Article 246A.

- Centre to levy & collect IGST on supplies in the course of inter-State trade or commerce including imports – Article 269A.

- Compensation for loss of revenue to States for five years on recommendation of GSTC – Clause 19.

- GST on petroleum crude, high speed diesel, motor spirit (commonly known as petrol), natural gas & aviation turbine fuel to be levied from a later date on recommendations of GSTC.

Benefits of GST – Advantage and Disadvantage

| Advantages | Disadvantage |

| 1. The most important benefit is the removal of cascading effect, i.e. removal of tax on tax.

2. Starting from registration to filing returns and payment of GST tax it’s an online procedure. 3. Startups won’t be running around tax offices for various registrations and procedures under excise, service tax and VAT. 4. Higher threshold for registration. 5. Composition scheme for small business.The purpose is to ease the burden of compliance which enables the small businesses to focus more on business and less on compliance. |

1. The GST structure has been marketed well to portray it as a simple concept but in reality, the understanding is complicated and distortionary to fully exploit the expected benefits.

2. Multiple tax rates and many complexities will result into tax disputes and lead to more corruption. 3. High confusion regarding the product classification and multiple rates is a major concern. 4. The food industry has criticized the levying of higher rates on value-added manufactured goods and has asked for a simpler regime. 5. Items like (i) Alcohol (ii) Real Estate and (iii) Electricity have been kept out of this regime defeating the purpose of one tax. |

Components of GST

GST would be levied on a common base by both the central and the state government simultaneously. The dual GST can be categorized into the following:

- Central GST (CGST)– GST to be levied by the central government.

- State GST (SGST)/Union Territory GST (UTGST)– GST to be levied by states/Union Territories with legislature.

- Integrated GST (IGST)- GST levied by central government on inter-state supply of goods and services to ensure that the credit chain is not disrupted. Apart from the applicable custom duties, import of goods and services would be treated as inter-state supplies and would therefore be subject to IGST.

GST Rates

At the time of GST implementation former Finance Minister, the late Mr. Arun Jaitley said that the government wanted to keep the GST rates close to the original rates. But there were differences in case of some items because of the changes in the economy as well as customer preferences. Some commodities were kept in the high tax bracket (18-28%) but on scrutinizing the list, they found that these commodities should be considered as necessities and not luxuries. This is why the GST rates were revised for commodities such as notebooks, exercise books.

Few GST Rates are:

| Tax Rate | Products |

| 0.25% | Cut and semi-polished stones are included under this tax slab. |

| 5% | Household necessities such as edible oil, sugar, spices, tea, and coffee (except instant) are included. Coal, Mishti/Mithai (Indian Sweets) and Life-saving drugs are also covered under this GST slab. |

| 12% | This includes computers and processed food. |

| 18% | Hair oil, toothpaste and soaps, capital goods and industrial intermediaries are covered in this slab. |

| 28% | Luxury items such as small cars, consumer durables like AC and Refrigerators, premium cars, cigarettes and aerated drinks, High-end motorcycles are included here. |

Goods & Services Tax (GST) Council

GST Council is a constitutional body for making recommendations to the Union and State Government on issues related to Goods and Service Tax. The GST Council is chaired by the Union Finance Minister and other members are the Union State Minister of Revenue or Finance and Ministers in-charge of Finance or Taxation of all the States.

The Union Cabinet in its meeting held on 12th September, 2016 approved setting-up of GST Council and setting up its Secretariat. As per Article 279A of the amended Constitution, the GST Council which will be a joint forum of the Centre and the States, shall consist of the following members: –

i. Chairperson – Union Finance Minister.

ii. Vice Chairperson – to be chosen amongst the Ministers of State Government.

iii. Members – MOS (Finance) and all Ministers of Finance / Taxation of each State.

- Quorum is 50% of total members.

- Decision by 75% majority.

- States – 2/3 weightage and Centre – 1/3 weightage.

- Council to make recommendations on everything related to GST including laws, rules and rates etc.