A. FAQs on Searching Tax Rate associated with HSN / Service Classification Code

1. Can I search for the tax rates associated with goods or services by mentioning the HSN/ Service Classification Code?

The Search HSN/Service Classification Code Tax Rates allows the user to search the HSN or Service Classification Code tax rates based on the product or service description. If for a particular HSN or Service Classification Code, more tax rates are specified, they will be listed as possible rates of tax.

Disclaimer: Any person can use this feature for searching the HSN or Service Classification Code by entering the description of goods or services. It is only an assistance provided to the user and does not constitute legal or professional advice and therefore, shall carry no legal force. For any further clarification, GST Authorities may be contacted.

B. Manual on Searching Tax Rate associated with HSN / Service Classification Code

I need to check the tax rate applicable on the goods I supplied this year to file GSTR 1. Where can I search the tax rate associated with an HSN code or Service Classification Code of specific goods or services on the GST Portal?

To search the tax rate associated with an HSN code or Service Classification Code of specific goods or services on the GST Portal, perform the following steps:

1. Access the www.gst.gov.in URL. The GST Home page is displayed.

2. Login to the GST Portal with valid credentials.

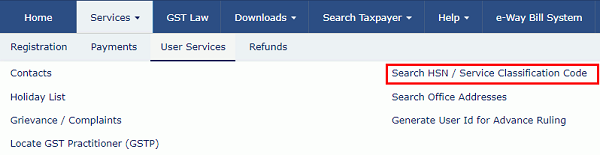

3. Click the Services > User Services > Search HSN / Service Classification Code command.

In case of HSN:

4. In the Tax Type drop-down list, select whether you want to search tax rates for IGST, CGST, SGST or Cess.

In case you select SGST from the Tax Type list, you also need to select the State for which you want to check the tax rate.

5. In the Search HSN Chapter by Name or Code field, enter the HSN Chapter name or code of the goods for which you want to search the tax rate.

6. In the Search HSN Code field, enter the HSN Code of the goods for which you want to search the tax rate.

7. In the Effective Period From and Period To fields, click the calendar icon and select the dates.

8. In the Type the characters you see in the image below field, enter the captcha text.

9. Click the SEARCH button.

The search results are displayed.

In case of Service Classification Code:

4. In the Tax Type drop down list, select whether you want to search tax rates for IGST, CGST, SGST or Cess.

In case you select SGST from the Tax Types list, you also need to select the State for which you want to check the tax rate.

5. In the Service by Name or Code field, enter the Service Classification Code or name of the services for which you want to search the tax rate.

6. In the Effective Period From and Period To fields, click the calendar icon and select the dates.

7. In the Type the characters you see in the image below field, enter the captcha text.

8. Click the SEARCH button.

The search results are displayed.

One More Option to Taxpayer is to use the following link to find

No such Facility is Seen Now @

Click the Services > User Services > Search HSN / Service Classification Code command