Page Contents

- A. FAQs on Search Taxpayers using GSTIN/UIN

- 1. How Can I search details of registered dealer/ supplier from the GST Portal?

- 2. Can I search details of registered dealer/ supplier without logging to the GST Portal?

- 3. What details need to be provided for searching details of registered dealer/ supplier on the GST Portal?

- 4. Can I check if the field visit has been conducted or not for the registration linked to a particular GSTIN without logging to the GST Portal?

- B. Manual on Search Taxpayers using GSTIN/UIN

A. FAQs on Search Taxpayers using GSTIN/UIN

1. How Can I search details of registered dealer/ supplier from the GST Portal?

The Search Taxpayer functionality allows you to view the profile of any other registered taxpayer at the GST Portal on entering the GSTIN/UIN.

Once you enter the GSTIN/UIN and click the submit button, following details will be displayed:

Pre Login

1. GSTIN/UIN

2. Legal Name of Business

3. State Jurisdiction

4. Centre Jurisdiction

5. Date of registration

6. Constitution of Business

7. Taxpayer Type

8. GSTIN/UIN Status

9. Date of Cancellation

10. Field Visit Conducted

11. Nature of Business Activity

12. Status of Return filed

Additional details which will be available Post Login are given below:

13. Name(s) of the Proprietor/Director(s)/Promoter(s)

14. Additional Place of Business – Post Login

15. Contact details of Principal Place of Business will be displayed post login

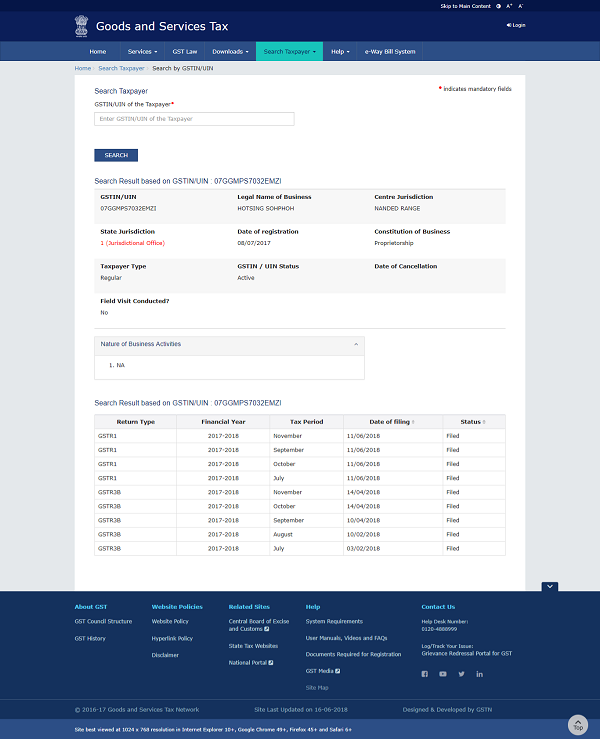

Along with other details of the taxpayer, you can also view Return Status for last 10 Returns transactions.

2. Can I search details of registered dealer/ supplier without logging to the GST Portal?

You can search details of registered dealer/ supplier without logging and after logging to the GST Portal.

In case of pre-login: Click the Search Taxpayer menu available at the GST Portal homepage.

In case of post-login:

- Login to the GST Portal with valid credentials.

- Click the Search Taxpayer menu.

3. What details need to be provided for searching details of registered dealer/ supplier on the GST Portal?

In case you want to search for details of normal taxpayer, you need to provide the GSTIN of the taxpayer.

In case you want to search for details of UN Bodies, Embassies, Government Offices or Other Notified persons, you need to provide Unique Identification Number (UIN).

4. Can I check if the field visit has been conducted or not for the registration linked to a particular GSTIN without logging to the GST Portal?

You can check if the Field Visit has been conducted or not for the registration linked to a particular GSTIN without logging to the GST Portal.

Navigate to Search Taxpayer > Search by GSTIN/UIN. Enter the GSTIN of the taxpayer and click the Search button.

If any field visit has been conducted for your GSTIN, “Field Visit Conducted?” would be displayed as “Yes”.

In case, no field visit has been conducted or field visit report not submitted, “Field Visit Conducted?” would be displayed as “No”.

B. Manual on Search Taxpayers using GSTIN/UIN

How can I search the details of a taxpayer registered under GST?

To search the details of a taxpayer registered under GST, perform the following steps:

You can search the details of a taxpayer without login and after logging to the GST Portal.

1. Access the www.gst.gov.in URL. The GST Home page is displayed.

In case of pre-login:

- Click the Search Taxpayer menu available at the GST Portal homepage.

In case of post-login:

- Login to the GST Portal with valid credentials.

- Click the Search Taxpayer menu.

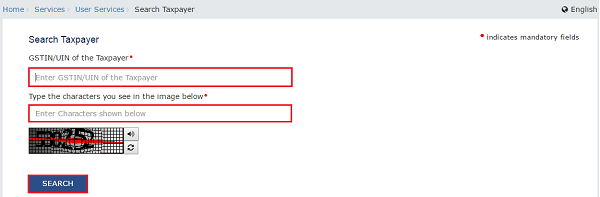

2. In the GSTIN/UIN of the Taxpayer field, enter the GSTIN or UIN of the taxpayer whose details has to be searched.

Note: In case you want to search for details of UN Bodies, Embassies, Government Offices or Other Notified persons, you need to provide Unique Identification Number (UIN)

In case of pre-login:

In the Type the characters you see in the image below field, enter the captcha text.

3. Click the SEARCH button.

Along with other details of the taxpayer, you can also view Return Status for last 10 Returns transactions.