FCMA Sawinder Singh Chug

India is going through one of the major reform in tax system since independence i.e. Goods & Service Tax(GST). GST GST will replace 17 indirect tax levies and compliance costs will fall. The GST regime seeks to subsume the following taxes into a single one:

Taxes levied by Central Govt. : Central Exercise. Service Tax.Service Tax.Central Surcharges.Central Cesses.

Taxes levied by State Govt. : VAT/Sales Tax. Entertainment Tax.Luxury Tax.State Taxes and Cesses.

To start with, Now Govt has started existing assessee registration with GST authorities. Different time slots have been given to different areas so that there may not be undue traffic on the GST Portal.

I have made a video to explain the process with screenshots taken from GST portal.

(1) The first step is to take Provisional id & Password from the concerned dept. It is normally provided in sealed envelope.

(2) Now visit gst.gov.in

(3) The Following screen will appear

(4) As we all are first time user so click at NEW USER LOGIN tab.

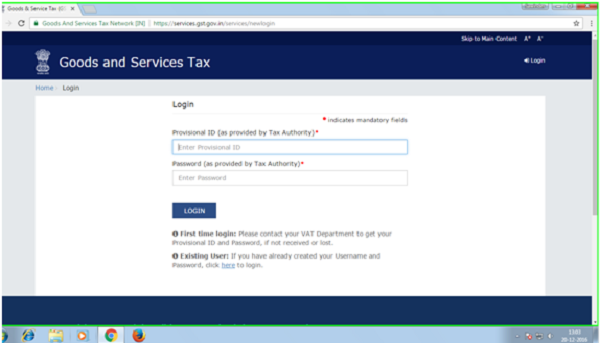

(5) Next page will follow as below

(6) Enter Provisional ID and Password as provided by tax authority in envelope & Click LOGIN

(7) You will get following prompt

(8) Please fill here your email id & password. Press CONTINUE

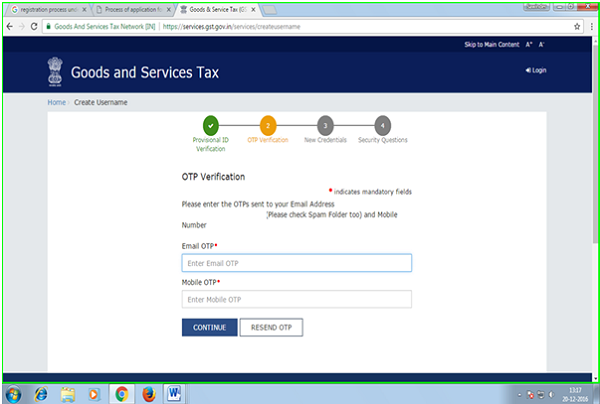

(9) You will two OTP(One-time passwords) one on mobile and another by email. The following screen will appear.

10. Enter the OTP received in respective prompts. Press Next screen will be as follows

11. Now enter Username & Password & note down them at the safe place. Next screen offered by GST Portal is as follows

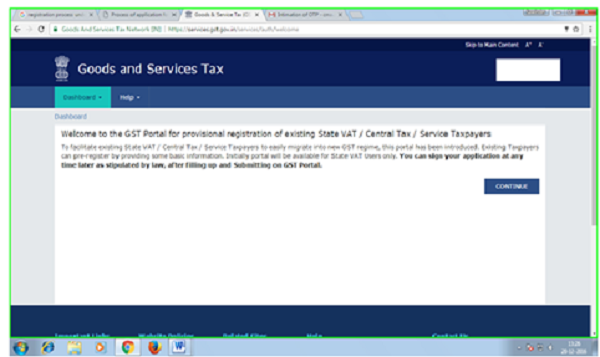

12. Click Continue to get next screen as follows

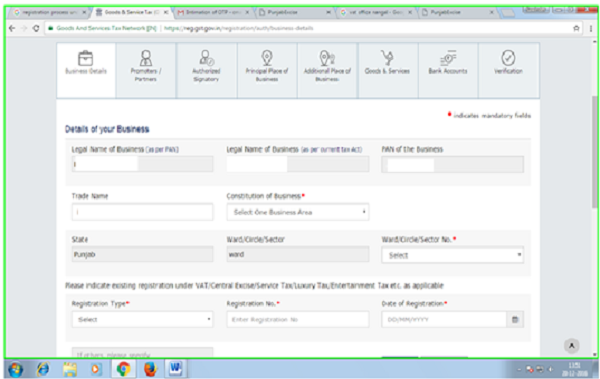

13. Here you will fill all the details of your business. You will also upload registration certificate of your firm.

All these steps have been beautifully explained in the video at the following link. You open it in youtube for better visibility. Duration of the video is only 3.38 minutes.

(Author is a Practicing Cost Accountant and can be reached at cma.sschug@gmail.com)

Sir, If you dont mind may i ask you a question. Have you noticed that in your screenshot date is 2016 but GST Started from 2017, So I am in doubt? Forgive me If I am Wrong, how its possible

Keep In mind dates given are only for generating Provisonal GSTN. Documents required to be Upload can be done upto 31st January 2017.

As you are new entrant, share your details about your turnover and area of business so that requirement for GST registration can be ascertained. At present Registration for current dealers registered with different authorities has started. My email is gst.sschug@gmail.com

I am situated in New Delhi-110003, where should I approach or which authority to approach for GST registration as I am a starter in small business in cosmetic hair oil production (new entrant).