Introduction

What is the need for Zero Rating?

As per section 2(47) of the CGST Act, 2017, a supply is said to be exempt,

-when it attracts nil rate of duty or

-is specifically exempted by a notification or

-kept out of the purview of tax (i.e. a non-GST supply).

When a good or service is exempted from payment of tax, it cannot be said that it is zero rated. The reason is being the inputs and input services which go into the making of the good or provision of service has already suffered tax and only the final product is exempted.

Moreover, when the output is exempted, tax laws do not allow availment/utilisation of credit on the inputs and input services used for supply of the exempted output.

Though the output suffers no tax, the inputs and input services have suffered tax and since availment of tax credit on input side is not permitted, it becomes a cost for the supplier.

The concept of zero rating of supplies aims to correct this anomaly.

What is Zero Rating?

By zero rating it is meant that the

- entire value chain of the supply is exempt from tax.

- not only is the output exempt from payment of tax, there is no bar on taking/availing credit of taxes paid on the input side for making/providing the output supply.

Such an approach would in true sense make the goods or services zero rated.

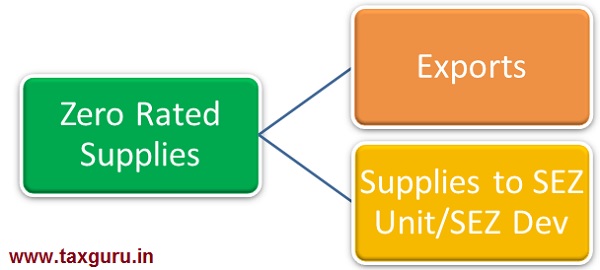

All supplies need not be zero-rated. As per the GST Law exports are meant to be zero rated , the zero rating principle is applied in letter and spirit for exports and supplies to SEZ.

The relevant provisions are contained in Section 16(1) of the IGST Act, 2017, which states that “zero rated supply” means any of the following supplies of goods or services or both, namely: –

a) export of goods or services or both; or

b) supply of goods or services or both to a Special Economic Zone developer or a Special Economic Zone unit.

The concept of zero rating of supplies requires the supplies as well as the inputs or input services used in supplying the supplies to be free of GST.

This is done by employing the following means:

a) The taxes paid on the supplies which are zero rated are refunded;

b) The credit of inputs/ input services is allowed;

c) Wherever the supplies are exempted, or the supplies are made without payment of tax, the taxes paid on the inputs or input services i.e. the unutilised input tax credit is refunded.

The provisions for the refund of unutilised input credit are contained in the explanation to Section 54 of the CGST Act, 2017, which defines refund as below:

“refund” includes refund of tax paid on zero-rated supplies of goods or services or both or on inputs or input services used in making such zero-rated supplies, or refund of tax on the supply of goods regarded as deemed exports, or refund of unutilized input tax credit as provided under sub-section (3).

Thus, even if a supply is exempted, the credit of input tax may be availed for making zero-rated supplies. A registered person making zero rated supply can claim refund under either of the following options, namely: ––

a) he may supply goods or services or both under bond or Letter of Undertaking, subject to such conditions, safeguards and procedure as may be prescribed, without payment of integrated tax and claim refund of unutilized input tax credit; or

b) he may supply goods or services or both, subject to such conditions, safeguards and procedure as may be prescribed, on payment of integrated tax and claim refund of such tax paid on goods or services or both supplied, in accordance with the provisions of section 54 of the CGST Act, 2017 or the rules made thereunder.

As per Section 54(3) of the CGST Act, 2017, any unutilized input tax credit in zero rated supplies can be refunded, wherever such supplies are made by using the option of Bond/ LUT.

Zero rated supplies and Exempted supplies as:-

Exempted Supplies “exempt supply” means supply of any goods or services or both which attracts

- Nil rate of tax or

- Which may be wholly exempt from tax under section 11 of CGST Act or under section 6 of the IGST Act, and

- Includes non-taxable supply

No tax on the outward exempted supplies, however, the input supplies used for making exempt supplies to be taxed

Credit of input tax needs to be reversed, if taken; No ITC on the exempted supplies

Value of exempt supplies, for apportionment of ITC, shall include supplies on which the recipient is liable to pay tax on reverse charge basis, transactions in securities, sale of land and, subject to clause (b) of paragraph 5 of Schedule II, sale of building

Any person engaged exclusively in the business of supplying goods or services or both that are not liable to tax or wholly exempt from tax under the CGST or IGST Act shall not be liable to registration

A registered person supplying exempted goods or services or both shall issue, instead of a tax invoice, a bill of supply

Zero rated Supplies

“zero-rated supply” shall have the meaning assigned to it in section 16.

No tax on the outward supplies; Input supplies also to be tax free

Credit of input tax may be availed for making zero-rated supplies, even if such supply is an exempt supply ITC allowed on zero rated supplies

Value of zero rated supplies shall be added along with the taxable supplies for apportionment of ITC.

A person exclusively making zero rated supplies may have to register as refunds of unutilised ITC or integrated tax paid shall have to be claimed

Normal tax invoice shall be issued

Provisional refund:-

As per section 54(6) of the CGST Act, 2017, ninety per cent of the total amount of refund claimed, on account of zero-rated supply of goods or services or both made by registered persons, may be sanctioned on a provisional basis.

The remaining ten percent can be refunded later after due verification of documents furnished by the applicant.

Non-applicability of Principle of Unjust Enrichment:

The principle of unjust enrichment shall not be applicable in case of refund of taxes paid wherever such refund is on accounts of zero rated supplies.

As per section 54 (8) of the CGST Act, 2017, the refundable amount, if such amount is relatable to refund of tax paid on zero-rated supplies of goods or services or both or on inputs or input services used in making such zero-rated supplies, shall instead of being credited to the Fund, be paid to the applicant.

Any supplies made by a registered dealer as an export (both goods or services) or supply to an SEZ qualifies for Zero Rate Supplies in GST. The rate of tax on such supplies is ‘Zero‘ or we can say the supplies are tax-free

Zero rated supplies mean supply of goods or services or both to SEZ or SEZ developer or Export of goods or services or both. GST is not applicable in India for exports. Hence, all export supplies of a taxpayer registered under GST would be classified as zero rated supply. The tax payer can claim the input tax credit or claim the refund of unutilized input tax credit.

zero rated supply means any of the following supplies of goods or services.

- Export of goods or services or both;

- Supply of goods or services or both to a Special Economic Zone developer

- Supply of goods or services or both to a Special Economic Zone unit.

Export of goods means

Section 2 (5) “export of goods” with its grammatical variations and cognate expressions, means taking goods out of India to a place outside India;

Export of goods will be treated as ‘zero-rated supplies’.

Accordingly, while no tax would be payable on such supplies, the exporter will be eligible to claim the corresponding input tax credits. It is relevant to note that the input tax credits would be available to an exporter even if the supplies were exempt supplies so long as the eligibility of the input taxes is established.

Point for consideration:-

- Unlike export of services which requires fulfillment of certain conditions for a supply to qualify as ‘export of services’ like the nature of currency in which payment is required to be made, location of the exporter etc.,

Export of goods doesn’t require fulfillment of any such conditions.

- The movement of goods is alone relevant and not the location of the exporter/ importer. This means that even if an order is received from a person outside India for delivery of goods within India, it will NOT be considered as export of goods.

- The exporter may utilize such credits for discharge of other output taxes or alternatively, the exporter may claim a refund of such taxes.

The exporter will be eligible to claim refund under the following situations:

(i) export the goods under a Letter of Undertaking, without payment of IGST and claim refund of unutilized input tax credit; or

(ii) export the goods upon payment of IGST and claim refund of such tax paid, without of course, charging this IGST to the customer. That is, to claim rebate, pay-without-charging only then will this refund be available.

Export of services means

Section 2(6) “export of services” means the supply of any service when

(i) the supplier of service is located in India;

(ii) the recipient of service is located outside India;

(iii) the place of supply of service is outside India;

(iv) the payment for such service has been received by the supplier of service in convertible foreign exchange [or in Indian rupees wherever permitted by the Reserve Bank of India”]; and

(v) the supplier of service and the recipient of service are not merely establishments of a distinct person in accordance with Explanation 1 in section 8;

The concept of export of services is broadly borrowed from the provisions of the erstwhile Service Tax law. But it is remarkably dissimilar to definition of export of goods.

It is for this reason the correctly identify whether supply involving goods are treated (by schedule II) as supply of services. If this ‘treatment by fiction’ is misunderstood that would lead to misapplication of the definition and claiming benefits that are not available or foregoing benefits that could have been availed.

Under the GST regime, export of service will be treated as ‘zero-rated supplies’. Accordingly, while no tax would be payable on such supplies, the exporter will be eligible to claim the corresponding input tax credits.

The point to note that the input tax credits would be available to an exporter even if supplies were exempt supplies as long as the eligibility of the input taxes as input tax credits is established.

The exporter may utilise such credits for discharge of other output taxes or alternatively, the exporter may claim a refund of such taxes.

The exporter will be eligible to claim refund under the following situations:

(a) He may export the services under a Letter of Undertaking, without payment of IGST and claim refund of unutilized input tax credit; or

(b) He may export the services upon payment of IGST and claim refund of such tax paid.

Point for Consideration:-

- The requirement under the Service Tax law was that the supplier should be located in the taxable territory i.e. India, excluding Jammu and Kashmir.

- Under the GST law, the requirement is that the supplier is located in India (which includes Jammu and Kashmir) as GST has been enacted in the State of J&K also.

- Although overseas establishment of a person who is situated in India is treated as a distinct person for purposes of levy of integrated tax, as regards export of services, this overseas establishment must demonstrate substance in its activities to qualify as recipient of the export of the services from India and establish itself as more than just a mere establishment of the person.

- Establishments will be treated as establishment of distinct persons under the following situations:

(i) an establishment in India and any other establishment outside India;

(ii) an establishment in a State or Union territory and any other establishment outside that State or Union territory; or

(iii) an establishment in a State or Union territory and any other establishment registered within that State or Union territory, then such establishments shall be treated as establishments of distinct persons.

Therefore, where both the establishments are located in a State/ Union Territory under the same GSTIN, the establishments will not be considered as distinct persons.

Amendment made by IGST Amendment Act, 2018– Effective from 1.02.2019

In clause (6), in sub-clause (iv), after the words “foreign exchange”, the words “or in Indian rupees wherever permitted by the Reserve Bank of India” inserted. This amendment is made to consider a service to be exported even if the export proceeds are received in Indian rupees, if the same is permitted by RBI. This has been done mainly to include within export of services, services provided to Nepal and Bhutan wherein payment is received in Indian Currency

Statutory provisions

16. Zero Rated Supply

(1) “Zero rated supply” means any of the following supplies of goods or services or both, namely: ––

(a) export of goods or services or both; or

(b) supply of goods or services or both to a Special Economic Zone developer or a Special Economic Zone unit.

(2) Subject to the provisions of sub-section (5) of section 17 of the Central Goods and Services Tax Act, credit of input tax may be availed for making zero-rated supplies, notwithstanding that such supply may be an exempt supply.

(3) A registered person making zero rated supply shall be eligible to claim refund under either of the following options, namely: ––

(a) he may supply goods or services or both under bond or Letter of Undertaking, subject to such conditions, safeguards and procedure as may be prescribed, without payment of integrated tax and claim refund of unutilized input tax credit; or

(b) he may supply goods or services or both, subject to such conditions, safeguards and procedures as may be prescribed, on payment of integrated tax and claim refund of such tax paid on goods or services or both supplied, in accordance with the provisions of section 54 of the Central Goods and Services Tax Act or the rules made thereunder.

Analysis

Exports have been the area of focus in all policy initiatives of the Government since long . Now with the Make in India initiative, exports continue to enjoy this special treatment because exports should not be burdened with domestic taxes.

On the other hand, GST demands that the input-output chain not be broken. Zero-rated supply is the method by which the Government has approached to address all these important considerations.

Zero-rated supply does not mean that the goods and services have a tariff rate of ‘0%’ but the recipient to whom the supply is made is entitled to pay ‘0%’ GST to the supplier.

As per section 17(2) of the CGST Act that input tax credit will not be available in respect of supplies that have a ‘0%’ rate of tax. But this disqualification does not apply to zero-rated supplies covered by this section.

It is interesting to note that section 7(5) (and even proviso to section 8(1)) declares that supplies ‘to’ or ‘by’ SEZ developer or unit will be treated as an inter-State supply. So, when two SEZ units or one SEZ developer and another SEZ unit supply goods or services to each other (among themselves within the zone) and the zone being located within the same State or UT, such supplies will always be inter-State supplies. But, it is important to note that this – being treated as inter-State supplies always – by itself does not mean that non-SEZ sales by SEZ unit will be liable to IGST in all cases.

The intention of government not to burden the export with tax could be achieved either by allowing not to charge tax on the exports of goods/services and claim the refund of input tax credits of taxes paid on inward supplies or by allowing the refund of tax charged on the

exports made. Both these alternatives have been enabled in this section.

Zero-rated supplies may be undertaken in either of the following ways:

By executing LUT

1. Taxable person to avail input tax credit used in making outward supply of goods or service or both and make zero-rated supply-

Without any payment of IGST on such outward supply by executing LUT (Letter of Undertaking) or bond (dispensed off vide notification 37/2017-Central tax)

Claim refund of input tax credit used in the outward supply

By making payment of IGST

2. Make payment of IGST on the outward supply by debiting ‘electronic credit ledger’ but without collecting this tax from the recipient

After completing the outward supply, claim refund of the IGST so debited (unjust enrichment having been duly satisfied) Subject to fulfillment of all associated conditions and safeguards that may be prescribed in either case.

SEZ is defined in section 2(20) to have the meaning from 2(g) of SEZ Act, 2005. Supply of goods by SEZ to non- SEZ area is governed by Customs Act in terms of Rule 47 in Chapter V of SEZ Rules, 2006.

Accordingly, although the supply is ‘treated as inter-State supply of goods’ in terms of section 7(5), no tax is to be charged by the SEZ supplier but instead, the non- SEZ recipient is to pay IGST at the time of assessment of the bill of entry filed for such goods in terms of Customs Tariff Act, 1975 duly amended by the Taxation Laws Amendment Act, 2017

However, with respect to supply of services by SEZ to non-SEZ area, though not prohibited, is not expressly dealt with by this Chapter V of SEZ Rules as to the taxes/ duties applicable.

To draw the relevant inference, one should observe the definition of India as per section 2(56) of CGST Act. It has been defined to mean territory of India as referred to in Article 1 of the Constitution.

SEZ units are also covered within above definition of India. As the CGST and IGST Act extend to whole of India, it could be said to be applicable to SEZ unit also and thereby making SEZ unit as

falling within definition of taxable territory.

If this view is taken, it may very simply be an inter-State supply of services liable to payment of IGST on forward charge basis by the SEZ unit because there is no reference in IGST to borrow the operation of section 53 from SEZ Act.

Reverse charge Notification No. 10/2017- Integrated Tax (Rate) dated 28-Jun-17 covers any services supplied by any person who is located in a non-taxable territory to any person located in the taxable territory under reverse charge mechanism.

SEZ unit may be said to be falling within definition of taxable territory and liable to tax under forward charge.

All refunds are subject to the ‘due process’ prescribed in section 54 of CGST Act read with Chapter X of CGST Rules including verification of unjust enrichment (not to include the refundable amount in the price charged to overseas customer).

All supplies to SEZ developer or unit being zero-rated does not mean that the entire company can enjoy this form of ab initio exemption.

For example:-

Company incorporated in Delhi may have established a SEZ unit in Jaipur. All goods and services supplied to SEZ in Jaipur will enjoy the ab initio exemption but the goods and services supplied to Delhi will be liable to tax.

Now, if the incorporated address of the Company were also in Jaipur and inside the zone, the Company must be cautious to differentiate the supplies that are not related to the authorized operations in the zone but related to the other affairs of the Company and instruct the suppliers to charge applicable GST on such non-SEZ supplies.

Complete use of this zero-rated exemption will invite recovery action against the SEZ developer or unit.

The supplier who supplied as a zero-rated supply is not responsible for this misuse because the SEZ developer or unit would have issued the GSTIN of the zone.

Please note that all supplies to SEZ developer or unit alone is treated as an inter-State supply but the supply to the Company relating to non-SEZ activities will continue to be inter-State or intra-State supply as the case may be.

With regard to ‘bill to-ship to’ transactions, it is important to mention that though the supply may be ‘billed to’ person located outside India (for exports) or inside zone (for SEZ supplies), where the supplies are ‘shipped to’ must be clearly identified in order to qualify for the benefit under this section.

‘exports’ are not zero rated but ‘supply by way of export’ are zero rated.

There is a lot of difference between these two expressions. With the difference between these two expressions:-

‘supply by way of export’ is a subset of ‘exports’. And in order to claim benefit of zero rating, it is important to examine an ‘export’ to meet the requirements of ‘supply by way of export’.

In other words, both the ‘bill to’ and ‘ship to’ locations must be to the destination – outside India (for exports) or inside zone (for SEZ supplies) – in order to qualify for zero rating benefit. This principle applies equally to supply of goods as well as supply of services for exports.

For example:-

A contractor is awarded civil works by a zone-developer and this contractor buys cement from a trader with instructions to deliver the cement directly at site (zone). Now, the supply of cement by trader is ‘ship to: zone’ but ‘bill to: contractor’. Question that arises is, can the cement trader claim zero-rating benefit?

The answer is no because the ‘bill to’ and ‘ship to’ locations must both be in the zone to satisfy the requirements of Section 16 of the IGST Act and Rule 89 of the CGST Rules.

Even if the goods or service which are either exported or supplied to SEZ unit developer are exempted goods or services, input tax credit is still available for making such zero rated supplies. The requirement to reverse ITC in relation to exempted supplies is not warranted if it is zero rated. This can also be inferred from Section 16(2) of the IGST Act 2017 which states that the input tax credit is eligible notwithstanding that such supply is exempted.

Procedure for zero-rated supply of goods or services:

Export of goods or services without payment of Integrated Tax Exporter of goods is eligible to export goods or services without payment of IGST by complying with following procedure (Note: Same procedures have to be followed by SEZ in respect to export of goods without payment of tax.)

A. Furnishing of Letter of undertaking:

i. Notification 37/2017 dated 4.10.2017 of Central Tax provides for the conditions and safeguards for export of goods or services without payment of IGST which supersedes notification 16/2017 dated 4.7.2017 of Central tax

ii. Conditions and safeguards for issuing letter of undertaking: all registered persons who intend to supply goods or services for export without payment of integrated tax shall be eligible to furnish a Letter of Undertaking in place of a bond except

- those who have been prosecuted for any offence under the Central Goods and Services Tax Act, 2017(12 of 2017) or

- the Integrated Goods and Services Tax Act, 2017 (13 of 2017) or

- any of the existing laws in force in a case where the amount of tax evaded exceeds two hundred and fifty lakh rupees;

iii. As per Circular No.40/14/2018 GST dated April 6, 2018, the registered person is required to fill and submit Form GST RFD-11 on the common portal.

An LUT is deemed to be accepted as soon as an acknowledgement for the same, bearing Application Reference Number (ARN) is generated online.

It is further clarified in the aforesaid Circular that no document needs to be physically submitted to the Jurisdictional office for acceptance of LUT.

iv. Letter of undertaking would be executed by the working partner, the Managing Director or the Company Secretary or the proprietor or by a person duly authorised by such working partner or Board of Directors of such company or proprietor.

vi. Existing LUT would be valid for the whole of the financial year in which it is tendered.

Therefore, every registered person should apply for fresh LUT at the start of each financial year i.e, 1st of April.

vii. Where the registered person fails to pay the tax due along with interest, as specified under sub-rule (1) of rule 96A of Central Goods and Services Tax Rules, 2017, within the period mentioned in clause (a) or clause (b) of the said sub-rule, the facility of export without payment of integrated tax will be deemed to have been withdrawn and when the amount mentioned in the said sub-rule is paid, the facility of export without payment of integrated tax shall be restored.

viii. Where a supplier wishes to effect zero-rated supplies without payment of IGST, the supplier is required to furnish the LUT in Form GST RFD – 11.

In terms of Section 16, the LUT should be filed before effecting the zero-rated supplies in order to claim an exemption from payment of taxes. Rule 96A of the CGST / SGST Rules, 2017 provides that LUT should be furnished prior to effecting export of goods / services.

It is inferred that if the LUT is not furnished prior to effecting zero rated supplies, the supplier cannot claim exemption on zero rated supplies.

In this regard, the Board has issued circular vide No. 37/11/2018 – GST dated 15.03.2018 wherein it is clarified that the substantial benefits of zero rating supplies should not be denied if it is established that the goods or services have been exported in terms of the relevant provisions.

B. Furnishing of RFD-11

1. Rule 96A of CGST Rules provides that any registered person availing option to export goods or services without payment of IGST has to furnish letter of undertaking prior to commencement of export in Form RFD-11.

2. Circular 26/2017 of customs dated 01-07-2017 provides that procedure prescribed under Rule 96A needs to be followed for export of goods or services w.e.f. 01-07-2017.

3. Condition to comply:

a. In case of goods:-

good to be exported within 3 months from date of issue of invoice

b. In case of services:-

Payment to be received in convertible foreign exchange within 1 year from date of invoice

4. Bond or LUT has to be furnished along Form GST RFD-11 binding himself that tax along with interest @18% would be liable to paid by him;

a. In case of goods:-

within 15 days after completion of 3 months on failure to export such goods.

b. In case of services: –

within 15 days of completion of 1 year if such payment is not received in convertible foreign exchange as per law.

C. Tax Invoice:-

i. Exporters would be required to raise tax invoice with prescribed particulars mentioning

ii. “Supply meant for export under bond or Letter of Undertaking without payment of integrated tax”.

iii. No tax needs to be charged on the invoice in this case.

iii. Tax invoice may be in addition to other export documents provided to customer.

D. Sealing (in case of goods):-

Sealing of containers shall be done under the supervision of the central excise officer having jurisdiction over the place of business where the sealing is required to be done.

E. Shipping Bill (in case of goods):-

i. Shipping Bill format has been revised by customs to capture GST related details.

ii. Shipping bill to be prepared in Form SB-I.

iii. In case of export of duty free goods shipping bills has to be prepared in Form SB-II.

iv. Shipping bill needs to be issued in 4 copies

- Original,

- Drawback purpose,

- Department purpose and

- export promotion

F. Refunds:-

Refund of taxes in respect of accumulated input tax credit has to be claimed by following procedure prescribed by section 54 of CGST Act read with Chapter X of CGST Rules, 2017.

- Time limit: 2 years from the relevant date

- Method of filing:-

Form GST RFD-01A in online portal of GST in format provided in CGST Rules 2017.

Further, the requisite documents need to be physically submitted with the relevant jurisdictional officer for processing of the claim.

- Provisional refund: 90% of refund claim to be sanctioned within 7 days subject to certain conditions AND

Balance 10% within 60 days on verification of documents by proper officer.

- Details of Bank Realization Certificate (BRC) or Foreign Inward Remittance Certificate (FIRC) needs be provided along with details of export invoice while filing Form GST RFD-01

Export of goods or services with payment of Integrated Tax The procedure to be followed under this option is as follows:

(Note: Same procedures have to be followed by SEZ in respect to export of goods with payment of tax.)

A. Commercial Invoice:-

Exporter can issue 2 sets of invoices to have a smooth flow of transactions with his foreign customers.

i. Commercial invoice can be issued (along with tax invoice) without showing tax amount.

ii. Points to keep in mind while following practice of issuing commercial invoice along with tax invoice:

- Total value of both the invoices should be equal.

- Every commercial invoice should have a corresponding tax invoice.

B. Tax Invoice:

i. Exporters would be required to raise tax invoice with prescribed particulars mentioning

” Supply meant for export on payment of integrated tax”.

ii. Applicable IGST needs to be disclosed on the invoice in this case.

iii. Tax invoice would be in addition to other export documents provided to customer.

C. Sealing (in case of goods):-

Sealing of containers shall be done under the supervision of the central excise officer having jurisdiction over the place of business where the sealing is required to be done.

E. Shipping Bill (in case of goods):-

i. Shipping Bill format has been revised by customs to capture GST related details.

ii. Shipping bill to be prepared in Form SB-I.

iii. In case of export of duty free goods shipping bills has to be prepared in Form SB-II.

iv. Shipping bill needs to be issued in 4 copies (Original, Drawback purpose, Department purpose and export promotion)

D. Refunds:-

In case of goods:-

Rule 96 of CGST Rules provides for the mechanism for refund of tax in case of export of goods with payment of tax.

i. Shipping bill filed with custom would be considered as application for refund of integrated tax paid on export of goods.

ii. Refund application shall be valid only when:-

(a) Filing of export manifest/export report by person in charge of the conveyance carrying the export goods.

(b) Furnishing of valid return in Form GSTR-3 or Form GSTR-3B, whichever is applicable, by the applicant.

iii. GST and custom portal is inter-linked in which custom portal would electronically confirm to GST portal about the movement of goods outside India.

iv. Upon the receipt of the information regarding the furnishing of a valid return FORM GSTR-3B, as the case may be from the common portal, the system designated by the Customs shall process the claim for refund and an amount equal to the integrated tax paid in respect of each shipping bill or bill of export shall be electronically credited to the bank account of the applicant mentioned in his registration particulars and as intimated to the Customs authorities.

V. Withheld of refund:-

Refund can be withheld upon receipt of request from Jurisdictional Commissioner or where customs provisions are violated.

vi. The exporter would not be eligible for refund in case of notified goods where refund of integrated tax is provided to Government of Bhutan.

In case of services:-

Refund of taxes in respect of tax paid has to be claimed by following procedure prescribed by section 54 of CGST Act read with Chapter X of CGST Rules.

- Time limit: 2 years from the relevant date

- Method of filing:-

Form GST RFD-01A on online portal of GST.

Further, the requisite documents need to be physically submitted with the relevant jurisdictional officer for processing of the claim.

- Provisional refund: 90% of refund claim to be sanctioned within 7 days subject to certain conditions. Balance 10% within 60 days on verification of documents by proper officer.

- Details of Bank Realization Certificate (BRC) or Foreign Inward Remittance Certificate (FIRC) needs to be provided along with details of export invoice while filing Form GST RFD-01.

Procedure for supplies to SEZ unit/ SEZ developer

(a) Supply to SEZ without payment of integrated tax

Note: Same procedures have to be followed by SEZ in respect to export of goods without payment of tax.)

(b) Supply to SEZ with payment of integrated tax.

(Note: Same procedures have to be followed by SEZ in respect to export of goods with payment of tax.)

(Note: Same will be followed in cases the above supplies are made by an SEZ unit or SEZ developer)

Point for Consideration:-

- In terms of Section 16 of the IGST Act, 2017 in case of supplies to SEZ developer or SEZ unit / exports in terms of Section 2(5) or 2(6) of the IGST Act, the supplier can either effect supplies on payment of tax, which can subsequently be claimed as a refund.

- Alternatively, the supplier may effect the supplies without payment of tax under

- bond or LUT and is entitled to claim refund of the input tax credit used in effecting such supplies.

- supplier would be disentitled from claiming refund of IGST paid on such supplies effected on payment of IGST (without LUT), if the supplier recovers the amount of tax from the recipients.

- The time of supply provisions require that tax is remitted on receipt of advances, in respect of supply of services.

- Rule 96A of the CGST / SGST Rules, 2017 specifies that LUT should be furnished prior to export of services.

- In terms of Rule 96A, the LUT in Form GST RFD – 11 should be furnished to undertake to remit the applicable taxes along interest if the consideration in convertible foreign exchange is not received within one year from the date of issue of invoice.

- LUT is not required to be furnished where the consideration in convertible foreign exchange is received in advance.

- Further, attention is drawn to Circular No. 37/11/2018 – GST dated 15.03.2018 wherein it is clarified that the substantial benefits of zero-rating supplies should not be denied if it is established that the goods or services have been exported in terms of the relevant provisions.

- Any variation in foreign currency subsequent to the date of time of supply in case of imports and export transaction would not be relevant in the determination of value of taxable supply under section 15.

- CBEC Circular with the subject “Whether rebate-sanctioning authority may re-determine the amount of rebate in certain cases

Instructions regarding” dated 3.2.2000 also highlight this fact. The C.B.E. & C. has then clarified in their Circular No. 510/06/2000-Cx, dated 3-2-2000 issued from F. No. 209/29/99-Cx-6 that the rebate sanctioning authority is not required to reassess the value for the export and the value assessed by the range officer on ARE-1 at the time of export has to be accepted.

- Duty is also not affected by the less realization of export proceeds owing to exchange rate fluctuation and the duty and value has to be on the date, time and place of removal and the exchange rate on that date alone would be applicable.

In other words any exchange gain or loss will remain outside the purview of GST law.

- Actual receipt of consideration (in any form whether in INR, Convertible foreign currency or any other currency) is not necessary for treating a supply of goods as export of goods. This equally applies on supply of goods to SEZ Unit/developer.

- However actual receipt of consideration and that too in convertible foreign exchange is necessary to treat supply of service as export of service and thereby necessary for refund in case of export of services. This equally applies on supply of services to SEZ Unit/developer.

- The exporters and suppliers of SEZ are entitled to a 90% refund on a provisional basis. Provisional refund is granted within seven (7) days of the refund claim. The amount of provisional refund is credited directly to the claimant’s bank account.

- There is a condition attached to provisional refunds. The provisional refund is not granted if the applicant has been prosecuted for any offense under the GST law or earlier law within past five (5) years. The amount of tax evaded in such prosecution shall be more than Rupees Two Hundred and Fifty Lakhs (Rs. 2.5 Crores).

The author-CA (Adv.) Sikander Sachdeva, FCA is a Chartered Accountant in Practice from Delhi and can be contacted for further clarification at 8882370570 or via mail at slsachdeva3@gmail.com

Disclaimer

The contents of this document are solely for informational purpose. It does not constitute professional advice or a formal recommendation. The document is made with utmost professional caution but in no manner guarantees the content for use by any person. It is suggested to go through original statute / notification / circular / pronouncements before relying on the matter given. The document is meant for general guidance and no responsibility for loss arising to any person acting or refraining from acting as a result of any material contained in this document will be accepted by us. Professional advice recommended to be sought before any action or refrainment.

Services rendered to vessel in India like survey or supplies to the ship on board

Do we need to pay IGST??

the vessel not on land. So should consider as zero rated services?