The application for opting-in composition scheme for the financial year, 2020-21 is available on GST Portal.

The taxpayers who are already in composition scheme in previous financial year are not required to opt in for composition again for FY 2020-2021.

Time limit for opting in Composite Scheme – 31st March 2020

FORM to be filled for opting in Composite Scheme – GST CMP-02

Advisory on Opting-in Composition Scheme for 2020-21

Process to opt-in Composition Scheme-

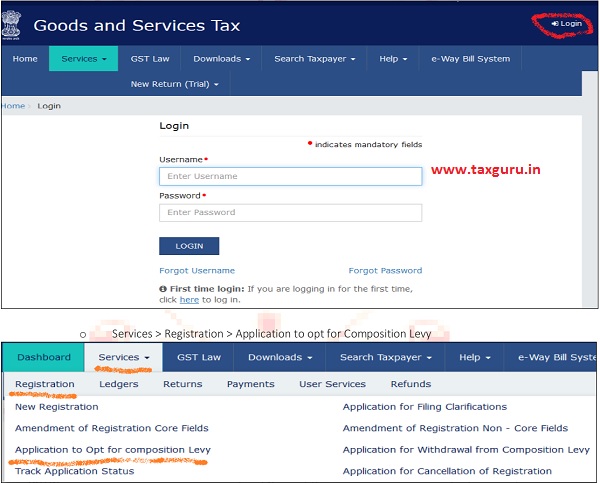

- The taxpayers have to navigate as follows:

- Log-in

- filing form GST CMP-02>file application under DSC/EVC.

- Once CMP-02 application is filed, the composition scheme shall be available to the taxpayer w.e.f. 1st April 2020.

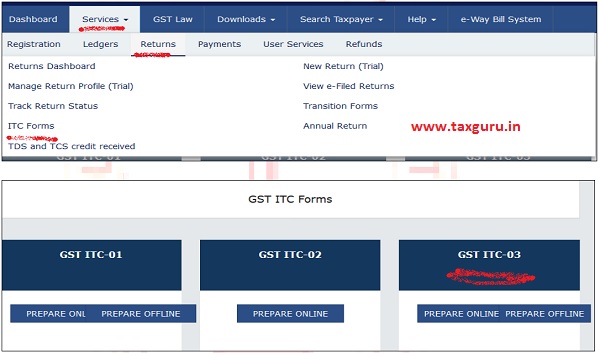

- The taxpayers who were a regular taxpayers in previous financial year but are opting-in composition scheme for 2020-21 should file ITC-03 for reversal of ITC credit on stocks of Inputs, semi-finished goods and finished goods available with him within a period as prescribed under Rule, 3(3A) of CGST Rules, 2017.

For ITC 03 Forms , click on Services →Returns→ITC Forms→GST ITC 03

Return /Payment-

Composite taxpayers have to file

- FORM GST CMP-08 quarterly and pay GST and

- GSTR-4 annually.

Eligible taxpayers for opting-in for Composition Scheme-

- The normal taxpayers having aggregate turnover below Rs. 1.5 Crore in the previous financial year, who doesn’t want to avail ITC facility,

- The normal taxpayers having aggregate turnover below Rs. 75 lakh in the previous financial year situated in following states:

i. Arunachal Pradesh,

ii. Manipur,

iii. Meghalaya,

iv. Mizoram,

v. Nagaland,

vi. Sikkim,

vii. Tripura and

viii. Uttarakhand:

- The normal taxpayers supplying services and/or mixed supplies having aggregate turnover of last financial year below Rs. 50 lakhs.

Taxpayers, who are not eligible for opting in composition scheme-

i. Suppliers of the goods/services who are not liable to be taxed under GST (Petroleum Products),

ii. Inter-State outward suppliers of goods/services(Goods sold from Maharashtra to Punjab) ,

iii. The taxpayers supplying through e-commerce operators, who are required to collect TCS under section 52,

iv. The manufacturers of notified goods like (i) Ice cream and other edible ice, whether or not containing cocoa, (ii) All goods, i.e. Tobacco and manufactured tobacco substitutes and (iii) Pan Masala, (iv) Aerated water

v. A Casual taxpayer,

vi. A Non-Resident Foreign Taxpayer,

vii. A person registered as Input Service Distributor (ISD),

viii. A person registered as TDS Deductor /Tax Collector,

My client registered under composit scheme, and not file returns since from Jan,18. Now he is willing to file returns, but in the GST portal shows 2018-19 regular not composit. So p lease let me to do in this issue

GOOD MORNING / GOOD AFTER NOON SIR,

I AM APPLY FOR NEW GST REGISTRATION WRONGLY IN REGULAR SCHEME IT WILL BE COMPOSITION SCHEME . ANY OPTION OR ANY RULES IT IS POSSIBLE TO OPT IN COMPOSITION SCHEME. I AM . GST REGISTRATION NOT OVER ONE MONTH . IT IS REQUEST TO YOU PLEASE REPLY THIS TOPIC

sir nice posting but would be more useful if gst rate is also mentioned