In a major move towards taxpayer facilitation, Government rolls out facility of filing of NIL GST Return through SMS

In order to facilitate convenient return filing for taxpayers, Government is rolling out the facility of filing of NIL GST monthly return in Form GST-3B through SMS. Over 22 lakh registered taxpayers are estimated to benefit from this move.

Ministry of Finance

Department of Revenue

Central Board of Indirect Taxes and Customs

New Delhi, the 8th June 2020

Press Release

Government rolls out facility of filing of NIL GST Return

through SMS

In a major move towards taxpayer facilitation, the Government has today onwards allowed filing of NIL GST monthly return in FORM GSTR-3B through SMS. This would substantially improve ease of GST compliance for over 22 lakh registered taxpayers who had to otherwise to into their account on the common portal and then tile their returns every month. Now, these taxpayers with NIL liability need not log on to the GST Portal and may file their NIL returns through a SMS.

2. For this purpose. the functionality of filing Nil FORM GSTR-3B through SMS has been made available on the GSTN portal with immediate effect. The status of the returns so filed can be tracked on the GST Portal by logging in to GSTIN account and navigating to Services>Returns>Track Return Status. The procedure to file NIL returns by SMS is as follows; –

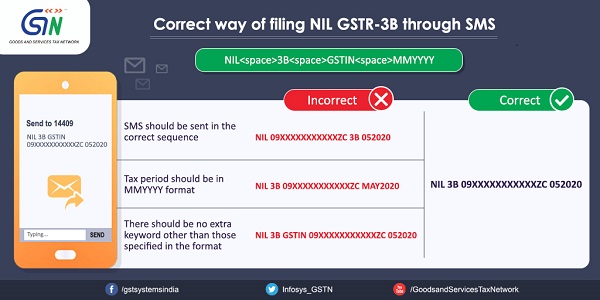

| Initiate Nil Filing | NIL <Space> 3B<space>GSTIN <space>Tax period EX. NIL 3B 09XXXXXXXXXXXZC 052020 |

123456 is the CODE for Nil filing of GSTR3B for 09XXXXXXXXXXXZC for period 05020. COde validity 30 minutes |

| Confirming Nil Filing | CNF <space>3B<space>Code Ex. CNF 3B 123456 |

Your 09XXXXXXXXXXXZC, GSTR3B for 052020 is filed successfully and acknowledged vide ARN is AA070219000384. Please use this ARN to track the status of your return |

| For help anytime | HELP<space>3B Ex. Help 3B |

To file Nil return of GSTIN for Mar 2020: Nil 3B 07CQZCD111114Z7 032020 To confirm Nil filing: CNF 3B CODE More details www.gst.gov.in |

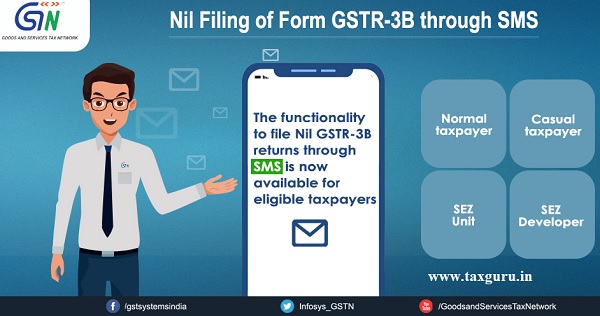

The Functionality to file Nil GSTR-3B returns through SMS is now available for eligible taxpayers

- Normal taxpayer

- Casual taxpayer

- SEZ Unit

- SEZ Developer

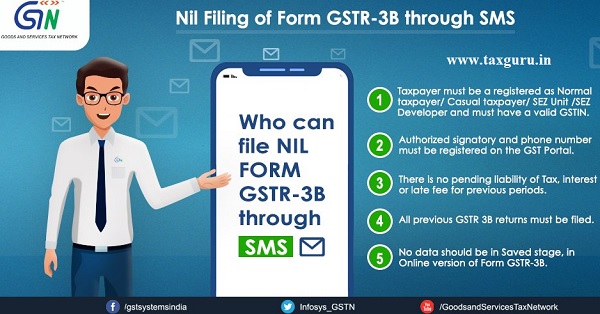

Who can file NIL FORM GSTR-3B through SMS

1. Taxpayer must be a registered as Normal taxpayer/Casual taxpayer/SEZ Unit/SEZ Developer and must have a valid GSTIN.

2. Authorized signatory and phone number must be registered on the GST Portal.

3. There is no pending liability of Tax, interest or late free for previous periods.

4. All Previous GSTR 3B Return must be filed.

5. No data should be in Saved stage, in Online Version of Form GSTR-3B.

Page Contents

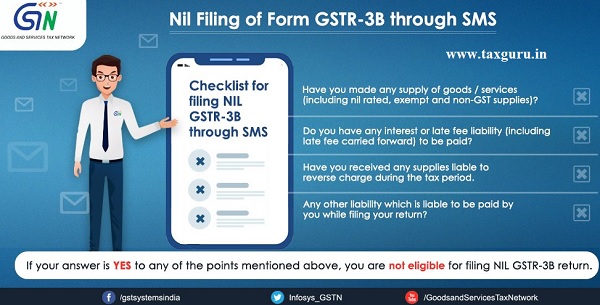

Checklist for filing NIL GSTR-3B through SMS

> Have you made any supply of goods/services (including nil rated, exempt and non-GST supplies)?

> Do you have any interest or late free liability (including late free carried forward) to be paid?

> Have you received any supplies liable to reverse charge during the tax period.

> Any other liability which is liable to be paid by you while filling your return?

If your answer is YES to any of the points mentioned above, you are not eligible for filing NIL GSTR-3B Return.

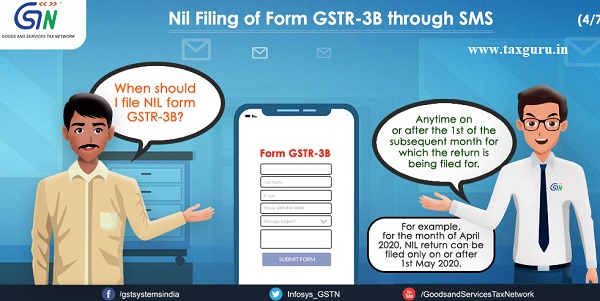

When Should I file NIL Form GSTR-3B?

Anytime on or after the 1st of the subsequent month for which the return is being filed for.

For Example: for the month of April 2020, NIL return can be filed only on or after 1st May, 2020.

Steps to file NIL GSTR-3B:

| 1 | 2 | 3 | 4 | Navigate to Services > Returns > Track Return Status option to track the status of your filed return application on the GST Portal. |

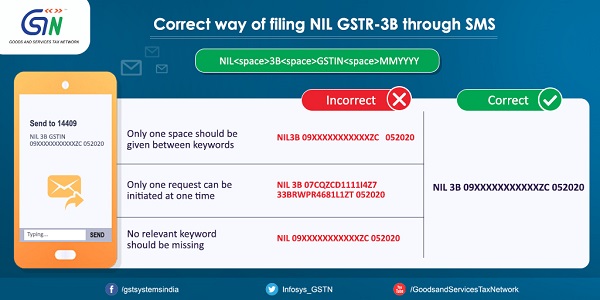

| Send message-NIL (space) 3B (space) GSTIN (space) tax period in mmyyyy format to 14409 from your registered mobile number | You Will receive a 06 digit validation code | Send SMS message CNF (Space) 3B (Space) 06 digit verification code to 14409 | You will receive a success message with ARN No. indicating that NIL filing has been successful | |

| Step 1 | Step 2 | Step 3 | Step 4 | |

| Create Message

NIL 3B 09AGBPS5577MSZC 052020 Send to 14409 |

782503 is the code for Nil filing of GSTR3B for 09AGBPS5577MSZC 052020.

Sender VD-GSTIND |

Create Message

CNF 3B 782503 send to 14409 |

Your 09AGBPS5577MSZC, GSTR3B for the tax period 052020 is filed successfully and ARN is AA070519888385F. please use this ARN to track the status of your return.

Sender VD-GSTIND |

Nil Filing of Form GSTR-3B through SMS

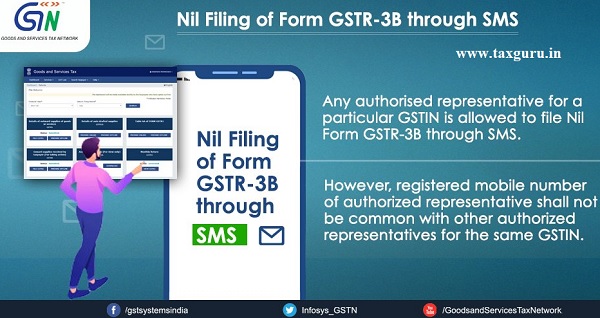

> Any authorised representative for a particular GSTIN is allowed to file Nil Form GSTR-3B through SMS.

> However, registered mobile number of authorized representative shall not be common with other authorized representatives for the same GSTIN.

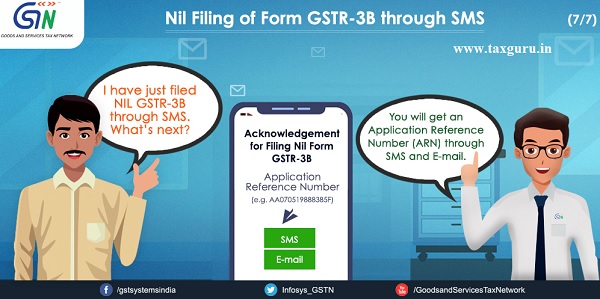

I have just filed NIL GSTR-3B through SMS. What’s next?

You will get an Application Reference Number (ARN) through SMS and E-mail.

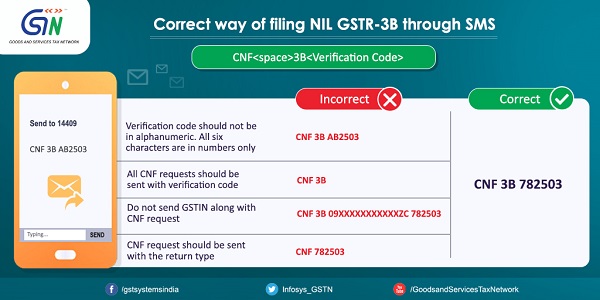

Know the correct way of filing NIL GSTR-3B through SMS

Related Posts-