Page Contents

- A. FAQs on Registration as Tax Collector at Source

- 1. Who needs to register under GST as a TCS?

- 2. How can register as TDS or TCS?

- 3. Are there any preconditions I must fulfill before registering with GST as a TDS or TCS?

- 4. Do I get registered automatically after submitting the registration application along with the prescribed documents?

- 5. I am an e-commerce operator; registered as a TCS under GST regime. I supply goods to multiple states. Do I need to register in each state?

- B. Manual > Tax Collector at Source

A. FAQs on Registration as Tax Collector at Source

1. Who needs to register under GST as a TCS?

TCS stands for Tax Collected at source. In the GST regime, every e-commerce operator needs to collect 1% under CGST Act and 1% under SGST Act; In case of inter-state transactions, 2% (under IGST Act) on the net values of taxable supplies made through the e-commerce operator.

2. How can register as TDS or TCS?

The Registration Application for Tax Deductor/Tax Collector can be filed by the applicant directly by themselves. In GST regime, the registration process is online and any person/entity wishing to register will have to access the GST system for the same.

Any person who wish to get registered as the Tax Deductor/Tax Collector needs to apply in the form prescribed.

3. Are there any preconditions I must fulfill before registering with GST as a TDS or TCS?

The preconditions are:

1. For Registration as Tax Deductor: Applicant has valid PAN or TAN.

2. For Registration as Tax Collector: Applicant has valid PAN.

3. Applicant must have a valid mobile number.

4. Applicant must have valid E-mail ID.

5. Applicant must have the prescribed documents and information on all mandatory fields as required for registration.

6. Applicant must have a place of business.

7. Applicant must have an authorized signatory with valid details.

4. Do I get registered automatically after submitting the registration application along with the prescribed documents?

No, Your registration application will be processed and approved by the relevant Tax Officer, only then will you be issued the registration certificate and GSTIN.

5. I am an e-commerce operator; registered as a TCS under GST regime. I supply goods to multiple states. Do I need to register in each state?

Yes, You need to register separately in each state and appoint a person in each state/UT who will be liable to pay GST.

B. Manual > Tax Collector at Source

1. How can I apply for Registration as a Tax Collector at Source?

What are the steps involved in applying for Registration as a Tax Collector (e-commerce) on the GST Portal?

For registering yourself as a Tax Collector on the GST Portal, perform the following steps:

1. Access the https://www.gst.gov.in/ URL. The GST Home page is displayed.

2. Click the REGISTER NOW link.

Alternatively, you can also click Services > Registration > New Registration option.

Part A:

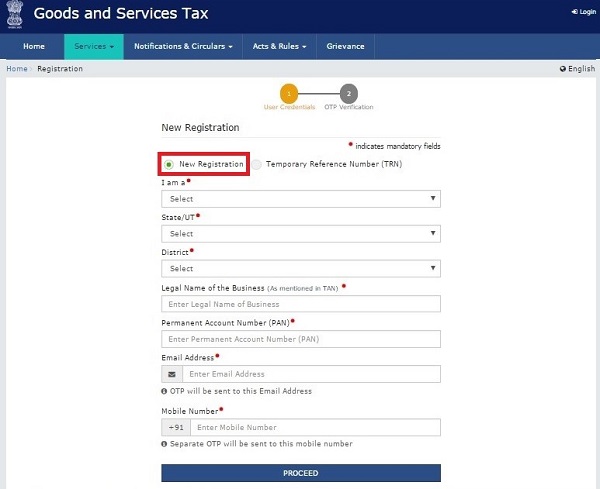

3. The New Registration page is displayed. Select the New Registration option.

4. In the I am a drop down list, select the Tax Collector as the type of taxpayer to be registered.

5. In the State/UT and District drop down list, select the state for which registration is required and district.

6. In the Legal Name of the Tax Collector (As mentioned in PAN) field, enter the legal name of your Tax Collector as mentioned in the PAN database.

7. In the Permanent Account Number (PAN) field, enter PAN number.

Note:

• In case you don’t have PAN, you can apply for PAN. To do so, click the here link.

8. Legal Name of the Tax Collector and PAN will be validated against the CBDT database.

9. In the Email Address field, enter the email address of the Primary Authorized Signatory.

10. In the Mobile Number field, enter the valid Indian mobile number of the Primary Authorized Signatory.

Note: Different One Time Password (OTP) will be sent on your email address and mobile number you just mentioned for authentication.

11. In the Type the characters you see in the image below field, enter the captcha text.

12. Click the PROCEED button.

After successful validation, you will be directed to the OTP Verification page.

13. In the Mobile OTP field, enter the OTP you received on your mobile number entered in PART-A of the form. OTP is valid only for 10 minutes.

14. In the Email OTP field, enter the OTP you received on your email address entered in PART-A of the form. OTP is valid only for 10 minutes.

Note: OTP sent to mobile number and email address are separate. In case OTP is invalid, try again by clicking the Click here to resend the OTP link. You will receive the OTP on your registered mobile number or email ID again. Enter both the newly received OTPs again.

15. Click the PROCEED button.

16. The system generated 15-digit Temporary Reference Number (TRN) is displayed.

Note: You will receive the TRN acknowledgment information on your e-mail address as well as your mobile number. Note that below the TRN the expiry date of the TRN will also be mentioned. Click the PROCEED button.

Alternatively, you can also click Services > Registration > New Registration option and select the Temporary Reference Number (TRN) radio button to login using the TRN.

PART B:

1. In the Temporary Reference Number (TRN) field, enter the TRN generated.

2. In the Type the characters you see in the image below field, enter the captcha text.

3. Click the PROCEED button. The Verify OTP page is displayed. You will receive same Mobile OTP and Email OTP. These OTPs are different from the OTPs you received in previous step.

4. In the Mobile / Email OTP field, enter the OTP you received on your mobile number and email address. OTP is valid only for 10 minutes.

Note: OTP sent to mobile number and email address are same.

In case OTP is invalid, try again by clicking the Click here to resend the OTP link. You will receive the OTP on your registered mobile number or email ID again. Enter the newly received OTP again.

5. The My Saved Application page is displayed. Under the Action column, click the Edit icon (icon in blue square with white pen).

Note:

• Notice the expiry date shown below in the screenshot. If the applicant doesn’t submit the application within 15 days, TRN and the entire information filled against that TRN will be purged after 15 days.

• The status of the registration application is ‘Draft’ unless the application is submitted. Once the application is submitted, the status is changed to ‘Pending for Validation’.

6. The Registration Application form with various tabs is displayed that must be filled sequentially. PART-B of the form has four sections that must be filled sequentially.

On the top of the page, the four tabs are displayed – Business Details, Authorized Signatory, Office Address of Tax Collector, and Verification. Click on the relevant tab to enter the details.

Business Details tab:

The Business Details tab is selected by default. This tab displays the information to be filled for the business details required for registration.

a) In the Trade Name field, enter the trade name of your business.

Note: Trade name of the business is different from the legal name of the business.

b) In the Constitution of Business drop-down list, select the type of constitution of your business. This will be validated with the CBDT Database for a match with the PAN entered in Part A of the form.

c) Select the Date of Liability to Deduct / Collect Tax using the calendar.

d) In the District drop-down list, select the district of your business.

e) In the Sector/ Circle / Ward/ Charge/ Unit drop-down list, select the appropriate choice.

f) In the Commissionerate Code, Division Code and Range Code drop-down list, select the appropriate choice.

g) Click the SAVE & CONTINUE button. You will notice a blue tick on the Business Details section indicating the completion of the tab information and notice the Profile indicating the percentage completion of the application form

—

Authorized Signatory tab:

This tab page displays the details of the authorized signatory. You can enter details of up to 10 authorized signatories, enter all the details of the authorized signatory and click SAVE AND CONTINUE at the bottom of the screen.

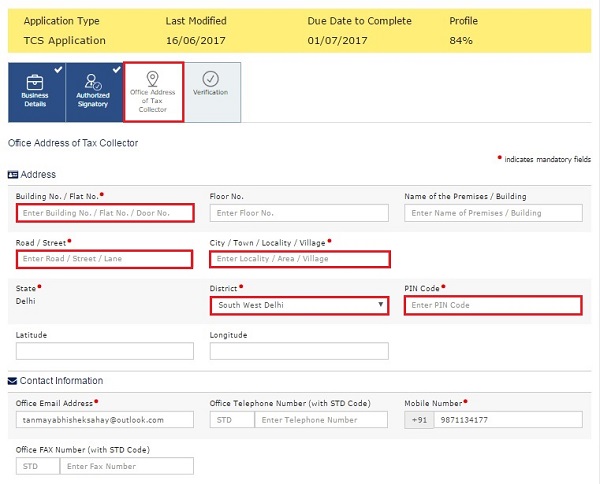

Office Address of Tax Collector Tab:

The third section is the Office Address of Tax Collector. Please enter the following details:

a. Address

b. Contact Information

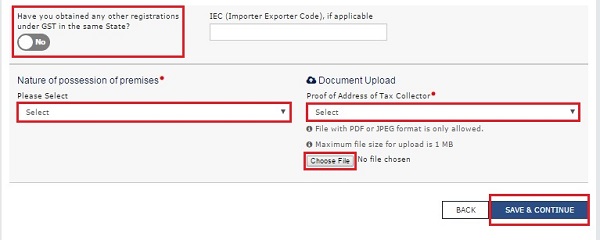

c. You must also enter details of any other GST Registrations in the same state if applicable

d. Nature of Possession of Premises (to be selected from the dropdown)

e. Upload the supporting document in the prescribed format for proof of Nature of Possession of Premises

f. Click SAVE AND CONTINUE.

Verification tab:

This tab page displays the details of the verification for authentication of the details submitted in the form.

a) Select the Verification checkbox.

b) In the Name of Authorized Signatory drop-down list, select the name of authorized signatory.

c) In the Place field, enter the place where the form is filed.

d) After filling the enrolment application, you need to digitally sign the application using Digital Signature Certificate (DSC) or E-Signature. Submission of application with the details is NOT completed unless DSC or E-Signature is affixed.

Note:

• For E-Sign and EVC you must update your Aadhaar number in the Applicant Details section.

• After submission, you cannot make any changes to your application.

In Case of DSC:

a) Click the SUBMIT WITH DSC button.

b) Click the PROCEED button.

Note:

• Make sure your DSC dongle is inserted in your laptop/ desktop.

• Make sure emSigner (from eMudra) is running on your laptop/ desktop with administrator permissions.

To check if the emSigner is running on your laptop/ desktop, perform the following steps:

1. Click the item tray.

2. Double click the emSigner icon.

3. Click the Hide Service button to minimize the dialog box.

g) Select the certificate and click the SIGN button.

Note: To view the details of your DSC, click the View Certificate button.

You will receive the acknowledgement in next 15 minutes on your registered e-mail address and mobile phone number. Application Reference Number (ARN) receipt is sent on your e-mail address and mobile phone number.

You can track the status of your application using the Services > Registration >Track Application Status command.

In Case of E-Signature:

a) Click the SUBMIT WITH E-SIGN button.

b) In the Declaration box, click the AGREE button.

Note: OTP will be sent to your e-mail address and mobile phone number registered with Aadhaar.

c) Verify Aadhaar OTP screen is displayed. Enter the OTP received on your e-mail address and mobile phone number registered with Aadhaar.

d) Click the CONTINUE button.

The success message is displayed. You will receive the acknowledgement in next 15 minutes on your registered e-mail address and mobile phone number. Application Reference Number (ARN) receipt is sent on your e-mail address and mobile phone number.

In Case of Electronic Verification Code:

a) Click the SUBMIT WITH E-SIGN button.

b) In the Declaration box, click the AGREE button.

Note: OTP will be sent to your e-mail address and mobile phone number registered with Aadhaar.

c) Verify Aadhaar OTP screen is displayed. Enter the OTP received on your e-mail address and mobile phone number registered with Aadhaar.

d) Click the CONTINUE button.

The success message is displayed. You will receive the acknowledgement in next 15 minutes on your registered e-mail address and mobile phone number. Application Reference Number (ARN) receipt is sent on your e-mail address and mobile phone number.

—

— —

—

kindly let me know we have taken gst registration as ecommerce operator and have registered in Tcs but as per rules we came to know that TCs registration is not applicable to us how can we surrender this registration and obtain new registration of the CA advised need to go to pune and submit it offline request kindly help us

Kindly guide me regarding how can we cancel GST registration as Tax Collector as i m not able to find any such option after GST Login .

https://twitter.com/JYashesh/status/992360949314043904

@askGST_GoI @FinMinIndia @GST_Council when purchase is made online eg @amazonIN @Paytm we get two choice with GST & without GST for same item why❓Even after purchasing with GST buyer not getting credit. Why one shop like @amazonIN @Paytm cannot ask supplier to give credit❓

Nice Information.