In this article we will read the FAQ’s related to Viewing Orders of Unblocking of E-Way Bill Generation Facility, where we will find find the status of order issued by Tax Official , steps to view Acceptance/Rejection Order and duration for which unblocking of an E-Way Bill generation facility. The detailed FAQ’s are:

Q 1. Why GSTIN will blocked for E-Way Bill generation facility?

Ans. Blocking of e-waybill generation facility means disabling taxpayer from generating E Way Bill, in case of non-filing of 2 or more consecutive GSTR 3B Return on GST Portal, by such taxpayer (refer Rule 138E of CGST/SGST Rules, 2017). The GSTINs of such blocked taxpayers cannot be used to generate the e-way bills either as Consignor or Consignee.

Q 2. How can E-Way Bill generation facility be unblocked?

Ans. Unblocking of e-waybill generation facility means restoring the facility of generation of E Way Bill, in respect of such taxpayers GSTIN (as Consignor or Consignee), in the event of filing of the return for the default period(s), thereby reducing the default period to less than 2 consecutive tax periods.

Also, the Unblocking can be done by the jurisdictional officer online on the GST Portal, upon considering the manual representation received from such taxpayer.

Q 3. How can e-way bill will be unblocked online?

Ans. Once the Return-3B is filed in the GST Common Portal, the blocked GSTIN will get automatically updated as ‘Unblocked’ within a day in the e-Waybill system and the tax payer can continue with e-way bill generation.

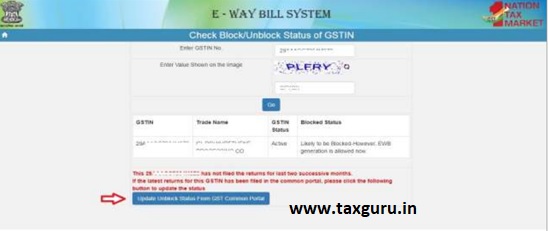

However, if the status is not updated in e-waybill system, then the taxpayer can do it immediately by going to the e-Waybill portal and clicking on the option Search-> Update Block Status. Enter the GSTIN, followed by the CAPTCHA and click on GO.

Q 4. How can taxpayer submit application for unblocking of E-Way Bill generation facility (if taxpayer is unable to file the return)?

Ans. Taxpayer can submit application for unblocking of an E-Way Bill generation facility through an offline/ manual request, citing the grounds why your facility should be un-blocked along with the required documents to your Jurisdictional Tax Official. Once the request is received, Tax official will dispose the application through Back Office GST Portal and issue order online.

Q 5. Where can taxpayer view the status of order issued by Tax Official on my application for Unblocking of E-Way Bill generation facility?

Ans. In case, the order for rejection/acceptance of the unblocking request made by the taxpayer is issued, Email and SMS of acceptance/ rejection of order will be sent to taxpayer on their registered email id and mobile number. Such orders can be seen by the taxpayer after login to the GST Portal.

Navigate to Dashboard > Services > User Services > View Additional Notices/Orders to view Acceptance/Rejection Order for unblocking of the E-Way Bill generation facility.

Q 6. What are the steps to view Acceptance/Rejection Order for unblocking of the E-Way Bill generation facility?

Ans. Navigate to Dashboard > Services > User Services > View Additional Notices/Orders to view Acceptance/Rejection Order for unblocking of the E-Way Bill generation facility. Also, intimation of acceptance/ rejection order will be sent to taxpayer on the registered email id and mobile number.

Q 7. What is the duration for which unblocking of an E-Way Bill generation facility, as per order of Tax Official, is valid?

Ans. Unblocking of an E-Way Bill generation facility is valid upto the period indicated by the Tax Official in his/her order.

Q 8. How will taxpayer get to know if my E-Way Bill generation facility has been blocked?

Ans. GST Portal will send SMS/ Email at the registered mobile number/ email id of the taxpayer whose E-Way Bill generation facility has been blocked. Also during such period, you or any other user will not be able to generate E Way Bill (either as consignor or consignee) against the blocked GSTIN.

Q 9. How will taxpayer be notified for any action taken by Tax Official on my application for unblocking of E-Way Bill generation facility?

Ans. After the Tax Official issues online Order in respect of your request for unblocking of the E-Way Bill generation facility (irrespective of Acceptance/Rejection), the copy of the said order is made available at Taxpayer’s login. Also, an Email and SMS will be sent to the taxpayer on the registered email id and mobile number.

Q 10. Will taxpayer receive any reminder before the expiry of my validity period as indicated in unblocking order?

Ans. Yes, the GST Portal will send reminder mail and SMS before the expiry of validity period as indicated in unblocking order and filing of returns within time to avoid unblocking of E-Way Bill generation facility. This mail is sent 7 days before the date of expiry.

Q 11. Is it possible to block my E-Way Bill generation facility before the expiry of the validity period?

Ans. No, E-Way Bill generation facility will not be blocked before the expiry of the validity period. However, E-Way Bill System will automatically ‘Block’ the Taxpayer post the expiry of the validity period. This automatic blocking will be done, if the extended period as given by Tax Official has expired and taxpayer has failed to file Form GSTR-3B return for last two or more consecutive tax periods.

Q 12. What are the various Application statuses while issuing an order of acceptance/rejection for unblocking of E-Way Bill generation facility?

Ans. Listed below are the various Application statuses while issuing an order of acceptance/rejection for unblocking of E-Way Bill generation facility:

> Order Generation Enqueue – When Order generation is pending with Tax Official.

> Order of Acceptance Issued – When Order is generated by Tax Official for acceptance of unblocking of E-Way Bill generation facility request of taxpayer.

> Order of Rejection Issued – When Order is generated by Tax Official for rejection of unblocking of E-Way Bill generation facility request of taxpayer.

Further, in few days respective taxpayer will able to file the “Application for unblocking of E-way bill” online under my application tab. Currently, this functionality is not available right now. Hope, the above article is helping you to know the unblocking of e-way bill.