Ever since the GST roll out, there have always been Technical glitches on portal, or the reason might be that the people were not properly educated and aware of the GSTN and may deposited tax or fees or interest or penalty under wrong head which leads to blockage of funds for genuine taxpayers and hits their business activities.

Once the taxpayer pays the challan, the payment gets credited in that head and the same can be utilized in settling their relevant output liabilities after adjusting with the Input Tax credit. But in some cases where the challan is wrongly paid or the amount is paid under the wrong head, it can’t be used against discharging the liabilities of that head due to which the taxpayers need to file another challan.

Although in such a scenario, they can claim the refund of the amount by filing a refund application in form RFD-01 choosing the option at the time of refund application of “Excess balance in electronic cash ledger”. Since taking the refund from govt is not really an easy task, an applicant must go through a long process which certainly takes more than a couple of months due to which the working capital of the taxpayers gets blocked.

In order to tackle such problem, Govt has made amendment in Finance (No. 2) Act, 2019 (23 of 2019) by inserting sub section 10 and 11 to Section 49 of The Central Goods And Services Tax Act, 2017 on 30th Aug, 2019 which is applicable w.e.f. 01st Jan, 2020 in accordance with Rule 87 of The CGST Rules, 2017. Sec 49 (10) and (11) are reproduced as below:

10) A registered person may, on the common portal, transfer any amount of tax, interest, penalty, fee or any other amount available in the electronic cash ledger under this Act, to the electronic cash ledger for integrated tax, central tax, State tax, Union territory tax or cess, in such form and manner and subject to such conditions and restrictions as may be prescribed and such transfer shall be deemed to be a refund from the electronic cash ledger under this Act.

(11) Where any amount has been transferred to the electronic cash ledger under this Act, the same shall be deemed to be deposited in the said ledger as provided in sub-section (1).”.

CBIC has also made corresponding changes in Rule 87 CGST rules, 2017 which deals with electronic cash ledger vide Notification No. 31/2019- Central Tax dated 28th June, 2019, with effect from a date to be notified later, by inserting sub rule 13 namely “ A registered person may, on the common portal, transfer any amount of tax, interest, penalty, fee or any other amount available in the electronic cash ledger under the Act to the electronic cash ledger for integrated tax, central tax, State tax or Union territory tax or cess in FORM GST PMT-09”. The said form was not enabled on portal on that date but deployed on GST common portal now which is being extremely crucial at this point of time when financial wheels of the business earning no revenue due to a nationwide lockdown amid COVID-19 outbreak.

Author View: Sub section 10 and 11 to Section 49 of the CGST Act, 2017 is applicable w.e.f. 01-01-2020 but Rule 87 (13) which enacts former section is surprisingly not effective till date.

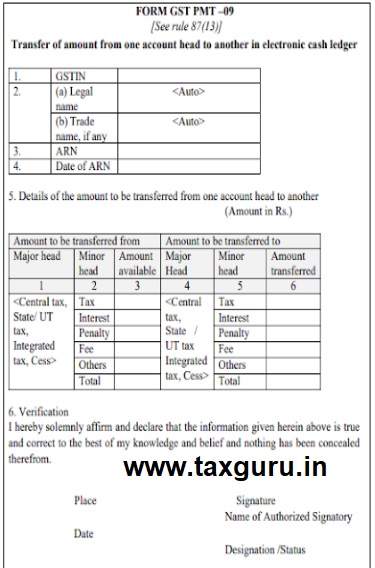

Form PMT-09 enables taxpayer to transfer amount from one minor head/ major head to another minor head/major head. For instance, taxpayer has paid ₹5,000 under interest of CGST. Now by filing PMT-09, he can shift that amount to late fess of SGST also.

Key Points to consider before filing PMT-09

1. If the wrong tax has already been utilized for making any payment, then this challan is not useful. In other words, it will be able to handle only one situation and that is when payment is done in the wrong head and not utilized.

2. This challan only allows shifting of the amounts that are available in the electronic cash ledger.

3. The amount once utilized and removed from cash ledger cannot be reallocated.

4. Major head refers to- Integrated tax, Central tax, State/UT tax, and Cess.

5. Minor head refers to- Tax, Interest, Penalty, Fee and Others.

HOW TO ACCESS PMT-09 on GST common portal?

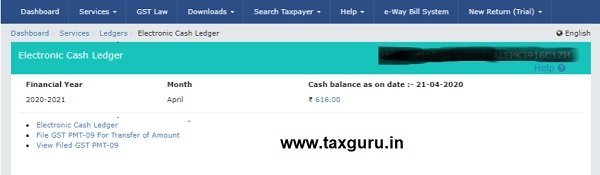

1. Login to GST portal at gst.gov.in

2. Click on Servicesà Ledgers

3. Click on Electronic Cash Ledger and

4. Now, you can file a fresh Form PMT-09 for transfer of amount or filed GST PMT-09. (Below is screenshot for your reference).

Format of PMT-09 (Transfer of amount from one account head to another in electronic cash ledger through):

PMT-09 comprises of minor and major heads. The taxpayer can mention the amount of tax which he wants to transfer from one head to another. The amount can be transferred from the head only if there is a balance available under that head at the time of transfer. A taxpayer can provide his GSTIN and fill the details in Table 5- Details of the amount to be transferred from one account head to another in Form GST PMT-09. Below is the format:

Disclaimer: The views presented are in personal and generic form and not as a legal advice. Users of this information are expected to refer to the relevant existing provisions of the applicable laws.

The author may be reached at cabkansal@gmail.com.

I read this Tax matter were good and useful . and send to my maile address reply important to Tax mater

Rule 87(13) of the CGST Rules, 2017 is applicable w.e.f. 21st Apr, 20 vide Notification no. 37/2020 dated 28-04-2020.

Hi

If there is a balance of TCS credit in cash ledger, then also it can be transferred or not?

GOOD JOB

Yes, Rule 87(13) is inserted vide Notification no. 31/2019 – Central Tax dated 28th June, 2019 which is called The Central Goods and Services Tax (Fourth Amendment) Rules, 2019 but the words “a effective date to be notified later” are specifically mentioned in the same.

Notification 31/2019 link is http://www.cbic.gov.in/resources//htdocs-cbec/gst/notfctn-31-central-tax-english-2019.pdf

USEFULL INFORMATION AND NICELY DRAFTED ARTICLE

Author/ ADmn. Hi Can you clarify whether, same as for / similar to in IT regime there is , for GST, any online generated statement of TDS/TCS ( like26 AS (AIR)) for taxpayers / recipient of supplies (of goods or services) , enabling to access and view the DATA uploaded for verifying the correctness or otherwise?

Big relief to taxpayers after launching this form. More over taxpayer have block their credit due to deposit wrong liabilities.

Thank You

-Rule 87 (13) has been notified in CGST rules, 2017 dated 03/04/2019. https://taxguru.in/goods-and-service-tax/central-goods-services-tax-fourth-amendment-rules-2019.html

Useful information

A very insightful write-up, Bhawna Madam!

PMT-09 has been brought in at a very right time. Multiple cases of blockages made in wrong payment heads will be cleared and can be used for making upcoming payments by the GST taxpayers in this period of liquidity issues.