Good news for taxpayers – Much awaited option “Consolidated Debit/Credit note” enabled on GST portal

This article is penned down to discuss the impact of much awaited consolidated credit/debit note issued under GST. Section 34 of the Central Goods and Services Act, 2017, which deals with Credit/Debit note under GST law is reproduced below:

34. (1) Where a tax invoice has been issued for supply of any goods or services or both and the taxable value or tax charged in that tax invoice is found to exceed the taxable value or tax payable in respect of such supply, or where the goods supplied are returned by the recipient, or where goods or services or both supplied are found to be deficient, the registered person, who has supplied such goods or services or both, may issue to the recipient a credit note containing such particulars as may be prescribed.

2. Any registered person who issues a credit note in relation to a supply of goods or services or both shall declare the details of such credit note in the return for the month during which such credit note has been issued but not later than September following the end of the financial year in which such supply was made, or the date of furnishing of the relevant annual return, whichever is earlier, and the tax liability shall be adjusted in such manner as may be prescribed:

Provided that no reduction in output tax liability of the supplier shall be permitted, if the incidence of tax and interest on such supply has been passed on to any other person.

(3) Where a tax invoice has been issued for supply of any goods or services or both and the taxable value or tax charged in that tax invoice is found to be less than the taxable value or tax payable in respect of such supply, the registered person, who has supplied such goods or services or both, shall issue to the recipient a debit note containing such particulars as may be prescribed.

(4) Any registered person who issues a debit note in relation to a supply of goods or services or both shall declare the details of such debit note in the return for the month during which such debit note has been issued and the tax liability shall be adjusted in such manner as may be prescribed.

Explanation. ––For the purposes of this Act, the expression “debit note” shall include a supplementary invoice.

In simple terms, as per above provision, a registered person has to issue two or more different credit or debit notes in respect of the multiple tax invoices raised in a financial year under GST.

However, CBIC has made amendment in Section 34 of the Central Goods and Services Act, 2017 through the Central Goods and Services (Amendment) Act, 2018 (31 of 2018) which is effective from 1st February, 2019 vide notification no. 02/2019 – Central Tax dated 29th January, 2019. Amendment under Sec 34 is reproduced below:

In section 34 of the principal Act, ––

(a) in sub-section (1), ––

(i) for the words “Where a tax invoice has”, the words “Where one or more tax invoices have” shall be substituted;

(ii) for the words “a credit note”, the words “one or more credit notes for supplies made in a financial year” shall be substituted;

(b) in sub-section (3), ––

(i) for the words “Where a tax invoice has”, the words “Where one or more tax invoices have” shall be substituted;

(ii) for the words “a debit note”, the words “one or more debit notes for supplies made in a financial year” shall be substituted.

Under the relaxation given through the amendment in Section 34, a taxpayer can now issue a consolidated credit or debit note against one or more tax invoices raised in a financial year.

For the sake of understanding, the amended provision is represented below in comparison with the earlier provision:

| Remarks | Earlier Provision | Amended Provision |

| Section 34 (1) of the CGST Act, 2017 relates to the ‘credit note’ | ‘Where a tax invoice has been issued ………………. a credit note containing such particulars as may be prescribed.

|

‘Where one or more tax invoices have been issued …………. one or more credit notes for the supplies made in a financial year containing such particulars as may be prescribed. |

| Section 34 (3) of the CGST Act, 2017 relates to the ‘debit note’ | ‘Where a tax invoice has been issued ………………. a debit note containing such particulars as may be prescribed.

|

‘Where one or more tax invoices have been issued …………. one or more debit notes for the supplies made in a financial year containing such particulars as may be prescribed. |

Even though this amendment is effective since 01st Feb, 2019 but “giving effect to any amendment under GST law is a one thing and to make it technically implemented for the benefit for taxpayers on GSTN portal is totally different thing.”

Now, after more than one and a half year of the amendment, GSTN has finally enabled the facility to report consolidated credit or debit note under GST in GSTR-1.

Recently, with the introduction of various facilities on GST portal, to name a few GST portal enhancements, GSTR-2B, the facility to view principal place of business, HSN/SAC code by using “search by GSTIN” option, Single GST refund application across different financial years etc on GST portal, interestingly it appears that the GSTN is in mood to enable numerous facilities on the common portal in the next couple of months.

Let us understand this amendment u/s 34 with the help of following illustration:

Suppose, Mr. A has issued five tax invoices

Invoice no 13/2020 dated 05-08-2020,

invoice no. 25/2020 dated 07-08-2020

Invoice no. 30/2020 dated 10-08-2020

Invoice no. 35/2020 dated 12-08-2020 and

Invoice no. 40/2020 dated 14-08-2020 in the m/o Aug,20

Further, in the m/o Sept, 20, there are sale returns against these invoices for which he has to issue credit note under GST.

Whether Mr. A has to issue five different credit notes or he can issue a consolidated credit note for these 5 tax invoices?

Moving further to understand the implication on GST portal while filing GSTR-1 return (OUWARD DETAILS). In order to have a clear understanding, the impact this facility on GSTN portal is divided into the following 2 parts:

1. Before a consolidated/single credit or debit note against one or more tax invoices facility available on GST portal.

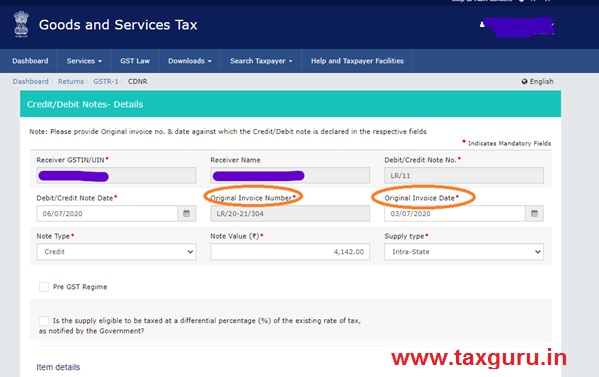

Prior to this facility implemented on GSTN portal, a registered person needs to furnish the “Original date and number of the tax invoice” in order to report credit or debit note issued under GST in his GSTR-1.

Moreover, taxpayers specially selling through online platforms such as Amazon, Flipkart, Paytm etc claim this task to issue different credit or debit notes for different tax invoices under GST law a cumbersome compliance as they need to spend more time, money and effort to maintain the records of credit or debit notes with meagre amounts.

Screenshot of Table-9B (Credit/ Debit notes -registered) is depicted below with highlighted details for better understanding:

2. After facility to issue a consolidated/single credit note, against one or more tax invoices raised in a financial year, implemented on GST portal.

From the screenshot given below, one can easily interpret that GST portal doesn’t ask for “original date and number of the tax invoice” as credit or debit note is delinked from original invoice on the common portal which in turn helps the taxpayers to report single credit or debit note in respect of the multiple tax invoices raised in one financial year in their GSTR-1.

The author is a Practicing Chartered Accountant offers a plethora of services such as GST, GST refunds, Income Tax, MSME, ROC and other tax related matters and can be reached at tax.bkansalco@gmail.com.

Disclaimer: The views presented are in personal and generic form and not as a legal advice. Users of this information are expected to refer to the relevant existing provisions of the applicable laws.

VERY CLEARLY AND NICELY DESCRIBED

nice