Introduction:

Job work under GST is the processing of goods supplied by the principal. The concept of job work already exists in Central Excise, where major manufacturers can send inputs or semi-finished goods to job workers for further processing. The Goods and Services Tax (GST) Act provides special provisions for the receipt of goods to job work and its receipt after processing by job workers without paying GST. The merit of these provisions is accessible both to the principal and the job worker.

What is Job work?

According to section 2(68) of the CGST Act, 2017, “job work” means any treatment or process undertaken by a person on goods belonging to another registered person and the expression “job worker” shall be construed accordingly.

J0B WORK PROCEDURE: The procedure for Job Work under GST involves several steps, including documentation, invoicing, and the transfer of goods.:

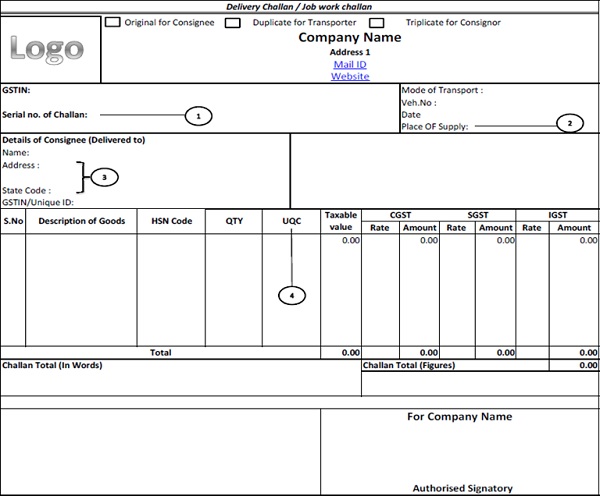

1. DISPATCHING Goods for Job Work: The principal must first send raw materials or semi-finished goods to the job worker for processing, assembly, or completion. They must prepare a delivery challan containing details such as the description of goods, quantity, value, GST identification number of the supplier, and the job worker.

2. Delivery Challan: Once the job work is completed, the job worker must update the delivery challan to include the details of the processed goods. The updated delivery challan must be sent back to the principal.

3. Receiving the Processed Goods: The principal must receive the processed goods along with the updated delivery challan from the job worker. They must also verify the quantity and quality of the goods received.

4. Issue Tax Invoice: If the processed goods are supplied back to the principal, then the job worker can issue a tax invoice to the principal. The tax invoice must contain details such as the name and address of the supplier and recipient, GST identification number, description of goods, quantity, value, and applicable GST rate.

5. Pay GST: The principal must pay GST on the value of the processed goods supplied by the job worker at the applicable GST rate. If the job worker supplies the processed goods to a third party, then the job worker must issue a tax invoice and pay GST on the value of the goods.

6. Claim Input Tax Credit: The principal can claim input tax credit for the GST paid on the raw materials or semi-finished goods sent for job work. However, the job worker cannot claim input tax credit for the GST paid on those materials.

7. Maintain Records: Both the principal and job worker must maintain records of the goods sent for job work, processed goods received, and any tax invoices issued or received. These records must be kept for a period of 6 years from the end of the financial year.

The Responsibilities Lie with The Principal: 1. The principal issues the challan (as specified in rule 10 of invoices rules under GST) to the job worker for the inputs or capital goods. 2. Maintaining the accounts of input and capital goods 3. Intimate the jurisdictional officer for the detailing of the intended input goods and the nature of the processing being delivered by the job worker

| “Principal” means a person on whose behalf an agent carries on the business of supply or receipt of goods or services or both. – clause 2 | |

| Sub-Section (1) | A registered person (principal) may under intimation and subject to such conditions as may be prescribed,

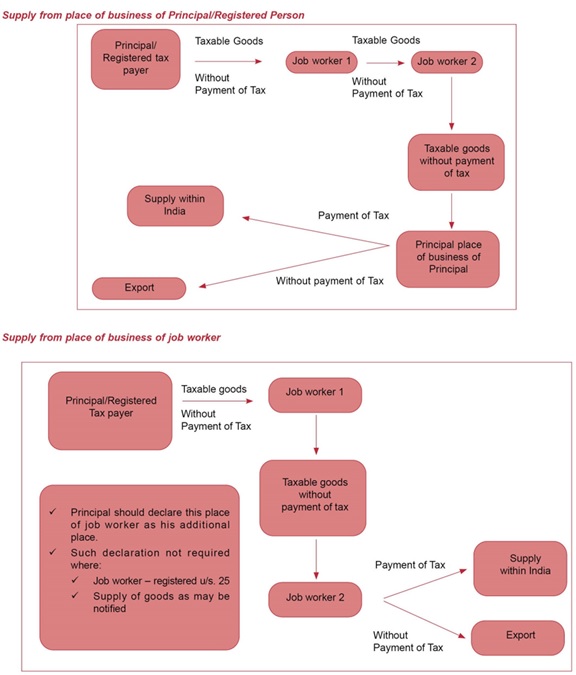

This permission will be for transfer of goods from principal to the job worker and then from there to another job worker again without payment of tax. Further to this after the completion of job work the goods shall be:

Direct supply from the premises of job worker shall be allowed only after fulfilling the following conditions:

|

| Sub-Section (2) | The responsibility for accountability of the goods including payment of tax thereon shall lie with the “principal”. |

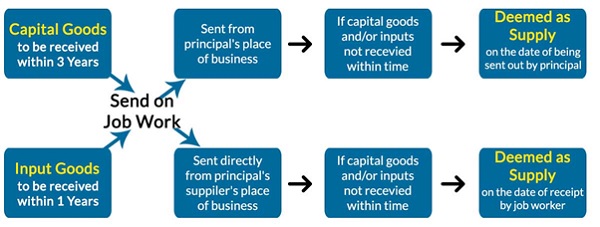

| Sub-Section (3) | Where the inputs sent for job work are not received back within the time limit mentioned in sub-section (1) above or are not supplied from the place of the job worker within the time limit of one year, it shall be deemed that such inputs had been supplied by the principal to the job worker on the day when the said inputs were sent out. |

| Sub-Section (4) | Where the capital goods, other than moulds and dies, jigs and fixtures, or tools, sent for job work are not received back within the time limit mentioned in sub-section (1) above or are not supplied from the place of the job worker within the time limit of three years, it shall be deemed that such capital goods had been supplied by the principal to the job worker on the day when the said capital goods were sent out. |

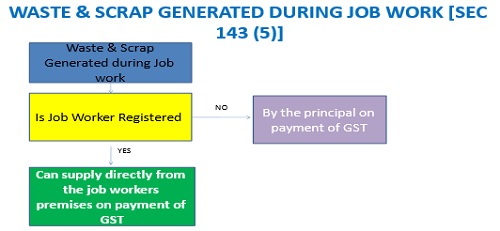

| Sub-Section (5) | Notwithstanding anything contained in sub-sections (1) and (2), any waste and scrap generated during the job work may be supplied by the job worker directly from his place of business on payment of tax,,

Explanation.—For the purposes of job work, input includes intermediate goods arising from any treatment or process carried out on the inputs by the principal or the job worker.

|

–

Provisions under GST for Job Work:

Under GST, there are several provisions that businesses engaged in Job Work need to be aware of. Here are some of the relevant provisions:

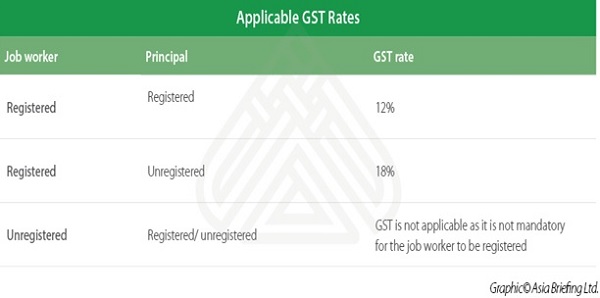

Registration Requirements: Job workers are required to register under GST if their aggregate annual turnover exceeds the threshold limit of Rs. 20 lakhs (or Rs. 10 lakhs for businesses located in the special category states). In addition, if the job worker is registered under GST, then the principal must provide their GST registration number to the job worker.

Input Tax Credit: If the principal sends raw materials or semi-finished goods to a job worker for job work, then the principal can claim input tax credit for the GST paid on those materials. However, the job worker cannot claim input tax credit for the GST paid on those materials.

Compliance Measures: The principal must follow certain compliance measures when sending goods for job work. For instance, they must issue a delivery challan containing details such as the description of goods, quantity, value, GST identification number of the supplier, and the job worker. The delivery challan must be issued before the goods are sent for job work, and it must be updated once the job work is completed.

Timeframe for Job Work: The principal must ensure that the job work is completed within a specified timeframe. If the job work is not completed within the specified time, then the principal must pay GST on the goods as if they were supplied by them. Tax Liability: If the processed goods are returned by the job worker to the principal, then the principal must pay GST on the goods at the applicable rate. However, if the processed goods are supplied by the job worker to a third party, then the job worker must issue a tax invoice for the same and pay GST on the value of the goods.

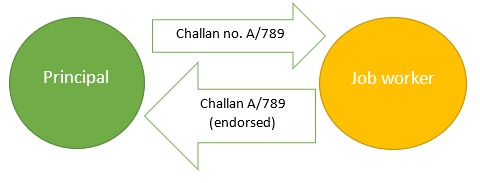

Job worker will endorse the challan, indicating therein the quantity and description of goods sent by the principal. One job worker can send goods to another job worker Challan shall contains all details as per rule 55The details of challans in respect of goods dispatched to a job worker or received from a job worker, Principal has to file ITC-04 in quarterly basis. FORM GST ITC-04 will serve as the intimation U/s 143.RULE -55 of CGST ACT 2017 Serially Numbered Delivery challan issued by the principal shall contain the below mentioned details (CGST Rule 55): –

> Date and number of the delivery challan.

> Name, address & GSTIN of the consignor, if registered

> Name, address & GSTIN of the consignee, if registered

> HSN code & Description of goods.

> Quantity of goods

> Taxable value.

> Tax rate & Tax Amount.

> Place of supply, in case of interstate movement.

The delivery challan shall be prepared in triplicate, in case of supply of goods –

> Original copy being marked as ORIGINAL FOR CONSIGNEE

> Duplicate copy being marked as DUPLICATE FOR TRANSPORTER &

> Triplicate copy being marked as TRIPLICATE FOR CONSIGNOR.

The Responsibilities Lies with The Principal

- The principal issues the challan (as specified in rule 10 of invoices rules under GST) to the job worker for the inputs or capital goods

The Responsibilities Lie with The Principal

- The principal issues the challan (as specified in rule 10 of invoices rules under GST) to the job worker for the inputs or capital goods

- Maintaining the accounts of input and capital goods

- Intimate the jurisdictional officer for the detailing of the intended input goods and the nature of the processing being delivered by the job worker

BOOKS THAT ARE TO BE MAINITAINED: As per Section 35 of the CGST ACT 2017

(1) Every registered person shall keep and maintain, at his principal place of business, as mentioned in the certificate of registration, a true and correct account of—

(a) production or manufacture of goods;

(b) inward and outward supply of goods or services or both;

(c) stock of goods;

(d) input tax credit availed;

(e) output tax payable and paid; and

(f) such other particulars as may be prescribed

Provided that where more than one place of business is specified in the certificate of registration, the accounts relating to each place of business shall be kept at such places of business Provided further that the registered person may keep and maintain such accounts and other particulars in electronic form in such manner as may be prescribed. Read with Rule-56.

Taking input tax credit in respect of inputs and capital goods sent for job work (Sec-19)

Principal shall be allowed to input tax credit on inputs and capital goods sent to a job worker for job work. Where the inputs or capital goods sent for job work are not received back by the principal after completion of job work or otherwise or are not supplied from the place of business of the job worker in accordance with clause (a) or clause (b) of sub-section (1) of section 143 within one/three year of being sent out, it shall be deemed that such inputs had been supplied by the principal to the job worker on the day when the said inputs were sent out.

Availability of input tax credit to the principal and job worker:

As per Para 10 of Circular No. 38/12/2018 ,, in view of the provisions contained in clause (b) of sub-section (2) of section 16 of the CGST Act, the input tax credit would be available to the principal, irrespective of the fact whether the inputs or capital goods are received by the principal and then sent to the job worker for processing, etc. or whether they are directly received at the job worker’s place of business/premises, without being brought to the premises of the principal. job worker is also eligible to avail ITC on inputs, etc. used by him in supplying the job work services if he is registered.

Rules and Restrictions to Claiming of Input Tax Credit under Job Work:

A. Inputs, semi-finished goods or capital sent out on job work

> Goods sent out from the principal place of business

> Goods sent out directly from the place of supply of the supplier

> It is necessary to send out goods along with a challan

B. The Challan should include the particular points

> Date and number of the delivery challan

> Name, address, and GSTIN of the consignor and consignee

> HSN code, description, and quantity of goods

> Taxable value, tax rate, tax amount- CGST, SGST, IGST,, UTGST separately

> Place of supply and signature

C. The information details of the challan should be shown in GSTR- 1 Form

D. Information details of input/ capital goods sent out to the job worker must be claimed through GST ITC –

a) Documents to be issued by manufacturer or Job worker:

The principal has to raise triplicate challan when sending goods to job work, one challan should be retained and remaining two challan will be sent to the job worker. One copy of challan for outward movement (principal to job worker) and the other copy of challan for return (job worker to principal). Note: The challan reference would remain the same.

Other types of Documentation:

a) One job worker to another job worker:

Goods may move under the cover of challan issued either by job worker or principal.

b) In piecemeal by job worker:

Goods returned by job worker in installments cannot be endorsed in the delivery challan issued by the principal, job worker requires to raise a fresh challan.

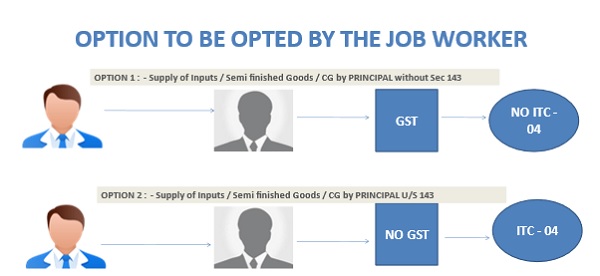

b) Filing of ITC-04: When principal sends inputs or capital goods for job work, he is required to file ITC-04, it will act as a timely intimation to the department of goods sent for job work. Note, the job worker need not file ITC-04. Following are the contents of the form:

Table 4: Details of inputs or capital goods sent for job work

GSTIN / State in case of un registered job worker |

Challan no. |

Challan date |

Description of goods |

UQC |

QTY |

Taxable value |

Type of goods (inputs /capital goods) |

Rate of tax (%) |

|||

CGST |

SGST |

IGST |

Cess |

||||||||

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

||||

Table 5: Detail of inputs/capital goods received back from job worker / goods sent out to another job worker or supplied from job worker

GSTIN / State of job worker if unregistered |

Challan no. issued by the job worker ## |

Challan date issued by job worker### |

Description of goods |

UQC |

QTY |

Original challan no. issued by principal |

Original challan date issued by job worker |

Nature of job work issued by job worker |

**Losses & Wastes |

|

UQC |

QTY |

|||||||||

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

10 |

|

***** In case of goods supplied directly from the job worker premises read as – ‘Invoice no. in case supplied from job worker premises issued by principal’.

***** In case of goods supplied directly from the job worker premises read as – ‘Invoice date in case supplied from job worker premises issued by principal’.

** Loss & wastes are included in the format of CGST Rules, although the same does not reflect in the GST portal. Hopefully, this anomaly is rectified at the earliest.

How to download & file ITC-04 in GST portal:

GST Home page > Downloads > Offline Tools > ITC-04 (in excel).

GST Home page > Login > Dashboard > Returns > ITC forms > File ITC-04

Due date per quarter: 25th of subsequent month of the said quarter.

HOW TO FILE ITC 04

Mr. Anand (principal) is sending product ‘X’ of quantity 100kgs for processing or converting (job work) into product ‘Y’. The conversion ratio of product X to Y will be 0.5 (2X=1Y)

How Mr. Anand will disclose in ITC-04?

When goods to send to job worker Mr. Anand will disclose under table 4 with the quantity 100kgs of product X

While goods returned from job worker after completion of job work, Mr. Anand will disclose under table 5 of ITC-04 with the quantity of 100kgs of product X.

The above disclosure, is not uniformly being adopted across the industry. Some persons are filing the returned goods as Product ‘Y’ of 50 quantity. No Circular/Trade notices received from the department as yet.

Considering the intention of the government, to be able to track whether the inputs/capital goods have been received back within 1/3 years, the details of goods received are to be filled in terms of the goods sent. Next question arises, how do we provide for this in our inventory?

In the inventory software the conversion ratio can be filled in, wherein, for the inventory it would disclose as Product Y – 50 quantities, but for the purpose of ITC 04 – it would disclose Product X – 100 quantities.

E- Way bill:

As per Rule 138 of CGST Rules, where Principal and job worker are located in the different states, E-way bill must be generated for inter-state movement without considering threshold limit of Rs. 50,000. For intra-state movement, the threshold limit of Rs. 100000 limit as applicable in such state would apply.

Furnishing of returns [rule 45(3) and rule 45(4) of the CGST Rules]-

> The principal is required to submit a quarterly return in Form GST ITC-04 summarizing details of challans regarding goods dispatched to or received from the job worker. The return in Form GST ITC-04 is to be submitted within a period of 25 days of the month succeeding the end of the respective quarter.

> While filing return in Form GSTR-1, in Table 13 at sr. no. 9 basic details like serial no. of challans issued to and from the job work; total number; cancelled challan numbers and net issued is to be mentioned.

> Further, in cases, wherein, inputs/ capital goods are not returned back within the prescribed time limit and accordingly the principal is liable to pay the tax. The same is to be declared as supply while filing a return in Form GSTR-1.

> Some of the important points-As per proviso to rule 138 of the CGST Rules, an e-way bill is to be mandatorily generated (either by the principal or the registered job worker) when the goods are sent by the principal located in one State/ Union territory to a job worker located in another State/ Union territory.

> Section 19 of the CGST Act deals with the provisions of input tax credit with respect to inputs/ capital goods sent for job work. Accordingly, the following can be summarized-

> The principal is eligible to avail input tax credit in respect of inputs/ capital goods sent to the job worker.

> The input tax credit is available also when the inputs/ capital goods are directly sent to the job worker without prior receiving them at the place of business of the principal.

Consequences for Non-Compliance: Non-compliance with Job Work requirements under GST can have several consequences, including penalties and interest charges. Here are some of the consequences of non-compliance:

Penalty: If a business fails to comply with the requirements for Job Work under GST, they may be liable to pay a penalty. The amount of the penalty depends on the nature and severity of the non-compliance. The penalty may be up to 10% of the tax payable or Rs. 10,000, whichever is higher.

Interest: If a business fails to pay the GST liability on time, they may be liable to pay interest on the amount due. The interest rate is usually 18% per annum and is calculated from the due date of payment till the actual date of payment.

Seizure of goods: In some cases, the tax authorities may seize the goods sent for job work if the business fails to comply with the Job Work requirements under GST. This can result in a loss of business and revenue for the business.

Prosecution: If the non-compliance is found to be intentional or fraudulent, the business may face prosecution. This can result in fines, imprisonment or both.

–

Certain case studies on job work with illustration

Case study 1

Prathap Industries Ltd., registered in the State of Jammu & Kashmir, manufactures plastic pipes for other suppliers on job work basis.

On 10.01.2020, Aarav Plastics Manufacturers (registered in the State of Himachal Pradesh) sent plastic worth ₹ 4 lakh and moulds worth ₹ 50,000, free of cost, to Prathap Industries Ltd. to make plastic pipes. Prathap Industries Ltd. also used its own material – a special type of lamination material for coating the pipes – worth ₹ 1 lakh in the manufacture of pipes. It raised an invoice of ₹ 2 lakhs as job charges for making pipes and returned the manufactured pipes through challan to Aarav Plastic Manufacturers on 20.10.2020

The same quality and quantity of plastic pipes, as was made for Aarav plastic Manufacturers, were made by Prathap Industries Ltd. from its own raw material and sold to Venus Pipes (registered in Jammu and Kashmir) for ₹ 7.5 lakhs on 20.10.2020.

Examine the scenario and offer your views on the following issues with reference to the provisions relating to job work under the GST laws:

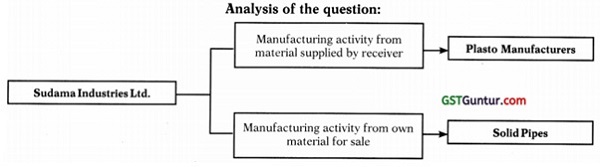

(i) Is there any difference between the manufacture of plastic pipes by Sudama Industries Ltd. for Aarav plastic Manufacturers and for Venus Pipes?

(ii) Whether Prathap Industries Ltd. can use its own material even when it is manufacturing the plastic pipes on job-work basis?

(iii) Whether sending the plastic and moulds to Prathap Industries Ltd. by Aarav Plastic Manufacturers is a supply and a taxable invoice needs to be issued for the same?

(iv) Whether Prathap Industries Ltd. should include the value of free of cost plastic supplied by Aarav plastic Manufacturers in its job charges?

| Difference between Goods manufactured by Prathap Industries Ltd. for | |

| Arav plastic manufacturers | For Venus Pipes |

| (a) It is job-work as the manufacturing process is undertaken on inputs (plastic and moulds) supplied by the principal (Aarav plastic Manufacturers). | it is manufacture on own account as the pipes are manufactured from company’s own raw material. |

| (b) It is a supply of service in terms of para 3 of Schedule II to the CGST Act, 2017 | It is a supply of goods being manufacture of pipes on own account |

Note:

(ii) 45 per Circular No. 38/12/2018 GST dated 26.03.2018, the job worker, in addition to the goods received from the principal, his can use own goods for providing the services of job work. Thus, Prathap Industries Ltd. can use its own material even when it is manufacturing the plastic pipes on job-work basis.

(iii) Issue of Invoice for sending the plastic and moulds to Prathap Industries Ltd.

Section 143 of the CGST Act, 2017 provides that the registered principal may, without payment of tax, send inputs or capital goods to a job worker for job work. Subsequently, on completion of the job work, the principal shall either bring back the goods to his place of business or supply (including export) the same directly from the place of business/ premises of the job worker within one year in case of inputs or within three years in case of capital goods (except moulds and dies, jigs and fixtures or tools). Thus, the provision relating to return of goods is not applicable in case of moulds, dies, jigs, fixtures and tools. If Input/Capital goods not received within specified time limit, it will be treated as supply.

Therefore, sending of plastic and moulds by Aarav plastic Manufacturers to Prathap Industries Ltd. (job worker) is not supply as the manufactured pipes are received back within the stipulated time and the provisions relating to return of goods are not applicable in case of moulds.

Rule 45 of the CGST Rules provides that the inputs, semi-finished goods or capital goods being sent for job work shall be sent under the cover of a challan issued by the principal.

Under cover of Challan Aarav Plastic Manufacturers need not issue a taxable invoice for sending the inputs to Sudama Industries Ltd. but should send the inputs under the cover of a challan.

(iv) Inclusion of value of free of cost plastic in job charges:

Section 15(2)(b) of the CGST Act, 2017 provides that any amount that the supplier is liable to pay in relation to such supply but which has been incurred by the recipient of the supply and not included in the price actually paid or payable for the goods or services or both, is includible in the value of supply. However, Sudama Industries Ltd. should not include the value of free of cost plastic supplied by A on job work basis.

The scope of supply of the Prathap Industries Ltd. is to manufacture plastic pipes from the raw material supplied by the Aarav Plastic Manufacturers. Thus, at no point of time was Prathap Industries Ltd. (supplier of job work service) liable to pay for the raw material and therefore, the value thereof should not be included in its job charges even though the same has been incurred by Aarav Plastic Manufacturers (recipient of job work service).

Case Study 2:

Alovera Pvt. Ltd., a registered manufacturer, sent steel cabinets worth ₹ 50 lakh under a delivery challan to M/s. Prem Tools, a registered job worker, for job work on 28.01.2021`. The scope of job work included mounting the steel cabinets on a metal frame and sending the mounted panels back to Alovera Pvt. Ltd.

The metal frame is to be supplied by M/s. Prem Tools. M/s. Prem Tools has agreed to a consideration of ₹ 5 lakh for the entire mounting activity including the supply of metal frame. During the course of mounting activity, metal waste is generated which is sold by M/s. Prem Tools for ₹ 45,000. M/s Prem Tools sent the steel cabinets mounted on the metal frame to Alovera Pvt. Ltd. on 03.12.2021.

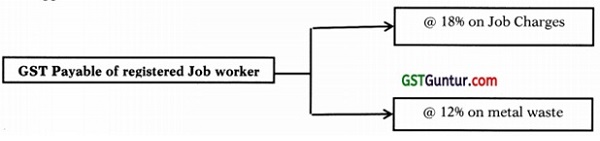

Assuming GST rate for metal frame as 28%, for metal waste as 12% and standard rate for services as 18%, you are required to compute the GST liability of M/s. Prem Tools. Also, give reason(s) for inclusion or exclusion of the value of cabinets in the job charges for the purpose of payment of GST by M/s. Prem Tools.

(1) Supply of services: M/s. Prem Tools (job worker) undertakes the process of mounting the steel cabinets of Alovera Pvt. Ltd. (principal) on metal frames. In view of para 3 of Schedule II to the CGST Act cited above, the mounting activity classifies as service even though metal frames are also supplied as a part of the mounting activity. Accordingly, the job charges will be chargeable to rate of 18%, which is the applicable rate for services.

(2) Value of supply: The value of steel cabinets will not be included in the value of taxable supply made by M/s. Prem Tools as the supply of cabinets does not fall within the scope of supply to be made by M/s. Prem Tools. M/s. Prem Tools is only required to mount the steel cabinets, which are to be supplied by Alovera Pvt. Ltd., on metal frames, which are to be supplied by it.

(3) Sale of waste: Since M/s. Prem Tools is registered, the tax leviable on the supply (sale of waste generated during the job work) will have to be paid by it in terms of section 143(5) of the CGST Act. This supply will be treated as supply of goods and subject to GST rate applicable for metal waste.

Computation of GST liability of M/s. Prem Tools

| Particulars | Amount (₹) |

| GST on Job charges (? 5,00,000 @ 18%) | 90,000 |

| GST on Sale of metal waste (? 45,000 @ 12%) | 5,400 |

| Total GST payable | 95,400 |

Case Study 3.

A Ltd. sends the machinery to B & Co. for fixing of some technical issue and intendency on 15-9-2018. The value of goods sent to B & Co. is ₹ 1,00,000. What are the tax implications, in the following cases:

(i) B & Co. sends the machinery back to A Ltd. on 30-12-2019.

(ii) B & Co. sends the machinery back to A Ltd. on 30-10-2021. Assume GST Rate at 18%.

In accordance with section 143 of the CGST Act, principle can remove the goods without payment of tax and take input tax credit provided capital goods sent for job work are returned back within three years of removal. Otherwise, it shall be deemed that such inputs had been supplied by the principal to the job worker on the day when the said inputs were sent out and it will be subject to the tax along with interest.

| B & Co. sends the machinery back to A Ltd. On: | Tax implication | Reason |

| (a) 30-12-2019 | No Tax | Since the machinery is received before completion of three years. |

| (b) 30-10-2021 | ₹ 9,000 (CGST) and ₹ 9,000 (SGST) along with specified interest on completion of 3 years. | As the machinery is received after the period of three years. Hence, B Ltd. needs to pay tax taken along with the interest. |

What is the procedure for removal of goods for job work under section 143 of CGST Act, 2017?

A registered person (Principal) can send inputs/capital goods under intimation and subject to certain conditions without payment of tax to a job-worker and from there to another job-worker and after completion of job-work bring back such goods without payment of tax. The principal is not required to reverse the ITC availed on inputs or capital goods dispatched to job-worker.

- Principal can also send inputs/capital goods directly to the job-worker without bringing them to his premises and can still avail the credit of tax paid on such inputs or capital goods.

- However, inputs and/or capital goods [other than moulds and dies, jigs and fixtures, or tools] sent to a job- worker are required to be returned to the principal within 1 year and 3 years respectively, from the date of sending such goods to the job-worker. The provision of return of goods is not applicable in case of moulds and dies, jigs and fixtures or tools supplied by the principal to job worker.

- The period of 1 year and 3 years may, on sufficient cause being shown, be extended by the Commissioner for a further period not exceeding 1 year and 2 years respectively.

- This amendment would cover situations where the period of 1 year specified is not adequate in respect of job works such as hull construction/fabrication of vessels (for defence purposes), since these processes complete in a period of around 14 to 16 months.

After processing of goods, the job-worker may clear the goods to-

> another job-worker for further processing, or

> dispatch the goods to any of the place of business of the principal without payment of tax.

Case study 4

What are the provisions relating to taking ITC in respect of inputs and capital goods sent for job work?

Answer:

The provisions relating to taking ITC in respect of inputs and capital goods sent for job work, are given under Section 19 of CGST Act, 2017. These are given as under:

| Section 19(1) | ITC to be allowed to principal | The principal shall, subject to such conditions and restrictions as may be prescribed, be allowed input tax credit on inputs sent to a job worker for job work. |

| Section 19(2) | Principal to get Credit even if Inputs sent directly to Job Worker | Notwithstanding anything contained in section 19(2)(b) of section 16, the principal shall be entitled to take credit of input tax on inputs even if the inputs are directly sent to a job worker for job work without being first brought to his place of business. |

| Section 19(3) | Deemed Supply of Goods | Where the inputs sent for job work are not received back by the principal after completion of job work or otherwise or are not supplied from the place of business of the job worker in accordance with section 19(1)(«) or section 19(1 ){b) within one year of being sent out, it shall be deemed that such inputs had been supplied by the principal to the job worker on the day when the said inputs were sent out:

Provided that where the inputs are sent directly to a job worker, the period of one year shall be counted from the date of receipt of inputs by the job worker. |

| Section 19(4) | Principal to get Credit even if Capital Goods are supplied to the Job Worker | The principal shall, subject to such conditions and restrictions as may be prescribed, be allowed input tax credit on capital goods sent to a job worker for job work. |

| Section 19(5) | Principal to get Credit even if Capital Goods are directly supplied to Job Worker | Notwithstanding anything contained in section 16(2)(b), the principal shall be entitled to take credit of input tax on capital goods even if the capital goods are directly sent to a job worker for job work without being first brought to his place of business. |

| Section 19(6) | Deemed Supply of Capital Goods | Where the capital goods sent for job work are not received back by the principal within a period of three years of being sent out, it shall be deemed that such capital goods had been supplied by the principal to the job worker on the day when the said capital goods were sent out:

Provided that where the capital goods are sent directly to a job worker, the period of three years shall be counted from the date of receipt of capital goods by the job worker. |

| Section 19(7) | No Time Limit for Moulds, Dies, Jigs, Fixtures, Tools | Nothing contained in section 19(3) or section 19(6) shall apply to moulds and dies, jigs and fixtures, or tools sent out to a job worker for job work. |

(Explanation. For the purpose of this section, “principal” means the person referred to in section 143.)

FRQUENTLY ASKED QUESTIONS:

1.Whether treatment or process done for an unregistered person’s goods, will it be considered as job work?

No, according to Section 2(68) of CGST Act, only in the case any treatment or process done for goods relating to registered person is treated as job work

2.Whether Job worker need to issues delivery challan while returning the goods after job work?

No, not required to issue new delivery challan. Job worker can endorse the goods through delivery challan issued by the principal. Ensure contents are as per Rule 55.

3.Whether goods imported for the purpose of Job work and re-exported would be liable for GST?

Up to 31st January 2019, as there was no specific provision to exclude such job work activity, GST was said to be liable on such transactions, and not as a zero-rated supply. This was in contrast to the erstwhile Excise law, which provided exemption for such activity.

From 1st February 2019 onwards (based on recent IGST Amendment Act) – GST not liable on such job work activity, could be covered under Export of Services (zero-rated supply). Proviso to section 13(3)(a) of IGST Act has been amended which prescribes the place of supply would not be the location where services are performed. This ensures that the place of supply would be the location of the recipient (outside India).

4.Whether goods sent for repairs & maintenance be considered as job work?

No, repairs & maintenance and job work are two different concepts under GST. The intention of the customer/principal, and the activity itself should define whether it is to ‘repair’ such goods, or to undertake any ‘process or treatment’ on such goods. Also, another indicator could be –

Repairs & maintenance – do not change the nature of the goods.

Job work – may result in a change of nature of the goods.

Repairs & maintenance falls under HSN code 9987, whereas job work falls under HSN code 9988, which also indicates, there is a difference between the two.

5.When the goods sent to job worker and same has been lost / destroyed at job worker premises, will it be considered as deemed supply?

situation 1 When goods are destroyed after receipt of goods by job worker:

In this case Principal needs to treat it as a deemed supply and raise tax invoice for the same, as the goods cannot be returned within time limit prescribed.

situation 2 When goods destroyed before receipt of goods to job worker (goods in transit): In this case principal need to reverse ITC according to Section 17(5)(h), as the goods are destroyed in the transit where possession of goods are not yet transferred to the job worker.

6.Who is responsible for maintenance proper books of accounts in lieu of inputs and capital goods sent for job work and filing of ITC-04?

a. According to Section 143(2) of CGST Act, the responsibility of maintaining proper books of accounts lies with the principal.

b. Responsibility of filing ITC-04 also lies with the principal.

7.What value is to be provided in the E-way bill, while returning goods from job worker after completion of job work?

a. Considering Rule 138 of CGST Rules, 2017 read with explanation 2, EWB is required for movement of goods of consignment value more than 50,000/100000 which requires to disclose the value of goods during movement.

b. The consignment value will be transaction value determined u/s 15 of CGST Act, the transaction value includes the job work charges, therefore the consignment will be the value of goods + job work charges (including taxes) ICAI publications on E-way bill (Feb 2019 issue) supports the above view.

8. what will be the impact if goods are supplied by unregistered principal to unregistered job worker for the job work to be done?

The situation would not be covered under the scope of job work under GST. The activity will be treated as supply of goods between both the parties.

9.Whether job worker has to include the amortization cost of moulds, jigs, fixtures and tools sent by the principal to the job worker in the value of job work services?

Amortization cost of moulds, jigs, fixtures and tools sent by principal to job worker shall be included in the value of job worker services only when the responsibility of procuring moulds, jigs, fixtures and tools, is of job worker, but supplied by principal as per section 15(2)(b) of CGST Act. (Refer Circular 47/2018)

10. Whether loss and wastage generated in job worker premises be disclosed in ITC-04?

According to ITC-04 format provided in CGST Rules, principal has to disclose loss and wastage incurred in the job worker premises. Returnable delivery challan should contain about the details from the job worker to Principal in order to maintain track & information. Presently GST portal has facilitated to include loss/wastage details.

11.When goods sent outside the India for the purpose of job work, do we need to disclose in the ITC-04?

Yes, there is no exception for the said case. It should be disclosed in ITC-04.

Conclusion: Job work under GST regime has been simplified to ensure ease of doing business for taxpayers. The rules are clear and transparent, and taxpayers must follow them to avoid any legal issues or penalties.

*****

Author M.S. Vijaykumar is a retired Assistant Commissioner (SGST) from the Madurai Division