Ministry of Finance

Presentation made by Chief Economic Adviser K. Subramanian on measures taken to boost Indian Economy

Posted On: 13 DEC 2019

Smt. Nirmala Sitharaman, Union Minister for Finance & Corporate Affairs, held a press conference on the measures taken to boost economy. Chief Economic Adviser K. Subramanian, gave a presentation on Major Interventions to Boost Economy.

Major Interventions to Boost the Economy

Measures implement a planned economic strategy

Measures to Support Consumption

◊ Support to NBFCs and HFCs to support retail lending:

♦ Total sanctioned support of Rs.4.47 lakh cr includes Rs.1.29 lakh cr for pool-buy-outs of assets

◊ Partial credit guarantee scheme for NBFCs and HFCs

♦ Cabinet approval for SMA-0 borrowers; asset pools rated BBB+ or better;

♦ Within two days,17 proposals amounting to Rs. 7657 Cr. Approved. Proposals amounting to Rs. 20,000 crores to be approved over next two weeks.

◊ Government & PSU dues cleared in two stages: Upto Rs. 61,000 Crores previously

♦ Dues of 32 CPSEs (Navratnas & Maharatnas) cleared by more than 60% in last two months

♦ 21/32 CPSEs have set up “Online Bill Tracking” systems to reduce pendency in bill payment and reduce Accounts Payables of CPSEs permanently; Rs. 4877 Cr. Currently due

◊ Following RBI guidelines mandating banks to link their lending rates to external benchmarks, all PSBs have introduced Repo Rate linked loan products

♦ 8.18 lakh Repo linked loans (Rs. 72,201 Cr.) sanctioned till 27th Nov 2019

◊ MSME Bill Discounting: 5.06 lakh bills (Rs. 12,698 Cr.) till 15th Nov 2019

◊ Transparent One-time Settlement Policy in PSBs: 5.26 lakh (Rs. 16,716 Cr.) sanctioned

Measures to boost Investment

◊ Continuous liberalization has resulted in record FDI inflows: $35 billion in H1 2019-20 as against $31 billion in H1 2018-19

◊ Corporate tax rates cut: 15% tax lowest among peers

♦ Given large market and large labour force, these tax rates make India more attractive than other countries

◊ Capital Expenditure (Capex) by the Government

♦ 66% of budgeted Capex of Rs. 3.38 lakh Cr already undertaken

♦ Indian Railways & Ministry of Road Transport and Highways projected to undertake Capex of Rs. 2.46 lakh Cr by 31.12.2019

♦ Select CPSEs (32 Maharatnas and Navratnas) have undertaken Capex of Rs. 98,000 Cr till Nov 2019. Projected to undertake Capex of Rs. 60,000 Cr in the rest of the year

◊ Approval of a realty fund worth Rs. 25000 crore for stalled housing projects

♦ Fund (SWAMIH) is fully operational and Investment Committee is completing due diligence on the first set of deals today

♦ Necessary changes in IBC to enable the Fund’s operations

♦ Careful due diligence requiring coordination done in record time (6-8 weeks as against 6-8 months usually)

♦ Fund has found excellent traction from 13 domestic financial institutions including HDFC, SBI, LIC. Legal documentation for Rs. 10,530 Cr. already executed

♦ Process has incorporated lessons from previous episodes of careless fiscal expansion

◊ Credit expansion via PSBs: Rs. 60,314 Cr equity infused; Rs. 4.9 lakh cr. Disbursed

♦ Rs. 2.2 lakh Cr to Corporates; Rs. 72,985 Cr to MSMEs and Rs. 39,453 Cr. to retail borrowers

◊ Enable and protect honest decision-making in PSBs

♦ Internal Advisory Committee (IAC) in banks to classify cases as vigilance or no vigilance;

♦ IAC/CVO decision to be final

♦ Advisory Board for Bank Frauds set up

Key Reforms in Capital Markets to enable financing

◊ Law passed by Parliament for setting up unified regulator for International Financial Services.

♦ This will enable capital flows by reducing regulatory and compliance burden.

♦ Bring back trading of Indian financial products from off shore centres.

◊ Regulatory burden for equity/equity-like instruments eased through comprehensive Rules for FEMA Non-Debt Instruments

♦ Will streamline the foreign investment regime

◊ One Unified market across the country for financial instruments through rationalisation of Stamp Duty

♦ Key recommendation of H R Khan Committee to foster Development of Corporate Bond Mkt

◊ A revised ECB Framework has been prescribed to rationalise the scheme of foreign debt access by Indian companies

♦ Includes Working Capital loans and Rupee denominated loans

♦ Will enable capital raising by Indian Corporates for funding investment

◊ A framework for debt ETF has been notified by SEBI

♦ Bharat Bond ETF utilises this framework

◊ A framework to allow shares with Differential voting rights (DVR) enabled

♦ Foster new economy by encouraging start-ups to raise funds from the market without diluting promoters’ interest in the company

◊ Interoperability among clearing corporations has been implemented

♦ Enable efficient use of capital for clients who trade on multiple stock exchanges

◊ Plain vanilla options in Commodities have been enabled for trading on exchanges

♦ Will facilitate hedging of risks in agricultural commodities

◊ Norms applicable for Credit Rating Agencies have been tightened

♦ Will enable further development of credit markets

◊ Know Your Customer (KYC) norms for FPIs: In consultation with the Ministry, SEBI has approved several changes in the KYC norms for FPIs on 5th November 2019

♦ Include simplified documentation requirements and exemptions for regulated entities

◊ Increase in statutory limit for FPI investment in a company from 24% to sectoral foreign investment limit w.e.f. 01.04.2020

◊ On 4th Oct 2019, RBI announced its decision to:

♦ Permit USD-INR trading at GIFT IFSC and

♦ Allow domestic banks to freely offer foreign exchange prices to non-residents at all times

♦ Bring offshore Rupee market to domestic stock exchanges and permit trading of USD -INR derivatives in GIFT IFSC

♦ Thereby enable further development of Forex market

Reforms: Disinvestment to enhance economic efficiency

◊ Disinvestment in non-priority areas where competitive markets have come of age

♦ Enable private buyers to bring capital, technology and better management

♦ Enhance productivity and thereby economic growth

♦ BPCL, CONCOR & SCI

◊ Widening the bandwidth of disinvestment for minority stake sale:-

♦ Govt. equity to be brought down below 51% in select CPSEs on case-to-case basis

♦ This will increase wider public ownership of selected CPSEs

◊ Bharat Bond ETF to enable private participation and wider pool of financing for CPSEs

Measures to improve ‘Ease of Doing Business’

◊ India has jumped to 63rd in World Bank’s EODB rankings; IBC a primary contributor to the same

♦ Ring-fencing successful bidders of stressed assets from the risk of criminal proceedings against offences committed by previous management and promoters

♦ Threshold for financial creditors to prevent triggering of insolvency for small amounts

◊ No need for Debenture Redemption Reserve (DRR) for debentures issued by Listed companies, Banks, NBFCs and HFCs

♦ Will reduce cost of issuance and help in developing the corporate bond market

◊ CSR violations de-criminalized and to be treated as civil offence

◊ NBFCs permitted to use the Aadhaar authenticated bank KYC

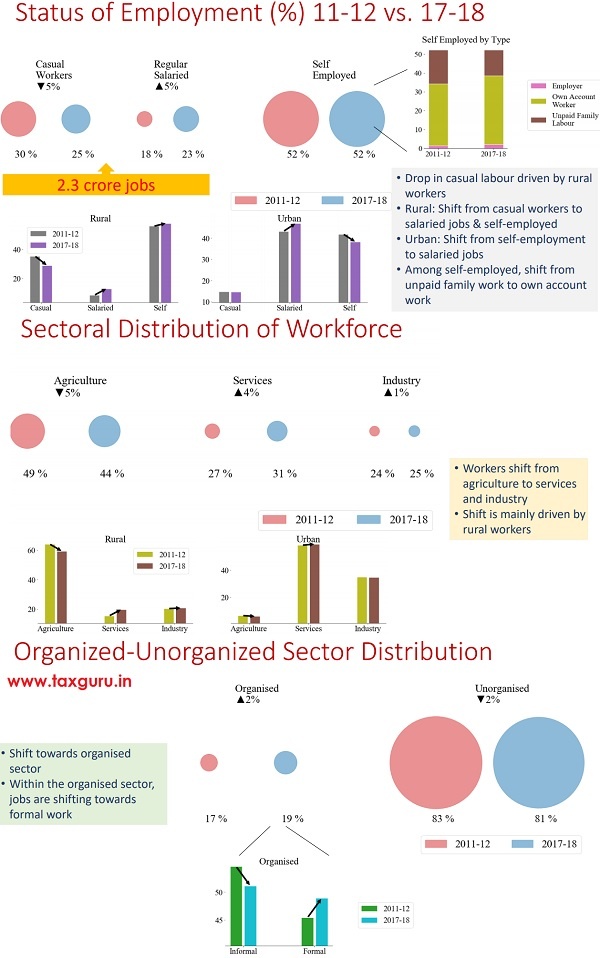

Ease of Doing Business: Reform in Labour Laws

◊ Code on Wages 2019 notified in August 2019

♦ Subsumes four acts to transform old and obsolete labour laws into more accountable and transparent ones. Enhances ease of compliance

◊ Code on Occupational Safety, Health and Working Conditions Bill, 2019, introduced in Parliament in July 2019

♦ 13 Central Labour Laws brought in ambit of New Code

◊ Industrial Relations Code, 2019 introduced in Parliament on 28th November 2019

♦ Amalgamates and rationalizes three Central Labour Acts to impart flexibility to the exit provisions (relating to retrenchment etc.)

◊ Social Security Code Bill, 2019 introduced in Parliament on 11th December 2019

♦ Enables universal security of workers

◊ Contribution of ESIC reduced from 6.5 percent to 4.0 percent.

◊ Web-based, Jurisdiction free inspections with report to be uploaded within 48 hrs

–