CHAPTER-I :- SUB: WORKING CAPITAL

Introduction: Working Capital is such a kind of capital which is required for daily business activities. This helps in keeping the wheel of the business organization running. The operating activities can run smoothly with the sufficient working capital and on the other hand, the same activities can be hampered due to lack of proper working capital. There are 2 kinds of working capital and they are (a) Gross Working Capital and (b) Net Working Capital.

The sum total of all current assets is known as Gross Working Capital and the difference between the sum total of current assets and total of current liabilities is introduced as Net Working Capital. Gross Working Capital will be always positive but the Net Working Capital may be positive or negative.

At the present time, every business sector has a Working Capital Management Cell. This Cell keeps its glance on the estimation of total working capital requirement based on its activity level and determines the sources of funds towards the requirement of working capital. Operating Cycle is an important tool to determine the net working capital requirement. Beside this, Current Ratio is used here and the ideal value is 2:1. Value of Net Working Capital can be reflected by the value of Current Ratio as given below-

Where Current Ratio is <1, the Net Working Capital will be always negative.

Where Current Ratio is =1, the Net Working Capital will be always zero.

Where Current Ratio is >1, the Net Working Capital will be always positive.

Example 1:

| Particulars | Situation-1 | Situation-2 | Situation-3 |

| A. Current Assets | Rs. | Rs. | Rs. |

| Inventory | 5000 | 5000 | 10000 |

| Debtors | 15000 | 15000 | 5000 |

| Bills Receivable | 5000 | 5000 | 6000 |

| Cash in hand | 2000 | 2000 | 15000 |

| Cash at bank | 1500 | 1500 | 25000 |

| A1. GROSS WORKING CAPITAL/TOTAL CURRENT ASSETS | 28500 | 28500 | 61000 |

| B. Current Liabilities | Rs. | Rs. | Rs. |

| Creditors | 15000 | 17000 | 12500 |

| Bills Payable | 5000 | 7000 | 8000 |

| Bank Overdraft | 15000 | 4500 | 25000 |

| B1. Total Current Liabilities | 35000 | 28500 | 45500 |

| CURRENT RATIO(CURRENT ASSETS/CURRENT LIABILITIES) | -4.38 | 1 | 3.94 |

| NET WORKING CAPITAL(A1-B1) | -6,500 | 0 | 15,500 |

CHAPTER-II :- Conceptual Framework

We know that there are 2 kinds of capital and they are (1) Fixed Capital and (2) Working Capital. Fixed Capital is required for the establishment of fixed assets such as plant & machinery, land & building etc. On the other hand, Working Capital is required to get the utility from the fixed assets at its optimum level. For example, machine can not be used without the raw materials, operators etc. This capital makes an important role in the field of financial management. The following points can be highlighted-

A. Short term solvency– Working Capital can explain the short term solvency position of a business organization. Positive net working capital indicates that the firm is able to pay its short term obligation. But the negative net working capital indicates that the firm is unable to pay its short term obligations.

B. Running operating functions smoothly– A firm can run its daily operating functions smoothly with the sufficient working capital. This capital is required for procurement of raw materials,

hiring of labours, expenses for overheads etc.

C. Getting optimum utility from the fixed assets– Fixed assets can be utilized at its optimum level with the proper working capital. Due to lack of working capital, operating activities are interrupted and as a result, the fixed assets are lying ideal.

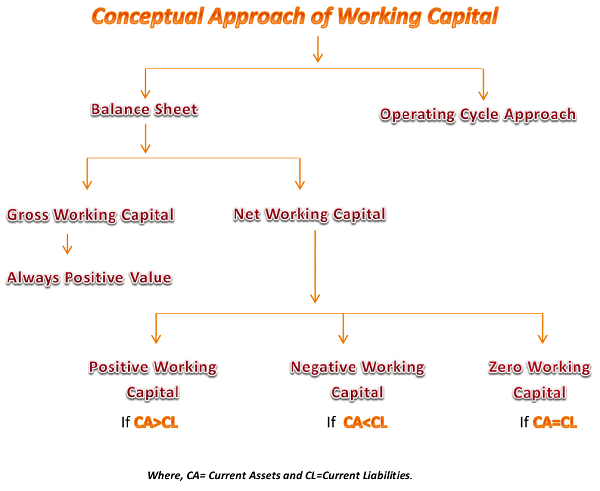

Concepts of Working Capital can be explained based on 2 approaches and they are (A) Balance Sheet Approach and (B) Operating Cycle Approach. A brief detail are stated as below-

(A) Balance Sheet Approach– Under this approach, the Working Capital is classified into 2 parts and they are Gross Working Capital and Net Working Capital. Gross Working Capital is always positive value but the Net Working Capital may not be positive. They may be of 3 types-

(1) Positive Net Working Capital

(2) Negative Net Working Capital and

(3) Zero Net Working Capital.

(B) Operating Cycle Approach– At the present scenario, this approach is becoming very famous to determine the Working Capital requirement. This cycle indicates the period of times (in days or in weeks or in months) during which the investment of one unit of money will remain blocked in the normal course of business till recovery out of revenue

CHAPTER-III :- Presentation of Working Capital Management

The important presentations of Working Capital are highlighted as below-

1. Factors in determining of Working Capital Requirement– The requirement of working capital depends upon the following factors-

(A) Nature of business– The business may be Manufacturing Concern, Trading Concern and Financial Concern. The working capital requirement of the Trading and Financial Concern is lesser than the working capital requirement of Manufacturing Concern.

(B) Size of the business– The working capital requirement depends on the size of the business concern. According to the size of the business, businesses are Large Scale, Medium Scale and Small Scale business. Large Scale business needs a large amount of working capital than a Medium and Small Scale business.

(C) Production Process– Production process is of 2 kinds-(i) Labour Intensive and (ii) Capital Intensive. In case of Labour Intensive, it needs a large amount of working capital than the Capital Intensive.

(D) Production Period– The working capital requirement depends on the Production Period. In case of high production period, a huge amount of working capital is required and in case of low production period, the requirement of working capital will be low.

(E) Credit period to debtors– Credit period allowed to debtors makes an important role in determining of working capital. If a long period of credit is allowed to debtors, a large amount is required as working capital.

(F) Nature of Inventory– If the business has to maintain a high rate of inventory, it requires a high amount of working capital and vice versa.

(G) Cash Reserve– A business with high cash reserve needs a large amount of working capital and on the other hand, a business with low cash reserve needs a low amount of working capital.

2. Sources of Working Capital– Sources of working capital can be classified into 2 parts and they are sources for Permanent working capital and sources for Temporary working capital. The various sources of permanent and temporary working capital are stated as below-

Sources of Permanent Working Capital

Internal Source– Retention of profit is the main internal source for permanent working capital. It makes an important role.

External Source– There are different kinds of external sources and a brief are stated as below-

1. Issue of Shares– A Company can issue both the equity share and pref. shares in the market to collect the working capital. The owner of the equity share is called as equity shareholder and the owner of pref. share is known as pref. shareholder.

2. Issue of Debenture– Like issue of share, a Company can issue debentures in the market for its working capital. The owner of the debenture is known as Debenture holder.

3. Loan from Bank and Financial Institution– It is also a source of internal working capital.

Sources of Temporary Working Capital

(A) Internal Source-The internal sources are highlighted as below-

1. Provision for depreciation– The provision accumulated as depreciation is an internal source of temporary working capital.

2. Provision for taxation– It is also an internal source for temporary working capital.

3. Outstanding wages and expenses– These are the expenses which are already due but not paid. Therefore, a time lag is enjoyed by the firm.

(B) External Source– The various external sources for temporary working capital are bank loan, loan from financial institutions, Government aid, factoring, public deposit, commercial paper etc.

3. Operating Cycle: This concept is gaining more importance in the present business scenario. Under this concept, requirements of Working Capital depend on the nature of operating cycle. This cycle indicates the period during which the investment of one unit of money will remain blocked in the normal course of business till recovery out of revenue. The following stages are observed-

1. Raw Material Storage Period

2. WIP Period

3. Finished Goods Storage Period

4. Receivable Collection Period

Remarks– from the above, it is clear that the Operating Cycle is of 2 kinds and they are Operating Cycle for Manufacturing Firm and Operating Cycle for Trading Firm.

–

–

Please consider the revised ratio that is 0.814 for situation 1 and 1.34 for situation 3. Thanks for ur valuable review for such correction.

Sir, some confusion in chapter i. how to calculate current ratio is -4.38 and 3,94 , it is not clear please ….my cell N0 9674719780