GST has just completed two years. An area that concerns me is that we have huge pending litigations from pre-GST regime. More than Rs.3.75 lakh crore is blocked in litigations in service tax and excise. There is a need to unload this baggage and allow business to move on. I, therefore, propose, a Legacy Dispute Resolution Scheme that will allow quick closure of these litigations. I would urge the trade and business to avail this opportunity and be free from legacy litigations.

Finance MInister – Nirmala Sitharaman

Introduction

The Sabka Vishwas (Legacy Dispute Resolution) Scheme is a one time measure for liquidation of past disputes of Central Excise and Service Tax as well as to ensure disclosure of unpaid taxes by a person eligible to make a declaration. The Scheme shall be enforced by the Central Government from a date to be notified. It provides that eligible persons shall declare the tax dues and pay the same in accordance with the provisions of the Scheme. It further provides for certain immunities including penalty, interest or any other proceedings under the Central Excise Act, 1944 or Chapter V of the Finance Act, 1944 to those persons who pay the declared tax dues.

Objectives of the scheme

♦ To encourage voluntary disclosure of past disputes of Central Excise, Service Tax and 26 other Indirect Tax Enactments.

♦ To facilitate an eligible person to declare the unpaid tax dues and pay the same in accordance with the provisions of this scheme.

♦ To provide certain immunities, including Penalty, Interest or any other proceedings including prosecution, to eligible persons who pay the declared tax dues.

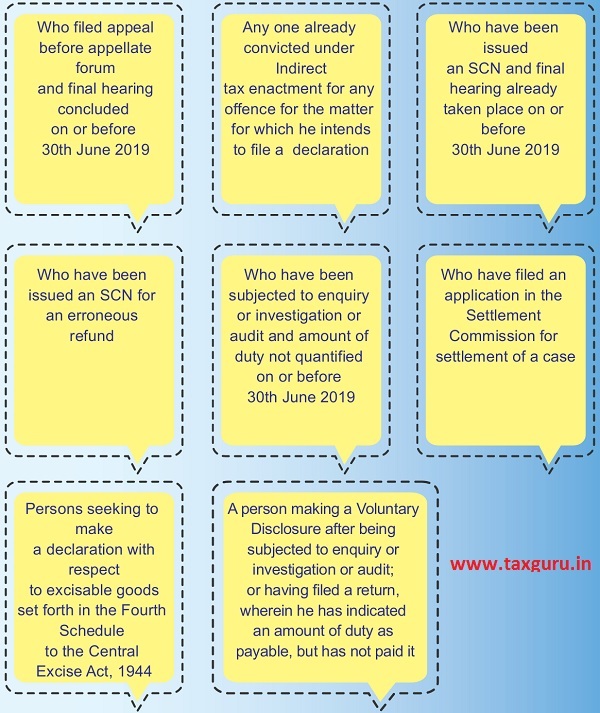

Who is not eligible to make a declaration under the scheme?

Relief available under this scheme

–

–

–

Remarks

Taxpayer cannot make a voluntary disclosure under this scheme after an enquiry or investigation or audit or for an amount declared as payable in a return filed consequent to such proceedings but not paid.

Designated Committee and its role

Restrictions of the Scheme

Once Discharge Certificate Issued

♦ Declarant not liable to pay any further duty, interest or penalty with respect to matter and time period covered.

♦ Case shall not be reopened in any other proceeding under Indirect enactment.

♦ If False declaration is made in voluntary disclosure, proceedings applicable laws shall be started within a time limit of one year.

If you require further information and assistance on this matter or on any other matter concerning GST, please contact: The Goods and Tax (GST) Helpdesk of GST and Central Excise, Chennai Outer located at its Anna Nagar Headquarters office either in person or by calling any these numbers: 26142850, 26142851, 26142852 and 26142853 or by writing to Sevakendra-outer-tn@gov.in

Issued in Public Interest

Office of the Commissioner of GST and Central Excise, Chennai Outer

Newry Towers, No.2054-I, 2nd Avenue, 12th Main Road,

Anna Nagar, Chennai – 600040

Email:gst.chennaiouter@gov.in

The assessee received show cause notice from the service tax department and the hearing is going on before the AO. Whether this case is applicable for the scheme or not?.