OFFICE OF THE COMMISSIONER OF CUSTOMS (NS-III)

MUMBAI ZONE-II, JAWAHARLAL NEHRU CUSTOM HOUSE,

NHAVA SHEVA, TALUKA: URAN, DISTRICT: RAIGAD,

MAHARASHTRA-400707.

No. S/22-Gen-04/2017-18/ AM (I)/JNCH

Dated. 17.05.2018

PUBLIC NOTICE NO. 83/2018

Subject: – Pilot implementation of paperless processing under SWIFT — Uploading of supporting documents regarding –Reg.

Attention of all the Importer, Exporters, Customs Brokers, other stake holders and members of the trade is invited to CBEC Circular No. 40/2017‐Customs, dated 13th October, 2017 (issued from F.No.450/148/2015-Cus.IV) regarding uploading of supporting documents. With the objective of reducing physical interface between Customs, other regulatory agencies and the trade, and to further enhance the speed of clearance of import cargo, a facility to upload digitally signed supporting documents has already been introduced at JNCH. Please refer to Public Notice No 162/2017, dated 29.12.2017 and Public Notice No 54/2018, dated 31.03.2018 issued by JNCH.

2. Under this facility (uploading digitally signed supporting documents), the authorized persons (Customs Brokers/ Importers) are also required to submit all the supporting documents online on ICEGATE after affixing digital signatures. The detailed procedure for uploading the supporting documents has been explained in the Public Notice No 162/2017, dated 29.12.2017.

3. It has been noticed that in certain situation, law provides for submission of Original Certificates / NOCs by Importers e.g. in order to claim benefit of preferential rate of duty, Country of Origin (COO) Certificates are to be produced in Original. Further, there is also a requirement for verifying genuineness of such Certificates by Customs.

4. Para 8 of the Public Notice No 162/2017, dated 29.12.2017 also mentioned that:

8. Some types of supporting documents are required to be presented in original (as specified in the respective notifications) for verification of seal/signature etc., for defacement and for the debit of quantities/value. Trade should present hardcopy at the time of the registration of goods or at a place specified by the Commissioner of Customs. It may however be noted that all supporting documents shall be uploaded digitally, including those documents that must be presented in hardcopy. For supporting documents, where a debit of quantity/value is required to be made on hardcopy, for every subsequent Bill of Entry filed for import, the latest debit sheet shall be uploaded. The authorized person filing the Bill of Entry should pay attention while linking supporting documents with Bills of Entry and should ensure that the correct unique reference numbers (IRNs) are mentioned in the Bills o f Entry.

5. In order to assist the importer to get these Original Certificates / NOCs verified/debited/defaced, etc., it has been decided to create a “Central Original Document Verification Cell” at JNCH. [ All such Certificates / NOCs required to be verified or debited and submitted in Original are being referred to as “Certificates” in this Public Notice.]

6. It has already been provided that in case the authorized person seeks to provide a document after the generation of the Bill of Entry number, he/she may first upload the document on ICEGATE, obtain a unique ID Image Reference number )IRN( for the document and link that document with the corresponding Bill of Entry by submitting an amendment at the Service Center. This procedure also applies when the authorized person submits a document in response to a query raised by Customs for a Bill of Entry. For the purpose of verification and uploading of said “Certificates”, similar procedure is to be adopted.

7. Following procedure is required to be followed for verification, uploading and tagging these documents so that there is no need to produce / submit these original documents (e.g. Certificate of Origin, PSIC, Exemption Certificate, conformity certificate, BIS Certificate, RCMC, etc.) at the time of “verification of self-assessment” or “registration” or “Out of Charge”.

i. Importer or authorized representative or Customs Broker will approach “Central Original Document Verification Cell” alongwith original copy of such “Certificates”.

ii. Appraising Officer / superintendent at “Central Original Document Verification Cell” will check genuineness / authenticity of such “Certificates” as per standard procedure (i.e. checking /matching signature from “authenticated signature list” or “online” or any other mode, as prescribed from time to time) and debit/deface such “certificates”. Thereafter, the said certificate will be handed over to the Importer or authorized representative or Customs Broker;

iii. Importer or authorized representative or Customs Broker will upload the said verified/debited/defaced “certificates” on ICEGATE and obtain a unique ID Image Reference number (IRN).

iv. Using the above mentioned IRN, the Customs Broker will link that document with the corresponding Bill of Entry by submitting an amendment at the Service Center (by following the same procedure as applicable for uploading a document after the generation of the Bill of Entry number).

8. “Central Original Document Verification Cell” will function from Room No 701, C Wing, 7th Floor of JNCH with effect from 01.06.2018.

9. To facilitate smooth functioning of this facility of uploading the supporting documents, the feedback, queries/difficulties, in implementation of this Public Notice, if any, shall be brought to the notice of the undersigned or may be addressed to the Deputy Commissioner of Customs (EDI), JNCH, Nhava Sheva by email to edi@jawaharcustoms.gov.in or Deputy/Assistant Commissioner in charge of Appraising Main (Import), NS-III (email address: appraisingmain.jnch@gov.in )

10. Action to be taken in terms of decisions taken in this Public Notice should be considered as standing order for the purpose of officers and staff.

Sd/-

(SUBHASH AGRAWAL)

Commissioner of Customs (NS-III).

Enclosed:

1. Step-by-step procedure for upload of supporting documents (also available on the ICEGATE website)

2. Frequently asked questions and their answers (also available on the ICEGATE website)

Copy to (through email):

1. The Chief Commissioner of Customs, Mumbai Zone-II, JNCH.

2. The Commissioner of Customs, NS-G/ NS-I/ NS-II / NS-IV / NS-V, JNCH.

3. All Additional / Joint Commissioners of Customs, JNCH.

4. All Deputy / Assistant Commissioner of Customs, JNCH.

5. All Sections / Groups of NS-G, NS-I, NS-II / NS-III/ NS-IV / NS-V, JNCH.

6. Representative of BCBA / FIEO for information and circulation among their members for information.

7. AC/DC, EDI for uploading on JNCH website immediately

e-SANCHIT

e-SANCHIT: Frequently Asked Questions

Question: Who can login e-SANCHIT application?

Answer: Only ICEGATE registered users can use e-SANCHIT applications by accessing the e-SANCHIT link.

Question: How can I upload a document?

Answer: Any registered ICEGATE user can upload documents using below steps.

I. Login into ICEGATE website using login credentials.

II. Access the e-SANCHIT application by clicking on e-SANCHIT link provided in menu options.

III. Upload document by clicking on Upload Documents button.

IV. Validate the document for digital signature.

V. Submit the document by clicking proper document type from document type drop down and click on the submit button.

Question: I am not able to submit the document using Submit Document button?

Answer: Once the document is uploaded, document type is selected and digital signature is verified then only the submit button will be visible.

Question: Am I able to upload documents in any format in any size.

Answer: Only PDF format is accepted in e-SANCHIT application having size lesser than 1 MB.

Question: Am I able to upload any no. of documents at a time?

Answer: No, you can upload maximum 5 documents at a time.

Question: What is the maximum file size that can be uploaded?

Answer: Maximum acceptable file size is 1 MB only.

Question: Will I be able to upload documents having same name?

Answer: No, as per business requirement, all documents to be uploaded must have different name. Uploader should provide meaningful file names to documents so that they can recognize and handle the file more effectively.

Question: How can I attach my digital signature with documents to be uploaded?

Answer: On ICEGATE website, a utility is provided in which user can attached DSC to their document. The web utility is publically available and free. It can be accessed via below link (https://www.icegate.gov.in/digitalSign/digitalSign.html)

Question: Can I use the same DSC for signing documents to be upload on e-SANCHIT which I am using for signing BE and SB documents?

Answer: Yes, the same DSC that is used for signing BE and SB documents can also be used for signing the document for e-SANCHIT.

Question: How can I delete the documents once uploaded?

Answer: Once the document is uploaded then you can see the delete link for each document at same page. However, once document is submitted and an IRN/ DRN are generated, it cannot be removed from the systems. Trade must ensure that its reference is not used in any Bill of Entry/ Shipping Bill.

Question: How to view the uploaded document before submission?

Answer: Once the document is uploaded then you can see the view link for each document at same page.

Question: Can I get any confirmation for document upload?

Answer: Yes, an email/ message are triggered immediately on your registered email once the document is submitted in e-SANCHIT application.

Question: How can I search a document that I have uploaded earlier?

Answer: Search functionality is provided in right side of e-SANCHIT, you can search any document uploaded by using the IRN, DRN, Supporting document types and between a date range.

Question: Will I be able to see other user’s documents?

Answer: No, you can able to view the documents uploaded by logged in user only. Question: What is IRN & DRN?

Answer: DRN stands for Document reference number, which is the unique reference to a batch of uploaded documents. Five IRN numbers can have one DRN. IRN stands for Image reference number, which is unique to each document. A group of IRN should be entered into the Bill of Entry, not DRN.

Question: What are the other ways to access e-SANCHIT application? Answer: You can access e-SANCHIT application via ICEGATE website only.

Question: What are the reasons for invalid digital signature?

Answer: You signature not registered on ICEGATE website or you have not signed the document which you are trying to upload.

Question: What can I do if the document format is not pdf?

Answer: Only PDF documents are supported on e-SANCHIT application, you can contact the document issuer for the proper pdf format or the document may be printed and scanned into a PDF.

Question: What are the mandatory documents that need to be submitted online?

Answer: The list of mandatory documents for export/ import of goods from/ into India have already been notified by DGFT notification No. 08/2015-2020 dated 4th June 2015 i.e.

- Bill of Lading / Airway Bill

- Commercial Invoice

- Packing List / or Commercial Invoice cum Packing List.

- Bill of Entry.

Other documents depending on the commodity imported, notification claimed and Participating Government Agency (PGA) requirement. The Compulsory Compliance Requirements provide an outline of the Supporting documents required for a CTH.

Question: Can one document contain multiple pages?

Answer: Yes, there is not any restriction for page count however the file size should not exceed 1 MB.

Question: How to map Import / Export flat file, with IRN received after uploading documents in e-SANCHIT?

Answer: An option is already there to provide IRN number in RES packages. Please refer to field 14 of the <TABLE> SUPPORTINGDOCS in the Bill of Entry message format. You can provide the IRN received while filling job in RES packages and submit the flat file generated as usual.

eSANCHIT – Step-by-Step Procedure for electronic document upload

The following steps are the step by step procedures involved in uploading of the supporting documents:

Step 1: Prepare Supporting Documents in digital format

Before uploading the document, the importer, exporter, Customs broker (referred to hereinafter as ‘submitter’) may ensure that the document is rendered into a PDF/A format (ISO 19005-2). The submitter may choose from among the following courses of action:

(a) The submitter may obtain the document in a PDF/A format (ISO 19005-2) directly from the document issuer. For example, the submitter may ask the document issuer (seller, exporter, airlines, shipping lines, regulatory authority etc) to render their documents in the PDF at source and deliver them to the submitter electronically, instead of sending a facsimile or a scanned image of the document. This should be possible if the document issuer uses computers to generate documents.

(b) In case the document issuer does not use automated systems/computers or for some other reason, it is not possible to generate PDF copies at source, and the submitter receives the documents in hardcopy or as a facsimile, the submitter may scan the document into a PDF format. In scanning the document, the following qualitative aspects may be kept in mind:

(i) The resolution should not be less than 200 dpi in black and white

(ii) The file size should not be more than 75 kb/ A4 size page.

(iii) Ideally,one document (eg and invoice or a packing list) shall be rendered into one pdf file regardless of the number of pages in the document. Given that the maximum permissible file-size is 1 MB, this would allow the submitter to upload a supporting document which is up to 13 pages long. If a supporting document is more than 1MB in volume, then it should be split and uploaded as two or more documents.

(iv) No stapler marks or punch-hole marks on the document should be visible. If stapler marks or punch-hole marks are unavoidable, the submitter shall ensure that these marks are on the margins and are at a clear distance away from the content in the document.

(v) While scanning the document, it must be ensured that the document was not placed in the scanner with a fold. For scanners with a roller feed, it should be ensured that there are no folds in the image as result of the action of the rollers.

(vi) The content in the document should not be skewed in any direction.

(vii) There should be no dark patches either in the source document or in the image.

(viii) The letters should not be elongated or compressed (as it happens during facsimile transmission).

(ix) If a document is stapled or bound in some way, before scanning, the individual pages should be are taken apart and then fed into the scanner sequentially in pages.

(ii) Whether the submitter renders supporting documents into pdf using either using ii.(a) or ii(b) above, he/she must preview the document in order to ensure that the document is clear and legible. In order to ensure that the document is legible and of proper quality, the submitter may also use automatic image quality assessment tools.

(iii) The submitter should digitally sign the PDF document using the digital signature certificate registered on ICEGATE. In doing so, the submitter acknowledges that the document is legible and authentic. Taking note of the content and the context of the supporting document, the submitter should save the file with a distinct name and save the file in a location that is readily accessed. It is advisable for the submitter to link this information to his own electronic system of records (RES package), which used to prepare the electronic files for submission to ICEGATE.

Step 2: ICEGATE Login

Only those who are registered on ICEGATE along with a digital signature certificate can upload supporting documents in electronic format.

Step 3: Click on eSANCHIT

Thereafter, the submitter should click on the link https://icegate.gov.in/dms. on ICEGATE. This link will take the submitter to a web page where the documents can be uploaded. Kindly note that without logging in, a user will not be allowed to access e-Sanchit.

Thereafter, the submitter should click on the link https://icegate.gov.in/dms. on ICEGATE. This link will take the submitter to a web page where the documents can be uploaded. Kindly note that without logging in, a user will not be allowed to access e-Sanchit.

Step 4: Click on the Upload Document Button.

At a time, the user can upload a batch of 5 documents.

At a time, the user can upload a batch of 5 documents.

At a time, the user can upload a batch of 5 documents.

If the document fails to meet the restriction on document size and type, the system will display appropriate comments instantly against each file indicating the exact error.

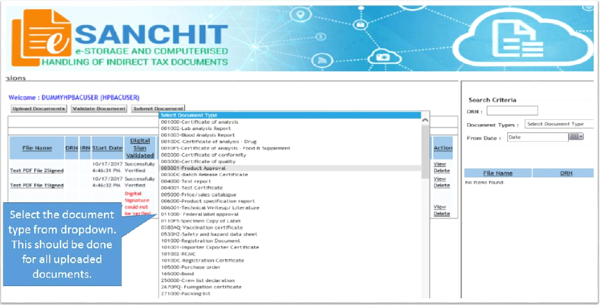

Step 5: Using the dropdown, select the document type you wish to upload.

Make sure that the document is in pdf and should be digitally signed by the same user who has logged in.

Once the documents are uploaded, the system will prompt the user to select the document type from a dropdown list. This list is also published on ICEGATE as part of the ‘Single Window Code-map Directory’.

Step 6: For each document, click Validate Document button to validate the digital signature.

The user must verify the file in respect of digital signature affixed on it by pressing the ‘validate’ button on the screen. Without completing the validation, the document will not be ready for the next action i.e., “Submit Document”

The user must verify the file in respect of digital signature affixed on it by pressing the ‘validate’ button on the screen. Without completing the validation, the document will not be ready for the next action i.e., “Submit Document”

Step 7 Click “submit document” button to submit up to 5 documents The submitter should click the submit document button.

If the document fails to meet the restriction on document size and type, the system will display appropriate comments instantly against each file indicating the exact error. The submitter should rectify the error and upload the file again.

If the file upload is successful, the system will generate a unique number called IRN, which will be displayed on the web-page and also transmitted to the user as a structured message from ICEGATE. The submitter may incorporate the data including the filename and the unique number in his system of records (eg RES package). ICEGATE users can also view the documents uploaded by them.

Step 8: Press OK to acknowledge the disclaimer

Result 1: System will generate the IRN and DRN, which can be viewed online.

Result 2: System will also generate a structured flat file containing IRN and DRN, which can be integrated into RES package

Result 2: System will also generate a structured flat file containing IRN and DRN, which can be integrated into RES package

Step 9: Using uploaded documents in Bills of Entry / Shipping Bills

Step 9: Using uploaded documents in Bills of Entry / Shipping Bills

The submitter should upload all the required supporting documents as per procedure described above in relation to a transaction e.g. a Bill of Entry or a Shipping Bill. The list of mandatory documents for export/ import of goods from/ into India have already been notified by DGFT notification No. 08/2015-2020 dated 4th June 2015 i.e.

- Bill of Lading / Airway Bill

- Commercial Invoice

- Packing List / OR as per CBEC Circular No. 01/15-Customs dated 12/01/2015. Commercial Invoice cum Packing List would also be accepted.

Other than above, supporting documents to be uploaded will depend on the commodity imported, notification claimed and Participating Government Agency (PGA) requirement. The Compulsory Compliance Requirements provide information on the Supporting documents required for different items in the Bill of Entry, which may be viewed online.

These uploaded documents may be linked to the corresponding Bill of Entry or the Shipping Bill by filling out the mandatory details in the the appropriate section in the electronic format in the Bill of Entry or Shipping Bill in the separate section titled <Table> Supporting Docs. The following fields are required to be filed in the <Table> Supporting Docs of the Integrated Declaration:

- Invoice serial number and Item sr. no: If the supporting document pertains to all items in an invoice, then the invoice and item no. will both be indicated as “0”. But if an invoice and item pertains to a particular item, then the invoice serial number and item serial number may be indicated.

- Unique Number – For this use the IRN (Image Reference Number): The Customs Broker/Importer receives this unique number when he digitally signs a digital copy of a document in pdf format (scanned from hardcopy or otherwise rendered into pdf) and submits the supporting document to ICEGATE. This will be auto-generated by when ICEGATE completes the upload process.

- Document type code: All supporting documents which are submitted by Customs Broker / importer have a document type. Use the appropriate code for the document type code for the document referenced by the unique number. Directory is already provided on ICEGATE website under Single Window tab.

- Document issuing party code: Optional field. Presently, this field is not validated.

- Document issuing party name and address: Name and address of the party that has issued the document.

- Document reference number: This is the actual number of the document use by the document issuer.

- If the supporting document is a license, then the Document Referene Number would be the License Number.

- If the supporting document is a Permit, then please enter the Permit Number in this field.

- If the supporting document is a Certificate – eg Certificate of Analysis or Certificate of Origin, please enter the Certificate Number.

- If it the supporting document is the invoice or Bill of Lading, this number, please use the same number that was quoted elsewhere in the Bill of Entry.

- This Number is not to be confused with the DRN, which is received from ICEGATE in response to the uploading of a document.

- Place of issue: Name of the city/town where the Document was issued.

- Document issue date. This is the document date – for example, if the document is a Certificate, please mention the date of issue of the Certificate

- Document expiry date.- In case, the document has an validity date, please mention that date. In case there is no validity or expiry mentioned in the document, you may leave this field blank.

- Document beneficiary party name and address: Name and address of the party in whose name document is issued. Usually the document is issued in the name of importer. However, if the document is issued in the name of a party other than importer, name and address of that party needs to be mentioned.

- Document beneficiary party code: If the document type is a registration, license, certificate or a permit, indicate the IE Code of the party which is shown as the beneficiary of this document.

Once the Bill of Entry is submitted into the system, Customs Officers or officers of Participating Government Agencies who wish to view the Bill of entry or Shipping Bill along with the supporting documents, can do so using appropriate screens in the Indian Customs EDI System.

Please note that the above data fields, some of which are optional, are crucial for the PGAs. If the importer/Broker keeps these data fields blank, they may be asked by the PGAs to provide this data into the Table through an amendment. In particular, please take note of the requirements specified in the following table where data from application forms of PGAs will be obtained in the <Table>Supporting Document of the Integrated Declaration in the following manner:

| S.No. | PGA Form Name | Filed Name in the Agency Form | Field Name in <Table>Supporting Document |

| “ADC Sheet for import of Drugs” by Drug Controller |

|

14, 15 & 22 | |

| 2 | “ADC Sheet for import of Drugs” by Drug Controller |

|

25 |

| 3 | “Application for import of Livestock and Livestock products” & by AQCS |

|

14, 15 & 22 |

| 4 | “Application for import of Pet Animals, Aquatic/ Other Animals, Birds & Poultry (Chicks)” by AQCS |

|

14, 15 & 22 |

| 5 | “Application for Pre/ Post Shipment Examination” by WCCB |

|

14, 15 & 22 |

| 6 | “Form PQ 15 – Application for quarantine inspection and clearance of Imported Plants/ Plant Products and (Others) Cargo” by PQIS |

|

14, 15 & 22 |

| 7 | “Form PQ 15 – Application for quarantine inspection and clearance of Imported Plants/ Plant Products and (Others) Cargo” by PQIS |

|

24 |

| 8. | “Import NOC application” by FSSAI |

|

14, 15 & 22 |