Summary: The Ministry of Corporate Affairs (MCA) issued a notification on 27th October 2023, mandating all Section 8 companies to dematerialize their existing securities by 30th September 2024, as part of the Companies (Prospectus and Allotment of Securities) Second Amendment Rules, 2023. Section 8 companies, which are non-profit organizations, must ensure that any new issuance or transfer of securities occurs in dematerialized form. While companies limited by guarantee are exempt, those with share capital must comply with the new provisions. Companies have 18 months, starting from March 2023, to convert their shares into demat form and obtain an International Security Identification Number (ISIN). Failure to comply could result in penalties under Section 450 of the Companies Act, 2013. Additionally, Section 8 companies are required to file Form PAS-6 within 60 days after each half-year period, detailing their share capital and dematerialization status, certified by a company secretary or chartered accountant. This new requirement, which builds on the earlier mandate for public companies to maintain shares in dematerialized form, aims to improve transparency, governance, and investor protection within Section 8 companies, ensuring smoother transferability of shares.

MCA has given 18 months’ time to Section 8 Company w.e.f. 31 March 2023 to 30 September 2024 for compliance of provision of these rules.

1. Que: Whether a Section 8 company with share capital is also covered under the Present Amendment?

Yes. Section 8 companies will get covered under the Present Amendment irrespective of the quantum of share capital.

2. Que: Whether a Section 8 company limited by guarantee is also covered under the Present Amendment?

No. As there is no share capital in case of a Section 8 company limited by guarantee, the Present Amendment will not apply

3. Que: If a Section 8 Company Incorporated after 31st March 2023. Whether Demat provisions will be applicable on that Company or if applicable, within how many days of incorporation company have to comply with the same?

Any Section 8 Company incorporated after 31st March 2023 required to comply with provisions of Demat within 18 months from the date of Incorporation.

Provisions of Companies Act, 2013:

- Section 29 of Companies Act, 2013

- Rule 9B of the Companies (Prospectus and Allotment of Securities) Second Amendment Rules, 2023

- Form PAS 6

A. NON-APPLICABILITY:

The provision of Demat of Securities shall not be applicable on the following Companies:

1. Section 8 Company, Limited by Guarantee

2. Nidhi Company

3. Government Company

4. Wholly Owned Subsidiary Company of Public Company

5. Small Private Limited Companies

B. APPLICABILITY:

1. All Section 8 Company Limited by Share Capital (Public or Private)

2. Applicable on Public Limited Companies w.e.f.02nd October, 2018

3. Applicable to Non-Small Private Limited Companies w.e.f. 30th September 2024.

Meaning of Section 8 Company:

Under sub-section (1) of this section a person or an association of persons proposed to be registered under this Act as a limited company must—

1. Have in its objects the promotion of commerce, art, science, sports, education, research, social welfare, religion, charity, protection of environment or any such other object

2. Intend to apply its profits, if any, or other income in promoting its objects; and

3. Intend to prohibit the payment of any dividend to its members.

d) Important Features of Section 8 Companies:

A Section 8 company comprises of the following distinct features that most other kinds of companies do not have:

i. Charitable objectives: Section 8 companies do not aim to make profits. Their objectives are purely charitable in nature. They aim to further causes like science, culture, research, sports, religion, etc.

ii. No minimum share capital: Section 8 companies, unlike all other companies, do not require a prescribed minimum paid-up share capital.

iii. Limited liability: Members of these companies can only have limited liability. Their liabilities cannot be unlimited in any case.

iv. Government license: Such companies can function only if they have the Central Government’s license. The Government can revoke this license as well.

v. Privileges: Since these companies possess charitable objectives, the Companies Act has accorded several benefits and exemptions to them.

vi. Firms as members: Apart from individuals and associations of persons, Section 8 also allows firms to be members of these companies

INTRODUCTION

MCA has added Rule 9B after Rule 9 to Companies (Prospectus and Allotment of Securities) Rules, 2014. As per the amendment,

Every Section 8 Company with effect from 30 September 2024 shall-

- Issue its securities only in dematerialized form; and

- Ensure dematerialization of all its existing securities

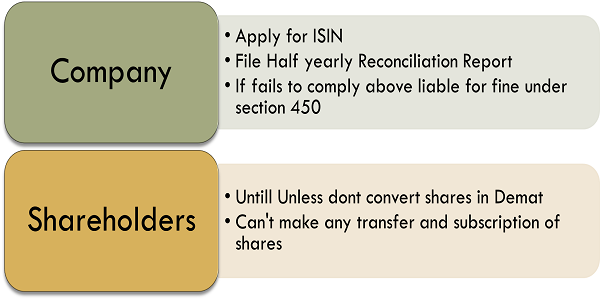

A. Major Impact of Dematerialization on Company:

I. After 30.09.2024, Section 8 Company has to ensure that entire holding of securities of its Promoters, Directors, Key Managerial personnel is in dematerialized Form, otherwise company shall not be able to do followings:

a) Issue of securities.

b) Buy-back of securities.

c) Issue of bonus shares; and

d) Rights issue

II. From 30.09.2024, all new issue of securities or transfer of securities shall be only in Dematerialize form for Section 8 Companies.

B. Impact on Security Holders (Transfer / subscription of Securities):

As per Sub Rule 4 of Rule 9B of the amendment specifies that, every holder of Securities

i. who intends to transfer securities on or after 30 September 2024 shall get such securities dematerialized before the transfer; or

ii. who intends to subscribe to any securities of the concerned Section 8 Company has to make sure that all their existing Securities are held in dematerialized form before such transfer or subscription to the Securities.

A. PROCESS OF COMPLIANCES:

FIRST STEP:

As per Rule 9B every holder of security of Section 8 Company can transfer its shares on or after 30th September 2024 only in Demat Form. For conversion of shares into Demat shareholders require ISIN No. of Company.

As per Companies Act, 2013 Rule 9B it is the responsibility of company to give opportunity to its shareholders to convert their shares into Demat. Therefore, all the Section 8 Companies required applying for ISIN on or before 30th September 2024.

Even as per Rule 9B(5) and Rule 9A(4) Every Section 8 Company shall facilitate dematerialization of all its existing securities by making necessary application to a depository as defined in clause (e) of sub-section (1) of section 2 of the Depositories Act, 1996 and shall secure International security Identification Number (ISIN) for each type of security and shall in-form all its existing security holders about such facility.

One can opine that:

It is mandatory for all Section 8 Companies to apply for ISIN no. to comply with provisions of Rule 9B. Irrespective of the fact whether shareholders want to transfer their shares or not. It is the responsibility of the Company to facilitate dematerialization to shareholders.

Que: If a Section 8 company applied for ISIN after 30 September 2024, shall it be considered as noncompliance?

The due date for the application of ISIN was 30 September 2024. If any company applied for the same after that, it shall be considered noncompliant, and the company is liable for the penalty u/s 450.

Consequences:

As there is no penalty/ fine prescribed under rule 9B therefore, as per section 450 of Companies Act, if no penalty/ fine prescribed in any Rule or Section then penalty / fine shall be as per Section 450 i.e.

The COMPANY and EVERY OFFICER of the company who is in default or such other person shall be punishable with fine which may extend to ten thousand rupees, and where the contravention is continuing one, with a further fine which may extend to one thousand rupees for every day after the first during which the contravention continues.

SECOND STEP:

As per the first step it is concluded that it is mandatory for Section 8 Company to apply for ISIN. In second step what are the compliances on Section 8 Company after allocation of ISIN:

As per Rule 9A (8) Every Section 8 Company governed by this rule shall submit Form PAS-6 to the Registrar with such fee as provided in Companies (Registration Offices and Fees) Rules,2014 within sixty days from the conclusion of each half year duly certified by a company secretary in practice or chartered accountant in practice.

One can opine that:

Every Non-Small Private Limited Company mandatorily required to file Reconciliation of Share Capital Audit Report with Roc within 60 days of end of half year.

Que: What is the Due Date of filing PAS 6?

The due date of filing of PAS 6 is:

– 30 May for half year ended 31st March

– 20 November for half year ended 30th November

Que: Will the Section 8 Company be required to file form PAS-6 for half year ending September 2024?

The provisions of the Present Amendment are applicable after 18 months from the closure of FY 22-23 i.e., from October 01, 2024 and therefore the companies will be required to file form PAS-6 for the half year beginning from October 2024 and therefore the first PAS-6 shall be filed for half year ended March 2025.

Que: If all the shareholders have not converted their shares in Demat, whether, Company is required to file PAS 6?

In Reconciliation of Share Capital Audit Report i.e. PAS 6, Company have to give details of Shares in Physical as well as shares in Demat. Therefore, even if shareholders have not converted their shares into Demat the company is required to file PAS-6.

Consequences:

As there is no penalty/ fine prescribed under rule 9B therefore, as per section 450 of Companies Act, if no penalty/ fine prescribed in any Rule or Section then penalty / fine shall be as per Section 450 i.e.

The COMPANY and EVERY OFFICER of the company who is in default or such other person shall be punishable with fine which may extend to ten thousand rupees, and where the contravention is continuing one, with a further fine which may extend to one thousand rupees for every day after the first during which the contravention continues.

THIRD STEP:

In third step further compliances on Section Company after allocation of ISIN:

A. Make timely payment of Fees (admission as well as annual).

B. Maintenance of Security deposit of 2 years’ Fees, as per agreement executed with the followings:

- Depository;

- Registrar to an issue;

- Share Transfer Agent

MOST IMPORTANT QUESTION – IMPACTS

Therefore, one can opine that

- In case Company fails to apply for ISIN or fails to file half yearly audit company is liable for consequences under Section 450.

- If shareholders fails to convert shares in Demat they are liable for consequences i.e. not able to transfer of shares not able to subscribe shares.

B. PROCESS OF COMPLIANCES:

Most Important: Every Section 8 Company shall submit Form PAS-6 to the Registrar with such fee as provided in Companies (Registration Offices and Fees) Rules, 2014 within sixty days from the conclusion of each half year duly certified by a company secretary in practice or chartered accountant in practice.

Key Highlight of E-Form PAS-6:

1. All information shall be furnished for the half year ended 30th September and 31st March in every half financial year for each ISIN separately

2. Mention ISIN of the Company

3. Detail of capital of company:

> Issued Capital

> Held in dematerialised form in CDSL

> Held in dematerialised form in NSDL

> Held in Physical form

> Reason for any difference in Issued & Total Capital

4. Details of changes in share capital during the half-year under consideration.

5. Detail regarding Updation of Register of Members and reason for non updation.

6. Whether there were dematerialised shares in excess in the previous half-yearly period and whether company resolved the matter mentioned in point no. 10 above in the Current half-year

7. Mention the total no. of demat requests, if any, confirmed after 21 days and the total no. of demat requests pending beyond 21 days with the reasons for delay.

8. Details of Company Secretary of the Company, if any.

9. Details of CA/CS certifying this form.

10. No penalty is prescribed for non-compliance than in this case Section 450 of Companies Act, 2013 shall become applicable.

Whether the private companies covered under Rule 9B will be required to maintain a register of members?

No. In terms of Section 88 (3) of the Act, the register and index of beneficial owners maintained by a depository under section 11 of the Depositories Act, 1996 (22 of 1996), will be deemed to be the corresponding register and index for the purposes of the Act.

****

Author – CS Divesh Goyal, GOYAL DIVESH & ASSOCIATES Company Secretary in Practice from Delhi and can be contacted at csdiveshgoyal@gmail.com).