Majorly covered Charges, Deposit and Directors KYC

SHORT SUMMARY:

As per Important Update Collum of MCA website has issued one information on 15th July, 2022 i.e.

In our continuous endeavour to serve you better, the Ministry of Corporate Affairs is launching first set of Company Forms on MCA21 V3 portal. These forms will be launched on 31st Aug 2022 at 12:00 AM. Following forms will be rolled-out in this phase: DIR3-KYC Web, DIR3-KYC Eform, DPT-3, DPT-4, CHG-1, CHG-4, CHG-6, CHG-8 & CHG-9. To facilitate implementation of these forms in V3 MCA21 portal, stakeholders are advised to note the following points: (1).Company e-Filings on V2 portal will be disabled from 15th Aug 2022 12:00 AM for the above 9 forms. All stakeholders are advised to ensure that there are no SRNs in pending payment and Resubmission status. (2).Offline payments for the above 9 forms in V2 using Pay later option would be stopped from 07th Aug 2022 12:00 AM. You are requested to make payments for these forms in V2 through online mode (Credit/Debit Card and Net Banking).

[1]As per this information, MCA is Coming with V-3 portal for Nine (9) forms of Companies Act as mentioned above w.e.f. 31st August 2022.

Also Read: Companies to take daily backup of Books of Account: MCA

As this is coming first time under Companies Act, 2013. Therefore, professionals having lot of questions and queries in their mind. In this editorial author shall try to elaborate and deliberate on such queries.

IMPORTANT POINT FOR DISCUSSION:

I. Filling Process w.e.f. 31st August 2022: –

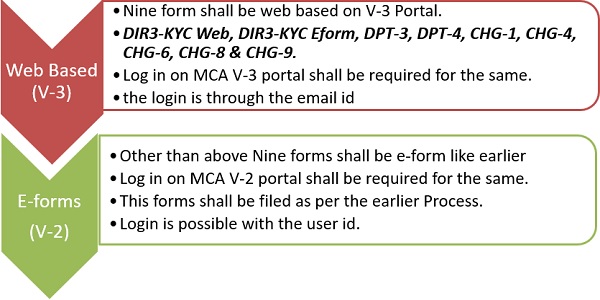

As MCA Company forms shall be divided into Two Parts. V_2 and V-3 Portal.

II. How to File Web Based form on V-3 Portal-

Situation 1: If you are an already existing LLP user of V3, same user id/password can be used to login for filing V3 Company forms. No need to create a fresh login id for accessing V3 Company forms

Situation 2: If you are existing Business user of V2, please use the same user id/password and click on button ‘Login for V3 filing

Situation 3: If you are existing Registered user of V2, please use the same user id/password and click on button ‘Login for V3 filings’ for the first time. Now upgrade your profile to Business user in V3 and then start filing V3 Company forms.

III. How to File e- form on V-2 Portal-

Use the same old process for filing of remaining forms on MCA V-2 Portal.

MOST IMPORTANT POINTS:

A. All the forms of Company V-3 Portal except DIR-3 KYC shall be file only on Business User Account only.

B. All the Forms shall be Web Based Forms.

C. Once CHG-8 filed by the Company to RD. Automatic the intimation shall be send to ROC. Therefore, no need to file GNL-2 form for the same.

D. Cost imposed by RD on CHG-8 shall be paid through online Link generated on Form Status.

1. If any of above 9 forms are in resubmission in V-2 then whether such form can be resubmitted in V-3?

Yes. Users will be able to resubmit the form in V3 as per the new notified form layouts.

2. Whether all 9 forms can be file through registered user or Business User?

Registered User: DIR-3 KYC can be file through Register User Log in.

Business User: Except DIR-3 KYC other form can be file only through Business User.

Author – CS Divesh Goyal, GOYAL DIVESH & ASSOCIATES Company Secretary in Practice from Delhi and can be contacted at csdiveshgoyal@gmail.com).

[1] “Due to this amendment from 15 August to 31 August above mentioned 9 forms are not available for filing.”