THE INSTITUTE OF COST ACCOUNTANTS OF INDIA

COST AUDITING AND ASSURANCE

STANDARDS BOARD (CAASB)

Presentation on Standard on Cost Auditing Cost Audit Documentation (SCA 102)

How Standards on Cost Auditing are formulated?

- Standards are issued by the Cost Auditing & Assurance Standards Board under the authority of the Council of the Institute of Cost Accountants of India.

- As per Section 148(3) of the Companies Act 2013, the auditor conducting the cost audit is required to comply with the “cost auditing standards”.

- While formulating standards, the CAASB takes into consideration the applicable laws, usage and business environment prevailing in India, relevant provisions of Cost and Works Accountants Act, Rules and Regulations, Code of Professional Ethics, Cost Accounting Standards and other Statements issued by the Institute.

- The Standards issued by the CAASB are aligned, to the extent possible, with other recognised Standards issued in India and prevailing International Practices. If a particular standard or any part thereof is inconsistent with a law, the provisions of the said law shall prevail.

Also Read-

Presentations on Standards on Cost Auditing: SCA 101

Presentations on Standards on Cost Auditing: SCA 103

Presentations on Standards on Cost Auditing: SCA 104

Authority of CAAS Board

The Board is authorized to issue following literatures:

- Standards on Quality Control

- Standards on Cost Auditing

- Standards on Review Assignments

- Standards on Assurance Assignments

- Standards on Related Services

- Guidance Notes

- Technical Guides

- Practice Manuals

Structure of Standards on Cost Auditing

| Clauses | Explanation |

| Introduction | Explains subject matter of SCA in brief, and context in which the SCA is set. |

| Objectives | Objectives to be achieved by the cost auditor in complying with the requirements of SCA keeping in mind the interrelationships among other SCAs. |

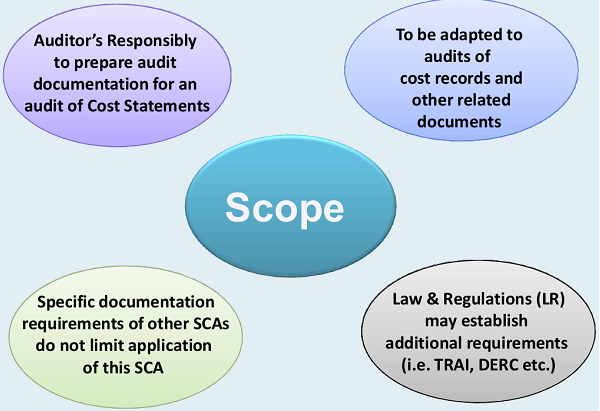

| Scope | Scope and applicability of SCA keeping in view subject matter & specific expectations from cost auditor and others in the context in which the SCAs are set. |

| Definitions | Description of terminology used in SCA. However, no definition can override the meaning defined in law and regulations. |

| Requirements | Outlines the specific requirements of SCA. Requirements containing the word “shall”, is mandatory (Bold Italic) to be complied with, unless stated otherwise The Non Bold Italic part of this section provide further explanation to relevant requirement. |

Structure of Standards on Cost Auditing

| SCA Elements | Comments |

| Application Guidance | Provides further explanation of the requirements and guidance for carrying the requirements set out in the SCA.

Covers background information, addresses meaning of requirements and explains the requirements precisely with examples wherever required. However, the actual procedures selected by the cost auditor require the use of professional judgment based on the particular circumstances of the entity. |

| Effective Date | Date from which the application of the SCA is mandatory. |

| Statement of Modification | SCAs are formulated based on International Standards on Auditing (ISAs) which primarily focus on financial audit. Due to fundamental differences between the scope and methodology of financial and cost audit, “Statement of Modifications” are issued by the Institute containing comparison to International Auditing Standards. |

| Annexure / Appendices | Appendices form part of the application and other explanatory material. The purpose and intended use of an appendix/ annexure are explained in the body of the related SCA, or within the title and introduction of the appendix/ annexure itself. |

Standards on Cost Auditing – Approved by MCA

Standards already approved by the MCA on 10.09.2015 and effective for audit on or after 11.09.2015

- SCA-101 – Planning an Audit of Cost Statement

- SCA-102 – Cost Audit Documentation

- SCA-103 – Overall Objectives of the Independent Cost Auditor and the Conduct of an Audit in Accordance with Standards on Auditing

- SCA-104 – Knowledge of Business, its Processes and Business Environment

Note: As per direction of MCA, Board has developed 15 more Standards, already been sent to MCA for approval.

Standards on Cost Auditing – Approved by Board

- SCA-105 – Agreeing the Terms of Cost Audit Engagements

- SCA-106 – Audit Sampling

- SCA-107 – Audit Evidence

- SCA-108 – Materiality in Planning and Performing Cost Audit

- SCA-109 – Cost Auditor’s Responsibility Relating to Fraud in an Audit of Cost Statements

- SCA-110 – Written Representations

- SCA-111 – Evaluation of Misstatements identified during the Cost Audit

- SCA-112 – Analytical Procedures

- SCA-113 – Using the Work of Internal Auditors

- SCA-114 – Using the Work of Cost Auditor’s Expert

- SCA-115 – Communication with Those Charged with Governance

- SCA-116 – Communicating Deficiencies in Internal Control to those Charged with Governance and Management

- SCA-117 – Identifying and Assessing the Risks of Material Misstatement

- SCA-118 – The Cost Auditor’s Response to the Assessed Risk

- SCA-119 – Related Parties

SCA – 102 Cost Audit Documentation

Documentation is necessary to have proper evidence that the audit was planned and performed in accordance with SCAs and applicable legal & regulatory requirements.

Cost auditor should document all matters, important in providing evidence to support the opinion given in the cost audit report. Documentation means the working papers prepared by and for, or obtained and retained by the cost auditor in connection with cost audit on paper, film, electronic or other media.

The standard prescribes that the cost auditor shall prepare documentation that is sufficient to enable other competent person to understand conformance to audit procedures and SCAs, results of audit procedures, audit evidence and significant matters arising during the audit.

Cost Audit Documentation will usually contain checklist of compliances, audit programs, analysis, audit query list, abstract of significant relevant contracts, letters of confirmation, letter of representation, abstract of entity’s records etc.

SCA – 102 Cost Audit Documentation

Audit Documentation

√ means the records, in physical or electronic form, including working papers.

√ provides principal support for the representations, to assist in planning, performance and supervision of the audit engagement.

√ Fundamental aspect of documentation is preparation or acquisition of working papers during course of cost audit.

√ Objective of working papers is to record the cost audit work from one year to another and it contains the information such as

- Client’s Name

- Type of engagement

- Nature of business

- Internal control system of the client

- Reliance on internal control Measures

- How the knowledge of business was obtained?

- Clarifications obtained from the client.

Importance of Documentation

The auditor may have executed appropriate audit procedures, however, if there is no documentation to prove, it is equal to having not done any work at all. Improper and incomplete documentation, at times, may even put the auditor in embarrassing situations.

Documentation is

√ Considered the backbone of audit,

√ Evidence of record of work performed, explanations given, conclusion arrived at and compliance with standards,

√ Reflection of goods performance in audit,

√ Helpful in planning an audit of cost statements,

√ Helpful in supervision and review,

√ Resulting in better conceptual clarity, clarity of thought and expression,

√ Facilitator of better understanding and helpful in avoiding misconceptions.

Cost Audit documentation serves a number of additional purposes, including the following:

√ Assisting the audit team to plan and perform the cost audit.

√ Assisting members of the audit team responsible for supervision to direct and supervise the cost audit work, and to discharge their review responsibilities.

√ Enabling the audit team to be accountable for its work.

√ Retaining a record of matters of continuing significance to future cost audits.

√ Enabling the conduct of quality control reviews in accordance with the Guidance Manual for Audit Quality issued by Quality Review Board (QRB).

√ Enabling the conduct of external inspections in accordance with applicable legal, regulatory or other requirements.

Content and Form of Audit Documentation

This will depend on a number of factors such as:

√ size and complexity of the operations of the auditee,

√ extent of computerization of cost records,

√ assessed risks of material misstatement of cost,

√ cost audit methodology and tools used. For example whether automated queries were used to get audit evidence from cost records.

√ nature of the audit procedure to be performed.

In particular, it is necessary to document the basis for a conclusion, not readily determinable from other documentation. For example: consumption of materials by a product vis-a-vis technical norms, normal price for a related party transactions.

Significant Matters to be included in Working Papers

Matters that may be documented together in an audit include

√ understanding of the entity and its internal control,

√ overall audit strategy and audit plan,

√ materiality,

√ assessed risks,

√ significant matters noted during the audit and conclusions reached,

√ significance of the evidence obtained to the assertion being tested.

Major Requirements

5.1 Shall record audit procedures performed, relevant audit evidence obtained, and conclusions reached.

Cost Audit Documentation usually contains

1. Checklists for compliance;

2. Audit Programs;

3. Analysis (it relies more on analytical review than on substantive testing to establish true and fair view);

4. Audit query list;

5. Abstract of significant contracts relating to costs and revenues;

6. Letters of confirmation;

7.. Letter of Representation from Management Correspondence (including email) concerning significant matters;

8. Abstract or copies of the entity records.

5.2 Shall Prepare audit documentation that is sufficient to enable another competent person, having no previous connection with the said audit, including person undertaking peer review to understand:

a) Conformance of audit procedures performed with legal and regulatory requirements;

b) Conformance to Cost Auditing Standards; Typical of such evidence are:

- an adequately documented audit plan

- the signed appointment letter from the auditee

- Minutes of discussion with client personnel, with names of members of audit team present, particularly of the audit partner when he is present

- Minutes of audit team discussions, with names of members of audit team present, particularly of the audit partner when he is present.

c) The results of audit procedures performed;

d) The audit evidence obtained;

e) Significant matters arising during the audit, the conclusions reached thereon, and significant professional judgments made in reaching those conclusions.

Matters that give rise to significant risks of a material misstatement are significant matters.

- Revision of the Cost Auditor’s previous assessment of risks of material misstatement.

- Conclusion Reached regarding material misstatement based on the availability of a well documented Bill of Materials but his assessment of risk may undergo a change if he finds that there is considerable use of substitute and alternate materials in the actual production process.

- Matters that cause significant difficulty in applying necessary audit procedures, for example heaps of bulk material in irregular shapes which make volumetric measurement of stock in a physical stock taking unreliable.

- Determining significant matters in an audit to warrant their inclusion in the documentation must be objectively done.

- Conclusions reached and application of professional judgment also needs to be documented.

5.3 Record the discussions of significant matters with client personnel and outsiders.

Minutes of the meeting with Management, discussion with third parties seeking information or confirmation.

5.4 The Cost Auditor shall record any departure from the standard requirement in a Cost Auditing Standard.

Cost Auditor shall document how the alternative audit procedures performed achieve the aim of that requirement, and the reasons for the departure.

5.5 In documenting the nature, timing and extent of audit procedures performed, the Cost Auditor shall record the characteristics of the specific items or matters tested, the persons responsible for performing and reviewing such procedures with relevant dates and extent of review.

[In connection with a Cost Audit these may include

- P. O. for supply of key raw materials,

- GRN for materials,

- Issue notes for materials,

- bills of contractors for supply of contract labour among others.

- Where the Cost Auditor resorts to test checking, the basis used for selection, for example issues of spares above a certain value, and the documents selected]

5.6 Prepare audit documentation on a timely basis.

It helps to enhance the quality of audit. Documentation prepared after the audit work has been performed is likely to be less accurate than the documentation prepared during execution.

5.7 If, in exceptional circumstances, Cost Auditor performs any new or additional audit procedures or draws new conclusions, after the date of Cost Audit Report, then he shall document such circumstances and details of such procedures performed.

Facts which become known to the Cost Auditor after the date of the audit report but which if known earlier would have caused the cost statements to be changed or the Cost Audit Report to be modified should be added to the Cost Audit Documentation. The resulting changes to the audit documentation must also be reviewed as the original documentation.

5.8 Assemble the audit documentation in an audit file.

[should be completed within a reasonable time after the completion of the audit. The cost auditor should not delete or discard audit documentation of any nature before the end of its retention period]

Audit documentation is the property of the Cost Auditor. Unless otherwise specified by law or regulation, he may at his discretion, make portions of, or extracts from audit documentation available to clients

Audit Documentation should be retained for at least ten years.

Note :-Section 128(5) of the Companies Act 2013 provides a period of not less than eight financial years immediately preceding a financial year, or where the company had been in existence for a period less than eight years.

Source- http://www.icmai.in/upload/CAASB/SCA-102.pdf