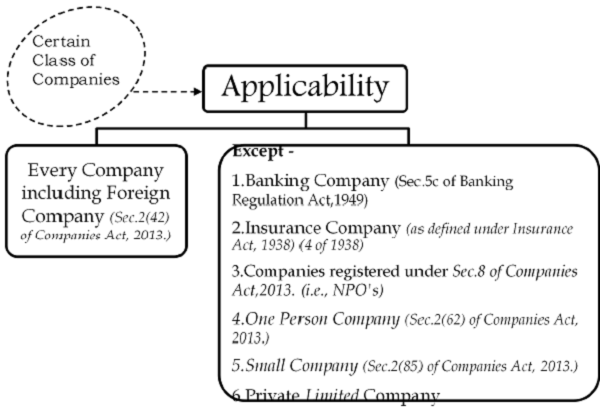

The MCA has issued the Companies (Auditor’s Report) Order, 2016 (CARO, 2016) which is applicable for audits of financial statements for periods beginning on or after April 1, 2015. The CARO 2016 contains several new/modified reporting requirements vis-a-vis the CARO 2003 / CARO 2015.

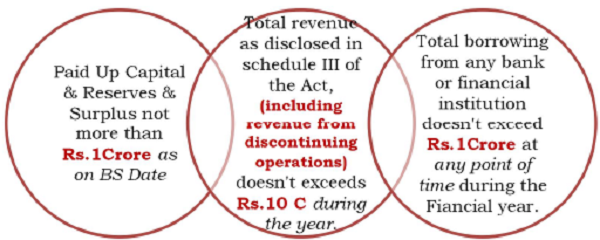

Private Limited Company (not being a subsidiary or holding company of a public company)–

- Earlier the limit for Private limited company was INR 50 Lacs which has been increased to INR 1 Cr & even the same was with the Total borrowings.

- Earlier, the turnover limit was restricted to INR 5 Cr which has been enhanced to INR 10 Cr.

- Small companies will not get covered unless they cross the stipulated limit for outstanding loans.

Auditor’s report to contain matters specified in paragraphs 3 and 4. Every report made by the auditor under section 143 of the Companies Act, on the accounts of every company examined by him to whom this Order applies for the financial year commencing on or after 1st April, 2015, shall contain the matters specified in paragraphs 3 and 4. In Simple terms, it means from financial year 2015-16, CARO 2016 starts to be applicable.

Matters to be reported under CARO, 2016

Fixed assets [3(i)]

√ Adequacy of Records – Whether the company is maintaining proper records showing full particulars, including quantitative details and situation of fixed assets?

√ Whether these fixed assets have been physically verified by the management at reasonable intervals? ; Whether any material discrepancies were noticed on such verification and if so, whether the same have been properly dealt with in the books of account?

√ Title Deed – Whether the title deeds of immovable property are held in the name of company. If not provide the details thereof.

- Proper Records for this purpose means Quantitative details and Particulars.

- Particulars mainly include the following –

> Asset classification

> Freehold/ Leasehold Premises should be motioned clearly

> Assets under Deferred Payment Guarantee

> Source of funds for procuring

- Physically verified and reasonable intervals depend on case to case and size of the company. In case of huge manufacturing Company, it may not be possible for them for to have physical verification once in year. They may have a policy that physical verification is required once in 3 years or more. For example Reliance Industries limited, ONGC.

- Additionally, auditor is required to verify the title deeds of immovable properties. This is a new inclusion as per CARO 2016 to ensure such properties which do not belong to company must not be clubbed into assets of the company like Director’s personal property being shown as asset for company & claiming depreciation for tax evasion.

Inventories [3(ii)]

√ Whether physical verification of inventory has been conducted at reasonable intervals by the management? & whether any material discrepancies were noticed on physical verification, and if so, whether the same have been properly dealt with in the books of account?

- Physically verified and reasonable intervals depend on case to case and size of the company.

- Inventory May be classified as follows: –

> Raw material.

>Work in Progress

>Finished goods

- Proper records include the inventory reports, verification reports, scrap report from costing department.

- Earlier auditors were required to understand & report whether the procedure used for physical verification is correct or not depending on the size of company. Since, it required a technical expertise & not being the main job of the auditor, the provision has be eliminated in CARO 2016.

- Internal controls for inventory should be checked so that any weaknesses should be reported and rectified by them management.

Loan given By Company [3(iii)]

Whether the company has granted any loans, secured or unsecured to companies, firms, Limited Liability Partnerships or other parties covered in the register maintained under section 189 of the Companies Act 2013. If so,

a. Whether Terms & Conditions are not prejudicial to the company’s interest.

b. Whether the schedule of repayment of principal & payment of interest has been stipulated & whether repayments or receipts are regular.

c. If the amount is overdue, state the total amount overdue for more than 90 days, & whether reasonable steps have been taken by the company for recovery of the principal & interest.

- Now the auditor’s responsibility has been further increased to cover the LLP’s even. Now he is required to verify the T&C as it in CARO 2003.

- Additionally, unlike CARO 2015 the limit of overdue amt for reporting which was INR 1 Lack has been replaced with any amount which exceeds 90 days to be reported. This clause helps in bringing transparency to identifying the defaulters in respect of companies

- Examine the register under section 189

- Seek Management representation

- Check if there are any related party translations and any loan agreements.

- Check the Profit and loss account and the balance sheet to verify the principal amount and whether any steps have been taken to recover the same in case the amount has been overdue.

Loan to Directors and Investment by Company [3(iv)]

√ In respect of loans, investments, guarantees, and security whether provisions of Sec.185 & Sec.186 of the Companies Act, 2013 have been complied with. If not, provide the details thereof.

“Auditor’s report has now been extended to cover loan given by the company to its directors & loans & investment by the company instead of Internal Control”

- Loans to directors and inter corporate loans has always been a debatable section from the beginning due to lack of clarity in the provisions. However, post amendments Section 185 & 186 has got some clarity & Notification in June’15 was boom to Pvt Companies and Other Companies as they were exempt from applicability of provisions provided certain conditions were meet.

- However, since the penalties imposed are very severe on the directors. The regulatory has decided to impose the responsibility on the auditor to intimate the auditor & report if there is any non-compliance.

- This brings more transparency & it is significant step taken in the Companies Act, 2013.

Deposits [3(v)]

In case the company has accepted deposits, whether the following has been complied with :

√ Directives issued by the Reserve Bank of India

√ The provisions of sections 73 to 76 or any other relevant provisions of the 2013 Act and the Rules framed there under,

√ If an order has been passed by the Company Law Board or National Company Law Tribunal or the Reserve Bank of India or any Court or any other Tribunal

However, if any of the above not complied with, the nature of contraventions should be stated.

Cost Records [3(vi)]

√ If Central Government has specified maintenance of cost records under Sec. 148(1) of the Companies Act, 2013 whether such accounts and records have been made & maintained.

Statutory Dues [3(vii)]

√ Is the company regular in depositing undisputed statutory dues including provident fund, employees’ state insurance, income-tax, sales-tax, service tax, duty of customs, duty of excise, value added tax,cess and any other statutory dues with the appropriate authorities and if not, the extent of the arrears of outstanding statutory dues as at the last day of the financial year concerned for a period of more than six months from the date they became payable, shall be indicated by the auditor.

√ In case dues of income tax or sales tax or service taxor duty of customs or duty of excise or value added tax or cess have not been deposited on account of any dispute, then the amounts involved and the forum where dispute is pending shall be mentioned.

√ Whether the amount required to be transferred to investor education and protection fund in accordance with the relevant provisions of the Companies Act, 2013 and rules made there under has been transferred to such fund within time. (Since, the same is required to be reported as per Rule 11 (c) of Companies (Audit & Auditors) Rule, 2014.)

√ “Wealth tax” has been removed from the list of taxes.

- Caro 2015 mandates the reporting whether the amount required to be IPEF is in accordance with rules and the act. However, CARO 2016 has removed the applicability of the provision.

- CARO 2016 removes the compliance of Wealth tax which has been abolished by the CBDT.

Repayment of Loans or Borrowing [3(viii)]

√ Whether the company has defaulted in repayment of loans or borrowings to a financial institution, bank, government or dues to debenture holders?

If yes, the period and the amount of default to be reported. (in case of defaults to banks, financial institutions, and government, lender wise details to be provided)

- With the happening of the recent cases like Sahara, Kingfisher & United Spirits, the regulatory has decided to ensure corporate who default in repayments to banks, financial institutions & Government have to be kept under controls & should be penalized so that they won’t be able to obtain additional loans from other bank till they repay the earlier.

- This has become a very stringent provision & auditor has been made the watch dog to keep an eye on companies to report anything unusual in advance to prevent big mistakes happening.

- Detailed list for each vendor is a significant move to protect the interest of other financial institutions & Govt.

Utilization of IPO and Further Public Offer [3(ix)]

√ Whether money’ raised by way of initial public officer or further public offer (including debt instruments) and term loans were applied for the purposes for which those are raised. If not, the details together with delays or default and subsequent rectification, if any, as may be applicable to be reported.

- Earlier in CARO 2015, provisions spoke only about term loans. Now it has been extended to IPO’s, Right issue, Term loans or any other purpose for which the loan raised using the public platform.

- Also the delay in utilizing the money for which it has been raised should also be reported by the auditor.

Reporting of fraud [3(x)]

√ Whether any fraud on or by the company by its officers or employees (earlier the provision was not specific) has been noticed or reported during the year? If yes, the nature and the amount involved is to be indicated.

“This reporting of Fraud under CARO’ 16 is different form fraud reporting under Sec 143(12). Under Section 143(12) fraud against company are reported – not fraud by the company”

- Earlier in CARO 2015, only the fraud by the company has been covered. However, after discussion among the professional circles, a request has been made the professionals to add also the fraud which has been committed against the company by its employees.

- This is very important inclusion to ensure that employees don’t take company for granted to commit frauds. Regulator doesn’t want to see Satyam, Kingfisher & other type of fraud where the employees & officers played a key role.

Managerial Remuneration [3(xi)]

√ Whether managerial remuneration has been paid or provided in accordance with the requisite approvals mandated by the provisions of Sec.197 read with Schedule V to the Companies Act, 2013? If not, state the amount involved and steps taken by the company for securing refund of the same;

“This is very important for all persons dealing with Section 197. Any excess payment as managerial remuneration is not only refundable to the company but also report able under CARO 2016 along with steps taken by the company for securing refund of the same”

Nidhi Company [3(xii)]

√ Whether the Nidhi Company has complied with the Net Owned Funds to Deposits in the ratio of 1:20 to meet out the liability and whether the Nidhi Co. is maintaining 10% unencumbered term deposits as specified in the Nidhi Rules, 2014 to meet out the liability.

- There was similar provision in Caro 2003 which had mad a special status to chit fund companies & Mutual funds which has been now re enforced.

Related Party Transactions [3(xiii)]

√ Whether all transactions with the related parties are in compliance with sections 177 and 188 of Companies Act, 2013 where applicable and the details have been disclosed in the Financial Statements etc., as required by the applicable accounting standards.

- Related party transactions have always remained a crucial topic when it comes to compliances. Sec. 188 mentions about the disclosures & arm length bases of doing business which is within the limit of the Companies Act, 2013.

- Now it is additional responsibility of the auditor to report the non compliance of related party transactions. This is to avoid frauds like National Herald & DLF-Robert Vadra.

Issue of Share Capital [3(xiv)]

√ Whether the company has made any preferential allotment or private placement of shares or fully or partly convertible debentures during the year under review and if so, as to whether the requirement of section 42 of the Companies Act, 2013 have been complied with and the amount raised have been used for the purposes for which the funds were raised. If not, provide the details in respect of the amount involved and nature of non-compliance.

- Similar provision in CARO 2003 which mentioned about the preferential allotment which has now be re-enforced with an additional reporting requirement of private placement.

Non – cash Transaction [3(xv)]

√ Whether the company has entered into any non-cash transactions with directors or persons connected with him and if so, whether the provisions of section 192 of Companies Act, 2013 have been complied with.

- The significance of this section is to identify if that no director takes any undue advantage for entering into a non-cash transaction with passing a proper board resolution and mentioning the particulars of such asset & its value as per the registered value.

Non – Banking Finance Company [3(xvi)]

√ Whether the company is required to be registered under section 45-IA of the Reserve Bank of India Act, 1934 and if so, whether the registration has been obtained.

Observations

1. In addition to introducing some new requirements and omitting some existing requirements, CARO 2016 has also made some changes in the existing requirements.

2. CARO 2016 has added 7 New Clauses [clause 3(vi), 3(xi), 3(xii), 3(xiii), 3(xiv), 3(xv) & 3(xvi)] & also added 2 New Sub clauses [in clause 3(i) & 3(iii)].

3. CARO 2016 has omitted 3 Clauses [clause 3(iv) – Internal Control System, 3(viii) – Accumulated Losses & incurrence of Cash Loses & 3(x)] – Guarantee for loan taken by others] & also 2 Sub clauses [in clause 3(i) & 3(vii)]

*If it is Private Limited Company – State the Fact in the Report.

Conclusion

√ CARO, 2016 lays more emphasis on Legal matters rather than procedural & propriety concept as seen in CARO, 2003.

√ CARO 2016 enhances the reporting requirements as per the respective sections and thereby, would increase the reporting responsibility of the auditors relating to important clauses & it has not restricted its scope to the Companies Act but has also covered RBI Act, Accounting Standards & Other statutes, which depicts MCA’s Focus on good Corporate Governance.

√ To assist the auditors in complying with these changes, and to address the various issues and intricacies involved therein, The Auditing and Assurance Standards Board of ICAI has brought out Guidance Note on the Companies (Auditor’s Report) Order, 2016

Page Contents