MEGA LIST-

GST PORTAL RELATED

1. Composition – ( to whomsoever applicable)

Opting or opting out Composition till 31-3 for FY 22-23

2. QRMP ( to whomsoever applicable)

Opting or opting out QRMP till 30-4 for FY 22-23

3. LUT ( to whomsoever applicable)

Apply LUT in case of Exporters for FY 22-23

4. FETCH BILL OF ENTRY –

IMPORT BOE DATA FETCH FOR ALL IMPORTS MADE IN FY 21-22 BY SEARCH BILL OF ENTRY – FOR THOSE WHOM IMPORT NOT APPEARING IN GSTR 2A

GST RELATED

5. GST Refund for FY 20-21 OR FY 21-22 CURRENT YEAR – IF PENDING – ( to whomsoever applicable)

Refund of following can be applied . if pending , Do file refund application asap

- ITC refund for Inverted duty structure

- ITC in case of Export under LUT

- ITC refund in case of Merchant Export 0.01%

- IGST in case of SEZ with pay

- ITC in case of SEZ under LUT

REMEMBER – FOR 20-21 , 31ST MARCH 2022 is last date

6. Reconciliation of GSTR 2A with the purchase invoices for 16(2)(aa) –

ITC shall be availed by the recipient subject to satisfaction of the condition “Supplier has furnished the details of Invoices referred to in Section 16(2)(a) in Form GSTR 1 . Do reverse ITC not reflecting.

7.Reconciliation of GSTR 2A with the purchase invoices and taking Pending ITC –

Do check your GSTR 2A of 21-22, if any ITC which is reflected in GSTR-2A and U hv not claimed credit in any previous months GSTR3B then Its better you avail this ITC in 21-22 only i.e March GSTR 3B

8. Reconciliation of GSTR 1 with GSTR 3B – comparison checking on Portal

Identify any difference in 3B vs 1 … reconcile in March return only . Also reconcile with Books . There may be sometime CN DN not shown in GSTR -1 or 3B or both

9. TDS CREDIT ACCEPTANCE- ( to whomsoever applicable)

TDS credit acceptance for period till MARCH 2022. Here, WE ARE TALKING ABOUT TDS OF “GST”. IF any TDS is being deducted under GST, accept the TDS credit on the GST portal.(Month to month basis). By doing so, the amount will be credited in cash ledger

10. SELF INVOICE in RCM –

Maintenance of Self invoice or Payment Voucher in case of RCM tax. This seems to be an ignored act where in, it is required to issue self-invoices and payment vouchers.

11. THINGS TO CHECK IN Outward side –

GST needs to be charged on following incomes but Not charged.

1. Sale of fixed asset or sale of car – Forgot to charge GST On these

2. Rent On Commercial Property received But GST has NOT been collected & paid

Freight Charged By Supplier On Goods Sold But forgot to charge GST on that

4. Commission Income earned but GST NOT CHARGED

5. Purchase return shown as “Sales ” and discharged GST as “Outward tax” wrongly.

if any such cases, the do rectify such mistakes in March return

12. THINGS to check in RCM –

if any GST needed to be paid under RCM but not paid ON (1) Advocate Fees (2) Security Services (3) Import of services (4) Transportation / Freight ( Whether On Inward Or Outward )

If not paid , pay in March return

13. THINGS to check in ITC SIDE –

1 If wrongly taken ITC but not reversed IT i.e CLAIMED wrong ITC u/s17(5) also if Destroyed/lost | Personal Expenses or Exempted Goods Manufactured then you need to reverse it (R. 42/43)

2 Wrongly claimed ITC twice. Expenses/Purchase bill entered twice So claimed ITC twice

3. Wrongly Claimed IGST instead of CGST + SGST

4. Wrongly claimed CGST + SGST instead of IGST

5 . Sales return shown as Purchase & Claimed ITC on that

if such cases the , rectify in march

14. ITC 4 – FOR THOSE WHO SENT GOODS ON JOB WORK –( to whomsoever applicable)

if pending for 21-22 or earlier year , file asap.

With effect from 1st October 2021, the frequency of filing the ITC-04 form has been revised

(1) Those with TO more than Rs.5 cr – Half-yearly

(2) Those with TO up to Rs.5 cr – Yearly

15. E-INVOICE ( to whomsoever applicable)

E-invoice is a process through which a normally generated invoice is authenticated by GSTN. Post authentication, each invoice will be issued an IRN

If TO has exceeded 20 Cr in ANY PRECEDING FY i.e. 17-18 TO 21-22, then E-Invoicing would be applicable from 1-4-22

16. GSTR 9+9C – FOR THOSE WHO HAS 2/5 CRORE OR MORE To FOR FY 20-21 ( to whomsoever applicable)

PL FILE if you haven’t still filed . LAST DATE ALREADY GONE (28th feb)..

• •

BOOK KEEPING RELATED

17. Completing your Accounting till 31st MARCH –

Give all File of purchase + sale + Exp Bank statement of current accounts and Saving accounts to your Accountant till March 2022 SO THAT your March GST return will be ready and your Accounting data will be ready for FY 21-22

18. MARCH ADJUSTMENTS-

Make provision for Expenses for March . E.g Salary, Rent, Audit fees, Accounting Fees, Telephone Bill, Electricity bills, Etc etc . Also Depreciation calculation

19. FOR 80C/80D/80CCD/80G/80GGC/80GGB –

Reminder to PAY YOUR LIC, MEDICLAIM, PPF AND OTHER OBLIGATIONS TO CLAIM DEDUCTIONS as soon as possible BEFORE 31ST MARCH

20. DN-CN

transactions like sale returns or purchase returns or price revision or volume discount , the required necessary Debit note or Credit notes may be raised in March 2022 . So it will form part of Fin year 21-22 & you book in your accounts in FY 21-22 .

21. INCOME TAX RELATED

15G – 15H – ( to whomsoever applicable)

The taxpayers who have income from interest only and it is less than the prescribed limit, then they can file manually or online in Form 15 G/ H.

For Tax deductors , Last date to file 15G/H is 30th april

22. TDS ON PURCHASE OF GOODS -194Q . ( to whomsoever applicable)

FOR FY 21-22 ====> APPLICABILITY – FY 20-21 TO 10 CRORE ABOVE PARTIES THEN APPLICABLE for FY 21-22

CONDITION – ONLY IF PURCHASES from PARTY CROSS 50 lacs in CURRENT YEAR

and

That Party not charging TCS

23. TCS ON SALE OF GOODS – 206C(1H) ( to whomsoever applicable)

FOR FY 21-22 ====>APPLICABILITY – FY 20-21 TO 10 CRORE ABOVE PARTIES THEN APPLICABLE

CONDITION – ONLY IF COLLECTION from PARTY CROSS 50 lacs in CURRENT YEAR AND

THAT PARTY IS NOT DEDUCTING TDS

24. TDS TCS – NORMAL PROVISIONS ( to whomsoever applicable)

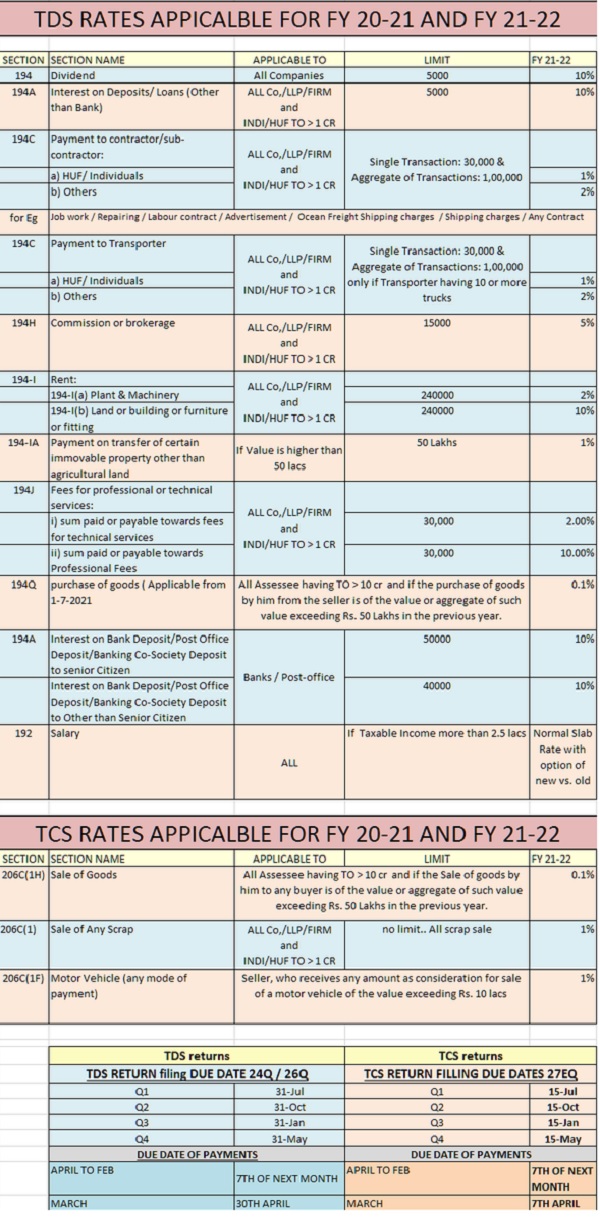

CHECK CHART BELOW

25. Physical Stock Checking: –

Physical stock need to be reconciled with the stock as per books of accounts. This would be handy in both income tax and GST audit. In case of any discrepancies, the possibility of ITC reversal or missed sales details may be checked.

26. Aadhar-authentication on GST portal

Atleast for exporters and refund applying Taxpayers, please authenticate Aadhar as soon as possible.

27. Pending Filling ITR for FY 20-21

If still pending then you can file upto 31-3-2022 with Late fees of 1000/5000

28. Advance Tax for Q4

Payment of Advance tax before 15th March .. for FY 21-22 INCOMES

The tax is payable if your tax liability exceeds Rs.10,000 in a financial year. after dividend is taxable and LTCG taxable on shares , we advise you to pay Advance tax if you have earned such income. Pay before 15th March after calculating