TCS is a tax that is collected by the seller from the buyer and paid to the government on behalf of the buyer. The Finance Act, 2020 has introduced the new section 206C (1H) of the Income Tax Act, 1961 related to TCS on sale of goods.

Applicable from:

1st October 2020

Applicability:

1. If total sales/ gross receipts/ turnover from the business in previous Financial Year is greater than 10 Cr for seller. AND

2. Sale of any goods above Rs. 50 lakhs

TCS Rate:

TCS shall be collected & paid on Receipt Basis.

1. 0.1% – if PAN/ Aadhar submitted to seller

2. 1% – if PAN/ Aadhar not Submitted to seller

Governing Section of Income Tax: 206C (1H)

Non-Applicability:

This provision will not be applicable in following cases:-

1. Goods exported out of India

2. Goods on which TCS/TDS provisions are already applicable under Income Tax Act

3. If Buyer is:

-

- the Central/State Govt, an embassy, a High Commission, legation, commission, consulate & the trade representation of a foreign State;

- a local authority;

- a person importing goods into India or any other person as notified by the Central Govt.

Compliance:

1. TCS Collected during month need to be paid to Govt by 7th of next Month

2. Quarterly TCS Return in Form 27EQ

Due Dates for Quarterly Return:

| Quarter | Due Date (in Normal Course) |

| April – June | 15th July |

| July – September | 15th October |

| October – December | 15th January |

| January – March | 15th May |

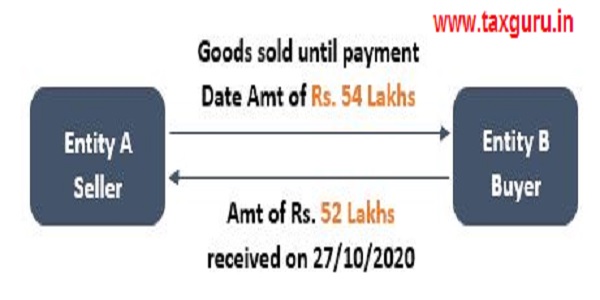

Illustration:

1. If aggregate value of sale of any goods from Entity A to Entity B, exceeds Rs 50 Lakhs in previous financial year or till 30th sept 2020 in this year then,

2. TCS to be collected on Rs. 2 lakhs i.e. 52 lakhs (actual Receipt) less threshold of Rs 50 Lakhs on receipt basis i.e. on 27/10/2020 @ 0.1% if PAN/ Aadhar provided.

3. This TCS to be deposited with Govt by 7th of November 2020

Important Point to Remember:

Main trigger point for applicability is receipt not sale. Therefore, If receipt after 1st October 2020, for any sale done before or after 1st October 2020, is more than 50 lakhs then only TCS to be deducted on Excess of Rs. 50 lakhs.