Summary: The Securities and Exchange Board of India (SEBI) has issued a consultation paper to review the framework for Small and Medium Enterprises (SMEs) under the SEBI (ICDR) Regulations, 2018, and SEBI (LODR) Regulations, 2015. The consultation aims to strengthen the pre-listing and post-listing provisions for SMEs, focusing on improving their corporate governance, eligibility criteria, and reporting requirements. Under the existing framework, SMEs are eligible to list on the SME exchange with specific eligibility criteria, including post-issue paid-up capital limits and underwriting requirements. The paper seeks to address the applicability of corporate governance provisions to SMEs, which are currently less stringent than those for larger entities listed on the main board. The review will also explore the impact of recent surges in SME IPO activity and their post-listing fundraising practices, such as preferential issues. As of October 2024, SMEs listed on the NSE and BSE platforms have seen significant growth, with a combined market capitalization of nearly ₹2 lakh crore. The consultation invites public comments to improve the SME listing framework and ensure better growth prospects for these companies.

Securities and Exchange Board of India

Consultation paper on Review of SME segment framework under SEBI (ICDR) Regulations, 2018, and applicability of corporate governance provisions under SEBI (LODR) Regulations, 2015 on SME companies to strengthen pre-listing and post-listing SME provisions

A. Background

1. In recognition of the need for making finance available to small and medium enterprises, SEBI decided to encourage promotion of dedicated exchanges and/or dedicated platforms of the exchanges for listing and trading of securities issued by Small and Medium Enterprises (“SME”). Accordingly, SEBI prescribed a framework for recognition and supervision of stock exchanges/ platforms of stock exchanges for small and medium enterprises in November 2008.

2. Further, SEBI amended SEBI (ICDR) Regulations, 2009, by inserting a Chapter XA on “Issue of specified securities1 by small and medium enterprises”, through notification dated April 13, 2010, which were subsequently also incorporated in the SEBI (ICDR) Regulations, 2018 (“ICDR Regulations”). Also, a model SME Equity Listing agreement for issuers seeking listing on SME Exchange, was specified through a Circular in May 2010. A revised framework for setting up of a Stock exchange/ trading platform by a recognized stock exchange having nationwide trading terminals for SME was prescribed by SEBI in May 2010.

3. Presently, in terms of Chapter IX – Initial Public Offer by Small and Medium Enterprises (SME) of the ICDR Regulations, following are SME–IPO Eligibility Criteria for an issuer (Regulation 229):

a. An issuer shall be eligible to make an initial public offer only if its post-issue paid-up capital is less than or equal to ten crore rupees.

b. An issuer, whose post issue face value capital is more than ten crore rupees and up to twenty five crore rupees, may also issue specified securities in accordance with provisions of this Chapter.

c. An issuer may make an initial public offer, if it satisfies track record and/or other eligibility conditions of the SME Exchange(s) on which the specified securities are proposed to be listed.

4. Other salient features of SME framework are as under:

a. In terms of ICDR Regulations, requirement of filing a draft red herring prospectus (DRHP) and obtaining SEBI observations, as required for Main Board have been waived for SME issues and issuer is only required to file a copy of offer document (i.e. Red Herring Prospectus (RHP)) with the Board immediately upon filing of the offer document with RoC.

b. Minimum application amount (Rs. 1 lakh) and minimum lot size for trading (Rs. 1 lakh) are kept higher in the SME exchanges to protect smaller investors.

c. Minimum number of allottees in SME IPO is 50 as compared to 1000 in Main Board IPO.

d. An issuer with post issue face value capital between Rs 10 crore and Rs 25 crore listed on SME exchange can migrate to Main Board, as specified in the ICDR Regulations and vice-versa, provided they meet the listing requirements of the stock exchange, including in-principle approval, where they propose to list the specified securities and have obtained the shareholders’ approval in the manner specified in the ICDR Regulations.

e. An issuer listed on SME exchange proposing to issue further capital pursuant to which their post -issue face value capital may increase beyond Rs. 25 crore shall migrate to the Main Board, subject to shareholders’ approval in the manner specified in the ICDR Regulations and obtaining in-principle approval of the Main Board before issue of such securities.

f. Issues on SME Exchange in India are mandated to be 100 per cent underwritten of which Lead Manager shall underwrite at least 15% of issue size on their own account. Further, the Lead Manager managing the IPO is also required to ensure market making through Stock Brokers during the initial three years post listing on SME platform.

g. In terms of post-issue reporting requirements, SMEs are required to submit an abridged financial results on a half-yearly basis whereas submission of comprehensive quarterly financial results is mandatory for entities/ companies listed in Main Board.

5. In addition to provisions of ICDR Regulations, Stock Exchanges (NSE and BSE) also have additional eligibility criteria for listing of companies on SME platform and migration from SME platform to main board. Details of Stock Exchange(s) listing and migration criteria are placed at Annexure A and Annexure B,

6. Post-listing obligations and disclosure requirements for companies are specified under SEBI (LODR) Regulations, 2015 (“LODR Regulations”). Chapter IV of LODR Regulations contains various corporate governance requirements relating to composition of Board of Directors and its committees, related party transactions, secretarial compliance, etc. for equity listed entities. Regulation 15 under Chapter IV specifies the listed entities to which the provisions of the Chapter are applicable.

7. Most of the corporate governance requirements under LODR Regulations are not applicable to the following equity listed entities:

a. Listed entities which have paid up equity share capital not exceeding Rs. 10 crores and net worth not exceeding Rs. 25 crores (“Small entities listed on Main Board”).

d. Listed entities which have listed their specified securities on the SME Exchange (“SME listed entities”).

Further, some of the quarterly reporting requirements, which are applicable to Main Board listed entities, are applicable to SME listed entities on a half-yearly basis.

8. A comparison of the requirements under LODR Regulations which are applicable to companies listed on SME and Main Board is given in the table below:

| Regulation | Regulatory Requirement | SME listed entities | Main Board listed entities |

| 17- 27 | Corporate Governance which include provisions related to Composition of Board, related party transactions and secretarial compliance etc. | Not

Applicable |

Applicable * |

| 31 | Shareholding pattern | Half yearly | Quarterly |

| 32 | Statement of deviation(s) or variation(s) | Half yearly | Quarterly |

| 33 | Financial Results | Half yearly | Quarterly |

| 46 | Website disclosures | Not

Applicable |

Applicable * |

| 47 | Advertisements in Newspapers (for results etc.) | Not

Applicable |

Mandatory to publish certain information |

* Not applicable to Small entities listed on Main Board.

B. Listings on SME Exchange

9. Since operationalization of SME Exchange on NSE and BSE, a total of 565 exclusive companies have listed on NSE and 524 exclusive companies have listed on BSE platform of which 322 SME companies have migrated to Main Board (140 from NSE SME Exchange and 182 from BSE SME Exchange) (as on Oct 15 2024).

10. As on October 15, 2024, a total of 417 companies are listed on NSE SME Exchange having Market Capitalization of 1.31 lakh crores and a total of 328 companies are listed on BSE SME Exchange having Market Capitalization of 68.5 thousand crores. Thus, together there are 745 SME companies with a market capitalization of approx. 2 lakh crore.

11. Further, it is noted that on NSE out of 417 SME listed companies as on Oct 15, 2024, 12 companies are suspended and in 15 companies no trade is executed in last one month i.e. 15-Sep-2024 to 15-Oct-2024 (Includes 11 suspended and 4 others). While on BSE out of 328 companies as on Oct 15 2024, 28 companies are suspended and in 35 companies no trade is executed in last one month i.e. 15-Sep-2024 to 15-Oct-2024 (Includes 24 suspended and 11 others).

12. Data w.r.t. migration from SME to Main Board is as under :

| Stock Exchange | 24-25 (till Oct 2024) | 23-24 | 22-23 | 21-22 | 20-21 | 19-20 | Prior to 19-20 | Total |

| NSE | 2 | 11 | 25 | 33 | 39 | 24 | 6 | 140 |

| BSE | 5 | 16 | 32 | 34 | 23 | 19 | 53 | 182 |

13. Number of listing and fund raising through SME IPOs in current FY and previous three FY is as under :

NSE Data:

| Particulars | Financial Year | |||

| 2024-25(Till October 15,2024) | 2023-24 | 2022-23 | 2021-22 | |

| Number of company listed | 117 | 138 | 62 | 31 |

| Fresh Issue amount raised (in Rs. Crore) | 4387 | 4348 | 1181 | 480 |

| Offer for sale (OFS) amount (in Rs. Crore) | 259 | 273 | 149 | 23 |

| Total (in Rs. Crore) | 4647 | 4621 | 1330 | 503 |

BSE Data:

| Particulars | Financial Year | |||

| 2024-25(Till October 15,2024) | 2023-24 | 2022-23 | 2021-22 | |

| Number of company listed | 42 | 58 | 63 | 33 |

| Fresh Issue amount raised (in Rs. Crore) | 992 | 1419 | 919 | 352 |

| Offer for sale (OFS) amount (in Rs. Crore) | 122 | 55 | 83 | 61 |

| Total (in Rs. Crore) | 1113 | 1474 | 1002 | 413 |

14. It is observed that SME IPOs have witnessed a surge in recent years particularly 2022-23 onwards. Since, the establishment of SME platforms, FY 2023-24 witnessed the highest number of SME public issue and highest SME fund raising with 196 IPOs tapping the market to mobilize more than Rs. 6000 crore. Also, in current FY 2024-25 already till Oct 15, 2024, more than Rs. 5700 crore has been raised through 159 SME IPOs.

Prior to recent surge, it is to be noted that in past SME segment has witnessed growth in financial years 2017-2019, where in FY 2017-18, 148 companies raised Rs.2147 crores. However, between FY 2019-20 to FY 2021-22, an overall sluggish trend was observed, mainly due to COVID-19, and therefore only 127 companies came out with SME IPOs.

15. Further, post listing fund raising activity of SME companies was also analysed and it is noted that preferential issue is most preferred way for SME companies to raise capital. Consolidated data of issues by companies in current FY and previous 3 FY [i.e. 21-22 to 24-25(till 15 Oct)] is given below:

| FPO | Rights Issue | QIP | Preferential Issue | |||||

| Number of issues | Amount raised (in Cr) | Number of issues | Amount raised (in Cr) | Number of issues | Amount raised (in Cr) | Number of issues | Amount raised (in Cr) | |

| NSE | 2 | 177 | 9 | 501 | 2 | 116 | 97 | 1227 |

| BSE | 1 | 15 | 2 | 52 | 0 | 0 | 72 | 822 |

16. It is noted that secondary fund raising by listed SME companies through preferential issue has also increased significantly in recent years. Further, year-wise data of preferential issue by SME companies is as given below:

| Financial Year | BSE | NSE | ||

| No. of issue | Amounts ( In Crores) | No. of issue | Amounts ( In Crores) | |

| 2021-22 | 4 | 23 | 10 | 79 |

| 2022-2023 | 20 | 170 | 10 | 119 |

| 2023-2024 | 28 | 252 | 33 | 371 |

| 2024-2025( till 15 Oct 2024) | 20 | 377 | 44 | 658 |

| Total | 72 | 822 | 97 | 1227 |

17. Corporate actions i.e. Bonus Issues and Split of shares by SME companies in current FY and previous 3 FY [i.e. 21-22 to 24-25(till 15 Oct)] were also analysed and details w.r.t. same is given below:

| Financial Year | BSE | NSE | ||

| Bonus Issue | Split of Shares |

Bonus Issue | Split of Shares | |

| 2021-22 | 4 | 2 | 19 | 1 |

| 2022-2023 | 11 | 0 | 22 | 3 |

| 2023-2024 | 16 | 2 | 13 | 3 |

| 2024-2025( till 15 Oct 2024) | 6 | 1 | 7 | 1 |

| Total | 37 | 5 | 61 | 8 |

18. Data of Price Movement on listing and post listing – Out of 255 SME companies listed on NSE in current FY and previous FY, it is noted that 224 companies listed at premium i.e. had listing gain and 31 companies listed at discount to issue price. Similarly, for BSE out 100 SME companies listed on BSE in current FY and previous FY, it is noted that 91 companies listed at premium and 9 companies listed at discount to issue price. Details of same include price change as on Oct 15, 2024, is provided in table below:

| NSE | BSE | |||||

| No of Companies | Gain as on Oct- 15-2024 (from issue price) |

Loss as on Oct-15-2024 (from issue price) |

No of Companies | Gain as on Oct-15-2024 (from issue price) | Loss as on Oct-15-2024 (from issue price) |

|

| Gain on listing day (from issue price) |

224 | 185 | 39 | 91 | 65 | 26 |

| Loss on listing day (from issue price) |

31 | 6 | 25 | 9 | 3 | 6 |

| Total listings | 255 | 191 | 64 | 100 | 68 | 32 |

C. Regulatory concerns

19. With an increase in the number of SME issues, it is noted that investor participation has also increased in such offering. Applicant to allotted investor ratio increased from 4X in FY 22 to 46X in FY23 and 245X in FY24.

20. SME listed entities are typically promoter driven or family business companies with high concentration of shareholding among a few promoter / promoter group persons or entities. There is also limited presence of private equity investors/ sophisticated investors, who act as a check on the promoter’s influence, in such companies.

21. In recent times, instances have been observed of diversion of issue proceeds to related parties / connected parties / shell companies and inflation of revenue by circular transactions through related parties / connected parties / shell companies. SEBI has observed that in some SME companies, the entity diverted money raised through IPO and subsequent Rights Issue to shell companies controlled by the promoters. It has also been observed in another entity that a company has booked fraudulent sales and purchases through circular transactions amongst related parties/ connected parties. By doing so such companies try to create a positive sentiment to induce investors into purchasing such securities. SEBI, in the recent past, has passed Orders against such entities, which are available on the SEBI website.

22. As per analysis of amount of RPTs undertaken by SME listed entities2, it was observed that 1 out of 2 SME listed entities have undertaken RPTs of more than Rs. 10 crores and 1 out of 5 SME listed entities have undertaken RPTs of more than Rs. 50 crores. In terms of amount of RPTs undertaken by SME listed entities1 in proportion to their consolidated turnover, it was observed that 1 out of 2 SME listed entities have undertaken RPTs of more than 10% of their consolidated turnover and 1 out of 7 SME listed entities have undertaken RPTs of more than 50% of their consolidated turnover.

23. The above issues highlight the buildup of systemic risks in managing the funds raised by SME listed entities. Thus, there is a need for greater scrutiny of RPTs which may be misused as instruments for fund diversion. Considering increased activity in SME segment, instances of misconduct as aforementioned, risks relating to siphoning of funds, promoter / investors exiting the company after listing, etc., it is felt that to protect the interest of the investors and market as a whole, there is a need to review SME IPO framework and applicability of corporate governance provisions to SME listed companies so that companies with sound track record make IPO/ raise funds and get listed on stock exchanges and comply with post listing requirements.

D. Proposals:

24. In view of the above backdrop, to have a review of framework for SME segment, SEBI had engaged with Stock Exchanges – NSE and BSE and Merchant Bankers which actively handle SME issues, to seek their comments and suggestions relating to both facilitating and regulating IPOs by SME companies to strengthen pre-listing and post-listing SME provisions.

25. Based on the suggestions submitted by Stock Exchanges and Merchant bankers and discussions held between SEBI, Stock Exchanges and Merchant Bankers, proposals related to SME segment were discussed with SEBI Primary Market Advisory Committee (PMAC). Consequently, based on PMAC recommendations and internal deliberations, proposals to amend SME provisions are detailed below.

26. These proposals are divided into 2 parts. The first part deals with provisions related to IPO at SME Exchange as well as conditions of migration from SME platform to Main Board post listing. The second part deals with Corporate Governance norms including post listing disclosures by issuers listed on SME Exchange. Following proposals are made for SME segment regulatory framework:

PART I: SME provisions under ICDR

a. SME – IPO process:

I. Minimum application value and Market lot size

i. Existing Provision – In terms of Regulation 267(2) of ICDR, presently there is a requirement that minimum application size shall be one lakh rupees per application.

ii. Suggestion – It has been suggested by both Stock Exchanges and Merchant Bankers, that minimum application size shall be increased from one lakh rupees per application to two lakh rupees per application

iii. Rationale – In terms of ICDR Regulations, “retail individual investor” means an individual investor who applies or bids for specified securities for a value of not more than two lakhs rupees. It is observed that the retail individual participation has increased in SME IPO over last few years. Therefore, considering that SME IPOs tend to have higher element of risks and investors getting stuck if sentiments change post listing, in order to protect the interest of smaller retail investors, it is proposed to increase the application size from Rupees one lakh per application to Rupees two lakhs per application in SME IPO, as higher size will limit participation by smaller investors and shall attract investors with risk taking appetite, which will enhance the overall credibility of SME segment.

iv. Proposal 1 – In view of the above, it proposed that the Minimum application size in SME be increased from Rs 1 lac to Rs. 2 lacs thus allowing only informed investors who have risk taking appetite and capability be allowed to make application in SME IPO.

Above proposal shall not require any change in current allocation categorization in SME IPO which mandates not less than 35% allocation to retail individual investor in book build issue and minimum 50% allocation to retail individual investor in fixed price issues, since under retail individual investor category applications of amount up to two lakhs are permitted.

v. Proposal 2 – It may be noted that the limit of Rs. 1 lakh was prescribed in SEBI Regulations over 14 years ago. In last 14 years Nifty and Sensex have grown by around 4.5 times. Thus in view of same and considering passage of time, the alternate proposal is that it would be fit to increase the threshold in same ratio as the markets have grown. Therefore, application size may be increased from one lakh rupees per application to four lakh rupees per application.

Above proposal shall also require change in allocation categorization in SME IPO as retail individual investor category will be redundant if application size is increased to four lakh rupees per application. Since, applicants will not be able to make application under retail category, it is proposed to merge allocation reserved for retail category in non-institutional category and delete provision related to reservation for retail individual investor category.

(Post listing lot size mechanism is covered under SEBI circular no CIR/MRD/DSA/06/2012 dated February 21, 2012 (https://www.sebi.gov.in/legal/circulars/feb-2012/standardized-lot-size-for-sme-exchange-platform_22185.html)).

Question for public comments

1. Do you agree with the proposal to increase minimum application size in SME IPO?

If you agree, then which proposal is favoured by you :

(a)to increase minimum application size in SME IPO from 1 lakh to 2 lakh; Or

(b) to increase minimum application size in SME IPO from 1 lakh to 4 lakh.

II. Alignment of allocation for non-institutional investors (“NIIs”) between main board IPOs and SME IPOs.

i. Existing Provision – Presently under ICDR, allotment procedure for NII category in a book built issue for SME IPO is based on proportional allotment which is different from allotment procedure for NIIs in Main Board IPO.

ii. Suggestion – It was suggested that the draw of lot allotment methodology and reservation in the portion available for NIIs, as currently in place for main board IPOs should also be extended for allocation to NIIs in SME IPOs. Accordingly following changes may be done for SME IPO:

(1) NII category may be further divided into two sub-categories:

a. Sub- category 1: One-third of the allocation earmarked for NIIs shall be for application sizes of up to ₹10,00,000.

b. Sub- category 2: Two-third of the allocation earmarked for NIIs shall be for application sizes above ₹10,00,000.

(2) Proportionate allotment in case of NII category may be discontinued and “draw of lots” allotment to be introduced, as is currently applicable for retail investor category (i.e., draw of lots to allot minimum bid lot to applicants, in case of oversubscription and balance allotment on proportionate basis).

iii. Rationale – The proposed change will align allocation methodology for NII category in SME IPOs with existing allocation methodology for NII category in main board IPOs. Proportionate allotment tends to encourage over-leveraging, over statement of interest and thus at times encourage mispricing.

Recent SEBI study also shows that post above change in Main Board IPO, “Big Ticket NII Investors” (applying for more than ₹1 crore in Main Board IPOs) declined from around 626 applications per IPO in pre-period (April 21-Mar 22) to 20 applications per IPO in the post period (April 22-Dec 23) and representation of such investors in NII category has decreased from 98% to 8%. This study shows that pro-rata allotment resulted in unnecessary exuberance in NII applicants just to get higher proportion in IPO allotment.

iv. Proposal– The following is proposed.

(1) NII category may be further divided into two sub-categories:

a. Sub- category 1: One-third of the allocation earmarked for NIIs shall be for application sizes up to ₹10,00,000.

b. Sub- category 2: Two-third of the allocation earmarked for NIIs shall be for application sizes above ₹10,00,000.

Proportionate allotment in case of NII category may be discontinued and “draw of lots” allotment to be introduced, as is currently applicable for retail investor category (i.e., draw of lots to allot minimum bid lot to applicants, in case of oversubscription and balance allotment on proportionate basis).

Question for public comments

2. Do you agree with the proposal to change allocation methodology in NII category of SME IPO and aligning it with allocation methodology used for Main Board IPO?

III. Allotment process and basis of allotment

i. Existing Provision – In terms of Regulation 268(1) of ICDR, presently there is a requirement that for SME public issue to be considered successful there should be minimum 50 allottees in public issue.

ii. Suggestion – It has been suggested to increase the requirement of minimum 50 allottees in public issue to 200.

iii. Rationale – The investor base in India has grown significantly since 2010. Above requirement will ensure that companies where investors have interest shall only get listing. This increased requirement will also ensure that post listing also there are sizeable number of investors and same shall help in providing liquidity in the market. Further, with the introduction of “draw of lots” in SME allotment process as mentioned at II above, the number of allottees will increase since smaller NIIs would also be assured allotment in SME IPO.

iv. Proposal – In view of above, it is proposed that minimum allottees in SME public issue may be increased to 200.

Question for public comments

3. Do you agree with the proposal that minimum allottees in SME public issue to be increased to 200 investors from existing number of 50 investors?

IV. Offer for sale

i. Existing Provision – Presently under ICDR Regulation there are no restrictions with respect to Offer for Sale (OFS) in SME IPO.

ii. Suggestion-It has been suggested by both Stock Exchanges and Merchant Bankers that either the OFS in SME IPOs may be restricted completely or alternatively it should be restricted as a percentage of Issue Size (20% – 25% of issue size).

iii. Rationale – The purpose of setting up of SME Exchange was to make finance available to needy small and medium enterprises for their growth. From SME IPO data it is noted that there were 2 pure OFS SME IPO i.e. 100% OFS in FY 23-24 and 1 in FY 24-25 (till Oct 2024). Further, there were total of 52 issues (in total in 23-24 and 24-25) where there was an OFS component along with fresh issue and in 30 out of 52 such issues, OFS portion was more than 20% of the total issue size. It is observed that the Promoter of the proposed IPO dilutes its stakes which was not the objective of forming the SME Platform. Hence, it is suggested to put restriction on OFS part of SME IPO as OFS proceeds are not forming capital for issuer and there may limit for OFS in terms of issue size as well as threshold may be prescribed for selling shareholders also.

iv. Proposal – It is proposed that OFS in SME IPO may be restricted to 20% of the issue size. Further, for selling shareholders, shares offered for sale in SME IPO shall not exceed more than 20% of their pre-issue shareholding on fully diluted basis.

Question for public comments

4A. Do you agree with the proposal that OFS in SME IPO may be restricted to 20% of the issue size?

4B. Do you agree with the proposal that for selling shareholders, shares offered for sale in SME IPO shall not exceed more than 20% of their pre-issue shareholding on fully diluted basis?

V. Monitoring of Issue Proceeds

i. Existing Provision – In terms of Regulation 262 of ICDR, Monitoring agency is required to be appointed if the fresh size issue is more than Rs. 100 crores for SME issue.

ii. Suggestion– Suggestions have been received in respect to appointment of Monitoring agency including making it compulsory irrespective of issue size. Some have also suggested to decrease the threshold of issue size requiring such appointment from Rs. 100 Crore to either 50 crore / 30 crore / 25 crore / 20 crore. Further, it has also been suggested that in case of some Object of the issue there should be compulsory requirement of appointment of monitoring agency. These are highlighted below:

(a) to fund subsidiary, and/ or

(b) to repay loans/ borrowing partially or fully of the subsidiary company, and/or

(c) investment in a joint venture or a subsidiary, and/or

(d) an acquisition.

From SME IPO data it is noted that in FY 24-25 (till Oct 2024) out of 145 issues only 5 issues were above 100 crore and 95 issues were of size more than 20 crore. 45 issues were of size less than 20 crore (out of which 16 issues were less than 10 crores in size).

iii. Rationale – Monitoring agency acts as an independent agency who will certify on utilisation of proceeds and will ensure funds are used for the purposes disclosed in the offer document, thus reducing the risk of misuse or diversion. This will also bring more transparency for investors and accountability for issuer.

As per ICDR Regulations, a Credit Rating Agency registered with SEBI can act as monitoring agency. They will be able to track the utilization proceeds and shall submit a report periodically (six months) which can be duly examined by the Audit Committee and Board of the company.

iv. Proposal – It is proposed that requirement of appointment of Monitoring Agency shall

be made applicable for issuer company if fresh issue size is higher than 20 crore.

It is also proposed that requirement of appointing monitoring agency shall be made mandatory for the aforementioned objects (see point ii above) irrespective of the issue size.

In cases where there is no requirement of appointment of Monitoring Agency, there should be a mandatory requirement of Statutory auditor’s certificate for utilization of money raised through the public issue, to be submitted to Exchange while filing the half yearly financial statement, till the issue proceeds are fully utilized. These certificates should also be submitted to the Audit Committee and Board of the Issuer Company.

Question for public comments

5A. Do you agree with the proposal that requirement of appointment of Monitoring Agency shall be made applicable for issuer company if fresh issue size is higher than 20 crore?

5B. Do you agree with the proposal that there should be compulsory requirement of appointment of monitoring agency for following objects irrespective of amount of proceeds:

(a) to fund subsidiary, and/ or

(b) to repay loans/ borrowing partially or fully of the subsidiary company, and/or

(c) investment in a joint venture or a subsidiary, and/or

(d) an acquisition.?

5C. Do you agree with the proposal that with respect to cases which don’t fall under above scenarios i.e. if issue size is less than 20 crore (fresh issue size) and the object is not as mentioned above at 5B, then in such cases Statutory Auditor need to submit a certificate for utilization of money raised through the public issue?

VI. Lock-in of specified securities held by the promoters

i. Existing Provision –In terms of Regulation 238 of ICDR, minimum promoter contribution by promoters is locked in for 3 years and holding in excess of minimum promoter contribution is locked in for 1 year post IPO.

ii. Suggestion– It was suggested by the Stock Exchanges that the release of lock in period of specified securities held by promoter should in a phased manner instead of releasing the entire lock in in one go.

Exchanges further suggested that 50% of holding in excess of minimum promoter contribution shall remain locked-in for 2 years post IPO and remaining 50% for 1 year (as required presently). Further, the lock-in on MPC should be until the company continues to be on the SME Exchange. Upon migration to Main Board, such lock-in may be again made applicable to such companies.

However, few Merchant Bankers have suggested to align lock-in requirements in SME IPOs with the requirements in main board IPOs i.e. reducing lock-in to 18 months / 3

year (as applicable) for MPC and 6 months for capital exceeding MPC.

iii. Rationale – It is observed that Promoter holding drops immediately after one year of listing excluding the mandatory MPC of 20% which is locked-in for longer period. The suggestion will ensure that the Promoter does not liquidate their entire holdings post release of lock in period thereby ensure sustainability and stability of company’s operations.

Since, SME companies are mostly promoter driven, it is necessary to ensure that promoter continues to have certain skin in the game until the company is on the SME Exchange, there is no need to align lock-in requirements of SME company with Main Board

i. Proposal – It is proposed that lock-in on minimum promoter contribution (MPC) in SME IPO shall be increased to 5 years. Additionally, lock-in on promoters’ holding held in excess of MPC shall be released in phased manner i.e. lock-in for 50% promoters’ holding in excess of MPC shall be released after 1 year and lock-in for remaining 50% promoters’ holding in excess of MPC shall be released after 2 year.

Question for public comments

6A. Do you agree with the proposal of increasing the lock-in period on minimum promoter contribution (MPC) in SME IPOs to 5 years?

6B. Do you agree with the proposal that lock-in on promoters’ holding held in excess of MPC shall be released in phased manner i.e. lock-in for 50% promoters’ holding in excess of MPC shall be released after 1 year and lock-in for remaining 50% promoters’ holding in excess of MPC shall be released after 2 year?

VII. General Corporate Purpose (GCP) portion of issue size

i. Existing Provision – In terms of ICDR Regulation 2(r), general corporate purposes is defined as :

“general corporate purposes” include such identified purposes for which no specific amount is allocated or any amount so specified towards general corporate purpose or any such purpose by whatever name called, in the draft offer document, draft letter of offer, the offer document, or the letter of offer:

Provided that any issue related expenses shall not be considered as a part of general corporate purpose merely because no specific amount has been allocated for such expenses in the draft offer document, draft letter of offer, the offer document, or the letter of offer;

Further, for SME issues in terms of Regulation 230(2) of ICDR, GCP amount can be 25% of the issue size. Also, in terms of Regulation 230(3) of ICDR, GCP + amount for unidentified acquisition should not exceed 35%.

ii. Suggestion– It has been suggested amount of the GCP should be restricted to 10% instead of 25% of the issue size with an absolute limit of Rs. 10 Crores. Similarly, the GCP amount + unidentified acquisition or investment target, the threshold should change or any unidentified acquisition during the filing of draft offer document should be disallowed.

iii. Rationale – Since there is no specific monitoring of GCP and therefore, any expenses can be classified as general corporate purpose, it increases the risk of misuse of issue proceeds. For example if the issue size is 100 crores, GCP amount becomes 25 crores, which is very high amount to be used by SME company without any specific information to investors on usage of such amount.

iv. Proposal – It is proposed that GCP amount in SME IPO may be restricted to 10% of issue size or Rs. 10 crore (whichever is lower). Further, Regulation 230(3) may be deleted which permits raising funds for unidentified target / acquisition.

Question for public comments

7A. Do you agree with the proposal that GCP amount in SME IPO may be restricted to 10% of issue size or Rs. 10 crore (whichever is lower)?

7B. Do you agree with the proposal that raising funds for unidentified target / acquisition may not be permitted for SME IPO?

b. Eligibility criteria for an SME IPO (Regulation 228 and Regulation 229):

I. Entities not eligible to make an IPO

Restriction w.r.t. Promoter Group for Eligibility:

i. Existing Provision – In terms of Regulation 228 (b), (c),(d) an issuer is not eligible to do SME IPO, if its promoters or directors are promoters or directors of any other company which is debarred from accessing capital market by SEBI, Wilful defaulter or fraudulent borrower or Fugitive economic offender. Extract of Regulation is as under :

“228. An issuer shall not be eligible to make an initial public offer:

(a) if the issuer, any of its promoters, promoter group or directors or selling shareholders are debarred from accessing the capital market by the Board;

(b) if any of the promoters or directors of the issuer is a promoter or director of any other company which is debarred from accessing the capital market by the Board;

(c) if the issuer or any of its promoters or directors is a wilful defaulter or a fraudulent borrower.

(d) if any of its promoters or directors is a fugitive economic offender.”

ii. Suggestion – It is suggested to add Promoter Group in Regulation 228 (b), (c) and (d).

iii. Rationale – It is observed that in Issuer Company proposed to be listed on SME IPO are closely held by Promoter & Promoter group. The business being handled / conducted by the Promoter as well as Promoter group. Therefore, any action against promoter group members may also have significant bearing on issuer.

iv. Proposal– It is proposed to add Promoter Group in Regulation 228 (b), (c) and (d).

Question for public comments

8. Do you agree with the proposal that to add Promoter Group in Regulation 228 (b), (c) and (d)?

II. Eligibility requirements for an initial public offer

i. Existing Provision– In terms of Regulation 229 of ICDR Regulations an issuer is eligible to make an initial public offer:

a. if its post-issue paid-up capital is less than or equal to ten crore rupees

b. if its post issue face value capital is more than ten crore rupees and up to twenty five crore rupees

Eligibility of issuer for IPO on SME and Main Board based on post issue paid-up capital (face value) requirement:

| Paid-up Capital (Face value) | SME platform | Main Board platform |

| Less than 10 crore | Mandatorily on SME | Not eligible |

| Between 10 – 25 crore | Issuer has option to choose SME or Main Board | Issuer has option to choose SME or Main Board |

| More than 25 crore | Not eligible | Mandatorily on Main Board |

In addition to above, as per Regulation 229(3) of ICDR, an issuer may make an initial public offer, if it satisfies track record and/or other eligibility conditions of the SME

Exchange(s) on which the specified securities are proposed to be listed.

Further ICDR provides proviso for cases where issuer had been a partnership firm or a limited liability partnership or in case an issuer is formed out of merger or a division of an existing company, for considering their track record provided they conform to certain requirements regarding financial statements.

ii. Suggestion – It is suggested that in case of conversion of Company from Limited Liability Partnership or from Partnership firm, in such case, the Company shall be in existence for at least period of Two full Financial Year. Further the restated financial statements of the issuer company prepared post conversion should be in accordance with Schedule III of the Companies Act 2013.

Further, it is suggested that there should be an insertion of provision to restrict SME IPO, in cases, whereby there is a complete change in the promoter(s) or there is a change in promoters with new promoter coming by acquisition in two year prior to filing of draft offer document.

iii. Rationale – The need to understand clear picture of financial post conversion whereas financial statement of partnership firm / LLP is different from the financial statement of the Company.

A new set of promoters would not be fully aware of the history of the company and so a 1 year cooling off period before going public is proposed to ensure a steadiness before listing.

It is also important to note that the in case of recent acquisition of the issuer company by a new promoter, the past track record reflects the effective management of the past promoter. Thus, it is also essential to provide sufficient time for the new promoter to demonstrate

iv. Proposal– It is proposed that in case of conversion of Company from Limited Liability Partnership or from Partnership firm, the Company shall be in existence for at least period of Two full Financial Year before filing of DRHP. Further the restated financial statements of the issuer company prepared post conversion should be in accordance with Schedule III of the Companies Act 2013.

Also, it is proposed to have 2 year cooling off period before SME IPO for a Company, if there is a change of promoter(s) or new promoter(s) have come after acquisition of 50% or more shareholding prior to filing of draft offer document.

Question for public comments

9A. Do you agree with the proposal to have 2 year cooling off period before SME IPO for a Company formed after conversion from Limited Liability Partnership or from Partnership firm?

9B. Do you agree with the proposal to have 2 year cooling off period before SME IPO for a Company if there is a change of promoter(s) or new promoter(s) have come after acquisition of more than 50% shareholding prior to filing of draft offer document?

III. Additional eligibility requirements for an initial public offer

Following suggestions were received w.r.t. additional eligibility conditions for an issuer making SME IPO:

i. Suggestion– An issuer should be eligible to make an initial public offer only if the issue size is more than Rs. 10 crore.

Rationale – Normally loans and alternative source of funding are available for amount smaller than Rs. 10 crore. A requirement of minimum 10 crore issue size will ensure that companies which have potential to grow will tap the market.

Proposal– It is proposed that an issuer should be eligible to make an initial public offer only if the issue size is more than Rs. 10 crore.

Question for public comments

10. Do you agree with the proposal that an issuer should be eligible to make an initial public offer only if the issue size is more than Rs. 10 crore?

ii. Suggestion – An issuer should be eligible to make an initial public offer only if the issuer have operating profit (earnings before interest, depreciation and tax) of Rs. 3 crore from operations for at least any 2 out of 3 financial years preceding the application.

Rationale – A minimum operating profit threshold indicates that the company has achieved certain level of profitability and is financially viable.

Proposal– It is proposed that an issuer should be eligible to make an initial public offer only if the issuer have operating profit (earnings before interest, depreciation and tax) of Rs. 3 crore from operations for at least any 2 out of 3 financial years preceding the application.

Question for public comments

11. Do you agree with the proposal that an issuer should be eligible to make an initial public offer only if the issuer have operating profit (earnings before interest, depreciation and tax) of Rs. 3 crore from operations for at least any 2 out of 3 financial years preceding the application?

iii. Suggestion– Mandating SME issuers to have shares having face value of Rs. 10/- for its issued capital and for proposed new shares to be issued / listed through IPO.

Rationale – In order to increase readability of financials and ensure comparability between issuer companies, it is suggested that all issuers have same face value.

Proposal– It is proposed to mandate SME issuers to have shares having face value of Rs. 10/- for its issued capital and for proposed new shares to be issued and listed through IPO. This proposal shall be prospective and applicable only for the new companies coming for listing through SME IPO.

Question for public comments

12. Do you agree with the proposal to mandate SME issuers to have shares having face value of Rs. 10/- for its issued capital and for proposed new shares to be issued and listed through IPO?

c. Migration of SME Companies to Main Board

I. Requirement of compulsory migration linked with fund raising post listing:

i. Existing Provision– Presently Regulation 280 (2) of ICDR requires that in cases post-issue face value capital of an issuer is likely to increase beyond twenty five crore rupees by virtue of any further issue of capital by the issuer, issuer shall migrate to Main Board.

“280. (1)………….

(2) Where the post-issue face value capital of an issuer listed on a SME exchange is likely to increase beyond twenty five crore rupees by virtue of any further issue of capital by the issuer by way of rights issue, preferential issue, bonus issue, etc. the issuer shall migrate its specified securities listed on a SME exchange to the Main Board and seek listing of the specified securities proposed to be issued on the Main Board subject to the fulfilment of the eligibility criteria for listing of specified securities laid down by the Main Board:

Provided that no further issue of capital by the issuer shall be made unless –

a) the shareholders of the issuer have approved the migration by passing a special resolution through postal ballot wherein the votes cast by shareholders other than promoters in favour of the proposal amount to at least two times the number of votes cast by shareholders other than promoter shareholders against the proposal;

b) the issuer has obtained an in-principle approval from the Main Board for listing of its entire specified securities on it.”

Therefore, as per Regulation 280(2), listed SMEs with face value beyond Rs. 25 crores are ineligible for SME segment and shall migrate to Main Board subject to approval of the Exchange.

Thus, SMEs which do not fulfill the Stock Exchange migration criteria* (mainly 3 year listing on SME platform of Exchange) to switch to Main Board, are not eligible for Stock Exchange in-principle approval for fund raising that will increase the paid up capital of issuer beyond Rs. 25 crore threshold.

Therefore, present provisions are restricting SME companies to raise funds post listing, if they are not meeting the main board migration criteria of Stock Exchange(s) and such fund raise may lead to post issue face value capital increasing beyond 25 crore.

ii. Suggestions– Multiple suggestions were received with regard to difficulty faced by SME companies due to restriction in fund raising leading to paid up capital increasing beyond 25 crore. There were suggestions that

a. This limit of paid up capital may be increased to 35 crore or 50 crore

b. Fund raising to be permitted only for companies having net worth more than 100 crore.

c. Fund raising to be permitted only for companies having market cap more than 1000 crore.

d. Allow fund raising and migration to main board even if Exchange migration criteria are not met.

e. Companies may be permitted to raise fund and still remain on SME platform, provided they comply with all corporate governance and disclosure norms under LODR as applicable for main board companies.

iii. Rationale – Above proposal will allow such companies to raise funds for their growth while remaining on SME platform, however with compliances as applicable for main board companies. This will also ensure that SME platform is not used as a backdoor entry for listing at the Main Board of the Exchange by the companies by increasing their paid up capital just after listing and remain listed on SME platform with light touch regulation having paid-up capital more than 25 Crores which otherwise would have attracted Corporate Governance and disclosure requirement of LODR for Main Board listed entities.

iv. Proposal: Based on the discussions, it is proposed that in cases where the company is still not eligible to migrate (i.e. does not meet Exchange criteria for migration), allow them to raise fund without migrating to Main Board, however such Company shall be subjected to Main Board compliances of corporate governance and disclosures under LODR including quarterly results, when its post issue paid-up capital increases beyond 25 crore.

Such companies can migrate to Main Board only when they meet Exchange(s) eligibility criteria for main board migration.

Question for public comments

13. Do you agree with the proposal that in cases where the company is still not eligible to migrate to Main Board (i.e. does not meet Exchange criteria for migration) should be permitted to raise funds / issue shares which results in its post issue paid-up capital going beyond 25 crore, without migrating to Main Board, provided such company is subject to compliances of corporate governance and disclosures under LODR including quarterly results as applicable for Main Board companies?

d. Objects of the Issue and additional disclosure requirements under Schedule VI

i. Object of the issue is repayment of loan of promoter / promoter group – Restriction of Object of Repayment of Loan of Promoter, Promoter Group or any related party from the Issue Proceeds whether directly or indirectly.

Suggestion – It is suggested that for SME issues where objects of the issue consists of Repayment of Loan of Promoter, Promoter Group or any related party from the Issue Proceeds whether directly or indirectly, may not be allowed.

Rationale – The purpose of setting up of SME Exchange was to make finance available to needy small and medium enterprises for growth. Repayment of loan, especially from Promoters or related parties, from issue proceeds does not serve the said purpose. Hence, repayment of promoter loan should not be one of the object of the issue.

Proposal– It is proposed that for SME issues, where objects of the issue consists of Repayment of Loan of Promoter, Promoter Group or any related party, from the issue proceeds, whether directly or indirectly, may not be permitted.

Question for public comments

14. Do you agree with the proposal that SME issues may not be permitted, where objects of the issue consists of Repayment of Loan of Promoter, Promoter Group or any related party, from the issue proceeds, whether directly or indirectly?

ii. Object of the issue is to fund working capital – In case of working capital as one of the objects where the amount exceeds Rs. 5 crores, Compulsory certificate of statutory auditor on half year basis of use of fund in working capital should be provided and disclosed in the financial statements.

Suggestion – In case of working capital as one of the object for fund raising through the issue where the amount raised for working capital exceed Rs. 5 Crore, statutory auditor certificate on half year basis of use of fund in working capital to be made mandatory. Format of working capital utilization certificate shall be the same as that was disclosed in the Offer document submitted to the Exchange.

Rationale – In many of the SME issues, it is observed that one of the object is to fund working capital requirement and it is also noticed that the working capital requirement suddenly jumps as compared to previous three years of its operation without any strong rationale. An additional requirement of statutory auditor certificate specifically for proceeds utilized for working capital should be provided herein which shall be duly endorsed by the audit committee and board of the company

Proposal– In case of working capital as one of the object for fund raising through the issue where the amount raised for working capital exceed Rs. 5 Crore, statutory auditor certificate on half year basis endorsing use of fund in working capital to be made mandatory. Format of working capital utilization certificate shall be the same as that was disclosed in the Offer document submitted to the Exchange.

Question for public comments

15. Do you agree with the proposal that in case of working capital as one of the object for fund raising where the amount raised for working capital exceed Rs. 5 Crore, statutory auditor certificate on half year basis w.r.t. use of fund in working capital to be made mandatory?

iii. Disclosure of firm arrangement of finance up to seventy- five % of issue proceeds –

Suggestion – In case if there is a requirement of firm arrangement of finance for a project completely funded by IPO, and if such projects are partially funded by the Bank/ financial institution, then such projects should be appraised by them and details regarding same shall be disclosed in the draft offer document and offer document.

Rationale – Additional diligence and disclosure for investors that project for which funds are raised for partial funding is appraised by Bank/ financial institution if such project is partially funded by them.

Proposal– In case if there is a requirement of firm arrangement of finance for a project funded by IPO, and if such projects are partially funded by the Bank/ financial institution, then details regarding sanction letter from the Bank/ financial institution shall be disclosed in the draft offer document and offer document.

Question for public comments

16. Do you agree with the proposal that if projects for which proceeds are raised through public issue and such projects are partially funded by the Bank/ financial institution, then details regarding sanction letter from the Bank/ financial institution shall be disclosed in the draft offer document and offer document?

iv. Additional disclosure specific to the company – Presently under ICDR Schedule VI, as part of general information company specific details like registered and corporate office address, details of board of directors, company secretary, compliance officer etc. Further in management section KMP and Senior Management details are required to be disclosed.

In SME companies it is observed that details of senior management are mostly not disclosed stating that Board has not identified any Senior Management.

Suggestions – It is suggested that for SME companies it is mandated to disclose Senior Level Employees in various departments (For e.g. Head of Sales, Purchase, Plant head, Finance, IT head or any other heads of various departments as per company) along with their experiences.

Further, separate disclosure along with additional details of ESIC / EPF viz. number of employees registered on the said portal, amount paid, delay in payment of due for past three years.

Site visit report by Merchant Banker shall form part of Due Diligence report submitted by the Merchant Banker and shall be included in material document for inspection in offer document.

Rationale – Above disclosure shall provide investors with more information including

employee strength of the company leading to better disclosure by the company.

Proposal– SME companies may be mandated to disclose Senior Level Employees in various departments (For e.g. Head of Sales, Purchase, Plant head, Finance, IT head or any other heads of various departments as per company) along with their experiences. Separate disclosure along with additional details of ESIC / EPF viz. number of employees registered on the said portal, amount paid, delay in payment of due for past three years.

Site visit report by Merchant Banker shall form part of Due Diligence report submitted by the Merchant Banker and shall be included in material document for inspection in offer document

Question for public comments

17. Do you agree with the proposal of additional disclosures w.r.t. senior level employees, details of ESIC / EPF viz. number of employees registered on the said portal, amount paid, delay in payment of due for past three years, site visit report by Merchant Bankers etc. in case of SME IPOs?

v. Disclosure of fees of Merchant Banker- Currently, there is no requirement in RHP to specifically disclose the quantum of issue related expenses.

Suggestions- It is suggested that Fees of Merchant Bankers may be disclosed in the RHP.

Rationale- Many a times it is noted that fees of Merchant Banker exceeds 30-40% of the issue size. Thus, it defeats the purpose of providing an alternative fund raising mechanism for SMEs.

Proposal- Fees of Merchant Bankers in any form / name / purpose may be disclosed in the RHP.

Question for public comments

18. Do you agree with the proposal that Fees of Merchant Bankers in any form / name / purpose shall be disclosed in the RHP?

e. Other proposals

I. Offer document to be made available to public

i. Existing Provisions – In terms of Regulation 247 under SME Chapter, the issuer and the lead manager(s) shall ensure that the offer documents are hosted on the websites as required under ICDR regulations.

In case of Main Board IPOs, in terms of Regulation 26 (1) and 26 (2), there is a requirement that offer documents are to be made public for comments, if any, for a period of at least twenty one days from the date of filing and public announcement is made (in one English, Hindi and regional newspaper) disclosing the fact of filing of the draft offer document and inviting the public to provide their comments.

Presently, similar requirement is not prescribed for SME IPOs at the time of filing of DRHP.

ii. Suggestion – The DRHP of SME IPO filed with the Stock Exchanges shall be made available to public for comments, if any, for a period of at least 21 days from the date of public announcement, by hosting it on the websites of the stock exchanges and websites of lead manager(s) associated with the issue and making a public announcement in one English, Hindi and regional language newspaper, regarding filing of DRHP and inviting the public to provide their comments.

iii. Rationale – Public will get information regarding filing of DRHP by the issuer company and can provide their comments, if any, in respect to the company. Presently, it is noted that investor references / complaints are mostly received at the time of issue opening and not at the time of dissemination of draft offer document.

iv. Proposal– DRHP of SME IPO filed with the Stock Exchanges shall be made available to public for comments, if any, for a period of at least 21 days from the date of public announcement, by hosting it on the websites of the stock exchanges and websites of lead manager(s) associated with the issue and making a public announcement in one English, Hindi and regional language newspaper, regarding filing of DRHP and inviting the public to provide their comments.

Question for public comments

19. Do you agree with the proposal that DRHP of SME IPO filed with the Stock Exchanges shall be made available to public for comments for a period of at least 21 days and making a public announcement in one English, Hindi and regional language newspaper, regarding filing of DRHP and inviting the public to provide their comments?

II. Converting outstanding convertible securities before IPO

i. Existing Provision – For main board IPOs, in terms of Regulation 5(2), an issuer is not eligible to make IPO if there are any outstanding convertible securities (with some exemption for ESOPs and fully paid up convertibles which are required to be converted before RHP/prospectus).

However, there are no such requirement for SME IPOs to convert outstanding convertible securities before IPO.

ii. Suggestion– It is suggested that capital structure of the issuer should be frozen in terms of number of shares before IPO, as same provides a clear picture to the investors as regards to underlying capital of issuer before applying in the IPO.

iii. Rationale – This will provide more clarity to investors on capital structure of the issuer.

iv. Proposal – In line with Regulation 5(2) for Main Board IPO, similar eligibility condition may be introduced for SME IPOs requiring conversion of outstanding convertible securities before IPO.

Question for public comments

20. Do you agree with the proposal that eligibility condition may be introduced for SME IPOs requiring conversion of outstanding convertible securities before IPO?

III. Due-diligence certificate by Merchant Banker

ii. Existing Provision – In terms of Regulation 246 of ICDR, the lead manager(s) shall submit a due-diligence certificate as per Form A of Schedule V including additional confirmations as provided in Form G of Schedule V along with the offer document to the Board.

Offer document in ICDR is defined as RHP and prospectus.

In Main Board IPOs, requirement of submitting due-diligence certificate by Merchant

Bankers is at the time of draft offer document i.e. at the time of DRHP.

iii. Suggestion – It is suggested that for SME IPO, Merchant Banker shall submit due-diligence certificate to Stock Exchanges at the time of filing of draft offer document.

iv. Rationale – Since, in SME IPOs DRHP is not filed with SEBI, due-diligence certificate at the time of DRHP can be submitted to Stock Exchanges.

v. Proposal – It shall be mandated for Merchant Banker to submit due-diligence certificate

to Stock Exchanges at the time of filing of draft offer document.

Question for public comments

21. Do you agree with the proposal mandating Merchant Banker to submit due-diligence certificate to Stock Exchanges at the time of filing of draft offer document?

IV. Non-uniformity in nomenclature

i. Existing Provision – In Chapter IX – IPO by SME, of ICDR the term post-issue paid-up capital is used mostly while at some places term post-issue face value capital is used (like Regulation 229 (2) of ICDR).

ii. Suggestion– It is suggested that nomenclature should be uniform and at all places term post-issue paid-up capital may be used.

iii. Rationale – This removes ambiguity and aligns terminology used across regulation.

iv. Proposal – Nomenclature should be uniform and at all places term post-issue paid-up capital may be used.

Question for public comments

22. Do you agree with the proposal that term post-issue face value capital in regulations be replaced with term post-issue paid-up capital at all places for uniformity in nomenclature?

V. Addition of new Regulation in line with regulation 59 of SEBI ICDR Regulation

i. Existing Provision – For main board IPO, in terms of Regulation 59 of ICDR, there are provisions which provide Post-listing exit opportunity for dissenting shareholders in case of change in objects or variation in the terms of contract related to objects referred to in the offer document.

Similar provisions are presently not provided for SME IPO.

ii. Suggestion – It is suggested that provisions related Post-listing exit opportunity for dissenting shareholders may be provided in SME chapter in line with main board provisions.

iii. Rationale – This will help in protecting the interest of the investors.

iv. Proposal – Post-listing exit opportunity for dissenting shareholders may be provided in SME chapter in line with main board provisions.

Question for public comments

23. Do you agree with the proposal of adding provision in SME chapter stating issuer to provide an exit offer to dissenting shareholders as provided for in the Companies Act, 2013, in case of change in objects?

VI. Clarification w.r.t. Securities ineligible for minimum promoters’ contribution (MPC)

i. Existing Provision –In terms of Regulation 237(1)(b) of ICDR, specified securities acquired during the preceding one year at a price lower than the price at which specified securities are being offered to the public in the initial public offer are ineligible for minimum promoters’ contribution (MPC).

ii. Suggestion – It is observed that the Company prior to filing of draft offer documents issue shares through Private placement / preferential issue basis at higher value and 2-3 months prior to filing of draft offer documents issue bonus shares at high ratio thereby the per share value (price) post bonus issuance calculated for diluted equity becomes lesser than the issue price whereas the actual price of such shares initially was kept such that it remains higher than the issue price.

It is suggested that an explanation may be provided that Price per share for determining securities ineligible for MPC, shall be adjusted for corporate actions e.g. split, bonus etc. done by the Issuer Company.

iii. Rationale – A clarification needs to provided that for determining eligibility price has to be recomputed after adjusting for corporate actions. For Example: If issue is priced at INR 60 and shares were acquired in last one at price of INR 100 and there has been a 1:1 split or bonus after such acquisition then acquisition price per share for such shares to be taken as INR 50. Accordingly, this price of INR 50 needs to be compared with issue price for determining securities eligibility for MPC.

Aforesaid explanation is needed to clarify the intent of the provisions.

iv. Proposal– It is proposed that an explanation may be provided that Price per share for determining securities ineligible for MPC, shall be adjusted for corporate actions e.g. split, bonus etc. done by the Issuer Company.

Question for public comments

24. Do you agree with the proposal that an explanation may be provided that Price per share for determining securities ineligible for MPC, shall be adjusted for corporate actions e.g. split, bonus etc. done by the Issuer Company?

PART II: Streamlining applicability of corporate governance provisions under SEBI (LODR) Regulations, 2015

a. With a view to bring parity between SME and Main Board listed entities and protect the interest of the investors in SME listed entities, it is proposed to enhance the applicability of provisions under LODR Regulations to SME listed entities as discussed below.

I. Applicability of provisions pertaining to related party transactions (RPTs):

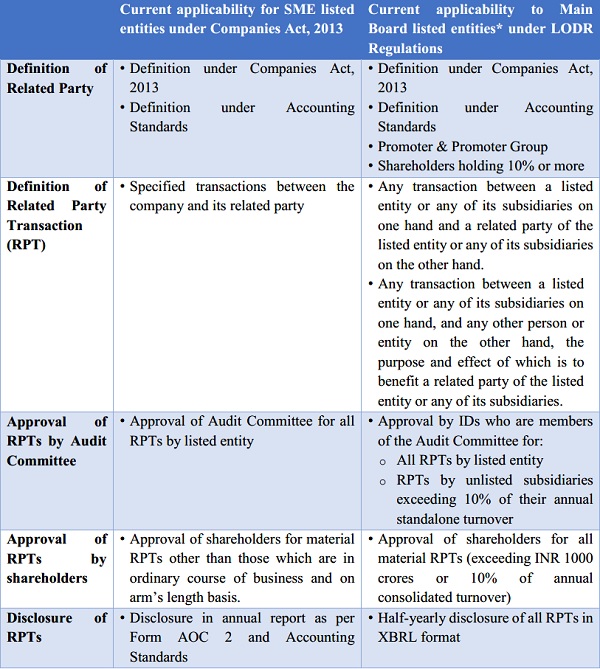

i. Existing provision: A broad comparison of current applicability of RPT provisions for SME listed entities under Companies Act, 2013 and for Main Board listed entities under LODR Regulations is given at Annexure C.

ii. Suggestion: RPT provisions under Regulation 23 of LODR Regulations should also be applicable to SME listed entities.

iii. Rationale: It is noted from the comparison given at Annexure C that the approval and disclosure requirements for RPTs under LODR Regulations are quite stricter than those under Companies Act, 2013. Further, certain transactions are also not included in the ambit of RPT for SME listed entities such as transactions between listed entity or any of its subsidiaries and any other entity the purpose and effect of which is to benefit a related part of the listed entity or its subsidiaries. Applying RPT norms under LODR Regulations to SME listed entities would contain the risks of siphoning of funds through related parties as observed in the instances mentioned in paragraph 21 above.

iv. Proposal: In view of the above, it is proposed that the applicability of RPT norms under LODR Regulations should be extended to SME listed entities other than those which have paid up capital not exceeding Rs. 10 crores and net worth not exceeding Rs. 25 crores. This will harmonize the applicability of RPT norms between SME listed entities and Main Board listed entities. However, materiality threshold under Regulation 23(1) of LODR Regulations for approval by shareholders for RPT shall be only for transactions exceeding 10% of annual consolidated turnover, and not lower of Rs. 1000 crore or 10% annual consolidated turnover since SMEs may not enter into high value transactions exceeding Rs 1000 crores.

Question for public comments

25. Do you agree with the proposal that RPT norms under LODR Regulations, except that materiality threshold under Regulation 23(1) of LODR Regulations shall be only for transactions exceeding 10% of annual consolidated turnover, should be extended to SME listed entities other than those which have paid up capital not exceeding Rs. 10 crores and net worth not exceeding Rs. 25 crores?

II. Disclosure of composition and meetings of the board of directors and its committees:

i. Existing Provision – In terms of Regulation 27 of the LODR Regulations, a listed entity on Main Board is required to submit a quarterly compliance report. The said report mandates disclosure of composition of directors, attendance details of directors, number of meetings held etc. No such requirement is applicable to SME listed entities.

ii. Suggestion: SME listed entities should also be required to disclose details of composition and meetings of Board of Directors and its committees.

iii. Rationale: Board of directors and its committees fulfill a vital role in ensuring effectiveness of the company’s governance practices and integrity of the company’s accounting and financial reporting systems. Proper composition and frequent meetings of the board of directors and its committees are paramount for effective functioning of the board. Extending disclosure requirements to SME listed entities would increase transparency on the functioning of the board of directors and its committees. It would also enable monitoring of the composition and meetings by the stock exchanges, analysts and investors.

iv. Proposal: In view of the above, it is proposed that requirement to disclose the composition and details of meetings (date, no. of directors present, etc.) of Board of Directors and its committees may be extended to SME listed entities other than those which have paid up capital not exceeding Rs. 10 crores and net worth not exceeding Rs. 25 crores. The disclosure may be required on a quarterly basis to the stock exchanges in XBRL format. This will harmonize these disclosure requirements between SME listed entities and Main Board listed entities.

Question for public comments

26. Do you agree with the proposal that the requirement to disclose the composition and details of meetings (date, no. of directors present, etc.) of Board of Directors and its committees, should be extended to SME listed entities other than those which have paid up capital not exceeding Rs. 10 crores and net worth not exceeding Rs. 25 crores?

III. Periodic filings:

i. Existing Provision: Shareholding pattern, Statement of deviation(s) or variation(s) and financial results are required to be submitted half-yearly by SME listed entities and quarterly by Main Board listed entities.

ii. Suggestion: Shareholding pattern, Statement of deviation(s) or variation(s) and financial results may be required to be submitted on quarterly basis by SME listed entities.

iii. Rationale: Financial results and statement of deviation(s) or variation(s) are important filings which reflect the financial health and fund utilization by companies. Hence, such filings should be made on a quarterly basis by SME listed entities as well. Further, filing of shareholding pattern by SME listed entities should also be brought at par with Main Board listed entities, i.e. quarterly, at present.

iv. Proposal: In view of the above, SME listed entities may be required to submit Shareholding pattern, Statement of deviation(s) or variation(s) and financial results on a quarterly basis, instead of the existing requirement of half-yearly basis, at par with the Main Board listed entities.

Question for public comments

27. Do you agree with the proposal that the SME listed entities should be required to submit Shareholding pattern, Statement of deviation(s) / variation(s) and financial results on a quarterly basis?

E. PUBLIC COMMENTS

27. Considering the implications of the aforementioned matters on the market participants, public comments are invited on the above-detailed proposals. The comments/ suggestions should be submitted latest by December 04, 2024, through the following link:

https://www.sebi.gov.in/sebiweb/publiccommentv2/PublicCommentAction.do?doPublicComments=yes

28. In case of any technical issue in submitting your comment through web based public comments form, you may send your comments through e-mail to consultationcfd@sebi.gov.in with the subject “Consultation Paper on Review of SME segment”.

Issued on: November 19, 2024

******

Annexure A

A. Eligibility criteria as prescribed by NSE for listing on SME platform

| Parameter | Criteria |

| Incorporation | The Issuer should be a company incorporated under the Companies Act 1956 / 2013 in India. |

| Post Issue Paid Up Capital |

The post issue paid up capital of the company (face value) shall not be more than Rs. 25 crore. |

| Track Record |

i. the applicant seeking listing; or ii. the promoters****/promoting company, incorporated in or outside India or iii. Proprietary / Partnership firm and subsequently converted into a Company (not in existence as a Company for three years) and approaches the Exchange for listing. ****Promoters mean one or more persons with minimum 3 years of experience in the same line of business and shall be holding at least 20% of the post issue equity share capital individually or severally

|

| Other Listing Conditions |

|

| Disclosures | The following matters should be disclosed in the offer document:

1. Any material regulatory or disciplinary action by a stock exchange or regulatory authority in the past one year in respect of promoters/promoting company(ies), group companies, companies promoted by the promoters/promoting company(ies) of the applicant company. 2. Defaults in respect of payment of interest and/or principal to the debenture/bond/fixed deposit holders, banks, FIs by the applicant, promoters/promoting company(ies), group companies, companies promoted by the promoters/promoting company(ies) during the past three years. 3. The applicant, promoters/promoting company(ies), group companies, companies promoted by the promoters/promoting company(ies) litigation record, the nature of litigation, and status of litigation. 4. In respect of the track record of the directors, the status of criminal cases filed or nature of the investigation being undertaken with regard to alleged commission of any offence by any of its directors and its effect on the business of the company, where all or any of the directors of issuer have or has been charge-sheeted with serious crimes like murder, rape, forgery, economic offences |

| Rejection Cooling Off Period

|

The application of the applicant company should not have been rejected by the Exchange in last 6 complete months.

|

B. Eligibility criteria as prescribed by BSE for listing on SME platform

| Parameter | Criteria |

| Incorporation | The Issuer should be a company incorporated under the Companies Act 1956 / 2013 in India. |

| Post Issue Paid Up Capital |

The post issue paid up capital of the company (face value) shall not be more than Rs. 25 crore. |

| Networth |

|

| Net Tangible Asset |

|

| Track Record |

taken over a proprietorship concern/ registered partnership firm/ LLP, then the combined track record with such proprietorship concern/ registered firm/ LLP should be atleast 3 years.Provided, the applicant company seeking listing should have a track record of operations for atleast one full financial year and audited financial results for one full financial year. Or Where the applicant company does not have a track record of 3 years, then the Project for which IPO is being proposed should be appraised and funded by NABARD, SIDBI, Banks (other than co-operative banks), Financial Institutions. Provided, the applicant company seeking listing should have a track record of operations for atleast one full financial year and audited financial results for one full financial year. |

| Earnings before Interest, Depreciation and tax |

Provided the company should have operating profit (earnings before interest, depreciation and tax) from operations for one full financial year preceding the application date.

|

| Leverage Ratio |

|

| Disciplinary action |

|

| Default |

|

| Name change |

|

| Additional Criteria for broking companies applying for SME IPO |

Net worth of minimum Rs. 5 crores with profit before tax of atleast Rs. 5 crores in any 2 years out of 3 financial years. Or Net worth of atleast Rs. 25 crores in any 3 years out of 5 financial years. The Financial year should be for a period of 12 months. Extraordinary income will not be considered for the purpose of profits.

The Net Tangible assets of at least Rs. 3 Crores as per the latest audited |

| Additional Criteria for Micro Finance Companies | Micro finance companies, in addition to the existing criteria for all SME companies, should have a Asset Under Management of at least Rs. 100 Crores, client base of 10000 & above and it should not have accepted / held public deposits. |

| General Requirements (for all companies) |

|

| Cooling Off Period | Gap of at least 6 months from date of withdrawal/ rejection of issue from SEBI/Exchanges. |

Annexure B

| Parameter | NSE- Migration policy from SME Platform to Main Board | BSE- Migration policy from SME Platform to Main

Board |

| Paid up Capital & Market Capitalisation |

The paid-up equity capital of the applicant shall not be less than 10 crores and the capitalisation of the applicant’s equity shall not be less than 25 crores**

** Explanation For this purpose capitalisation will be the product of the price (average of the weekly high and low of the closing prices of the related shares quoted on the stock exchange during 3 months preceding the application date) and the post issue number of equity shares |

|

| Earnings before Interest, Depreciation and Tax (EBITDA) and Profit After Tax (PAT) |

|

|

| Listing period | The applicant should have been listed on SME platform of the Exchange for at least 3 years. | The applicant company is listed on SME Exchange/ Platform having nationwide terminals for atleast 3 years. |

| Other Listing conditions | The applicant Company has not referred to the Board of Industrial & Financial Reconstruction (BIFR) &/OR No proceedings have been admitted under Insolvency and Bankruptcy Code against the issuer and Promoting companies.

The company has not received any winding up petition admitted by a NCLT. |

|

| Public Shareholders | Total number of public shareholders on the last day of preceding quarter from date of application should be at least 1000. | The applicant company shall have a minimum of 250 public shareholders as per the latest shareholding pattern. |

| The applicant desirous of listing its securities on the main board of the Exchange should also satisfy the Exchange on the following: | 1. The Company should have made disclosures for all material Litigation(s) / dispute(s) / regulatory action(s) to the stock exchanges where its shares are listed in adequate and timely manner.