Securities and Exchange Board of India

REGULATORY FRAMEWORK FOR MICRO, SMALL & MEDIUM REITs (MSM REITs)

May 12, 2023 | Reports : Reports for Public Comments

1. Objective:

1.1. The objective of this consultation paper is to seek comments/views/ suggestions from the public on the proposals for regulating platforms offering fractional ownership of real estate assets. Such fractional ownership of real estate assets is proposed to be brought as MSM REITs under SEBI (Real Estate Investment Trusts) Regulations, 2014.

Page Contents

2. Background:

2.1. In the past 2-3 years, there has been a mushrooming of web based platforms offering fractional ownership of real estate assets. These platforms provide investors an option to invest in buildings and office spaces including warehouses, shopping centres, conference centres, etc. The minimum investment on these Fractional Ownership Platforms (FOPs) range from INR. 10 lakhs to INR. 25 lakhs. The underlying real estate assets offered on FOPs are similar to the real estate or property defined under the REIT Regulations.

2.2. The self-disclosed / self-declared details of some of the prominent FOPs including the total assets under management as per their response or as disclosed on their respective websites are as under:

Table 1

|

Platform |

Backed by | No. of users / investors registered | Total Assets under management (in Crores) |

| Prop Share | Commercial properties and Office space in Mall | NA | 960 |

| Hbits | Commercial properties |

250 | 138 |

| Strataprop | Commercial properties, Warehouses |

1819 | 704 |

| Asset Monk | Commercial properties |

NA | 217 |

| Myre Capital | Commercial properties |

NA | 227 |

2.3. Globally, such fractional ownership platforms have been in existence since 2015. Some of the platforms across the globe are as follows:

CONSULTATION PAPER

Table 2

|

Name of platform |

Country | No. of users / investors registered | Total Assets under management |

| Fundrise | United States | 3,87,000 | $ 7 billion |

| Realty Mogul | United States | 2,74,000 | $ 6 billion |

| Cadre | United States | 250,000 | $ 5 billion |

| Stake | UAE | 150,000 | $39 million |

2.4. Given the increasing value of investments with such FOPs, as well as rising number of investors it has become necessary to consider whether it is an appropriate juncture to require registration and regulate these FOPs in order to bring about, inter-alia, regulatory oversight, common uniform standard disclosure practices, ensuring liquidity by way of listing or similar such measure, investor redressal mechanism, etc. to safeguard the interest of investors.

2.5. Towards this end, this consultation paper attempts to bring forth the salient features of such FOPs and proposes extending the framework of SEBI (Real Estate Investment Trust) Regulations, 2014 (REIT Regulations), with due modifications as required, in order to bring these FOPs under the regulatory ambit / regulatory perimeter of SEBI. This would not only help develop the real estate market but also provide investor protection measures and lead to an orderly development of this sector and the market.

3. REIT REGULATIONS

3.1. SEBI (REIT) Regulations were notified on September 26, 2014, thereby providing a regulatory framework for regulation of Real Estate Investment Trust (REIT). REIT Regulations provides an avenue to investors to invest in real estate assets which otherwise they would not have been able to take an exposure.

3.2. REIT are set up as a trust and registered with SEBI. It has parties such as Trustee, Sponsor(s) and Manager. The trustee of a REIT is required to be a SEBI registered Debenture Trustee who is not an associate of the Sponsor. The Trustee generally has an overseeing role in the activity of the REIT and the Manager has operational responsibilities. At least half of the directors are independent in case of Manager that is constituted as a company and half the members of the governing board are required to be independent in case of Manager that is constituted as an LLP.

3.3. REIT can invest in real estate assets, either directly or through Holdcos and/or SPVs. REIT is required to hold controlling interest and at least 50% of the equity share capital or interest in Holdco and/or SPV. A REIT is required to invest at least 80% of its value of assets in completed and revenue generating properties and maximum 20% can be invested in under development properties and other eligible investments. The assets are required to be situated in India. The minimum value of the assets owned/proposed to be owned by REIT should be INR 500 crore and the minimum issue size for initial offer should be INR 250 crore. It is required to distribute at least 90% of its net distributable cash flows, to its investors. REIT Regulations were notified with minimum lot size of INR 1 lakh which has now been gradually reduced to 1 unit.

3.4. REIT Regulations allows REIT to invest in land and any permanently attached improvements to it, whether leasehold or freehold and includes buildings, sheds, garages, fences, fittings, fixtures, warehouses, car parks, etc. and any other assets incidental to the ownership of real estate.

3.5. As of March 31, 2023, 5 REITs are registered with SEBI, of which three REITs have issued units which are listed on the stock exchange platform and have total unit capital of INR 54,411 crores.

3.6. Although there is immense potential in real estate investment in office spaces, one of the reasons for lesser number of REITs may be attributed to the requirement of minimum asset size of INR 500 crores and minimum offer size of INR 250 crores as envisaged in the REIT Regulations.

4. FRACTIONAL INVESTMENT OR OWNERSHIP OF REAL ESTATE ASSETS – HOW IT WORKS

4.1. As such, investment in real estate is capital intensive and requires an investor to invest huge amounts which can make it quite difficult for majority of the non-institutional investors to invest in such properties. The appetite in this sector appears to be considerable which is borne out of the number of players and investors in FOPs as shown in the previous paragraphs / tables 1 and 2.

4.2. Apart from limited ability to invest huge amounts, non-institutional investors may have:

4.2.1. limited market knowledge of real estate and opportunities available for investing

4.2.2. no wherewithal to manage the real estate or

4.2.3. problem in finding premium tenants and negotiate terms with such tenants on an on-going basis.

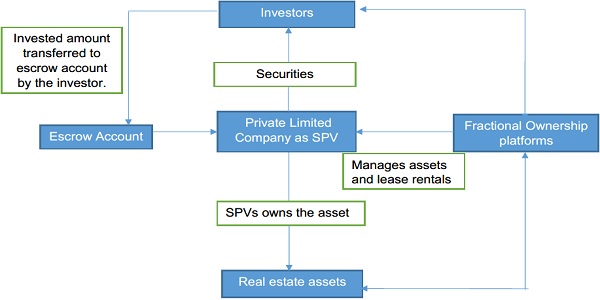

4.3. Fractional investment or ownership of real estate through FOPs is an investing strategy in which the cost of acquisition of real estate is split among several investors, who invest in securities issued by a Special Purpose Vehicle (SPV) established by the FOP. Such SPV purchases the real estate asset. The costs of upkeep and acquisition are divided among the investors/shareholders in SPVs, who also share the benefits and returns of the assets subject to management and maintenance fees levied by the FOP or its associates or specified third parties. Thus, FOPs allow investors to own a certain percentage / fractional share in the real estate asset through the securities issued by the SPVs.

4.4. FOPs provide an avenue and an opportunity to bring together diverse set of investors and create joint or fractional ownership of such real estate. The main advantage of FOPs is that a group of people can pool in money and jointly purchase real estate. The minimum investments vary across FOPs, and have been indicated to be in ranging between INR 10 lakh to INR 25 lakh.

4.5. FOPs facilitate investment in primarily pre-leased real estate, which earn the investors a rental yield as well as permits participating in potential rise in value of such real estate. The returns and incomes so generated are distributed to the investors subject to management / maintenance fees and other charges, costs and expenses. Fractional ownership reduces the financial burden on a single investor while allowing them to generate a steady stream of cash flows and long-term returns. Additionally, certain FOPs indicate that investors can diversify their real estate portfolios by investing in multiple real estate assets across different locations and cities through SPVs established for each such real estate project. Similarly, investors with limited appetite for real estate or who desire focused investment in a particular business district or location or city are also well-served through the multiple SPVs established by FOPs.

For example, there is a premium office space at a prime location in Mumbai worth INR 100 crores. The said office space is already pre-leased by a large MNC, ensuring a steady cash flow and capital appreciation in the long term. However, an individual investor with only INR 20 lakhs will not be able to invest in this property. FOPs enable individuals to pool the investible amounts (subject to a minimum amount) with other individuals and jointly own such office space. As a result, individual investors can invest in the INR 100 crore valued office space with an investment of just as low as INR 20 lakh.

4.6. The transaction structure of an FOPs is as follows:

4.6.1. The property is first identified by the FOP.

4.6.2. The identified property is listed on the website of FOP seeking expression of interest from public with token amount ranging from INR 10,000 to INR 1 lakh.

4.6.3. On receipt of 100% expression of interest, the placement memorandum to subscribe to the securities issued by the private limited company i.e. SPV which will purchase the real estate asset or which own the real estate asset are forwarded to the investor.

4.6.4. The investor transfers the amount to the escrow account

4.6.5. The investors are allotted the securities.

4.6.6. The flow chart of the process followed by most of the FOPs are as under:

In the above illustration, the SPV issues unlisted securities to the Investors.

5. REGULATORY OVERSIGHT OF FOPS – AMBIGUOUS OR ABSENT

5.1. Some of the FOPs are operated by real estate agents or brokers (before the property is purchased) and as property managers thereafter. For the former, some FOPs may have registered themselves as ‘real estate agents’ under the provisions of the state level Real Estate (Regulation and Development) Act, 2016 (RERA) if any, as applicable. However, it is unclear whether all FOPs actually follow this practice and even for FOPs which do follow such a practice, whether the same addresses any investor issue which may arise. This is because the full extent and nature of operations of the FOPs or its role in dealing with the developers, investors and in managing the real estate projects and operating the platform which facilitates disclosure or transactions may not be within the purview of RERA, & hence there is ambiguity whether the complete set of activities undertaken by FOPs fall under the regulatory ambit of RERA.

5.2. RERA lays down responsibilities of a real estate agent, including maintaining books of accounts, not getting involved in unfair trade practices and facilitating the provision of all information to the allottee/s at the time of booking. Such responsibilities do not appear to offer protection to investors, as the context in which RERA operates is significantly different from the nature and extent of operations of an FOP, and its engagement with the potential / actual investors. Many FOPs facilitate investors being constituted as shareholders and/or debenture holders of the SPV which actually owns the real estate. The governance of such SPVs may require review and independent oversight. Some FOPs facilitate direct joint ownership of the real estate among a large number of individuals, creating complexity and future challenges for the investors who are joint owners. Hence, RERA’s oversight may be limited to specific areas and may not encompass the extended operational aspects of these FOPs.

5.3. It is also noteworthy that the SPVs, if any, established by the FOPs are constituted as private limited companies and are governed mainly by the provisions of the Companies Act, 2013, as applicable to private limited companies. Such companies are required to restrict transferability of shares and securities, and also may have limited governance oversight. Furthermore, the Companies Act 2013 limits the number of investor in a private limited company to 200 investors. However, given how the FOPs obtain interest of participation from members of public, it is entirely possible that the SPV may have undertaken a deemed public issue (DPI) without attendant compliances of issuing prospectus or filing with SEBI. The FOPs may also be organizing investors interested in the same real estate into more than one SPV to remain below the threshold of DPI. Concerns have also been expressed, that the same may amount to unregistered collective investment schemes (CIS).

5.4. This varying nature of structures adopted by the FOPs raise concerns regarding due investor protection, lack of uniformity in disclosure standards, lack of transparency in valuation, management fees, maintenance costs, redress of investor issues and grievances, participation in upside from potential sale of the real estate without concomitant contribution to acquisition price, etc. Moreover, a lack of transparency or lack of a market in effecting sale of the unlisted securities of the SPVs or of the underlying real estate when investor needs liquidity could lead to investor grievance. Therefore, there arises an imperative need that the FOPs as providers of such products, platforms and services operate in a transparent and regulated environment that balances the needs of all stakeholders.

5.5. SEBI notified SEBI (Real Estate Investment Trusts) Regulations, 2014 in September 26, 2014. REITs are set up as a Trust under the Indian Trust Act, 1882 and it must be registered under the SEBI (Real Estate Investment Trusts), Regulations 2014. REITs to raise funds through an initial offer and subsequently through follow on offer, rights issue, qualified institutional placement, etc. The minimum asset size, of a proposed REIT, is prescribed at INR 500 crore and the minimum offer size for initial offer is prescribed at INR 250 crore. REIT Regulations mandate that there shall be minimum 200 subscribers (excluding related parties). REIT units are mandatorily required to be listed on recognized stock exchanges in India. This provides exit to investors whenever desired. Further, REITs are mandated to distribute at least 90% of the net distributable cash flows to investors on a half-yearly basis and conduct full-fledged valuation of all REIT assets on a yearly basis through a registered valuer.

5.6. Extending the regulatory framework of REIT Regulations to fractional ownership platforms would address the above mentioned concerns to a large extent, and also provide an impetus for the growth of this market. The migration of the current SPVs or other structures established by FOPs to the REIT structure, may also result in treatment of such investment by investors as investment in Business Trusts as defined under the Income-tax Act, which provides certain tax benefits for SEBI registered REITs that are otherwise not available to the SPV or the investors or both.

6. INVESTOR CONCERNS:

The FOPs largely target the Non-Institutional Investors I.e. High net worth individual investors for investments into real estate. It is a welcome sign that such investors are investing in the real estate. However, certain concerns that arise for investors in relation to the transactions in real estate are outlined as under:

6.1. The mode, manner and sanctity of transactions executed on the FOPs may be a cause of concern as the dealings are with non-institutional investors, and the subject matter of transactions is real estate, with accompanying issuance of securities or as joint ownership of the real estate using untested instruments or mechanisms on a large scale among unconnected investors. The mode and manner of completion of the purchase/acquisition of the real estate and of issuance of the securities or confirmations may be ambiguous, opaque or not subject to independent review or oversight. Moreover, in case of any infirmity, investors may not have recourse to legal remedies.

6.2. At present, FOPs offer purchase of real estate on fractional ownership basis. There is a lack of uniformity of disclosures regarding:

6.2.1. the valuation of the real estate

6.2.2. disclosures made to the investors at the time of soliciting investment, 6.2.3. property title diligence and property title documentation,

6.2.4. lease, rental or tenancy documents and terms arrived at with the lessees/renters/tenants,

6.2.5. continuing disclosures including of receipts of lease payments, due payment of outgoings (including property taxes, electricity or water charges), cancellation or suspension of leases, potential offers for purchase of property by third parties, status of lease renewals, etc.

6.2.6. disclosure and managing of potential, perceived or actual conflict of interest by the FOPs/developer/tenants, etc.

6.3. It was observed that unlisted securities which connotes the fractional investment in a specific real estate are issued to the investors. For exiting or liquidation of such fractional investment, the investor is dependent upon the FOP for necessary information to aid diligence by potential purchaser or in identifying potential purchasers and in effecting transfers. Such dependency on the FOP without assurance of exit, due valuations, liquidity or transparency is unfavorable for the investors and is not in their long term interests.

6.4. In case of FOPs which facilitate direct joint ownership of the real estate among a large number of individuals appear to have done so through Power of Attorney (POA) structures creating a binding liability of the FOP with the owners, who are circumscribed from independently dealing with their own stake. This creates dependency on the FOP for effecting any transfers, and requires incoming transferee/s to also execute a POA in favor of the FOP. The issues of due valuation, liquidity, and transparency subsist in this structure as well. It is noted that POAs have also been misused/abused in other situations, and hence add risk on the investors. It is also noteworthy that in case of death of an investor or in case of insolvency or bankruptcy, the POA would automatically lapse, and expose other investors / fractional owners to the vagaries of claimants on account of succession and inheritance to the stake of the deceased investor or of insolvent or bankrupt investor.

6.5. As such, with FOPs not being within the purview of any financial sector regulator purview, KYC / AML norms are not applicable to their activities. Accordingly, many of these FOPs do not align and/or comply with the Prevention of Money Laundering Act, 2002 (PMLA) guidelines or KYC requirements specified by financial sector regulators. FOPs appear to be following norms of their own choosing for performing customer identification and hence would lack standardization and uniformity. This represents a risk in combating misuse of identity credentials, could result in camouflaging source of funds and money laundering and represents a risk to the financial system.

6.6. There may be no uniformity or common approach on investor grievances and its handling by the FOPs. Each FOP has its own process for redressing the grievances of its investors and it is not a standard practice. Furthermore, it is not ascertainable whether the FOPs have evaluated possible issues that may arise, and are adequately geared to evaluate and redress the grievances. Finally, the efficacy of independent review of such redress mechanism is absent.

6.7. A major concern is the possibility of investors having a false sense of comfort that their fractional investment in real estate on an FOP being fully regulated. As noted, while certain FOPs have taken a real estate agent registration with state-level RERA, such registration does not imply end-to-end regulation by RERA of the FOP and its role/activities. Similarly, structural variations adopted by FOPs including fractional investment connoted by unlisted securities of SPV constituted as a company also requires due filings in MCA, with tax or municipal authorities. The investors could be ultimately held responsible or face the consequences in case of failure of the FOP or service providers identified and appointed by the FOP to comply with such filing requirements, as such FOPs lack mandatory independent review or assurance mechanisms.

6.8. FOPs offer for fractional investment in real estate which appears to have high value or high profile tenants or give an appearance of the investment being in high demand (through wait list or showing sold-out status) as a means of enticing or attracting investor interest. Independent review of such sales materials and validation of valuation may also be absent. While it is an investor’s decision to invest in such real estate, the lack of standard, uniform selling practices and lack of independent valuation, or of diligence of information or materials provided to potential investors could result in investors falling prey to mis-selling.

7. Proposed scope of Regulation:

7.1. Given some of the above mentioned concerns, it is felt that there is a need to regulate the operations of FOPs, keeping in mind the core objective of investor protection particularly for non-institutional investors. In this regard, it is proposed to bring FOPs under regulatory ambit / regulatory perimeter by introducing a chapter under REIT Regulations and labelling these as MSM REITs. The key points of the proposed regulatory framework are given below:

7.1.1. Provision for registration and regulation of FOPs under REIT Regulations: It is proposed that any person or entity (including FOPs) which facilitate or have facilitated fractional investment in real estate by any structure whatsoever shall be required to register with SEBI for operating as MSM REIT in the manner specified by SEBI, and shall apply for registration to SEBI in the specified format.

7.1.2. Such persons/entities shall be required to fulfil eligibility criteria as specified by SEBI from time to time and also to migrate the existing transaction structures, if any, to that of the MSM REITs and to thereafter continue activity as MSM REIT.

7.1.3. Persons/Entities which either do not meet the eligibility criteria as specified or do not register within the given timelines shall be required to wind-up their operations and cease to operate. Investors aggregated by such Persons/Entities in the real estate should be provided due exit option within a pre-specified period. The SPVs should be duly wound up, and if any other structures have been utilized for fractional investment in real estate, such structures should be closed on or before the period allowed for registration as MSM REITs.

7.1.4. Structure of MSM REIT

7.1.4.1. MSM REIT shall be set up as a Trust under the provisions of the Indian Trusts Act, 1882 with an ability to establish separate and distinct scheme/s for owning of real estate assets through wholly owned special purpose vehicles constituted as a company under the Companies Act, 2013.

7.1.4.2. MSM REIT Scheme shall have full control and shall hold hundred per cent. equity share capital in all SPV(s). The SPV(s) shall be required to have full control and shall hold hundred percent ownership in all the underlying property(ies).

7.1.4.3. MSM REIT shall have parties such as trustee, sponsor and Investment Manager with each such person being a separate and distinct entity.

7.1.5. Mandatory SEBI registration:

7.1.5.1. No person shall act as a MSM REIT or establish or do activity which is eligible to be done as MSM REIT unless it is registered with the Board under the REIT Regulations.

7.1.5.2. The application for registration as a MSM REIT shall be made by the sponsor on behalf of the Trust in the format specified by SEBI and the instrument of Trust is in the form of a deed duly registered in India under the provisions of the Registration Act, 1908.

7.1.5.3. The Trust deed has its main objective as undertaking activity of MSM REIT.

7.1.5.4. The Sponsor(s) shall be clearly identified in the application of registration and in the offer document.

7.1.5.5. The Sponsor shall have at least five years experience in real estate industry as either a developer or a fund manager.

7.1.5.6. The sponsor shall be required to hold a minimum of <fifteen> percent of the total units of the MSM REIT for each scheme for a period of at least three years from the date of listing of such units of such scheme pursuant to initial offer on a post-issue basis. Any holding of the sponsor exceeding the minimum holding, shall be held for a period of at least one year from the date of listing of such units.

7.1.5.7. The minimum holding requirement for the sponsor in each scheme post completion of three years shall be as prescribed for existing REITs.

7.1.5.8. The Sponsor shall have a net worth of at least INR twenty crores. Out of the same, an amount of INR ten crores shall be in the form of positive liquid net worth. Liquid net worth shall mean net worth deployed in liquid assets which are unencumbered. Liquid Asset shall be an asset that can easily be converted into cash in a short amount of time, including cash, money market instruments, Government Securities, T-bills and Repo on Government Securities.

7.1.5.9. The Investment Manager of MSM REIT shall be a distinct entity whose primary business is to manage assets and investments of the MSM REIT and undertake operational activities of the MSM REIT. The Investment Manager of MSM REIT shall not pursue any other business other than management of MSM REIT and its Schemes or SPV(s) held by such Schemes.

7.1.5.10. The Investment Manager of MSM REIT shall have a net worth of at least INR ten crores. The net worth shall be in the form of positive liquid net worth. Liquid net worth shall mean net worth deployed in liquid assets which are unencumbered. Liquid Asset shall be an asset that can easily be converted into cash in a short amount of time, including cash, money market instruments, Government Securities, T-bills and Repo on Government Securities.

7.1.5.11. The Investment Manager of MSM REIT shall be a company incorporated under The Companies Act, 2013.

7.1.5.12. The Investment Manager of MSM REIT or its associate has at least five years’ experience in fund management in the real estate industry or advisory services in the real estate industry or property management in the real estate industry or in development of real estate.

7.1.5.13. The Investment Manager of MSM REIT has at least two key personnel who each have at least five years’ experience in fund management in the real estate industry or advisory services in the real estate industry or property management in the real estate industry or in development of real estate.

7.1.5.14. The Investment Manager of MSM REIT has at least half of its directors as independent and not directors of the Investment Manager or Manager of another MSM REIT/REIT.

7.1.5.15. The Investment Manager of MSM REIT has entered into an Investment Management Agreement with the trustee which provides for the responsibilities of the Investment Manager in accordance with the Regulations.

7.1.5.16. Alternatively, the role of Sponsor and Investment Manager could be combined into making the Investment Manager into as self-sponsored entity. The above proposals for Sponsor/Investment Manager could accordingly be combined for such an approach.

7.1.5.17. The trustee is registered with the Board under SEBI (Debenture Trustees) Regulations, 1993 and is not an associate of the sponsor(s) or Investment Manager;

7.1.5.18. The trustee has such wherewithal with respect to infrastructure, personnel, etc. to the satisfaction of the Board and in accordance with circulars or guidelines as may be specified by the Board

7.1.5.19. No unit holder of the MSM REIT scheme enjoys superior voting or any other rights over another unit holder in the same scheme and there are no multiple classes of units of REIT in each scheme

7.1.5.20. The MSM REIT and parties to the REIT are fit and proper persons based on the criteria as specified in Schedule II of the Securities and Exchange Board of India (Intermediaries) Regulations, 2008.

7.1.5.21. SEBI, on being satisfied with the eligibility conditions, shall grant the MSM REIT certificate of registration.

7.1.5.22. On issuance of certificate of registration for operating a MSM REIT, the Sponsor shall establish a trust and appoint a SEBI registered Debenture Trustee as a Trustee, and also identify a Investment Manager. The Trustee shall appoint such Investment Manager for launching and administering MSM REIT and its Schemes.

7.1.5.23. MSM REIT will be permitted to launch schemes. Each Scheme will be identified by a separate name

7.1.5.24. After registration, the MSM REIT shall raise funds initially through an initial offer of units of a scheme.

7.1.5.25. The listing of units of the MSM REIT Scheme/s shall be mandatory and shall be listed on stock exchange. The units of such MSM REIT Scheme will be held in dematerialized form. Further, any investments of MSM REIT in SPV(s) shall also be held in dematerialized form.

7.1.5.26. For coming with initial offer of a scheme, the size of the asset proposed to be acquired should be at least INR 25 crores and should not exceed INR 499 crores.

7.1.5.27. At least ninety-five percent of the schemes AUM shall be invested in completed and rent generating real estate properties at all times.

The balance five percent can be deployed in liquid assets which are unencumbered. Liquid Asset shall be an asset that can easily be converted into cash in a short amount of time, including cash, money market instruments, Government Securities, T-bills and Repo on Government Securities. The schemes of MSM REIT shall not be allowed to invest in under construction or non-rent generating real estate properties.

7.1.5.28. With respect to distributions made by the scheme of MSM REIT and/or SPV

(a) not less than ninety five per cent. of net distributable cash flows of the SPV shall be distributed to the scheme of MSM REIT subject to applicable provisions in the Companies Act, 2013; the amount retained at the SPV level may be utlized only in the manner specified by the Board from time to time

(b) hundred per cent. of net distributable cash flows of the MSM REIT shall be distributed to the scheme wise unit holders

7.1.5.29. The MSM REIT Scheme shall raise funds from at least twenty investors that are unrelated to the Sponsor, its related parties and its associates.

7.1.5.30. MSM REITs may raise funds from any investors, resident or foreign.

7.1.5.31. MSM REIT Schemes shall not be allowed to raise debt.

7.1.5.32. The minimum subscription size to the units of a MSM REIT Scheme shall be INR. Ten lakhs and the unit size shall be INR. Ten lakhs.

7.1.5.33. The maximum subscription to an MSM REIT Scheme from any investor (other than sponsor(s), its related parties and its associates) shall not be more than 25 percent of the total unit capital;

7.1.5.34. Existing Persons/Entities (including FOPs) shall ensure that each SPV formed by it is effectively transferred to an MSM REIT Scheme that exclusively will own such SPV, and the investors who were issued securities by such SPV shall receive units of such MSM REIT Scheme in lieu thereof. Such of the investors not desirous of continuing in the MSM REIT Scheme shall be provided an exit by the Sponsor, which shall acquire at fair value the relative units from such investor/s or the securities issued by the SPV to the investors and receive the units of the MSM REIT Scheme as envisaged.

7.1.5.35. MSM REIT shall not enter into any transaction with related parties. However, payment of fees to the Investment Manager and trustee for carrying out the activities of MSM REIT shall be allowed.

7.2. Valuation of assets

7.2.1. Valuation of assets shall be carried out by a valuer as defined under Regulation 2(1)(zz) of SEBI (REIT) Regulations, 2014 or by any other intermediaries specified by SEBI from time to time.

7.2.2. To ensure that the underlying assets of a MSM REITs are valued accurately, a full valuation including a physical inspection of the properties shall be carried out on a quarterly basis for each scheme. Consequently, the NAV of each scheme shall be required to be declared on quarterly basis.

7.2.3. Detailed disclosures are proposed to be specified for the quarterly valuation reports.

7.2.4. Further, for any purchase of a new property or sale of an existing property, a full valuation shall be required to be undertaken by the valuer. In case the property is proposed to be purchased / sold at a value which is greater than 102% / less than 98% of the value of property as assessed by the valuer respectively, approval from unitholders shall be required wherein votes cast in favour of the resolution shall be at least three times the number of votes cast, if any, against the resolution.

7.3. Disclosure & reporting requirements (for initial offer as well as on a continuous basis to the stock exchange and unitholders) shall be made as specified by SEBI from time to time in order to ensure compliance with the provisions proposed in relation to MSM REIT.

7.4. In order to ensure safeguarding of interests of the investors, the following rights shall be specified for the investors in order to empower them.

7.4.1. The investors shall have right to remove the Investment Manager, auditor, principal valuer, seek winding up of the scheme, etc.

7.4.2. An annual meeting of all investors is mandatory to be convened by the Trustee wherein matters such as latest annual accounts, valuation reports, performance of the MSM REIT Scheme, approval of auditors & their fees, appointment of valuer/relevant intermediary, etc. shall be discussed.

7.4.3. Further, approval of investors shall be mandatory in cases of change in Investment Manager/ sponsor, change in investment strategy, etc.

7.4.4. In order to ensure that a related party does not influence the decision, it has been specified that any person who is a party to any transaction as well as associates of such person(s) shall not participate in voting on the specific issue.

7.5. To further safeguard the interest of the investors, it is proposed that SEBI will specify the cap on total expense ratio for MSM REITs.

7.6. Keeping in mind that transparency has been a cornerstone of the REIT industry globally, the following disclosure requirements will be prescribed for MSM REIT Schemes.

7.6.1. Minimum disclosure requirements in the offer document will be specified.

7.6.2. Minimum disclosures will be specified for the annual and half yearly reports to be sent to the investors.

7.6.3. Further, the MSM REIT Schemes shall additionally be bound by periodical disclosure requirements required under the listing agreement with the exchanges.

7.6.4. Property-wise disclosure of lease rental income along with comparable lease rental income of other similar properties should be disclosed in the offer document for each property proposed to be acquired by the MSM REIT. The above comparable disclosures shall be certified by an independent registered valuer or any other intermediaries specified by SEBI from time to time.

8. Benefits of the proposed Regulatory framework:

8.1. Registration of FOPs under SEBI REIT Regulations, as outlined, will be beneficial to the market and market participants as:

8.1.1. The standard KYC requirements will be applicable while registering clients.

8.1.2. The Net worth and deposit requirements prescribed for Sponsor and Manager will ensure that these platforms have a sound and stable financial health.

8.1.3. The applicability of code of conduct mandated for Managers will ensure fairness in their dealings with clients.

8.1.4. They will be subjected to regulatory inspection and oversight, providing more confidence to investors and hence, will have the potential to attract more investors.

8.1.5. Regulated entities in the financial services sector would be able to undertake distribution of MSM REIT

8.1.6. Artificial limitations on number of investors and creation of SPVs to overcome the limitations will be eliminated

8.1.7. Retention of the business potential and opportunities for the FOPs;

8.2. Listing of units and trading through stock exchanges will provide the following benefits:

8.2.1. Robust Risk Management framework and Surveillance mechanism;

8.2.2. Fair and transparent pricing;

8.2.3. Guaranteed settlement;

8.2.4. Liquidity and Exit opportunity to the investors;

8.2.5. Augment market making; and

8.2.6. Well defined framework for redress of Investor grievances

8.2.7. Efficient offering of services to the non-institutional investors.

9. Public Comments:

Public comments are invited for the proposed regulatory framework for the MSM REITs. Specific comments are invited:

a) Whether to bring persons /entities (including FOPs) organizing or undertaking or facilitating fractional real estate investments under regulatory perimeter?

b) If so, whether MSM REIT and schemes thereunder as outlined above are appropriate?

c) Whether the time period for existing Persons/Entities (including) FOPs with SPVs to migrate to MSM REIT within six months is sufficient?

d) Whether net worth of Sponsor of INR 20 crores is adequate?

e) Whether relevant experience of Sponsor outlined above is sufficient?

f) Whether the minimum Unitholding requirement of sponsor outlined above shall be mandated?

g) Whether net worth of Manager of INR 10 crores is adequate?

h) Whether the cap on Consolidated value of MSM REIT to INR 500 crores or scheme should be capped at INR 250 crores or INR 500 crores?

i) Whether minimum subscription should be mandated to INR ten lakhs?

j) Whether trading lot should be kept as minimum value of INR ten lakhs?

k) Whether the requirement on sponsor holding at least 15% of the total number of units of the MSM REIT on post initial offer basis for a period of atleast three years post listing of units adequate?

l) Whether the Sponsor and Investment Manager should be two distinct entities, or Whether only one entity (i.e. the Investment Manager) can take up the roles and responsibilities of both the Sponsor as well as Investment Manager? Kindly provide your comments with supporting rationale.

10. The comments/ suggestions may be provided as per the format given below to the following email ids on or before May 27, 2023:

a) Ritesh Nandwani, DGM (riteshn@sebi.gov.in)

b) Pawan Kumar Chowdhary, AGM (pawanc@sebi.gov.in)

c) Rohan Shukla, Manager (rohan@sebi.gov.in)

d) Barun Gurani, AM (barung@sebi.gov.in)

|

Name of the person/ entity proposing comments: |

|||

| Name of the organization (if applicable): | |||

| Contact details: | |||

| Category: whether market intermediary/ participant (mention type/ category) or public (investor, academician etc.) | |||

| Sr. No. | Issues | Proposals/ Suggestions | Rationale |