SEBI Market Rumour Verification: Ensuring Market Integrity in Age of Rapid Information Dissemination

Summary: SEBI’s regulations, introduced under the LODR framework, require listed companies to verify rumours related to material events that could impact stock prices. Previously, companies were mandated to deny or clarify rumours if they involved material events, irrespective of share price movements. However, the Industry Standard Forum (ISF) recently proposed that companies should verify rumours only when there is a significant price change. This change aims to reduce the burden on companies while maintaining market transparency. Under the amended SEBI framework, set to apply from June and December 2024 for top-listed companies, firms are now required to verify or deny rumours tied to significant events like mergers or fundraising if they lead to material price movements. SEBI’s introduction of ‘unaffected prices’ ensures that stock valuations are not swayed by unverified rumours. Companies must follow a detailed, step-by-step process to assess material price movements, including calculating price variations and verifying rumours if necessary. This new framework focuses on safeguarding investors and maintaining fairness in the stock market.

Sebi Market Rumour Verification

“Ensuring Market Integrity in the Age of Rapid Information Dissemination”

Prior to the amendment in SEBI (LODR) Regulations 2015, listed companies were required to verify any rumours related to Material Events or information as defined in Part A of Schedule III of the Listing Obligations and Disclosure Requirements (LODR) Regulations. This means that if a rumour pertains to a Material Event, the company must either deny or clarify the rumour, regardless of whether there is any movement in the share price.

However, if a rumour does not relate to a Material Event, the company is not obligated to respond. SEBI designed this framework to ensure transparency in the market and to protect investors from misinformation that could cause unnecessary fluctuations in share prices.

Proposal by Industry Standard Forum (ISF)

Recently, the Industry Standard Forum (ISF) has proposed a more practical approach to rumour verification. They suggested that companies should only be required to verify rumours if there is a significant movement in their share price. Under this proposed model, companies would not need to deny or clarify every rumour, but only those that result in material price changes in the securities of the listed entity.

This new approach would come as a relief for companies struggling with the existing regime, which focuses primarily on whether a rumour involves a Material Event. The material event is not restricted to the illustrative list specified in Schedule III of SEBI (Listing obligation and disclosure requirements) 2015. The ISF proposal offered a more practical approach, tying the obligation to verify rumours directly to the actual impact on share prices, making it easier for companies to comply.

PRESENT SCENARIO

SEBI, India’s financial market regulator, introduced amendments in regulation 30(11) of Listing Obligation and Disclosure Requirements 2015 which shall apply to the top 100 listed entities with effect from June 01, 2024, and to the top 250 listed entities (i.e., the next top 150) with effect from December 01, 2024 as specified by SEBI circular dated January 25, 2024 to protect investors and ensure transparency. The goal is to prevent false or misleading information from causing stock prices to swing wildly, which can hurt investors and distort the market.

Under this framework, when there are rumours about important news involving a company—such as a merger, acquisition, or fundraising—the company must quickly confirm whether the rumours are true or false. This prompt disclosure helps ensure that investors have accurate information to base their decisions on, rather than acting on potentially false rumours.

Moreover, SEBI introduced the concept of ‘unaffected prices’. This means the price of a company’s shares before any rumours start spreading. By focusing on these ‘unaffected prices,’ SEBI wants to make sure that decisions around mergers, acquisitions, or fund-raising are based on real company value, not inflated or deflated by market rumours.

In essence, this framework helps keep the market fair and orderly by reducing the impact of false or misleading information, ensuring that everyone—investors, companies, and the

market—operates on a level playing field.

STEPS TO BE FOLLOWED FOR MARKET RUMOUR VERIFICATION

Verification of market rumours can be a complex task. To correctly understand, let’s divide it into a 3-step process:

1. Identifying material price movements

2. Identifying market rumours

3. Accepting, clarifying, and denying market rumours

The compliance requirement of verification of market rumour is triggered ONLY when there is a material price movement. Thus, identification of the same is the foremost task and a listed entity should develop processes to know if the scrip price triggers the cut-off levels prescribed.

Calculation of Material Price Movement

1. Calculate percentage variation in price movements

- The closing price of the immediately preceding trading day shall be the basis for calculating;

a. % movement in scrip price

b. % movement in the benchmark index

2. Cut-off levels were introduced to identify the trigger of material price movement

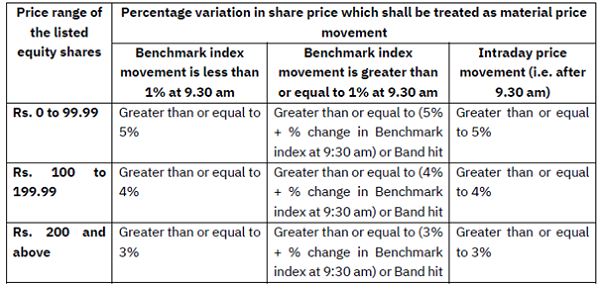

A. In case of ‘Positive’ news/rumour:

Notes:

1. Rumour must be verified only if the scrip prices have moved in the direction of the news.

- The rumour must be specific in nature, connected to an impending event and should be an information which is not available to the public at large.

- The rumour shall be searched in the mainstream media for a considerable time period i.e. 5-7 trading days.

2. Index movement is to be considered at 9:30 am of the trading day w.r.t. the closing price on the previous trading day.

3. Percentage variation in scrip price is to be considered at any point of time during trading hours w.r.t. the closing price of the scrip on the previous trading day.

4. Intraday price movement (i.e. after 9:30 a.m.), only percentage variation in the scrip prices shall be considered irrespective of the benchmark index movement.

Illustrative Example: positive rumour

If the benchmark Index is less than 1% (Positive Rumour) & Intraday calculation

| Benchmark index movement is < 1% at 9:30 a.m. | Intraday price movement (i.e. after 9:30 a.m.) | ||||

| Closing Price on 01/10/2024 (A) | Opening price at 9:30 a.m. on 02/04/2024 (B) | Highest price on 02/04/2024 (C) | Opening vs closing of previous trading day % Variation

(B)/(A) |

High vs closing of previous trading day % Variation

(B)/(A) |

|

| Sensex Index (BSE) | 80000 | 80500 | – | 80500-80000 X 100% 80000 = 0.65% | – |

| Scrip Price | 250 | 260 | 265 | 260-250 X 100% 250 = 4% | 260-250 X 100% 250 = 6% |

Note: Percentage variation in Index movement is calculated at 9:30 a.m.

Presume: Percentage variation in Scrip Price movement is also calculated at 9:30 a.m.

Step 1: The percentage variation in Benchmark Index movement is less than 1% at 9:30 a.m. i.e. 0.65%

Step 2: The percentage variation in scrip price shall be greater than or equal to 3%

Step 3: The percentage variation in scrip price i.e. 4% > 3%, hence Material Price movement is triggered.

Step 4: The percentage variation in scrip price during intraday i.e. 6% > 3%, hence Material price movement is triggered.

Step 5: If there is any positive rumour specific to the company in mainstream media to such MPM, then the Company must verify/confirm/deny within 24 hours from material price movement.

Illustrative Example: positive rumour

If benchmark Index is greater than 1% (Positive Rumour) & Intraday calculation

| Benchmark index movement is > 1% at 9:30 a.m. | Intraday price movement (i.e. after 9:30 a.m.) | ||||

| Closing Price on 01/10/2024 (A) | Opening price at 9:30 a.m. on 02/04/2024 (B) | Highest price on 02/04/2024 (C) | Opening vs closing of previous trading day % Variation (B)/(A) | High vs closing of previous trading day % Variation (B)/(A) | |

| Sensex Index (BSE) | 80000 | 82000 | – | 82000-80000 X 100% 80000= 2.5% | – |

| Scrip Price | 250 | 265 | 270 | 265-250 X 100% 250

= 6% |

270-250 X 100% 250

= 8% |

Note: Percentage variation in Index movement is calculated at 9:30 a.m.

Presume: Percentage variation in Scrip Price movement is also calculated at 9:30 a.m.

Step 1: The percentage variation in Benchmark Index movement is greater than 1% at 9:30 a.m. i.e. 2.5%

Step 2: The percentage change in benchmark index is added to 3% i.e. 3% + 2.5% = 5.5%

Step 3: The percentage variation in scrip price shall be greater than or equal to 5.5.%

Step 4: The percentage variation in scrip price i.e. 6% > 5.5%, hence Material Price movement is triggered.

Step 5: The percentage variation in scrip price during intraday i.e. 8% > 3%, hence Material price movement is triggered.

If there is any positive rumour specific to the company in mainstream media to such MPM, then the Company must verify/confirm/deny within 24 hours from material price movement.

Illustrative Example: positive rumour

If benchmark Index is greater than 1% (Positive Rumour) & Intraday calculation

| Benchmark index movement is > 1% at 9:30 a.m. | Intraday price movement (i.e. after 9:30 a.m.) | ||||

|

Closing Price on 01/10/2024 (A) |

Opening price at 9:30 a.m. on 02/04/2024 (B) |

Highest price on 02/04/2024 (C) |

Opening vs closing of previous trading day % Variation (B)/(A) |

High vs closing of previous trading day % Variation (B)/(A) |

|

| Sensex Index (BSE) | 80000 | 82000 | – | 82000-80000 X 100% 80000 = 2.5% | – |

| Scrip Price | 250 | 255 | 270 | 255-250 X 100% 250 = 2% | 270-250 X 100% 250 = 8% |

Note: Percentage variation in Index movement is calculated at 9:30 a.m.

Presume: Percentage variation in Scrip Price movement is also calculated at 9:30 a.m.

Step 1: The percentage variation in Benchmark Index movement is greater than 1% at 9:30 a.m. i.e. 2.5%

Step 2: The percentage change in benchmark index is added to 3% i.e. 3% + 2.5% = 5.5%

Step 3: The percentage variation in scrip price shall be greater than or equal to 5.5.%

Step 4: The percentage variation in scrip price i.e. 2% < 5.5%, hence Material Price movement is not triggered.

Step 5: The percentage variation in scrip price during intraday i.e. 8% > 3%, hence Material price movement is triggered.

Although there was no material price movement (step 4) but there was a material price movement (step 5) during intraday i.e. 8%, hence there is material price movement and the company must verify/confirm/deny within 24 hours from material price movement.

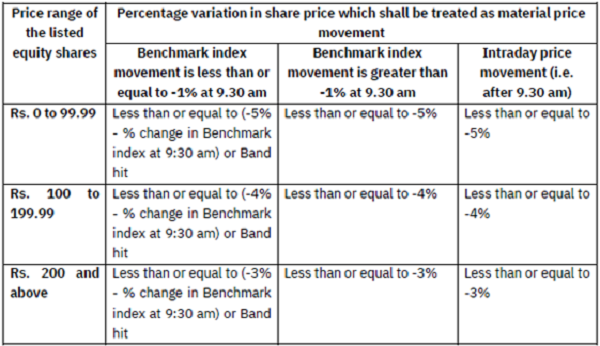

B. In case of ‘Negative’ news/rumour

Notes:

1. Rumour must be verified only if the scrip prices has moved in the direction of the news.

- The rumour must be specific in nature, connected to an impending event and should be information which is not available to the public at large.

- The rumour shall be searched in the mainstream media for a considerable time period i.e. 5-7 trading days.

2. Index movement is to be considered at 9:30 am of the trading day w.r.t. the closing price on the previous trading day.

3. Percentage variation in scrip price is to be considered at any point of time during trading hours w.r.t. the closing price of the scrip on the previous trading day.

4. Intraday price movement (i.e. after 9:30 a.m.), only percentage variation in the scrip prices shall be considered irrespective of the benchmark index movement.

Illustrative Example: Negative rumour

If benchmark Index is less than or equal to -1% (Negative Rumour) & Intraday calculation

| Benchmark index movement is < 1% at 9:30 a.m. | Intraday price movement (i.e. after 9:30 a.m.) | ||||

| Closing Price on 01/10/2024 (A) | Opening price at 9:30 a.m. on 02/04/2024 (B) | Lowest price on 02/04/2024 (C) | Opening vs closing of previous trading day % Variation (B)/(A) | Low vs closing of previous trading day % Variation

(B)/(A) |

|

| Sensex Index(BSE) | 82000 | 80000 | – | 80000-82000 X 100% 82000 = -2.43% | – |

| Scrip Price | 255 | 250 | 230 | 250-255 X 100% 255 = -1.96% | 230-255 X 100%

255 = -9.8% |

Note: Percentage variation in Index movement is calculated at 9:30 a.m.

Presume: Percentage variation in Scrip Price movement is also calculated at 9:30 a.m.

Step 1: The percentage variation in Benchmark Index movement is less than -1% at 9:30 a.m. i.e. -2.43%

Step 2: The percentage change in benchmark index is added to -3% i.e. -3% + (-2.5%) = -5.5%

Step 3: The percentage variation in scrip price shall be less than or equal to -5.5%

Step 4: The percentage variation in scrip price i.e. -2.43% > -5.5%, hence Material Price movement is not triggered.

Step 5: The percentage variation in scrip price during intraday i.e. -9.8% < -3%, hence Material price movement is triggered.

Although there was no material price movement (step 4) but there was a material price movement (step 5) during intraday i.e. -9.8%, hence there is material price movement and the company must verify/confirm/deny within 24 hours from material price movement.

Illustrative Example: Negative rumour

If benchmark Index is greater than -1% (Negative Rumour) & Intraday calculation

| Benchmark index movement is > -1% at 9:30 a.m. | Intraday price movement (i.e. after 9:30 a.m.) | ||||

| Closing Price on 01/10/2024 (A) | Opening price at 9:30 a.m. on 02/04/2024 (B) | Lowest price on 02/04/2024 (C) | Opening vs closing of previous trading day % Variation (B)/(A) | Low vs closing of previous trading day % Variation

(B)/(A) |

|

| Sensex Index (BSE) | 82555 | 82000 | – | 82000-82555 X 100% 82555 = -0.67% | – |

| Scrip Price | 255 | 245 | 240 | 245-255 X 100% 255 = -3.92% | 240-255 X 100% 255 = -5.88% |

Note: Percentage variation in Index movement is calculated at 9:30 a.m.

Presume: Percentage variation in Scrip Price movement is also calculated at 9:30 a.m.

Step 1: The percentage variation in Benchmark Index movement is greater than -1% at 9:30 a.m. i.e. -0.67%

Step 2: The percentage variation in scrip price shall be less than or equal to -3%

Step 3: The percentage variation in scrip price i.e. -3.92% < -3%, hence Material Price movement is triggered.

Step 4: The percentage variation in scrip price during intraday i.e. -5.88% < -3%, hence Material price movement is triggered.

There is material price movement and the company must verify/confirm/deny the rumour within 24 hours from material price movement.

Note: The requirement to confirm a market rumour under Regulation 30(11) shall not be applicable for transactions undertaken in the ordinary course of business as per Industry Standard Notes

Framework for considering unaffected price for transactions upon confirmation of market rumour

The rationale behind SEBI’s introduction of the “unaffected price” concept in the market rumour verification framework is rooted in the need to protect investors, ensure fairness, and maintain the true value of companies during key decisions, like mergers or acquisitions, etc.

Here’s an easy-to-understand breakdown:

1. Protecting Investors from Misleading Information

When rumours about a company spread in the market, it can cause the company’s share price to fluctuate—either rising or falling based on the rumour, regardless of whether the rumour is true or not. These fluctuations can mislead investors, making them act on false or unverified information.

SEBI wanted to create a system where decisions are based on factual information, not market gossip. By introducing the concept of “unaffected prices,” SEBI ensures that prices are considered before any rumour starts to influence the market. This prevents rumours from artificially inflating or deflating share prices and ensures investors have a fair understanding of the company’s value.

2. Ensuring Fair Valuation During Major Corporate Decisions

When companies go through significant events, like a merger, acquisition, or fundraising, these actions can drastically change the company’s financial standing. SEBI noticed that, during such events, market rumours often distort the share prices, affecting the valuation of the company.

For example, if there’s a rumour about a merger, the share price might spike even if the merger is not confirmed. If a deal were to be made based on that inflated price, the valuation would be unrealistic and such inflated prices might prove to be a deal-breaker for the company. To prevent this, SEBI introduced the “unaffected price” rule. This means that decisions such as mergers or acquisitions should be based on the company’s actual value before any market noise or rumours influence the price.

3. Reducing Market Manipulation

Sometimes, rumours are spread intentionally to manipulate stock prices. For example, bad actors might spread false news to lower a company’s stock price and buy shares cheaply or spread positive rumours to artificially boost the price and sell for profit. This kind of market manipulation harms regular investors who don’t have insider information.

The “unaffected price” concept helps curb such manipulation. By focusing on prices before rumours begin to circulate, SEBI ensures that decisions, like those on acquisitions, are made on the true market value of the company, free from manipulation.

4. Creating a Level Playing Field

SEBI’s broader goal is to create a level playing field for all investors, whether they are institutional investors, retail investors, or companies themselves. By focusing on “unaffected prices,” SEBI ensures that everyone is looking at the same accurate and verified information about a company’s value, without being swayed by potentially false or speculative market rumours. The framework for unaffected price provides price protection to the companies in their proposed transactions.

Calculation of Unaffected Prices

1. The unaffected price will be deemed applicable for transactions governed by pricing regulations set forth by SEBI or the stock exchanges, subject to the confirmation of the rumour reported in mainstream media related to such transaction within 24 hours following the initiation of material price movement.

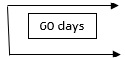

2. Once confirmed the unaffected price shall be applicable for a period of 60 days or 180 days based on the stage of transaction each instance of confirmation of rumour. The benefit of this ‘unaffected price’ is available for 60 days or 180 days. This means that the deal must be signed within 60 days/180 days to qualify for this price protection.

Illustration

| Relevant date (i.e. approval by board of directors to preferential issue to QIB) | Applicability of unaffected price for rumour confirmation on July 28, 2023 | |

|

29th July 2023 to 28th August 2023 | Applicable |

| 29th August 2023 to 26th September 2023 | Applicable | |

| 27th September 2023 to 27th October 2023 | Not Applicable |

3. Furthermore, it has been defined that the unaffected price shall be assessed by disregarding the impact on the price of equity shares of the listed entity as a result of material price movements and the confirmation of market rumours.

Framework for Calculating Unaffected Price

Illustration for calculation of VWAP

| Trading Day (A) | Daily WAP (B) | Adjusted Daily WAP (C) | No. of Shares traded (D) | Remarks

(E) |

| 20-Jul | 1,045.06 | 1,045.06 | 47,004 | |

| 21-Jul | 1,053.26 | 1,053.26 | 24,750 | |

| 24-Jul | 1,047.07 | 1,047.07 | 37,262 | T-10 |

| 25-Jul | 1,054.90 | 1,054.90 | 15,000 | |

| 26-Jul | 1,060.76 | 1,060.76 | 44,519 | |

| 27-Jul | 1,164.47 | 1,060.76 | 7,60,853 | Date of material price movement |

| 28-Jul | 1,173.45 | 1,060.76 | 2,38,320 | Date of rumour confirmation |

| 31-Jul | 1,178.90 | 1,060.76 | 88,450 | Next trading day after rumour confirmation |

| 01-Aug | 1,173.16 | 1173.16 – 118.14 = 1055.02 | 68,613 | |

| 02-Aug | 1,165.71 | 1167.71 – 118.14 = 1047.57 | 41,954 | |

| 03-Aug | 1,163.36 | 1163.36 – 118.14 = 1045.23 | 56,267 | |

| 04-Aug | 1,212.36 | 1212.36 – 118.14 = 1094.23 | 5,99,197 | |

| 07-Aug | 1,208.33 | 1208.33 – 118.14 = 1090.20 | 1,08,762 | Relevant Date (T) – Date of Board approval to preferential issue to QIBs |

Step 1: To calculate adjusted daily WAP (Column C) from 27th July (date of material price movement) to 31st July (next day after confirmation of rumour), the WAP (Column B) of 26th July (the day preceding material price movement) i.e. 1060.76 shall be applicable.

Step 2: The adjusted daily WAP in column C for 27th July, 28th July, 31st July shall be 1060.76

Step 4: The variation in daily WAP shall be calculated by subtracting daily WAP of 26th July from daily WAP of 31st July. (Note: This variation has occurred due to market rumour)

WAP (31st July) – WAP (26th July) = 1178.90 – 1060.76 = 118.14

Step 3: The adjusted daily WAP (Column C) from 1st August onwards shall be calculated by subtracting the WAP Variation (118.14) from the daily WAP of respective dates. (Note: WAP adjusted for impact of rumour and its confirmation)

Step 4: We now use Adjusted WAP to calculate the adjusted VWAP in the look back period (T-1 to T-10) which is 1069.80

Much Informative, Your efforts appreciated.