The National Stock Exchange of India (NSE) has issued a significant circular dated May 10, 2024, concerning Business Responsibility and Sustainability Reports (BRSR). This article provides detailed insights into the guidelines outlined by NSE for filing BRSR, including FAQs, general observations, and comprehensive guidelines for listed companies.

National Stock Exchange of India

Circular

Department: Listing

Circular Ref. No: NSE/CML/2024/11 Date: May 10, 2024

To,

The Company Secretary(ies)

Listed Companies

Subject: Business Responsibility and Sustainability Report (BRSR) – FAQs & General Observations / Guidelines for filing of BRSR.

Dear Sir / Madam,

This has reference to Regulation 34 (2) (f) of Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations, 2015 and SEBI vide Circular No. SEBI/HO/CFD/CFD-SEC-2/P/CIR/2023/122 dated July 12, 2023, which requires Top One Thousand listed entities based on market capitalization, to submit BRSR as per the updated format as specified by SEBI.

In this regard, please find annexed the BRSR FAQs / Guidelines & General Observations based on filing of BRSR for last year.

The Companies are requested to comply with the requirement of listing regulations and other applicable regulations as amended from time to time.

Yours faithfully,

For National Stock Exchange of India Ltd.

Apeksha Raichura

Manager – Listing

Encl: Annexure – FAQs

Disclaimer: These guidelines are issued as guidance only. The directions / instructions issued in the provision of Law, Regulation, SEBI, and Exchange circular are referred to in these guidelines are final for decision making in the matter. These guidelines are not and should not be construed as substitution / clarification / explanation on any matter on which provision of Law, Regulation or SEBI / Exchange circular were issued.

FREQUENTLY ASKED QUESTIONS / GENERAL OBSERVATIONS & GUIDELINES ON FILING OF BUSINESS RESPONSIBILITY AND SUSTAINABILITY REPORT (BRSR / BRSR Core)

PART 1 – FREQUENTLY ASKED QUESTIONS

1. Which listed Companies are mandatorily required to file BRSR?

Top one thousand listed Companies based on market capitalization shall mandatorily submit BRSR in the format as specified by the SEBI Circular SEBI/HO/CFD/CMD-2/P/CIR/2021/562 dated May 10, 2021.

Link of market capitalization as on March 31, 2024, is given below:

https://www.nseindia.com/regulations/listing-compliance/nse-market-capitalisation-all-companies

For e.g. If the listed Companies are falling under top one thousand listed Companies based on market capitalization as on March 31, 2024, filing of BRSR shall be applicable to them for the Financial Year 2023-24.

2. If the Company is not falling under top one thousand listed Companies based on market capitalization as on March 31, 2024, but the Company was falling under top one thousand listed Companies based on market capitalization as on March 31, 2023, and March 31, 2022, will BRSR be applicable to the Company for March 31, 2024, pursuant to Regulation 3 (2) of SEBI LODR, 2015?

Pursuant to Regulation 3(2) of the SEBI LODR, 2015 – The provisions of these regulations which become applicable to listed companies on the basis of market capitalisation criteria shall continue to apply to such companies even if they fall below such thresholds.

The listed companies are requested to comply with the existing Regulation.

3. Can the listed Companies which do not form part of top one thousand listed Companies file BRSR on a voluntary basis?

Yes, listed Companies which do not form part of top one thousand listed Companies including the Companies which have listed their specified securities on the SME Exchange, may voluntarily submit BRSR.

4. If the listed Company is in top one thousand market capitalization list of NSE & not in top one thousand market capitalization list of BSE or vice versa. Whether the applicability for filing BRSR is with NSE / BSE only or with NSE & BSE together?

If the listed Company is in the top one thousand market capitalization list on any Exchange, then the listed Company is required to file BRSR with both the Exchanges.

5. Which listed Companies are mandatorily required to obtain Reasonable Assurance on BRSR Core?

Top 150 listed Companies based on market capitalization as on March 31, 2024, shall mandatorily obtain Reasonable Assurance of BRSR Core as specified by the SEBI Circular SEBI/HO/CFD/CFD-SEC-2/P/CIR/2023/122 dated July 12, 2023.

If the listed Companies have obtained assurance and selects “Yes” under “Whether the company has undertaken reasonable assurance of BRSR Core?” in BRSR utility, then it shall be mandatory to provide details of Point 15 i.e. Name of assurance provider & Point 16 i.e. Type of assurance obtained, in the BRSR utility. If listed Companies select “All / Partial” option under Point 16 in the BRSR utility, then the listed Companies need to specify whether the assurance obtained is “Reasonable Assurance” or “Limited Assurance”.

Also, a copy of Reasonable Assurance Certificate is mandatorily to be attached along with the BRSR while submitting PDF & Annual Report with the Exchanges.

6. Whether the BRSR XBRL utility at the BSE portal can be used for uploading at NSE NEAPS portal and vice-versa?

Yes, listed Companies can use either of NSE or BSE BRSR XBRL utility to upload at either of the Exchanges. The utility is compatible at both BSE and NSE.

7. What is the mode of submission of BRSR with the Exchange?

The BRSR is to be submitted with the Exchange in PDF and XBRL mandatorily. The path for submitting the same is enumerated as under:

XBRL & PDF: Path: NEAPS > Common XBRL Upload > Business Responsibility & Sustainability Report.

8. What is the timeline for submitting the BRSR in PDF and XBRL format?

BRSR PDF and XBRL shall be submitted on the same day of submission of Annual Report with the Exchanges.

9. Whether the BRSR can be provided as a LINK in the Annual Report of the Company instead of publishing the whole report?

Yes, BRSR Link can be provided in the Annual Report instead of publishing the whole report.

10. Is there any option for Revision for BRSR XBRL and PDF filed with the Exchange? Yes, BRSR filed with the Exchange can be revised by listed Company on the following path.

XBRL & PDF:

Path: NEAPS > Common XBRL Upload > Business Responsibility & Sustainability Report.

Please note that although the option of filing revised BRSR with the Exchange is available, the same needs to be exercised only as a last resort and sparingly. The Exchange request(s) the listed Companies to verify the correctness of data and other fields prior to filing the original BRSR submission with the Exchange.

Further, listed Companies need to submit Covering letter, wherein they should update what are the changes in the revised filing made.

11. What should listed Companies do in case data is not available for certain Industries / fields?

Some of the disclosures sought under the BRSR XBRL may not be applicable to certain industries, in such cases, the Company can state that such disclosure is not applicable along-with reasons for the same. The reason shall be provided in BRSR pdf and in BRSR XBRL under add Notes.

12. Has Exchange published any material / guidance note on BRSR?

Yes, to help the listed Companies in understanding the updated disclosure requirements and concepts associated with the new format of the BRSR, NSE has released guidance on 38 sector-specific integrated guides to BRSR format. This comprehensive guidance provides detailed explanation of each parameter in the format and the objective for such disclosures, along with an elaborate guidance on how to measure and report such parameters.

Link for the 38-sector specific guidance notes.

https://www.nseindia.com/research/publications-reports-corporate-governance-reports (Kindly refer – NSE-SES Integrated Guide to BRSR)

13. What about listed Companies who are already preparing BRSR as per internationally accepted standards?

Those listed Companies which prepare and disclose sustainability reports (as part of annual report) based on internationally accepted reporting frameworks such as GRI, SASB, TCFD, Integrated Reporting, can provide the cross-reference of the disclosures made under such framework to the disclosures sought under the BRSR. Further, if the data sought in the reporting format is already disclosed in the annual report, the listed Company can provide a cross-reference to the same.

Thus, a Company need not disclose the same information twice in the annual report. However, the Company should specifically mention the page number of the annual report or sustainability report where the information sought under the BRSR format is disclosed as part of the report prepared based on internationally accepted reporting framework.

14. Where will be the BRSR filings displayed on NSE website?

BRSR filings shall be viewed on NSE website through below mentioned link:

https://www.nseindia.com/companies-listing/corporate-filings-bussiness-sustainabilitiy-reports

In case of query, the contact details of the NSE Officials are available over path NEAPS > HELP > CONTACT US > Listing Compliance.

PART 2 – GENERAL OBSERVATIONS & GUIDELINES ON FILING OF BUSINESS RESPONSIBILITY AND SUSTAINABILITY REPORT (BRSR / BRSR Core)

Exchange Observations based on the BRSR Submissions F.Y. 2022-23

In order to have consistent, comparable, and useful information available to the investors and to provide guidance to the listed Companies with respect to filing of the disclosure requirements for BRSR, the disclosure made by the listed Companies with the Exchange for F.Y. 2022-23 have been reviewed and the principal areas of BRSR submissions and general observations pertaining to the submission received by the Exchange have been discussed hereunder.

There are a number of variations and lack of uniformity noticed in disclosures made under the BRSR submissions made by the listed Companies.

Below are some of the observations on BRSR submissions made by the listed Companies along with the specificity on what Companies must disclose, which will produce more useful information for the investors.

SECTION A, B & C: GENERAL DISCLOSURE, MGT & PROCESS DISCLOSURE & PRINCIPLE 1

- It may be noted that the BRSR format requires Companies to provide a Yes/ No response to a set of questions on Policy formulation across 9 principles. However, some Companies have either not disclosed information in the prescribed format or not provided mapping of answers to questions under BRSR format with their sustainability report (applicable in case sustainability report is published).

- With regards to providing the links of the Policies under the BRSR format (wherever applicable), some Companies only provide link of their website and not specific document link.

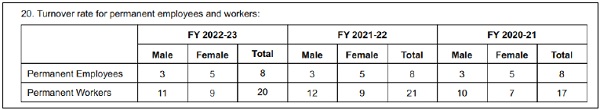

- In case of turnover rate for permanent employees and workers, Companies have provided an overall turnover rate instead of actual turnover rate for individual category.

- If the Company has hired differently abled employees and workers, details for the same shall be provided.

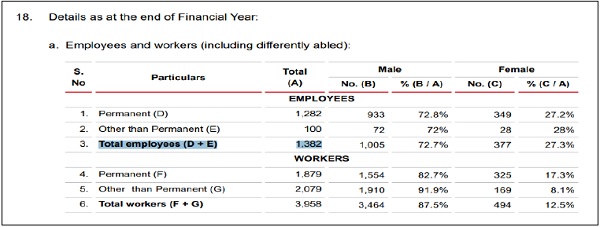

- Companies have not provided details like break up of contract workers enrolled, break up of employees or workers or break up of permanent and non-permanent employees.

- For products / Services sold by the company (accounting for 90% of the Company’s Turnover), Companies shall provide bifurcation based on the various products and various NIC codes and the total shall not exceed 100%.

PRINCIPLE 2

- For Point 1, some Companies have disclosed absolute values instead of percentage as required in Percentage of R&D and capital expenditure investments.

- For Point 2 a. & b. Details pertaining to procedures in place for sustainable sourcing and percentage of inputs sourced sustainably, lack of uniformity was observed in disclosures made under this category. Details for the percentage of inputs sourced sustainably is expected to be provided for total sourcing.

- In case of Point 3 for the details of processes in place to safely reclaim products for reusing, recycling, and disposing at the end of life, Companies must mandatorily provide this information and if the same is not applicable to the Company, the reason for the same shall be provided.

PRINCIPLE 3

- A lack of uniformity was observed between disclosures made under measures of well-being of employees / workers and the disclosures under the employees and workers (including differently abled) provided in General Disclosure – Point 21a. & b. If there is any difference in either of the categories, the reason for such difference shall be provided in “Add notes” column.

- Percentage of employees / workers covered under maternity benefits to be disclosed as a percentage of only female employees / workers and not total employees. (same shall be followed for paternity benefits).

- It was observed that some Companies have carried out assessment for the year but details for corrective actions were not provided in the relevant section i.e. under Point 15.

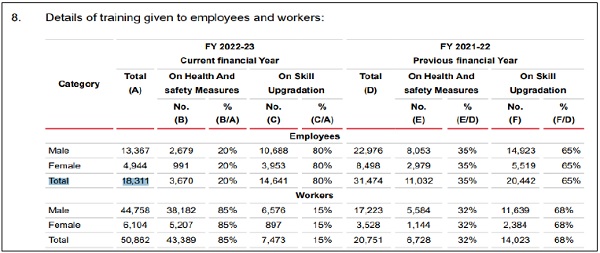

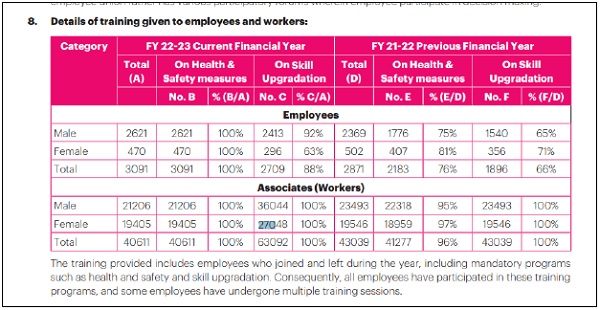

- Companies are required to disclose skill upgradation training provided to employees and workers whether permanent or non-permanent. It was observed that Companies have provided the said disclosures only for permanent employees and have not included nonpermanent employees and workers under the skill upgradation data.

PRINCIPLE 5

- Companies have provided the details of actual remuneration for total employees however median remuneration was not disclosed for employees.

PRINCIPLE 6

- Wide divergence was observed in some Companies within the same industry, indicating that although Companies are operating within same industry yet there is asymmetry in disclosure made with regards to environmentally sustainable practices and disclosure.

- For details of total energy consumption (in Joules or multiples) and energy intensity, some Companies have disclosed the data in units other than joules. Few Companies disclosed the data on energy consumption, however, have failed to precisely disclose the measurement units in the following format. As per the updated XBRL, a dropdown for unit column has now been provided in the utility for uniformity of disclosures.

- Some Companies have provided the disclosure under the Performance, Achieve and Trade (PAT) Scheme irrespective of applicability of the said Scheme. This point of PAT scheme is applicable only to certain class of industries which have been identified under PAT Scheme of the Government of India and identified as designated consumers. The Companies are advised to mention as “Not Applicable” if the Scheme is not applicable.

- For applicability of total energy consumption and energy intensity / air emissions (other than GHG emissions) / greenhouse gas emissions (Scope 1 and Scope 2 emissions) the Companies shall select Yes / No based on their applicability. The Companies if selects Yes – needs to select the applicable Unit from drop down.

- While the Financial Services industry on one hand claims GHG emissions are not materially relevant while making disclosures on environmental parameters, GHG emission in Financial Services Industry was greater than the emission in Automobiles industry.

- The disclosures of Air Emission are not uniform across industries.

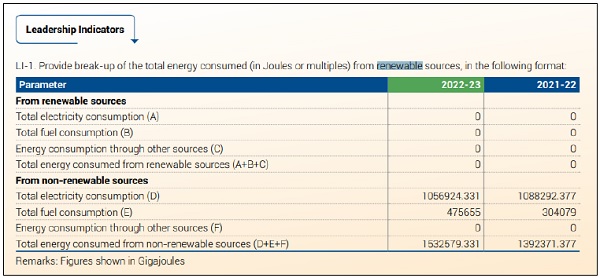

- Few Companies have not provided adequate disclosures on renewable energy, while some companies have not made any detailed updates whereas some Companies have provided disclosures on the initiatives on renewable energy, but not disclosed any data on the same. Maximum number of Companies not disclosing data are from financial services sector.

- Few Companies from Consumer Durables and Oil Gas & Consumable Fuels Industries have disclosed data on water discharge. Whereas a significant number of Companies in Consumer Services and Other Industries have not made these disclosures.

- For disclosures related to water, although as per their data size, Companies have used varied decimal options, i.e. reported either in Litres, Kilo Litres, ‘000 Kilolitres, Million KL, Mega KL, Million Cubic Meter (MCM), etc.

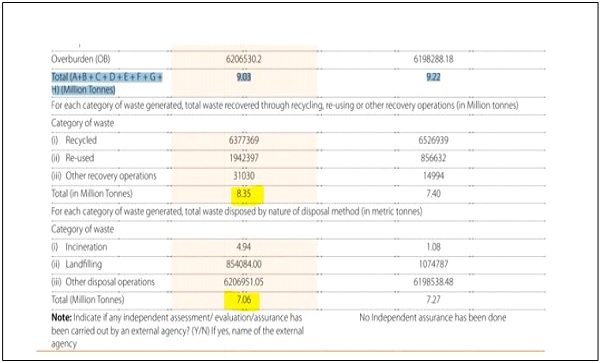

- Companies have provided the disclosures of waste management at an aggregated level instead of providing details in a bifurcated manner as provided under the format for specific heads (i.e. e-waste, plastic waste etc.).

- Companies have made disclosures for waste management in Metric tonnes or kilograms or kilo tonnes. Companies are advised to provide the said details in Metric tonnes only.

- Some companies from industries like Construction Materials, Cement, Power and FMCG, have disclosed total waste recovered or disposed more than the total waste generated. However, companies have not provided adequate justification in this regard.

- Most Companies under the Financial Services industry have stated that given the nature of their business, disclosures relating to waste have limited applicability to them. However, they should provide adequate disclosures on waste generated such as e-waste, battery waste, paper waste and plastic waste from their operations.

PRINCIPLE 9

- For Information relating to data breaches, the Companies have provided reference relating to general complaints which do not pertain to data breach and have provided little to no disclosures regarding instances of data breaches during the year. Companies shall ensure to provide the details only for data breach under this category.

- Companies from industries such as Consumer Durables and Metals & Mining have not recorded any complaints regarding the irresponsible Advertising, Delivery of Essential Services and Restrictive/ Unfair Trade practices i.e. all their customer complaints were classified under other matters.

**The listed Companies must carefully consider the above points while submitting BRSR XBRL utility. Further the Companies are advised to ensure that there are no deviations in the submissions made in XBRL and PDF. **

A few illustrations for inconsistencies observed in BRSR filings are given below.

1. Listed entities have mentioned overall turnover rate instead of actual turnover in the below screenshot –

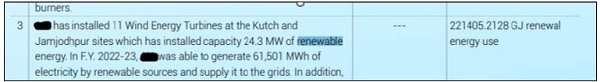

2. Company has disclosed zero energy consumption from renewable sources in the first table and reported 2,21,405.21 GJ in another table –

3. Total Employees count reported in General Disclosure does not match with the total employees reported under training given to employees and workers –

4. Total waste recovered and disposed is more than the waste generated.

5. Entity has provided training to total workers on skill upgradation more than the total strength and still the number shows 100% & vice versa.

****************************************************************************