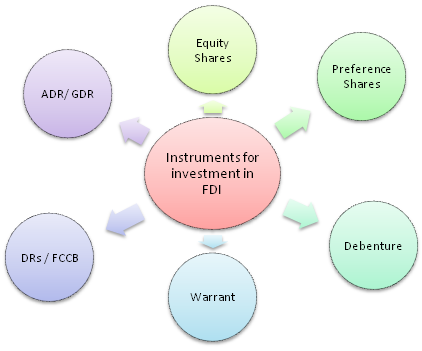

Articles discusses instruments by which Indian Companies can raise Foreign Direct Investment in India. Details of such Instruments are as follows :-

I. Equity Shares: The Indian Company can issue equity shares in accordance with the provisions of the Companies Act, as applicable, shall include equity shares that have been partly paid, subject to pricing guidelines/valuation norms prescribed under FEMA Regulations.

II. Preference Shares: The Indian Company can issue Fully, compulsorily & mandatorily convertible preference shares subject to pricing guidelines/valuation norms prescribed under FEMA Regulations. Preference shares shall be required to be fully paid, and should be mandatorily and fully convertible.

III. Debenture: The Indian Company can issue Fully, compulsorily & mandatorily convertible Debentures subject to pricing guidelines/valuation norms prescribed under FEMA Regulations. Debentures shall be required to be fully paid, and should be mandatorily and fully convertible.

Condition:

- The Indian Company can issue above mentioned securities subject to pricing guidelines/valuation norms prescribed under FEMA Regulations.

Price Guidelines:

- The price/conversion formula of convertible capital instruments should be determined upfront at the time of issue of the instruments.

- The price at the time of conversion should not in any case be lower than the fair value worked out, at the time of issuance of such instruments, in accordance with the extant [1]FEMA regulations

IV. Warrant: Fully, compulsorily & mandatorily convertible Warrant.

Further, ‘warrant’ includes Share Warrant issued by an Indian Company in accordance to provisions of the Companies Act, 2013 subject to terms and conditions as stipulated by the Reserve Bank of India in this behalf, from time to time.

A. When Company will determine the price or conversion formula of convertible Instrument?

The Company will determine the price or conversion formula of convertible Instrument at the time of issue of the instruments.

B. Whether price can be lower than the fair value worked out at the time of issuance of such instrument?

The price at the time of conversion should not in any case be lower than the fair value worked out, at the time of issuance of such instruments.

C. Whether Optionality clauses are allowed to holder of Equity/ Preference shares and debentures?

Yes, Optionality clauses are allowed in equity shares, fully, compulsorily and mandatorily convertible debentures and fully, compulsorily and mandatorily convertible preference shares under FDI scheme, subject to the following conditions:

CONDITION:

Lock in Period: There is a minimum lock-in period of one year which shall be effective from the date of allotment of such capital instruments[2].

After the lock-in period and subject to FDI Policy provisions, if any, the non-resident investor exercising option/right shall be eligible to exit without any assured return, as per pricing/valuation guidelines issued by RBI from time to time.

D. Whether Indian Company can issue Non-Convertible/ optionally convertible or Partly Convertible Preference Shares or Debentures to Foreign Investors under FDI?

No, Indian Company can’t issue Non-Convertible/ optionally convertible or Partly Convertible Preference Shares or Debentures to Foreign Investors under FDI.

If Company will issue the same and received the fund will be consider as Debt. Accordingly all norms applicable for ECBs relating to eligible borrowers, recognized lenders, amount and maturity, end-use stipulations, etc. shall apply.

V. DRs and FCCBs: The inward remittance received by the Indian company vides issuance of DRs and FCCBs are treated as FDI and counted towards FDI.

Conditions:

i. FCCBs/DRs may be issued in accordance with the Scheme for issue of Foreign Currency Convertible Bonds and Ordinary Shares (Through Depository Receipt Mechanism) Scheme, 1993 and DR Scheme 2014 respectively, as per the guidelines issued by the Government of India there under from time to time.

ii. DRs are foreign currency denominated instruments issued by a foreign Depository in a permissible jurisdiction against a pool of permissible securities issued or transferred to that foreign depository and deposited with a domestic custodian.

iii. In terms of Notification No. FEMA.20/2000-RB dated May 3, 2000 as amended from time to time, a person will be eligible to issue or transfer eligible securities to a foreign depository, for the purpose of converting the securities so purchased into depository receipts in terms of Depository Receipts Scheme, 2014 and guidelines issued by the Government of India there under from time to time.

iv. A person can issue DRs, if it is eligible to issue eligible instruments to person resident outside India under Schedules 1, 2, 2A, 3, 5 and 8 of Notification No. FEMA 20/2000-RB dated May 3, 2000, as amended from time to time.

v. The aggregate of eligible securities which may be issued or transferred to foreign depositories, along with eligible securities already held by persons resident outside India, shall not exceed the limit on foreign holding of such eligible securities under the relevant regulations framed under FEMA, 1999.

vi. The pricing of eligible securities to be issued or transferred to a foreign depository for the purpose of issuing depository receipts should not be at a price less than the price applicable to a corresponding mode of issue or transfer of such securities to domestic investors under the relevant regulations framed under FEMA, 1999.

vii. The issue of depository receipts as per DR Scheme 2014 shall be reported to the Reserve Bank by the domestic custodian as per the reporting guidelines for DR Scheme 2014.

VI. ADR & GDR:

Two-way Fungibility Scheme:

- A limited two-way Fungibility scheme has been put in place by the Government of India for ADRs/GDRs.

- Under this Scheme, a stock broker in India, registered with SEBI, can purchase shares of an Indian company from the market for conversion into ADRs/GDRs based on instructions received from overseas investors.

- Re-issuance of ADRs/GDRs would be permitted to the extent of ADRs/GDRs which have been redeemed into underlying shares and sold in the Indian market

Sponsored ADR/GDR issue:

- An Indian company can also sponsor an issue of ADR/GDR.

- Under this mechanism, the company offers its resident shareholders a choice to submit their shares back to the company so that on the basis of such shares, ADRs/GDRs can be issued abroad.

- The proceeds of the ADR/GDR issue are remitted back to India and distributed among the resident investors who had offered their Rupee denominated shares for conversion.

- These proceeds can be kept in Resident Foreign Currency (Domestic) accounts in India by the resident shareholders who have tendered such shares for conversion into ADRs/GDRs.

[1] As per any internationally accepted pricing methodology on arm’s length basis for the unlisted companies and valuation in terms of SEBI (ICDR) Regulations, for the listed companies].

[2] Share Certificates, Debenture Certificates

(Author – CS Divesh Goyal, ACS is a Company Secretary in Practice from Delhi and can be contacted at csdiveshgoyal@gmail.com)

(Author – CS Divesh Goyal, ACS is a Company Secretary in Practice from Delhi and can be contacted at csdiveshgoyal@gmail.com)

Read Other Articles Written by CS Divesh Goyal

Disclaimer: The entire contents of this document have been prepared on the basis of relevant provisions and as per the information existing at the time of the preparation. The observations of the author are personal view and the authors do not take responsibility of the same and this cannot be quoted before any authority without the written consent of the author.