Tax Bar Association, Jodhpur has written a letter to Union Finance Minister, Smt. Nirmala Sitharaman and Request for Extension of due date for filing of Income-tax returns from 31st July, 2019 to 30th Sept 2019. Extension is requested in view of enormous delay on part of department to provide IT forms preparation software, Dynamic amendment of Return Preparation Utility, TDS details and instructions for filing ITRs. Text of the Letter is as follows:-

Date: 18/07/2019

To,

1) Smt. Nirmala Sitharaman

Hon’ble Union Minister of Finance & Corporate Affairs

Government of India, North Block,

New Delhi-110001

2) The Chairman

The Central Board of Direct Taxes

3) Prime Minister Office New Delhi

Hon,ble Madam,

Greetings of the Day!

Sub.: Request for Extension of due date for filing of Income-tax returns from 31.July.2019 to 30.Sept.2019,

Tax Bar Association, Jodhpur hereby takes the privilege to address the concern of the members, being Chartered Accountants, Advocates and Tax Practitioners, practicing in the area of indirect taxation which are of utmost importance and need to be addressed by your good office on utmost priority.

There is sufficient cause and need for extension of last date of filing Income tax Returns for a reasonable period not less than 30th September 2019

Due to the following reasons a case is made out for extension of above date.

1. Return forms (in pdf form) for assessment year 2019- 20 were released in first week of April, 2019 but return filing software were made available for different forms on different dates upto June, 2019. In fact Return Preparation Software for ITR-6 and ITR-7 not yet made available.

2. Similarly, instructions for filling up ITR forms were released in a staggered manner on different dates. Instructions for filling up ITR-7 were released just two—three days back. Without following instructions a return cannot be filed correctly.

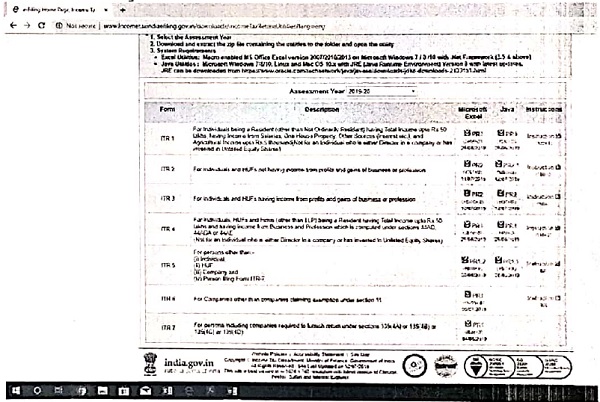

3. Further, Return Filing Utility provided on e filing site is continuously being changed. Utility for filing ITR-2 and ITR-3 just changed on 12.07.2019. [ Screenshot attached]

4. Due date for filing TDS return in respect of salary payments was extended upto 30.06.2019 and due date for issue of form no 16 by tax deductor was extended upto 10.07.2019 and in many cases form no 16 and form no 26AS is not yet updated. As you are aware filing ITRs without matching with 26AS results into defective notice from the CPC. So matching is a necessity.

5. Pre-filled XML also just made available on 11.07.2019 (Screenshot attached).

6. Just four-five days back Return Preparation Software MIS updated and a Schedule 112A was added. This schedule requires voluminous information regarding shares and mutual funds sold during the year 2018-19 that too ISM wise (i.e. details of every share sold is required). This schedule requires information regarding lair value as on 3 1.01.2018 which is a herculean task.

7. As per law facility Ibr filing 1TR be ready on I st day of April of the assessment year so that asscssees get sufficient time to collect information desired in IT forms and file it properly.

Since this year there is enormous delay on part of department to provide IT forms preparation software, Dynamic amendment of Return Preparation Utility, TDS details and instructions for filing ITRs a case is made out for extension of due date.

Therefore we request an extension of at least two months of Due Date for filing ITR to 30.09.2019.

Kindly look into above at the earliest and announce the extension immediately.

Continuing Suggestion:

1) Time and again, citizens and various forums of the country have been requesting that all relevant compliances and the procedures including the forms shall be made available to the concerned class well before start of the financial year so that necessary data can be built in the desired format and purpose. Its time and again that Government bodies overlook this aspect and the ‘Ease of Doing Business’ objective propagated by the Government becomes a hypocrite punch line. Each day a new amendment / updation not only in Income tax law but various other commercial laws makes the life tough and the small businesses are into more of Government business of compliances rather than their actual business. Even various High Courts have advised the Government in this regard while extending last dates through writs in the matters of Income tax audits, etc.

Tax Bar Association is of the belief that in a democratic country, the People of the country are the supreme authority and it is confident that the Government will not suppress the concerns of its People. We understand that the Govt. is well aware of the above facts and will definitely consider the above representation of date extension.

We would be thankful if your goodself judiciously extend the date well in advance which will keep the members relieved from last minute unwanted stress and would be effective and meaningful.

Yours Faithfully,

A Definite Partner in Nation Building

Tax Bar Association, Jodhpur

CA. Vishnu Prakash Daga

President

CA. Manoj Gupta

Joint Secretary & Co-ordinator

CA. Raj Bothra

Secretary

Download Representation of Tax Bar Association, Jodhpur

List of the other recent Representation

| S. No. | Dated | Submitted by | Link |

| 10. | 19/08/2019 | BCAS and 4 Others | Representation on Income Tax and GST Issues faced by taxpayers |

| 9. | 19/08/2019 | Professional Accountants’ & Tax Consultants’ Association |

Request for Extending Due Dates for filing Annual GST Returns |

| 8. | 17/08/2019 | Chamber of Tax Consultants | Extend due date for filing of GSTR -9, 9A and 9C for F.Y. 2017-18 |

| 7. | 14/08/2019 | Western Maharashtra Tax Practitioner’s Association | Extend Due date of GST Returns in Flood affected States |

| 6. | 13/08/2019 | Goods & Services Tax Practitioners Association of Maharashtra | Extend GST, Income Tax and other due dates falling in Aug & Sep 2019 |

| 5. | 12/08/2019 | Association of Tax Lawyers, Delhi | Request to Extend time limit for claim of ITC for FY 2017-2018 |

| 4. | 10/08/2019 | Karnataka State Chartered Accountants Association | Extend Due Date for Filing of Income Tax and GST Returns |

| 3. | 18/07/2019 | Tax Bar Association, Jodhpur | Extend due date for filing of Income-tax returns to 30th Sept 2019 (As above Post) |

| 2. | 11/06/2019 | Goods And Services Tax Practitioners’ Association Of Maharashtra | GST Annual Return & subsequent reconciliation for GST Audit- Issues |

| 1. | 05/08/2019 | Gujarat Sales Tax Bar Association | Request for extension of due date of Annual Return- GSTR-9 |

Tax Audit Date For F.Y. 2018-19 must be Extend to 30.11.2019…is any representation made for Extentention…

TAX AUDIT FIN YEAR 2018-19 ASS YR 2019-20 SHOULD BE EXTENDED TO 30/11/19

In chennai heavy rain now , Pls extend income tax efiling atleast upto 15 day (Sep 15 2019)

Respect.F.M. kindly extend ITR filing date to 3oth Sept.2019 Thanks hoping for a favour

Its a request to extend the due date till 30th spetember as many due dates are colliding with each other and there is lot of pressure.

DATE EXTENSITION NEWS WILL ANNOUNCE ON 01-08-2019 MORNING ..TILL THN ENJOY ..

Lets hope for an extension…!!! Probably 31.8.2019 at least….

Please extend the date to at least 31st August 2019.

DUE DATE ASSTT. YEAR 2019-20 EXTENDED I AGREE Reason IS GENUINE

Please extend the date to at least 31st August 2019.

Please extend it till 31-09-2019.and also extend the date for 44AB assessees

any hope for extention

I also agree with the above. Please extend the date to at least 31st August 2019.

Many of the practitioners are practicing in the field of GST also , the last date for filing the GST return is 31st August and September as per turnover , so it is very much necessary for extension of the date of filing of income tax return the latter is really appreciable ,sended by tax bar association Jodhpur but I think as per the letter I have observed that it is mention from the beginning of the letter that tax bar association Jodhpur is the association of chartered accountants, advocates and tax practitioners it means all are the members of this association but at the last the sender of the letter have mentioned their professional degree. I think , this is not fair as per the constitution of the association. Bar council is also does not permit for the same because as per the rule of of BAR council ,who may be the member of the association it is clearly mentioned for the association ., we should to write only the name with their designation like as President general secretary or others. Every person has a professional degree who is the member of the tax bar association Jodhpur the professional degree may be different but they have so show all the persons all the members of the association and those all the members decide this that who will be the president general secretary for others through the process. If the letter is given in the latter pad of the association then it is completely clear that the sender is a member of the association and who has sended it only the designations should be mentioned. thank you!

It is necessary to extend due date kindly fm accept it

Good effort taken by Association. I think due date for filing returns should be 30th September every year for Non Audit and for Audit 30th November or December permanently. Because always every year we are facing same situation it makes pressure on every one just due to shorter time and various technical issue like Form16 from Traces etc. it will help to every one practicing direct tax or indirect tax to organised their works schedule peacefully.

Verygood suggestion of All Indian Income tax

Assessee. Hope we will get the extension at the earliest

Thanks sirs by raising voice in right time.It is essential for a larger section of people sufficient time to file return correctly.

Due date for filing ITE BY individuals must be extended upto September 3019

It is rightly pointed out and rightly said under the head “Continuing Suggestion”

“the ‘Ease of Doing Business’ objective propagated by the Government becomes a hypocrite punch line”

“the small businesses are into more of Government business of compliances rather than their actual business”

“the People of the country are the supreme authority”

Please extend due date to ease tax payer ‘s agony.our govt. has a great sympathy for the tax payer.

Yes, date has to be extended. Till now few 26as are not updated and still employee from few company are waiting for salary certificate and in addition to other there are lot of challenge in system and software.

Thank you for the initiative due date need to be extended

Yes very good initiative to extend the date.

Thanks Sirs for Bringing this into the knowledge of Government about Practical difficulties to implement endless changes for filing ITRs. They should also make it easy and less time taking process to increase more taxpayers to file on time with out paying huge penalities.

yes, announcement of extention of due date must be declared immediately.

Excellent initiative, thank you

Thank you sirs…for the concern…

Thanks for the request to the extension of the ITR Due Date. This is very helpful to file the returns with satisfies.

Hope we will get the extension at the earliest

Yes, date has to be extended. Till now few 26as are not updated and still employee from few company are waiting for salary certificate and in addition to other there are lot of challenge in system and software.

very good request also felling that due date must be extend….