FAQs on quarterly Submission of Form 15CC by an authorised dealer

Q.1 What is Form 15CC?

Ans. Every authorized dealer making remittance to a non-resident, not being a company or to a foreign company, is required to make a quarterly disclosure of such remittance in Form 15CC.

Q.2 What are the modes of submission of form 15CC?

Ans. Form 15CC can be submitted either in offline mode or online mode. In case you are filing the Form online, post login to e-Filing portal, select the Form, prepare and submit it. In case you are filing the form using an Offline Utility, you can download the Offline Utility for Statutory Forms, prepare the form and submit it. You can refer to the Offline Utility for Statutory Forms to learn more.

Q.3 Is ITDREIN required to be mandatorily generated before filing form 15CC?

Ans. Yes. Authorized person added by the reporting entity will have to use the ITDREIN to log in to the e-Filing portal and file form 15CC.

Q.4 When is it required to file Form 15CC?

Ans. It is required to be furnished to the competent authority of the Income Tax Department electronically within fifteen days from the end of the quarter of the financial year to which such payment relates.

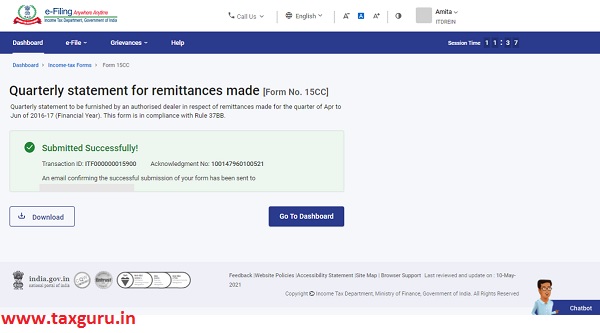

Q.5 How do I know that the form has been submitted successfully?

Ans. You will receive a confirmation on your email ID and mobile number registered with the e-Filing portal. Additionally, you can also view the status in your Worklistunder For your Actions tab.

Q.6 Is e-Verification necessary for submitting Form 15CC? if yes, how can I e-Verify the Form 15CC?

Ans. Yes, it is necessary to e-Verify Form 15CC. You will have to e-Verify using Digital Signature Certificate.

Manual on quarterly Submission of Form 15CC by an authorised dealer

1. Overview

As per the Section 195 of the Income Tax Act, 1961, read with Rule 37BB of the Income Tax Rules, 1962, every authorized dealer making a payment to a non-resident, not being a company or to a foreign company, is required to furnish statement of such payments Form 15CC.

It is required to be furnished to the competent authority of the Income Tax Department electronically within fifteen days from the end of the quarter of the financial year to which such statement relates.

Form 15CC can be submitted either through online mode or using Offline Utility.

2. Prerequisites for availing this service

| User | Prerequisites |

| Reporting Entity |

|

| Authorized Persons |

|

3. About the Form

3.1. Purpose

Rule 37BB requires Authorized Dealers to furnish a quarterly statement in respect of remittances made for each quarter of the financial year in Form 15CC.

Before filing Form 15CC, the reporting entity is required to generate ITDREIN (a Unique ID issued by Income Tax Department for submission of Form 15CC and Form V) on e-Filing portal. After successful generation of ITDREIN, the reporting entity is required to add an authorized person for filing Form 15CC with respect to the ITDREIN number generated.

3.2. Who can use it?

Authorized persons added by a reporting entity after generation of ITDREIN number.

4. Form at a Glance

Form 15CC has three sections:

1. Authorized Dealer Details

2. Remittance Details

3. Verification

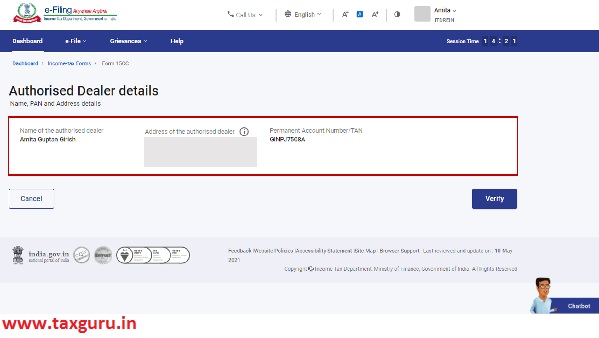

4.1. Authorized Dealer Details

The first section contains the detail of Authorized Dealer.

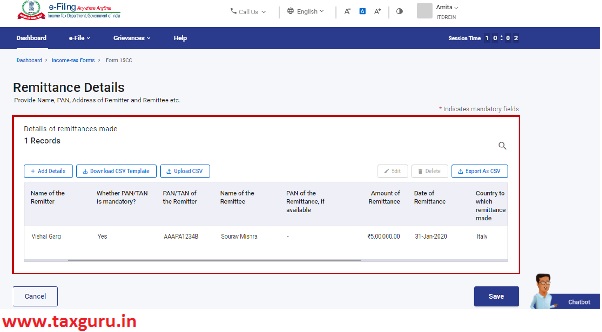

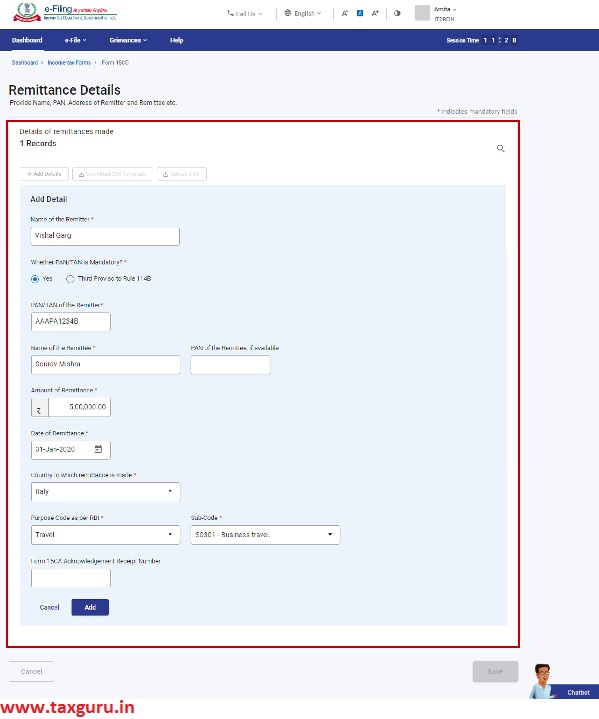

4.2. Remittance Details

The next section contains details of remittances made to a non-resident, not being a company or to a foreign company.

In this section you can add details of remitter, remittee and location to which remittance has been completed.

You can choose to upload a .csv file for uploading details of multiple remittances using a template (available on the same page).

4.3. Verification

The final section contains a self-declaration form for Form 15CC.

How to Access and Submit

You can fill and submit Form 15CC through the following methods:

- Online Mode – through the e-Filing portal

- Offline Mode – through the Offline Utility

Note: Refer to the Offline Utility for Statutory Forms user manual to learn more.

Follow the below steps to fill and submit Form 15CC through online mode.

5.1. Submitting Form 15CC (Online Mode)

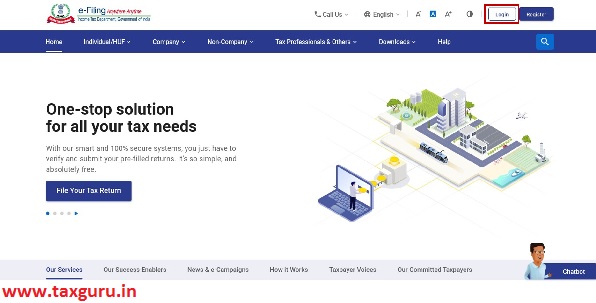

Step 1: Log in to the e-Filing portal using ITDREIN, your user ID (PAN) and password.

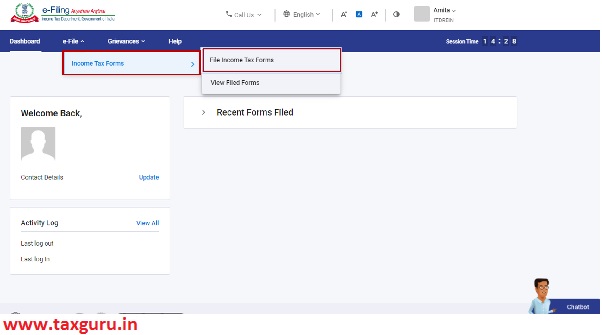

Step 2: On your Dashboard, click e-File > Income tax forms > File Income Tax Forms.

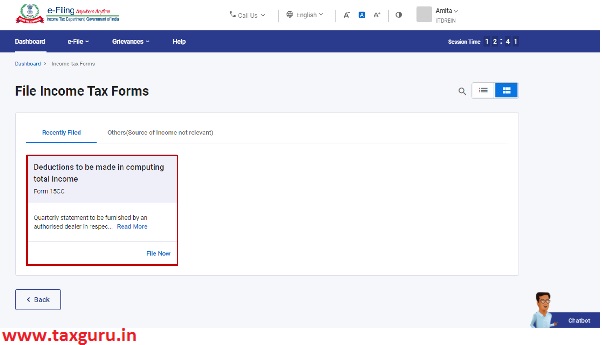

Step 3: On the Income Tax Forms page, select Form 15CC. Alternatively, enter Form 15CC in the search box to find the form.

Step 4: On the Form 15CC page, select the Submission Mode, Filing Type, Financial Year (F.Y.) and Quarter. Click Continue.

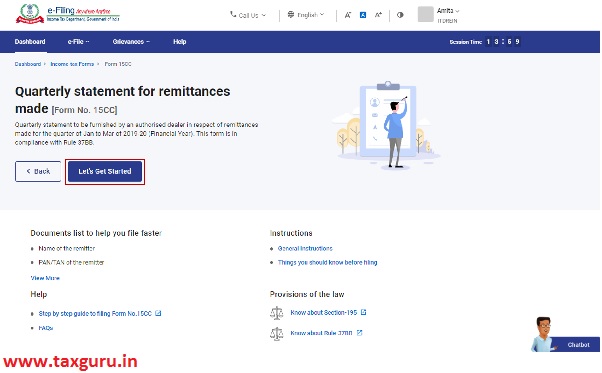

Step 5: On the Instructions page, click Let’s Get Started.

Step 6: On click of Let’s Get Started, Form 15CC is displayed. Fill all the required details and click Preview.

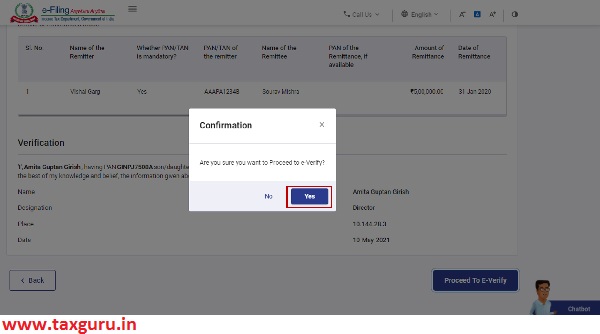

Step 7: On the Preview page, verify the details and click Proceed to e-Verify.

Step 8: Click Yes to submit.

Step 9: On clicking Yes, you will be taken to the e-Verify page where you can verify using Digital Signature Certificate.

Note: Refer to the How to e-Verify user manual to learn more

After successful e-Verification, a success message is displayed along with a Transaction ID and Acknowledgement Receipt Number. Please keep a note of the Transaction ID and Acknowledgement Receipt Number for future reference. You (and the reporting entity) will also receive a confirmation message on the email ID(s) and mobile number(s) registered with the e-Filing portal.