PROCEDURE FOR FILING FORM 10BD – A STEP BY STEP APPROACH

Procedure for filing Form 10BD for Financial Year 2021-22 [Due date 31st May 2022]

A. Introduction

Much awaited Form 10BD has been release by the Income Tax Department. In continuation to my article on ‘Note on Statement of Donations and Certificate of Donations‘ dated 7th June 2021, here in this article I have tried to explain to the procedure to followed for filing Form 10BD in a step-by-step approach. [refer separate attachment]

It is very important to follow certain instructions while filing Form 10BD and here are the details of the same.

Things you should know before filing

1. This statement of particulars to be filed by reporting person under section 80G(5)(viii) and under section 35(1A)(i)

2. Reporting person can generate pre ARN’s for Form 10BE up to 1000 without filing Form 10BD. Pre-acknowledgement no. will be unique number to be quoted on manual (handwritten) donation certificates issued to the donors at the time of receipt of donation. The details of such had written certificates shall be entered while filing Form 10BD.

3. E verification of Form 10BD is mandatory either through DSC or EVC

4. Please ensure that the details of Principal officer or Authorised Signatory has been updated in the My Profile before Submission of the form.

5. Please ensure that DSC of the principal officer or Authorised signatory is registered before submission of the form.

B. What you need to file Form 10BD

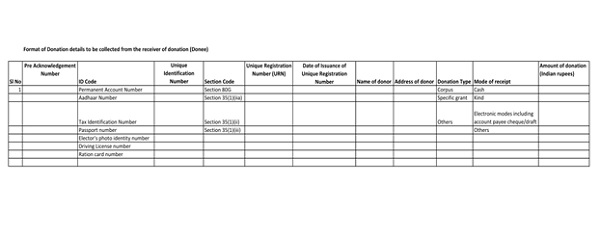

Compile the information about the donations received during the financial year 2021-22 in the following format in an excel sheet

Form 10BD can be filed for FY 2021-22. Whereas Pre acknowledgement numbers can be generated for the financial year 2022-23 [ Generation of Pre acknowledgment numbers for manual issue of Form 10BE is available from FY 2022-23 this is yet to get activated in the portal as on 27-04-2022].

If you are filing Form 10BD for FY 2021-22 they you may leave the filed “Pre acknowledgment number’ blank in the CSV file uploaded.]

In case of revised Form 10BD is being filed for FY 2021-22 it is mandatory to provide ARN of the original Form 10BE which is to be revised.

C. How to file Form 10BD

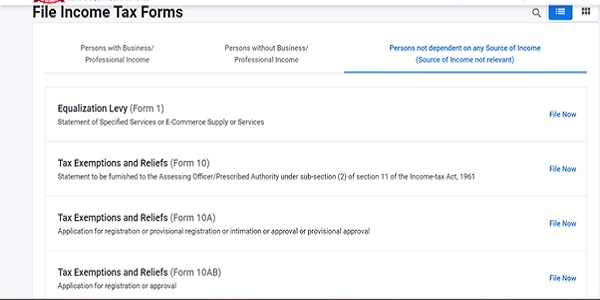

1. After login into to portal under e-file option select the income tax forms and then file Income Tax Forms.

2. Under the forms there are three options available viz “Persons with business/Professional income” and “Persons without business/Professional income” and Persons not dependent on any source of Income(source of income not relevant).

3. The option to select Form 10BE is “Persons not dependent on any source of Income(source of income not relevant)”

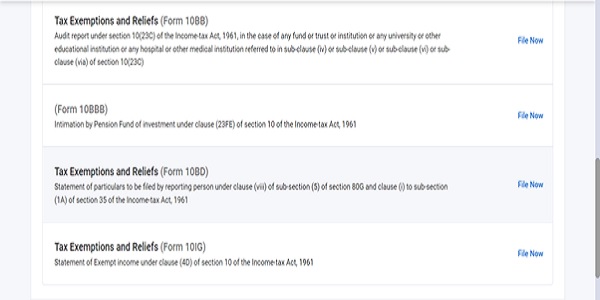

4. Under the above option one needs to select form “Tax Exemptions and Reliefs (Form 10BD)– and click on “File Now”

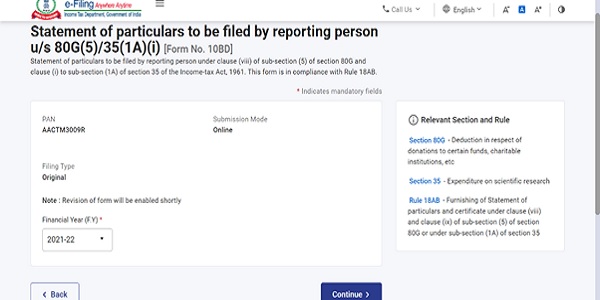

5. upon clicking File now, it will take you to next screen i.e., “Statement of Particulars to be filed by reporting person U/s 80G(5)/35(1A)(i)” under this tab one needs to select the financial year for which form is being filed [currently only FY 2021-22 is available]

6. once financial year is selected continue button will get activated and the click on the continue button

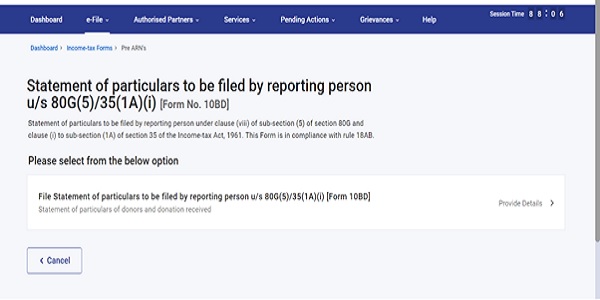

7. the next screen that appears is “File statement of particulars to be filed by reporting person u/s 80G(5)/35(1A)(i) [Form 10BD] – once you select this tab next step is to get started with “Let’s get started”

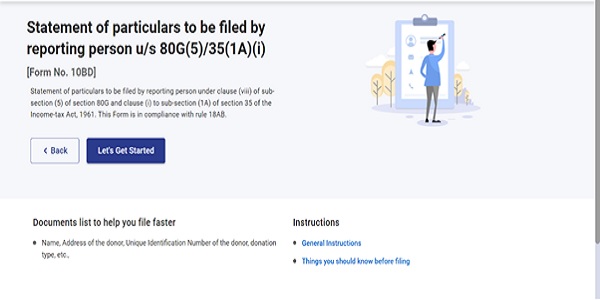

8. upon clicking on let’s get started a tab with provide details for each section will appear under which “Basic Information” (PART A), “Details of Donors and Donations” (PART B) and “Verification” will appear. Click on each of them one by one and complete the process by providing details of person responsible for filing the Form 10BD with DSC or EVC.

9. After filing Form 10BD, download Form 10BE which provide ARN for each of the donation’s details.

10. Do not forget to Issue the Form 10BE to the donors

D. Guide to File Form 10BD

STEP BY STEP GUIDE TO FILE FORM 10BD

Procedure for filing Form 10BD for Financial Year 2021-22 [Due date 31st May 2022]

Step 1 – Login into income Tax portal – www.incometax.gov.in

Step 2- Go to > e file > Income Tax Forms>File Income Tax Forms

Step 3 – Under File Income Tax forms choose -Select >Persons not dependent on any source of Income(source of income not relevant) >Scroll down you will find Form >Tax Exemptions and Reliefs(Form 10BD) click on File Now then It will take you to next screen

Step 4 – statement of particulars to be filed by reporting person U/s 80G(5)/35(1A)(i)

Step 5 – from screen showed in above step 4 Select Financial Year (FY) i.e., 2021-22>once your select FY>continue button will get activated>click on continue

Step 6-next screen is >Please select from below option>select >File Statement of Particulars to be filed by reporting person U/s 80G(5)/35(1A)(i)

Step 7- >click on> Let’s get started

Step 8-Provide details under each section >Basic information>Details of the donors and donations>Verification

Part A – basic information> click on this and confirm / modify if required the information already appearing on the screen [<if required to update then update details by clicking My profile> ]>click on Confirm

Step 9 – PART B>Details of the donors and donations>download the Template > [it is an excel template which you can fill offline and convert it into CSV file > then upload CSV file>Save

Step 10 – Verification >fill the particulars in the verification tab and complete the process of filing >through DSC or EVC

Also Read: How to file Form 10BD – Part-B Details of donors & donation

Foreign Donations are updated in the Form 10BD

Sir, Can you please suggest where to mention the PAN or Aadhaar Number of the donee in excel file downloaded from the portal.

We have received the grants from different agencies towards the Implementation of project activities. We have not received the donations under 80G . So can we upload the grants in form 10BD???

what date should i write for date of issuance of unique registration number

If no id proof available of donor (amount below 2K), what should be mentioned in 10BD format .

What if no PAN no is available or any other identification number is available for small donations below 2k?

How to procedure form 10BD Revised Return

Respected Sir,

Suppose a trust received 2 donations out of which one donor have given their id and another donor have not given the id then both the transaction is required to be reported or the only that donation which is having id?

Sir,

Can you please suggest where to mention the PAN or Aadhaar Number of the donor in excel file downloaded from the portal.

Donor is the reporting entity his PAN is not needed in excel. Enter PAN of donee only in excel template

Sir, Form 10A has not filed yet. As a result, could not download form 10AC. How to file Form 10BD without Unique Registration number.

Do we have to file separate form 10 BD for each unique donor so that we get an unique form 10 BE for her?

Do we have to fill the details of all the donors in one CSV file only or do we have to upload separate CSV files for each donor? Will form 10BE be issued separately for each donor? or will it be a composite one for all donors together which will compromise the privacy of the donors.

Good for Education

Is a trust which do not receive any donations required to file the above form

What about Anonymus donations received not having any donor details, where to disclose and how to disclose those donations

The Unique Registration Number (URN) & Unique Identification Number & the date of issuance will be available in the Order Form 10 AC. The Form 10 AC will be available for download in “View Filed Form” > “Form 10A” >Under Additional Actions. Once u click on Additional Actions , U will be able to download the “Order” or “Withdraw”

In Form 10BD, what details should be filled in column Unique Identification Number, Unique Registration Number, Date of issuance & pre acknowledgement number. Kindly reply

Dear Pratima,

The Unique Registration Number (URN) & Unique Identification Number & the date of issuance will be available in the Order Form 10 AC.

The Form 10 AC will be available for download in “View Filed Form” > “Form 10A” >Under Additional Actions.

Once u click on Additional Actions , U will be able to download the “Order” or “Withdraw”

In our Form 10AC we have been given Provisional Approval Number & Date of provisional approval and Not Unique Registration Number(URN) and not Date of issue of URN, so whether we should mention provisional approval no. and it’s date, please confirm

Pratima -i have sent an email replying to your query with instructions for filing form 10BD, pls do refer instructions sent.

In form 10BD under Income Tax Portal, what should be mentioned under column Unique Registration Number