Article contains Important Information for Online TDS/TCS/Demand Payment With Challan ITNS 281, Brief steps for ‘Online TDS/TCS/Demand Payment With Challan ITNS 281’ and Pictorial Guide for ‘Online TDS/TCS/Demand Payment With Challan ITNS 281’.

1. Important Information for “Online TDS/TCS/Demand Payment With Challan ITNS 281”.

- Challan No. ITNS 281 is used by the Deductors to deposit Tax Deducted at source/Tax Collected Source (TDS/TCS) and Demand Payment.

- User should have Internet Banking Account in order to avail facility of Online payment of Challans.

- Following details required to be filled while payment of Challan ITNS-281:

1. Tax Applicable:-This column has two options:

-

-

- 0020: This is applicable in the case of income tax of companies ( If Deductee is company).

- 0021: This is applicable to income tax for other than companies (If Deductee is not a company i.e. an individual, HUF, partnership firm, etc.).

-

2. Assessment Year.

3. TAN No., Name and Address

4. Type of Payment:

-

-

- 200 ( TDS/TCS payable by Taxpayer)

- 400 ( TDS/TCS payable regular Assessment).

-

√ Note : In case of Online Demand Payment Deductor can select Minor Head 400 ( TDS/TCS Regular Assessment ). For TDS/TCS payment Deductor can select Minor Head 200 ( TDS/TCS payable by Taxpayer).

5. Nature of Payment: Deductor has to select Section Code as per the section under which TDS/TCS is deducted.

2. Brief steps for “Online TDS/TCS/Demand Payment With Challan ITNS 281”.

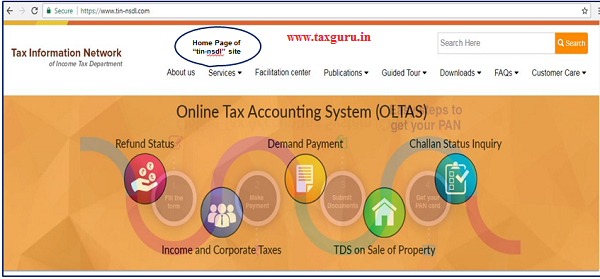

Go to www.tin –nsdl .com website .

Step 1: Click on “ e- payment Pay Taxes Online” available at home page under “Services” tab.

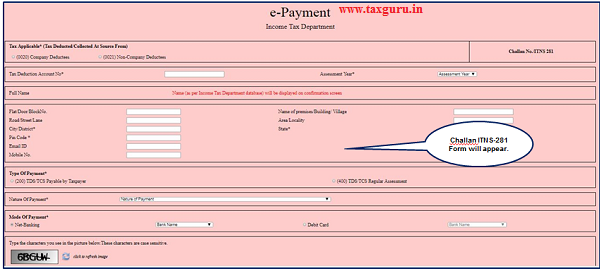

Step 2: Select Challan ITNS 281 for Demand payment from the list. Challan ITNS-281 Form will appear.

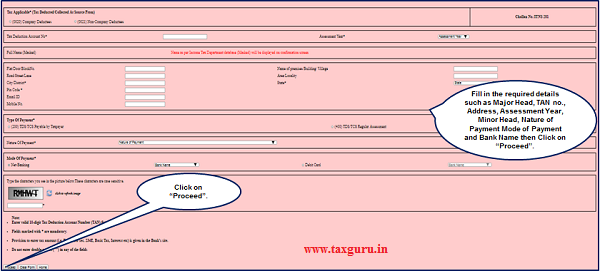

Step 3: Select Major Head (0020/0021), Enter valid 10-digit Tax Deduction and Collection Account Number (TAN), Assessment Year, Address. Minor Head/Type of Payment (200/400), Nature of payment, Mode of Payment & Bank Name then Click on “Proceed” button.

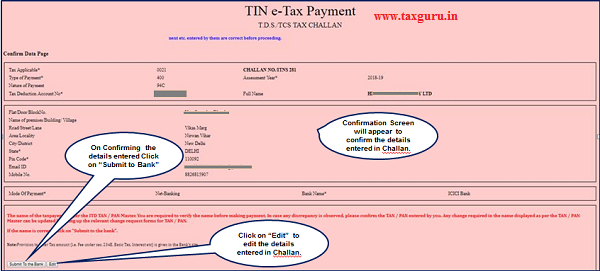

Step 4: Confirmation Screen will appear to confirm the details entered in Challan . On Confirming the details entered in Challan. Click on “Submit to Bank” button.

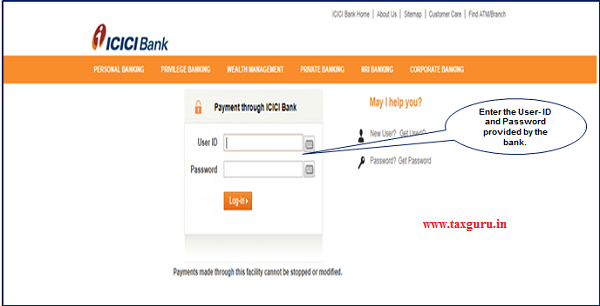

Step 5: Deductor will be re-directed to the Internet- Banking site of the bank. Enter the User- ID and Password provided by the bank.

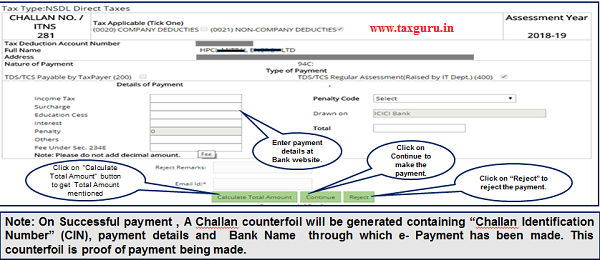

Step 6: Enter payment details at Bank website and make the TDS payment.

√ Note: On Successful payment , A Challan counterfoil will be generated containing Challan Identification Number (CIN), payment taxguru.in details and Bank Name through which e- Payment has been made. This counterfoil is proof of payment being made.

3. Pictorial Guide for “Online TDS/TCS/Demand Payment With Challan ITNS 281”.

Go to www.tin –nsdl .com website . Home page will be displayed.

Step 1: Click on “ e- payment Pay Taxes Online” available at home page and under “Services” tab.

Step 2: Select Challan ITNS 281 for TDS/TCS/Demand payment from the list.

Step 2 (Contd..) : Challan ITNS-281 Form will appear.

Step 3: Fill in the required details such as Major Head, TAN No., Address, Assessment Year, Minor Head, Nature of Payment Mode of Payment and Bank Name then Click on “Proceed”.

Step 4: Confirmation Screen will appear to confirm the details entered in Challan . On Confirming the details entered in Challan click on “Submit to Bank”.

Step 5: After clicking on “Submit to the Bank” button, Deductor will be re-directed to the Internet- Banking site of the Chosen bank. Enter the User- ID and Password provided by the bank.

Step 6: Enter payment details at Bank website and make the Demand Payment.