Page Contents

Important Information on Online Correction- Add/delete salary details

All type of corrections like ‘Personal information, Deductee details and Challan correction’ can be made using Online correction functionality available from FY.2007-08 onwards depending upon the type of correction.

This feature is extremely useful as it is :

Free of Cost : TRACES does not charge any fee for doing online correction

Time saving: No need to request for Conso file and wait for file availability. Just raise a request and you can select the type of correction you wish to proceed with. Correction gets processed in 24hrs

Effort saving: No need of any software/ CD/PEN drive , just login and file the correction Enhance efficiency: Error specific correction is possible

Note: For paper return, online correction cannot be done

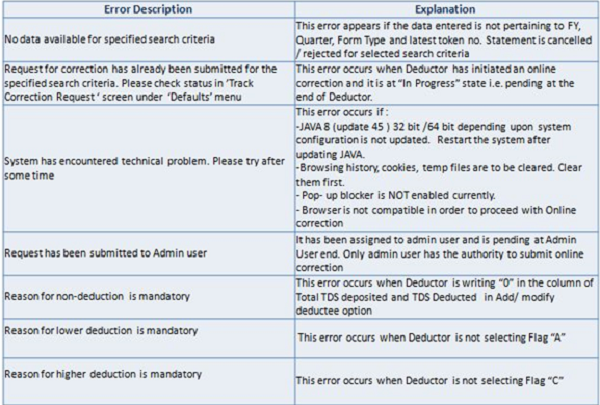

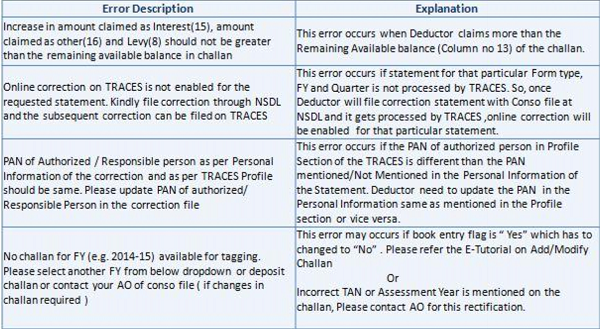

Most Common Error While filing Online Correction

Brief Steps for Online Correction- Add /delete salary details – Annexure II

- This feature enables deductor to Add/delete salary details in Annexure-2 it is available from FY 2013-14 onwards

- Digital Signature Certificate should be registered on TRACES before making this correction, However, regular statement should be processed from TRACES

- In case statement is not processed by TRACES, please file C1 (Personal Information) through Conso file then you will be able to taxguru.in proceed with online correction

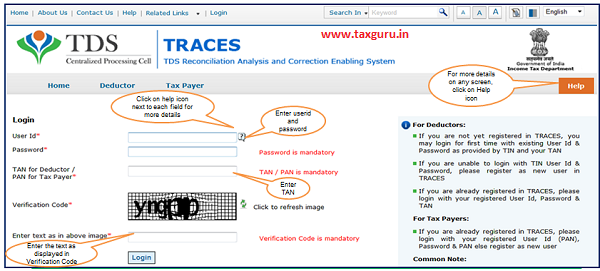

- Step 1 : Login to TRACES website

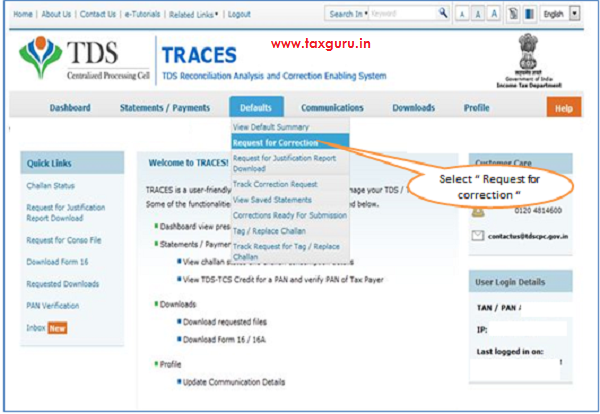

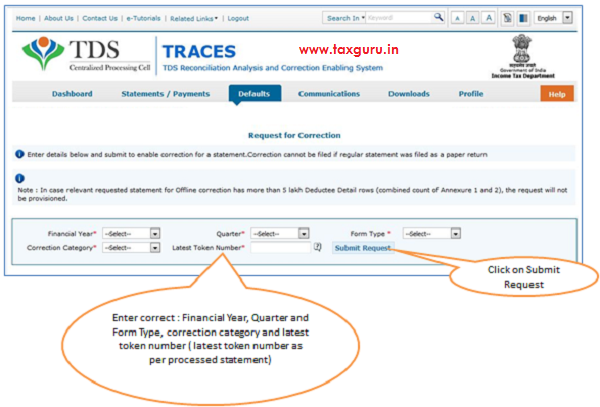

- step 2: Go to “request for correction” under “Defaults”by entering relevant Quater, Financial Year, Form type, latest Accepted token number

- Correction category should be “online”

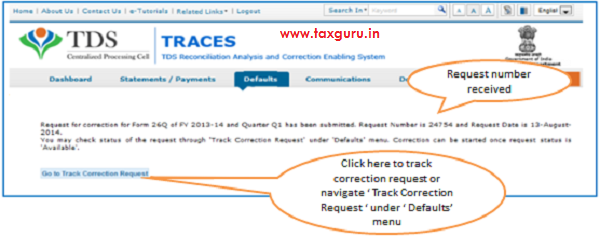

- Request number will be generated

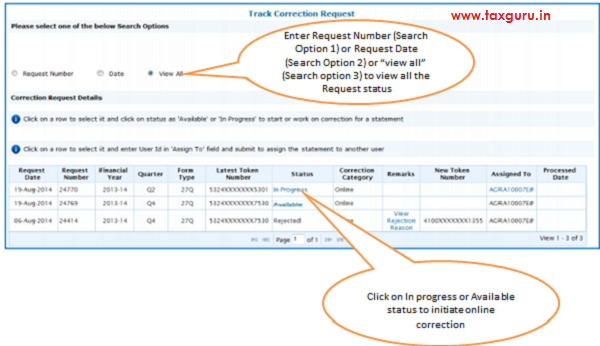

- Step 3: Request will be available under “Track Correction Request”

- When Request status become “Available” click on Available/In Progress Status to procerd with the correction

- Provide information of Valid KYC

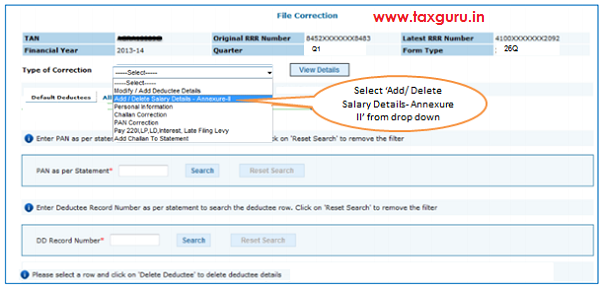

- Step 4 : Select the type of correction category from the drop down as “Add /delete salary details – Annexure II ”

- Step 5 : Make the required corrections in the selected file

- Step 6 : Click on “Submit for Processing” to submit your correction (Only Available to Admin User)

- Step 7 : 15 digits token number will be generated and mailed to Registered e-mail ID

Status of Online Correction Requests:

- Requested – When user submits request for correction.

- Initiated – Request is being processed by TDS CPC

- Available – Request for correction is accepted and statement is made available for correction. User can start correction on the statement. Clicking on the hyperlink will take user to validation Once user clicks on request with ‘Available’ status, status of request / statement will change to ‘In Progress’

- Failed – Request cannot be made available due to technical error. User can re-submit request for same details

- In Progress – User is working on a statement. taxguru.in Clicking on the hyperlink will take user to validation screen

- Submitted to Admin User – Sub-user / Admin User has submitted correction statement to Admin User

- Submitted to ITD – Admin User has submitted correction statement to ITD for processing

- Processed – Statement has been processed by TDS CPC (either for Form 26AS or for defaults)

- Rejected – Statement has been rejected by TDS CPC after processing. Rejection reasons will be displayed in ‘Remarks’ column

Login to TRACES

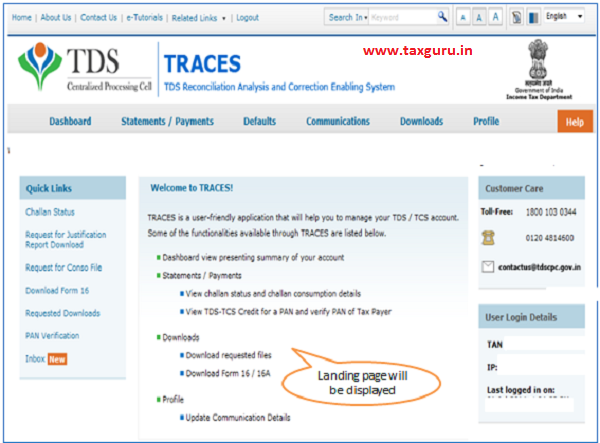

Welcome Page

Online Correction Request Flow

–

–

Online Correction Request Flow- View submitted request

Available Status – Request for correction is accepted and statement is made available for correction. User can start correction on the statement. Clicking on the hyperlink will take user to validation screen. Once User clicks on request with ‘Available’ status, status of request/ statement will change to ‘In progess’

In Progess status- user is working on Statments. Clicking on the hyperlink will take user to vaildation Screen

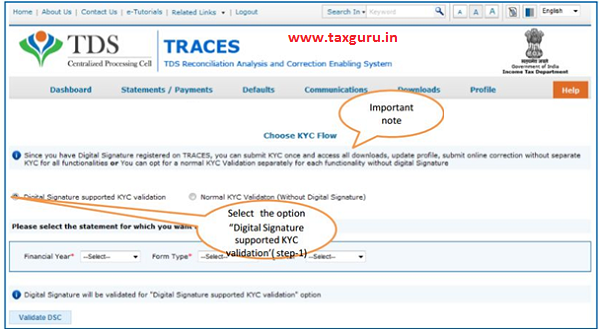

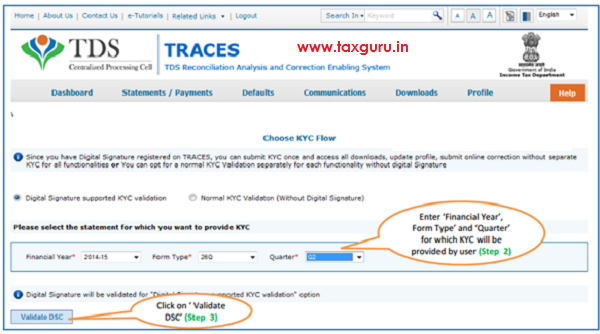

Digital Signature supported KYC Validation contd. (Step 1)

- Digital Signature Support KYC validation screen will appear only if Digital Signature is registered. Deductor can register/re register their Digital Signature in Profile. Please refer Digital Signature Certificate Registration e-Tutorial for more information.

- Normal KYC Validation (without Digital Signature) User can opt a normal KYC validation separately for each functionality without digital signature.

Digital Signature supported KYC Validation contd. (Step 2 & 3)

After validating the DSC,one time KYC Page will be displayed for the FY+Qtr+From Type combination which has been selected by the user.

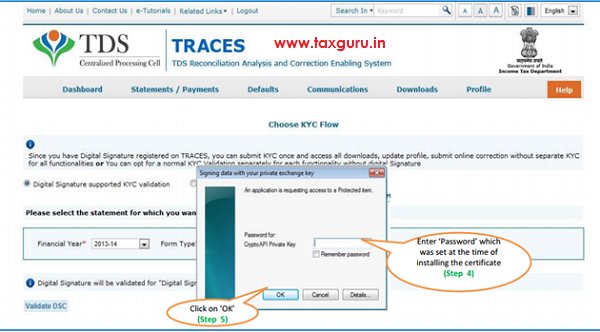

Digital Signature supported KYC Validation contd. (Step 4 & 5)

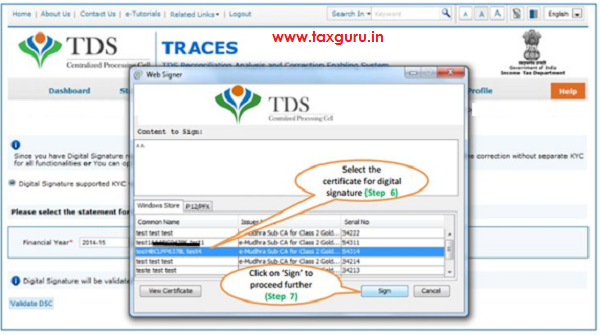

Digital Signature supported KYC Validation contd. (Step 6 & 7)

Digital Signature supported KYC Validation contd. (Step 8)- KYC of the FY+Quarter+From type selected in step 2 will be displayed

- Authentication Code will not appear on the screen in case DSC Supported KYC

- In one session this manual KYC page ( On the basis of input selected by the user ) will be displayed only once

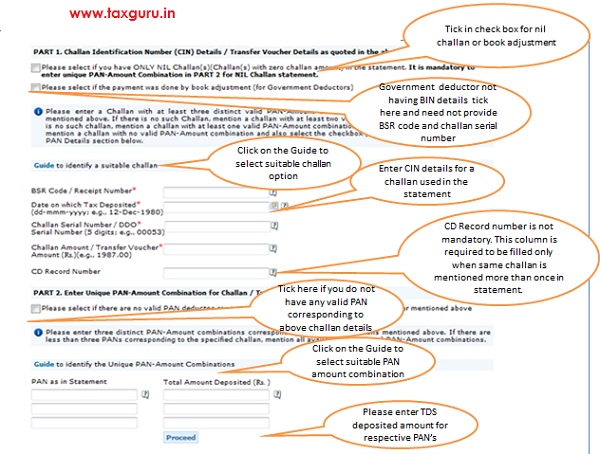

Token Number Details (Contd.)

Notes for Validation Screen:

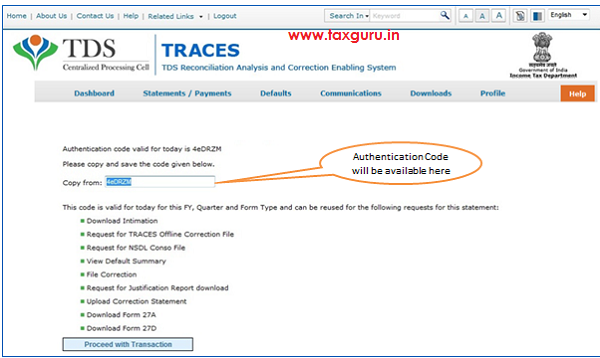

- Authentication code is generated after KYC information details validation, which remains valid for the same calendar day for same form type, financial year and quarter

- Token Number must be of the regular statement of the FY, Quarter and Form Type displayed on the screen

- CIN/BIN details must be entered for the challan/book entry mentioned in the statement corresponding to the FY, Quarter and Form Type mentioned above

- Government deductor can enter only Date of Deposit and Transfer Voucher amount mentioned in the relevant Statement

- Amount should be entered in two decimal places (e.g., 1234.56)

- Only Valid PAN(s) reported in the TDS/TCS statement corresponding to the CIN/BIN details in Part1 must be entered in Part 2 of the KYC. Guide available on the screen can be referred for valid combinations.

- Maximum of 3 distinct valid PANs and corresponding amount must be entered

- If there are less than three such combinations in the challan, user must enter all (either two or one)

- CD Record no. is mandatory only in case of challan is mentioned more than once in the

statement

Authentication Code Screen

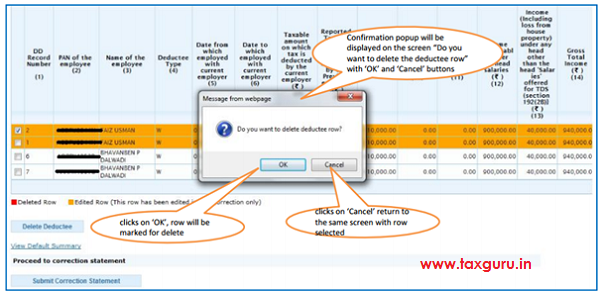

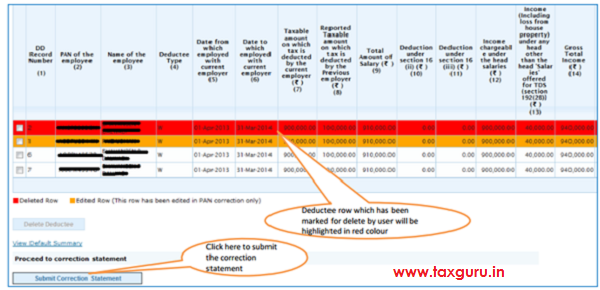

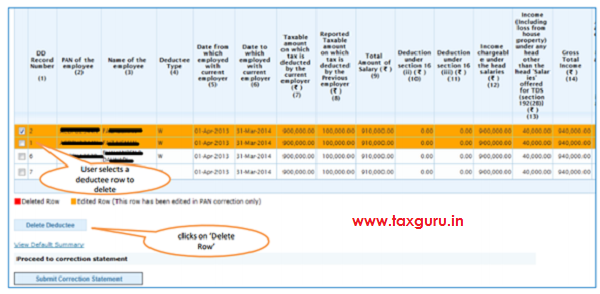

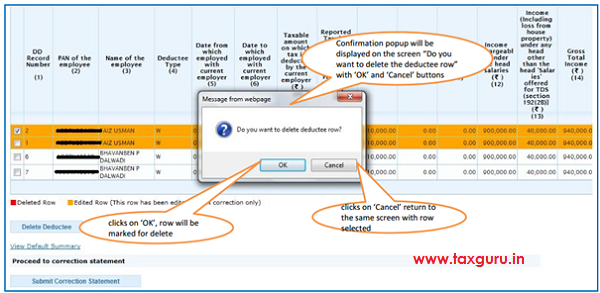

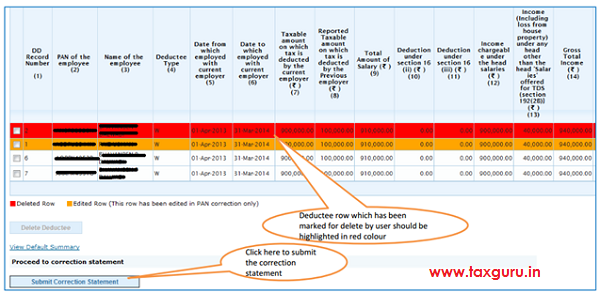

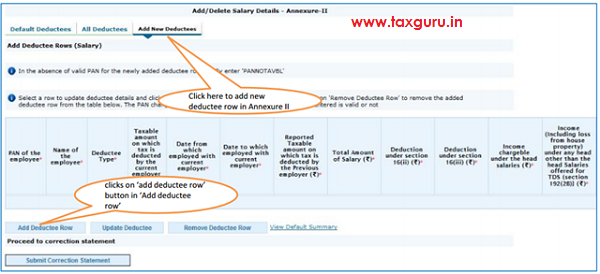

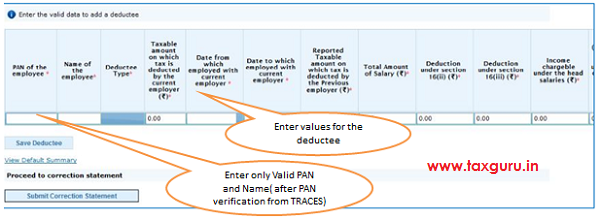

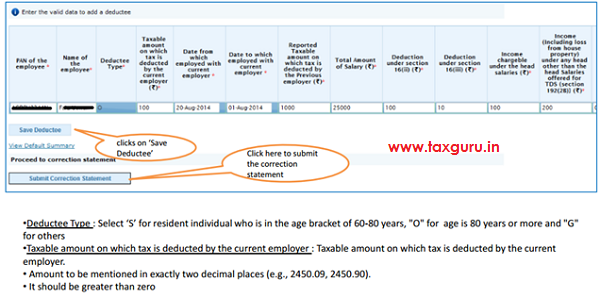

Add /Delete Salary Detail –Annexure II

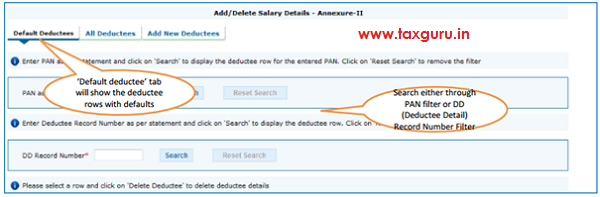

Add /Delete Salary Detail –Annexure II : Default Deductee

–

–

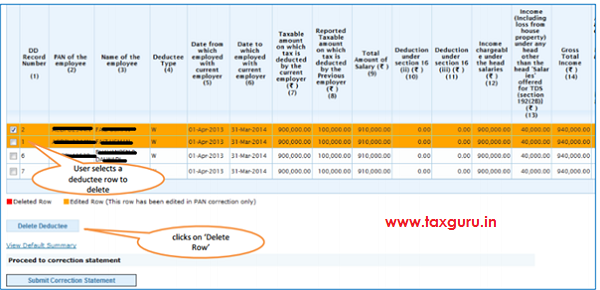

Add /Delete Salary Detail –Annexure II : All Deductee

–

–

–

–

–

–

–

–

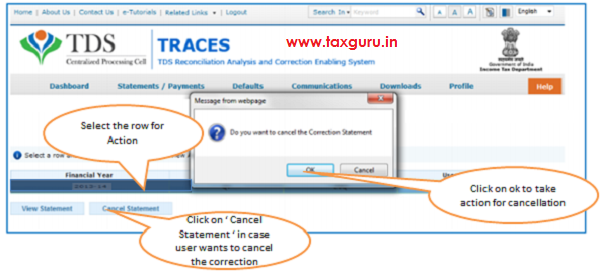

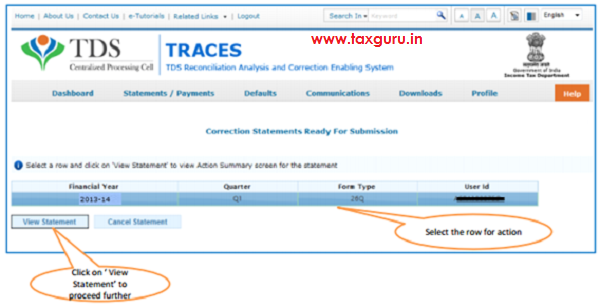

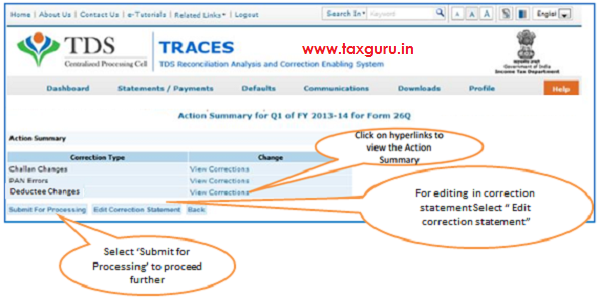

Action Summary

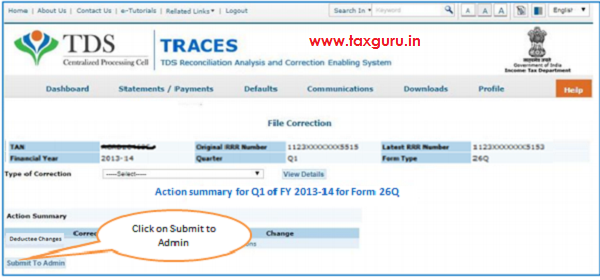

Action Summary –Submit to Admin User

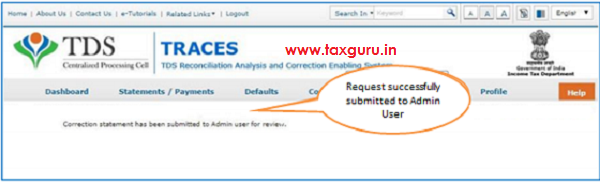

Above Screen will be appeared in case correction submitted by Sub-user

Action Summary

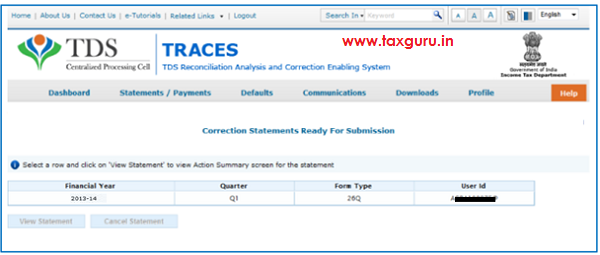

Request will be submitted to Admin user . Sub-user cannot submit the correction from ‘ Correction Ready for Submission’͘

Sub-user should only be able to view statements saved by them

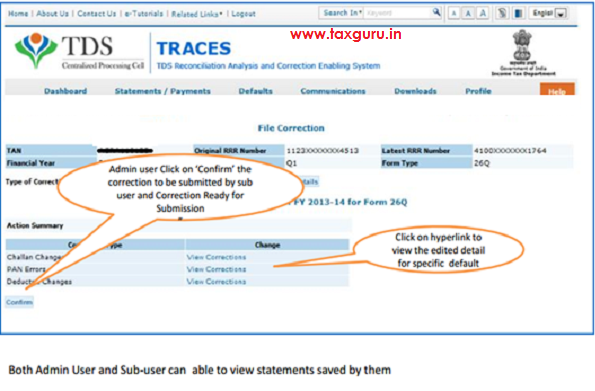

Action Summary – View edited Statement

Action Summary- Admin User Login

–

Action Summary- Admin User

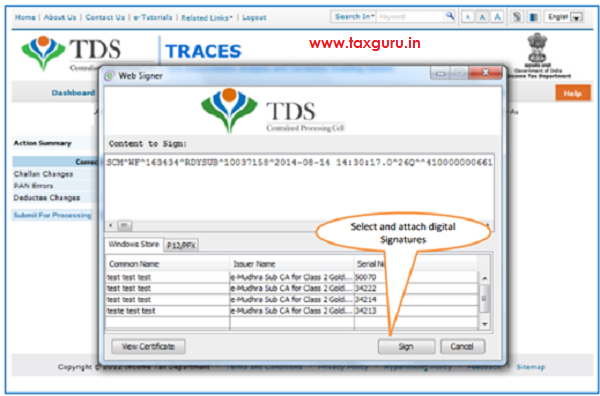

Action Summary- Submit For Processing

Admin User needs to attached the digital signature and submit the correction

Action Summary-Attach Digital Signature

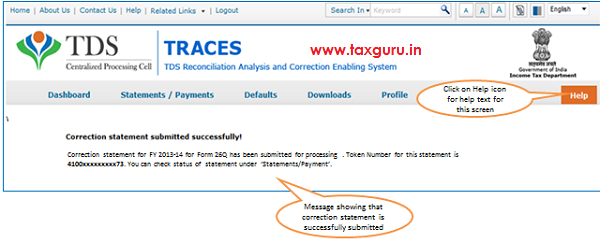

Action Summary –Token Number Generated

Note: Note down the Token Number for future reference

Note: Note down the Token Number for future reference

Source- https://contents.tdscpc.gov.in

Sir, I am a govt deductor. I filed TDS returns for FY 2020-21 Q4. I got a notice for short deduction for Rs 6280/-. I submitted ITNS 281 for Rs 6280/- on 07 May. Subsequently, while preparing correction return, I added this challan (ITNS 281). However, i deleted the salary records of the default deductees. Now I am unable to add salary records for the deductees. How to proceed further? Pl advise

sir, advice how i correct PAN of employee, only salary details uploaded with return. i.e. no tax deduction made but only salary details uploaded.