Mukesh Kuriyal

Do You Agree That CBDT Has Taken Right Decision On Measurement Of Distance To Be Taken Aerially After Assessment Year 2014-15

CBDT issued Circular No. 17/2015-Income Tax dated 06.10.2015 regarding Measurement of the distance for the purpose of section 2(14)(iii)(b) of the Income-Tax Act for the period prior to the Assessment Year 2014-15.

It clearly quotes that the “distance to be measured by the For the period prior to assessment year 2014-15, the High Court held that the distance between the municipal limit and the agricultural land is to be measured having regard to the shortest road distance. The said decision of the High Court has been accepted and the aforesaid disputed issue has not been further contested”.

It further quotes that the amendment prescribing “distance is to be measured aerially, applies prospectively i.e in relation to assessment year 2014-15 and subsequent assessment years”.

The CBDT clearly means that

| Period | How To Measure The Distance |

| Before 01/04/2014 | By Road Distance(Shortest Road Distance) |

| From 01/04/2014 | Aerially |

This decision was taken because in almost 90%-95% cases of Capital gains The H’ble High Court Of Different States gave judgement in favour of the assessee. Even in the case of Smt. Maltibai R Kadu quoted by CBDT the court said that the distance should be taken which ever is in the favour of assessee.

I welcome the notification issued by CBDT but at the same time what is the logic that in case of the capital gain after 01/04/2014 the Measurement should be Aerially.

1. I think that Max Of the Capital Gain cases which went to the court or are in court are prior to 01/04/2014.

2. The Max no of Judgements (in case of sno 1) so far were going in favour of assessee.

3. But after few years again the cases will be pending in the courts regarding Capital Gains due to the measurement of aerial distance.

4. Logically speaking the Local Limits of Municipality are getting increased day by day then past years so its really ill-logical that “when the local limits of municipality are increasing the distance is to be measured aerially” whereas “when the local limits of municipality are increasing the distance should be measured By road distance(The shortest Road distance)”

Is The Decision Taken By CBDT Is Correct Or Not???????

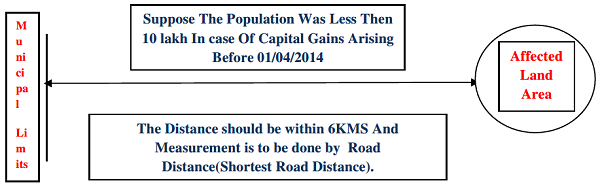

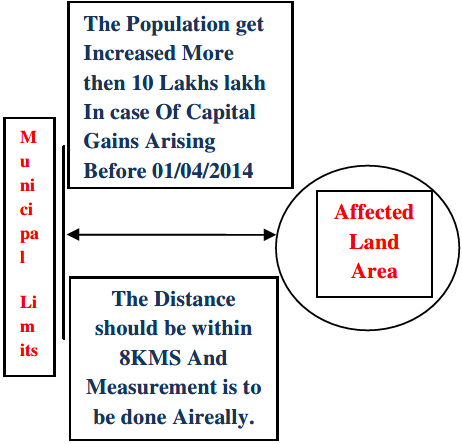

I Am Trying To Show It Through Diagrams

In Case Of Measurement

(1)Prior To Fin-Year 2014-15

(2) From Fin-Year 2014-15 Onwards

In Case Of Population

(3) Prior To Fin-Year 2014-15

(4) From Fin-Year 2014-15 Onwards

Mukesh Kuriyal Systems, Analyst Pursuing LLB, Practicing Income Tax

I m a farmer &i want to sell my agriculture land how can i measure ariel distance. Is there any govt institute that gives the ariel distance certificate to us

I m a farmer &i want to sell my agriculture land but how can i measure the ariel distance is there any govt institute that gives the ariel distance certificate to us

@ Vijay I Think You Are Right On That Part Since Aerial Distance Cannot Be Measured Easily By Every One Whereas Road Distance Can Be easily Measured That Is Why Govt Has Preferred Aerial Distance..Hahaha

Any designated authority that will do aerial measurements ?

Can you expect illetrate small & marginal farmers to be aware of published population figures, as per last census ?

Any CAs who can off hand tell the same ?