In the Union Budget 2025-26, the government proposed significant changes to the income tax regime, aiming to provide relief to the middle class and stimulate consumption. Under the new tax regime, there will be no income tax on annual earnings up to Rs. 12 lakh, with an additional Rs. 75,000 standard deduction for salaried taxpayers, raising the limit to Rs. 12.75 lakh. The revised tax slabs now range from 0% for incomes up to Rs. 4 lakh, with incremental rates increasing based on higher income brackets, reaching a maximum of 30% for earnings above Rs. 24 lakh. These changes are expected to reduce the tax burden significantly, leaving more disposable income in the hands of taxpayers, thereby encouraging household consumption, savings, and investment. The tax reforms are part of the government’s vision to simplify the system, reduce litigation, and enhance governance. Finance Minister Nirmala Sitharaman emphasized that the new tax structure aims to benefit all taxpayers and foster economic growth, ensuring a straightforward and more predictable system.

A calculation on how much does one save with the new 12 lakh tax limit by CA (Dr.) Suresh Surana?

(As in earlier, how much would the tax liability be and now it is NIL).

| Total Income – Rs. 12,00,000 | |||||||||

| Existing Slab Rates (New Tax Regime) | Rate Of Tax | Amount Of Tax | Proposed Slab Rates (New Tax Regime) | Rate Of Tax | Amount Of Tax | Incremental Tax /(Savings ) | |||

| 0 – 300,000 | 0% | – | 0 – 400,000 (NIL) | 0% | – | ||||

| 300,001 – 700,000 | 5% | 20,000 | 400,001 – 800,000 | 5% | 20,000 | – | |||

| 700,001 – 10,00,000 | 10% | 30,000 | 800,001 – 12,00,000 | 10% | 40,000 | ||||

| 10,00,001 – 12,00,000 | 15% | 30,000 | 12,00,001 – 16,00,000 | 15% | |||||

| 12,00,001 – 15,00,000 | 20% | 16,00,000 – 20,00,000 | 20% | ||||||

| Above 15,00,000 | 30% | 20,00,001-24,00,000 | 25% | ||||||

| Above 24,00,000 | 30% | ||||||||

| Tax (Gross) | 80,000 | 60,000 | |||||||

| Less: Rebate u/s 87A | – | 60,000 | |||||||

| Tax (Net) | 80,000 | – | 80,000 | ||||||

Under the revised tax slabs proposed in Budget 2025, individual taxpayers earning up to Rs. 12 lakh under the new tax regime will benefit from a full rebate under Section 87A, effectively reducing their tax liability to zero. Currently, under the existing tax slabs in the new tax regime, a taxpayer with a total income of Rs. 12 lakh would have faced a gross tax liability of Rs. 80,000. The new structure increases the basic exemption from Rs. 3 lakh to Rs. 4 lakh and extends the 5% and 10% tax brackets, resulting in a lower overall tax outflow. The key difference is that the enhanced 87A rebate now covers incomes up to Rs. 12 lakh, wherein there is NIL tax burden for eligible taxpayers. This results in direct tax savings of ~ Rs. 80,000, significantly increasing disposable income and easing the financial burden on middle-class taxpayers.

Ministry of Finance

NO INCOME TAX ON ANNUAL INCOME UPTO Rs. 12 LAKH UNDER NEW TAX REGIME

LIMIT TO BE Rs. 12.75 LAKH FOR SALARIED TAX PAYERS, WITH STANDARD DEDUCTION OF RS. 75,000

UNION BUDGET 2025-26 BRINGS ACROSS-THE-BOARD CHANGE IN INCOME TAX SLABS AND RATES TO BENEFIT ALL TAX-PAYERS

TAX SLAB RATE REDUCTION AND REBATES TO RESULT IN SUBSTANTIAL TAX RELIEF TO MIDDLE CLASS, THEREBY BOOSTING HOUSEHOLD CONSUMPTION EXPENDITURE AND INVESTMENT

Posted On: 01 FEB 2025

Reaffirming Government’s commitment to the philosophy of “trust first, scrutinize later”, the Union Budget 2025-26 has reposed faith in the Middle class and continued the trend of giving relief in tax burden to the common tax–payer. Presenting the Budget in the Parliament today, Union Minister for Finance and Corporate Affairs, Smt. Nirmala Sitharaman proposed an across-the-board change in tax slabs and rates to benefit all tax-payers.

Giving the good news to tax payers, the Finance Minister stated, “There will be no income tax payable upto income of Rs. 12 lakh (i.e. average income of Rs.1 lakh per month other than special rate income such as capital gains) under the new regime. This limit will be Rs.12.75 lakh for salaried tax payers, due to standard deduction of Rs. 75,000.” Tax rebate is being provided in addition to the benefit due to slab rate reduction in such a manner that there is no tax payable by them, she added.

Smt. Sitharaman stated, “The new structure will substantially reduce the taxes of the middle class and leave more money in their hands, boosting household consumption, savings and investment”. In the new tax regime, the Finance Minister proposed to revise tax rate structure as follows:

| 0-4 lakh rupees | Nil |

| 4-8 lakh rupees | 5 per cent |

| 8-12 lakh rupees | 10 per cent |

| 12-16 lakh rupees | 15 per cent |

| 16-20 lakh rupees | 20 per cent |

| 20- 24 lakh rupees | 25 per cent |

| Above 24 lakh rupees | 30 per cent |

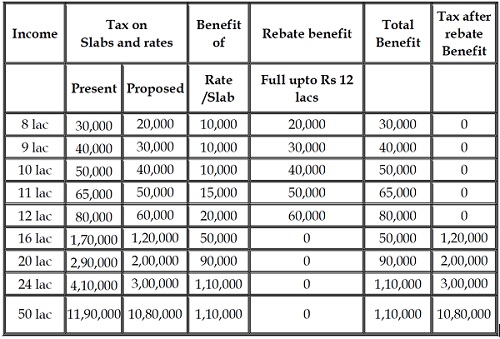

The total tax benefit of slab rate changes and rebate at different income levels can be illustrated in the table below:

While underlining Taxation Reforms as one of key reforms to realize the vision of Viksit Bharat, Smt. Sitharaman stated that the new income-tax bill will carry forward the spirit of ‘Nyaya’. The new regime will be simple to understand for taxpayers and tax administration, leading to tax certainty and reduced litigation, she informed.

Quoting Verse 542 from The Thirukkural, the Finance Minister stated, “Just as living beings live expecting rains, Citizens live expecting good governance.” Reforms are a means to achieve good governance for the people and economy. Providing good governance primarily involves being responsive. The tax proposals detail just how the Government under the guidance of Prime Minister Shri Narendra Modi has taken steps to understand and address the needs voiced by our citizens, Smt. Sitharaman added.

Again senior citizens and super senior citizens were ignored and clubbed with other earning personal for IT and the old scheme of IT payees also cruelly punished by retaining 2.5 lakhs exemption limit and for disabled persons. This Government has no sympathy for senior citizens and who were already in old IT scheme. Do we require such Government causing agony to it’s old and disabled people.

*NOTE ON REBATE u/s 87A – FISCAL BUDGET 2025*

*CA NARESH DHARIA* ✍🏻✍🏻✍🏻

From assessment year 2026-27 onwards, for an assessee, being an individual resident in India whose income is chargeable to tax under the sub-section (1A) of section 115BAC of the Income Tax Act, the Finance Minister proposed to,– enhance the limit of total income for rebate in clause (a) and (b) of first proviso under section 87A, on which the income-tax is payable as per the rates of income-tax under sub-section (1A) of section 115BAC of the Income Tax Act, from Rs. 7,00,000/- to Rs. 12,00,000/- and the limit of rebate in clause (a) of first proviso to section 87A from Rs. 25,000/- to Rs. 60,000/-

*BUT*

The provisions of sub-section (1A) of section 115BAC of the Income Tax Act are subject to the other provisions of Chapter XII i.e. determination of tax in certain special cases. Hence, proviso to section 87A clearly provides that tax on incomes chargeable at special rates (for e.g.: capital gains u/s 111A, 112 etc.) as specified under various provisions of Chapter XII, are not included while determining the rebate of income-tax under the first proviso to section 87A.

*NARESH DHARIA FCA*✍🏻✍🏻✍🏻✍🏻