Introduction

In our increasingly interconnected world, many Indian taxpayers find themselves earning income from foreign sources. Whether it’s through international business ventures, employment abroad, or investments overseas, such income can lead to the complexities of double taxation. However, the Indian government provides a solution in the form of the Tax Credit, which allows eligible taxpayers to claim relief from paying taxes on the same income in both India and the foreign country. This article serves as a comprehensive guide on how to claim FTC in India using Form 67.

Page Contents

What is Foreign Tax Credit (FTC) and Form 67?

FTC allows them to offset taxes paid to a foreign country against their Indian tax liability. Form 67 is the official document used to claim this credit. It requires taxpayers to report foreign income, detail foreign taxes paid, and specify the Double Taxation Avoidance Agreement (DTAA) applicable, ensuring they don’t pay taxes twice on the same income and receive the appropriate credit for foreign taxes paid.

Below is the comprehensive article which delves into the concept of Foreign Tax Credit (FTC):

https://taxguru.in/income-tax/claiming-credit-taxes-paid-foreign-countries.html

Due Date for Filing Form 67

As per Rule 128, Residents must submit Form 67 on or before 31st of December of the Assessment year.

For example: If the return of income for Financial 23-24 is filed by 31st October 2024, then the due date for filing Form 67 is 31st December of 2024.

Criteria required to claim the FTC

- Proof of deduction of tax

It can be a certificate of tax deduction from the person responsible for deducting such tax in the foreign country just like Form 16/16A/16C furnished in India i.e TDS/TCS certificates or some other certificate specifying nature of income and taxes.

- Proof of payment of Tax

An acknowledgement of online payment or bank counter foil or challan for payment of tax where the payment has been made by the Assessee

- Proof of discharge of tax

Any statement specifying nature of income and tax paid in foreign country can be the return of income filed in the foreign country or certificate issued by the foreign tax authority.

- In absence of the above-mentioned documents, the person claiming the credit of foreign taxes can also furnish self-attested/self-signed statement specifying the income offered and taxes paid abroad, but the said statement shall be valid.

Things to be kept in mind for Form-67

- It is important to note that the Indian Income Tax Department neither allows any refund of the foreign taxes paid nor any carry forward of those taxes. It only allows the credit of such taxes paid.

- The FTC can only be taken against the income tax, surcharge and cess payable under the income tax regulations. Interest, fees and penalties cannot be applied to the foreign tax credits.

- The FTC will be the lesser of the tax payable as per income tax regulations in India or the tax paid in the foreign country.

- Single form 67 can be filed for multiple countries credit

- The conversion rate on the foreign tax paid will be the Telegraphic Transfer Buying Rate as specified by the SBI as on the last day of the month immediately preceding the month in which the foreign tax was paid or deducted.

- FTC needs to be computed separately for each source of income and then aggregated after computed tax payable under each head.

- The foreign tax credit can only be claimed in the year in which the income has been subjected to tax in India.

Steps to fill and submit Form 67

Step 1: Log in to the Income Tax e-Filing portal using your user ID and password.

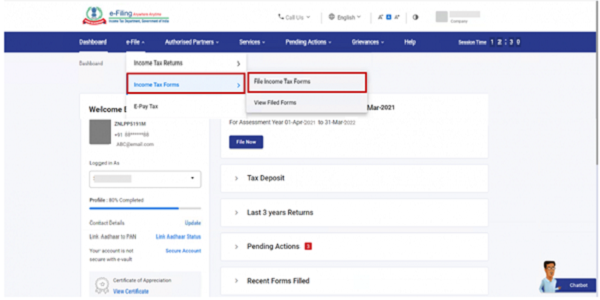

Step 2: On the ‘Dashboard’, click ‘e-File’, click ‘Income Tax Forms’ and select ‘File Income Tax Forms’.

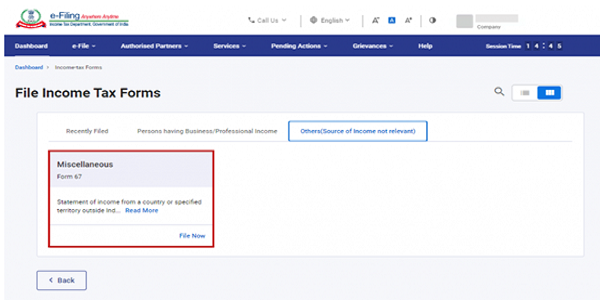

Step 3: On the next page, select ‘Form 67’.

Step 4: Select the ‘Assessment Year (AY)’ and click ‘Continue’.

Step 5: On the instructions page, click ‘Let’s Get Started’.

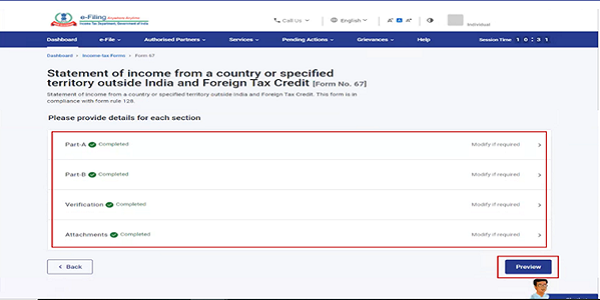

Step 6: Form 67 will be displayed. Fill the required details and click ‘Preview’

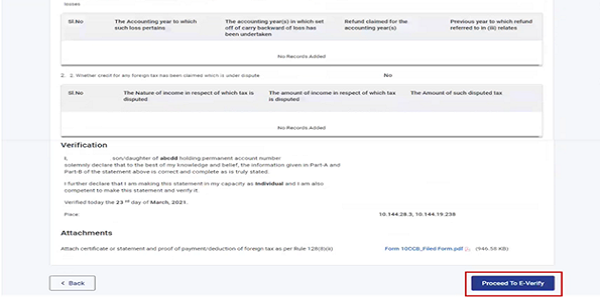

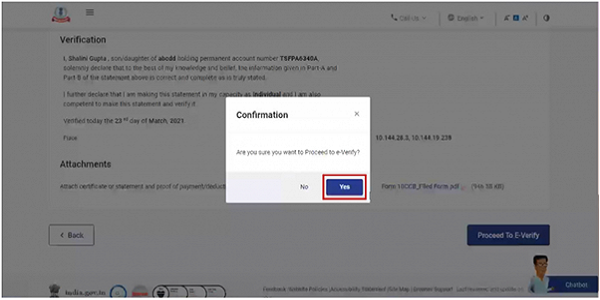

Step 7: Verify the details and click ‘Proceed to E-Verify

Step 8: Click ‘Yes’ on the confirmation message to submit the form

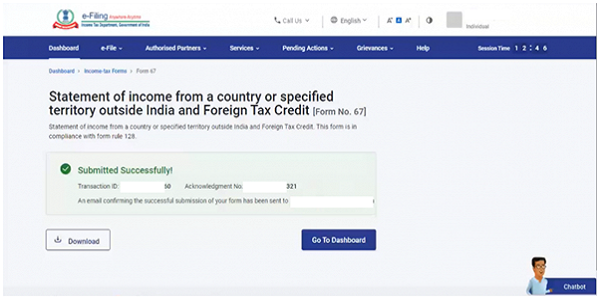

Step 9: It will be redirected to the E-Verify page. After successful e-verification, a success message will be displayed along with a transaction ID and acknowledgement number.

Conclusion:

The filing of Form-67 under the Income Tax Act serves as a pivotal step in ensuring accurate reporting and compliance with tax regulations. This document not only facilitates a transparent disclosure of specified income but also enables taxpayers to avail themselves of the benefits of various provisions. Timely and precise submission of Form-67 is imperative for maintaining financial integrity. As taxpayers fulfil this obligation, they contribute to the overall efficiency and effectiveness of the income tax framework, promoting a fair and accountable taxation ecosystem.

*****

Authors:

Vishal Kothari | Partner

Nitesh Jha | Manager

Suraj Sodhani | Consultant

Authors can be reached at Email: blogs@bilimoriamehta.com or at Contact: +91 9320614111)